Outdoor Lighting Market Report Scope & Overview:

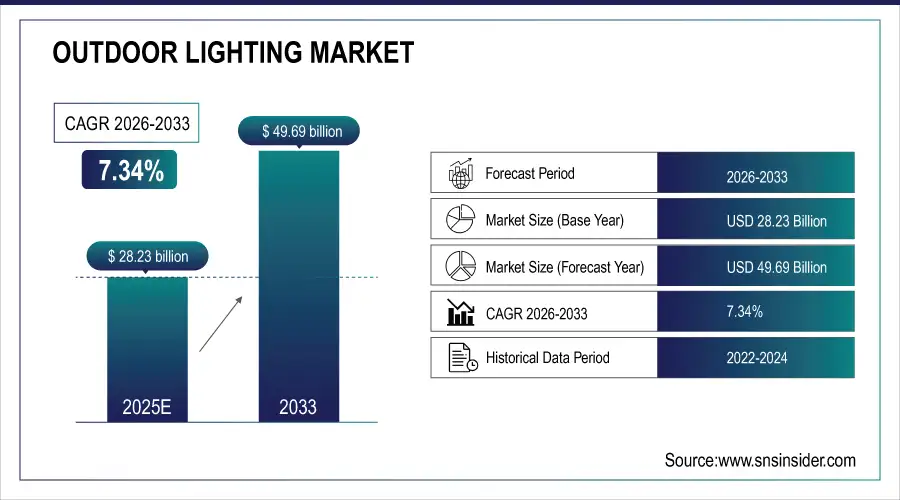

The Outdoor Lighting Market Size is valued at USD 28.23 Billion in 2025E and is expected to reach USD 49.69 Billion by 2033 and grow at a CAGR of 7.34%% over the forecast period 2026-2033.

The Outdoor Lighting Market analysis, driven by rapid urbanization, rising infrastructure development, and expanding construction of roads, highways, public parks, and commercial spaces. Governments and municipalities are increasingly upgrading streetlights and public-area lighting to improve safety, visibility, and urban appeal.

According to study, Urban infrastructure projects account for an estimated 42–48% of new outdoor lighting installations, driven by expanding roadways, public parks, and commercial spaces.

Market Size and Forecast:

-

Market Size in 2025: USD 28.23 Billion

-

Market Size by 2033: USD 49.69 Billion

-

CAGR: 7.34%% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information on Outdoor Lighting Market - Request Free Sample Report

Outdoor Lighting Market Trends:

-

Smart city projects driving large-scale adoption of connected and adaptive outdoor lighting.

-

Rapid shift from conventional lamps to LED-based energy-efficient outdoor lighting systems.

-

Growing demand for solar-powered lighting solutions across developing and rural regions.

-

Increasing use of IoT sensors enabling remote monitoring and intelligent brightness control.

-

Government sustainability programs accelerating installation of low-maintenance LED streetlights globally.

-

Rising preference for architectural and landscape lighting in commercial outdoor environments.

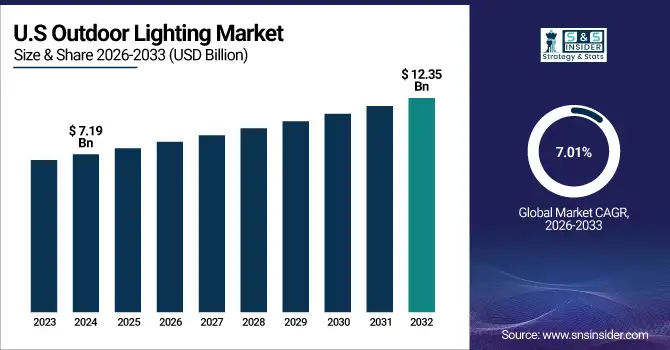

The U.S. Outdoor Lighting Market size is USD 7.19 Billion in 2025E and is expected to reach USD 12.35 Billion by 2033, growing at a CAGR of 7.01% over the forecast period of 2026-2033,

The U.S. Outdoor Lighting Market is driven by extensive smart city projects, energy-efficiency initiatives, and replacement of aging infrastructure. High adoption of LED and IoT-enabled streetlights, supported by regulatory policies and urban development, fuels consistent market growth.

Outdoor Lighting Market Growth Drivers:

-

Smart City Development Rapidly Accelerates Global Demand for Efficient Outdoor Lighting Solutions

A major driver for the outdoor lighting market growth is the accelerating global urbanization and the large-scale development of smart city projects. Cities are increasingly investing in modern outdoor lighting systems such as LED streetlights, smart poles, and adaptive lighting networks to improve safety, reduce energy consumption, and enhance urban aesthetics. LED technology offers long lifespan, low maintenance, and high energy efficiency, making it the preferred choice for municipal and commercial outdoor applications. As governments focus on strengthening public infrastructure, improving night-time visibility, and deploying smart IoT-based lighting controls, the demand for connected and energy-efficient outdoor lighting solutions continues to rise sharply

Government-led infrastructure improvement projects generate over 40% of total outdoor lighting investments

Outdoor Lighting Market Restraints:

-

High Installation Costs and System Integration Challenges Limit Widespread Modern Lighting Adoption

A major restraint for the market is the high initial installation cost associated with modern outdoor lighting systems, especially smart and connected networks. Advanced LED fixtures, sensor-based controls, wireless communication modules, and centralized monitoring platforms require substantial upfront investment. Integration with existing electrical infrastructure can also be complex, requiring skilled technicians, upgraded power systems, and compatibility checks with legacy equipment. Budget limitations in smaller municipalities or developing regions often slow adoption, making traditional lighting systems remain in use longer.

Outdoor Lighting Market Opportunities:

-

Solar, Smart, and IoT-Enabled Lighting Technologies Create Powerful Global Market Opportunities

A significant opportunity of market merges from the rising demand for smart, solar-powered, and energy-efficient outdoor lighting technologies. The global shift toward sustainability is driving municipalities, industries, and commercial spaces to adopt solar LED streetlights and motion-sensor-based lighting systems that reduce operational costs and environmental impact. The integration of IoT, AI-based lighting controls, and cloud connectivity enables remote monitoring, predictive maintenance, and dynamic brightness adjustment based on traffic and weather conditions. Increasing government incentives for renewable energy, coupled with growing awareness of carbon reduction targets, creates massive opportunities for manufacturers to innovate and expand across residential, commercial, and public infrastructure sectors.

Cloud-connected lighting networks enable 25% faster issue detection through predictive maintenance analytics.

Outdoor Lighting Market Segmentation Analysis:

-

By Product: In 2025, LED Lights led the market with a share of 50.62%, while Plasma Lamps is the fastest-growing segment with a CAGR of 10.40%.

-

By Lumen Output: In 2025, 1,000–4,000 Lumens led the market with a share of 67.40%, while Above 4,000 Lumens is the fastest-growing segment with a CAGR of 9.50%.

-

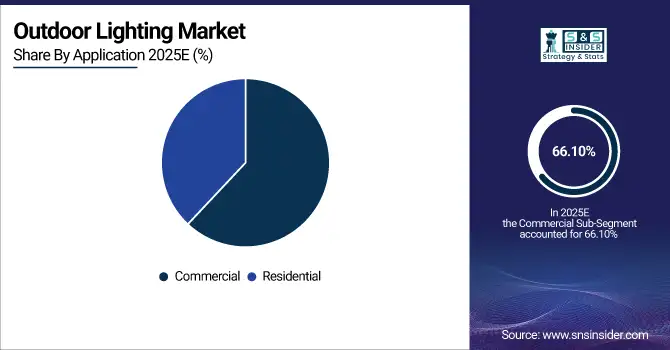

By Application: In 2025, Commercial led the market with a share of 66.10%, while Residential is the fastest-growing segment with a CAGR of 8.90%.

-

By Distribution Channel: In 2025, Offline led the market with a share of 65.40%, while Online is the fastest-growing segment with a CAGR of 11.20%.

By Application, Commercial Lead Market and Residential Fastest Growth

In 2025, Commercial applications dominate the outdoor lighting market, fueled by extensive use in streets, parking lots, campuses, hospitality areas, and public infrastructure projects. Governments and private organizations are increasingly investing in smart and energy-efficient lighting to improve safety, visibility, and long-term cost savings.

Meanwhile, Residential lighting is the fastest-growing segment, supported by rising consumer investment in home exteriors, gardens, driveways, and security lighting. The expansion of smart home ecosystems and affordable LED solutions is accelerating adoption in households worldwide.

By Product, LED Lights Lead Market and Plasma Lamps Fastest Growth

In 2025, LED lights dominate the outdoor lighting market due to their superior energy efficiency, long lifespan, reduced maintenance cost, and compatibility with smart lighting systems. Their adoption is strong across streets, parks, commercial premises, and residential spaces as governments and private sectors move toward sustainable lighting solutions.

Meanwhile, Plasma lamps are the fastest-growing segment, driven by their high-intensity illumination, strong performance in large outdoor areas, and suitability for industrial and sports lighting. Their ability to deliver uniform, bright light with strong energy efficiency is pushing rapid adoption in specialized outdoor applications.

By Lumen Output, 1,000–4,000 Lumens Leads Market and Above 4,000 Lumens Fastest Growth

In 2025, the 1,000–4,000 lumen segment dominates the market, as it is ideal for most outdoor applications including residential exteriors, pathways, parking areas, and small commercial spaces. This range provides balanced brightness, efficiency, and cost-effectiveness, making it the preferred choice for widespread deployment in urban and semi-urban environments.

Meanwhile, above 4,000 lumen lighting is the fastest-growing segment, driven by rising demand for high-intensity illumination in highways, stadiums, industrial zones, and public infrastructure projects. Increasing adoption of high-powered LEDs and smart control systems further accelerates growth in this high-lumen category.

By Distribution Channel, Offline Leads Market and Online Fastest Growth

In 2025, Offline distribution dominates the market, as many buyers especially commercial and government entities prefer in-person product evaluation, installation support, and long-term service assurance. Retail stores, electrical distributors, and specialty outlets remain the major purchasing channels for large-scale projects.

Meanwhile, Online distribution is the fastest-growing segment, driven by expanding e-commerce, product variety, competitive pricing, and increasing consumer comfort with digital purchases. Manufacturers are also strengthening direct-to-consumer online platforms, further accelerating growth in this segment.

Outdoor Lighting Market Regional Analysis:

North America Outdoor Lighting Market Insights:

The North America dominated the Outdoor Lighting Market in 2025E, with over 35.84% revenue share, due to advanced urban infrastructure, large-scale smart city deployments, and strong investment in energy-efficient LED systems. High adoption of connected and IoT-enabled streetlights, along with strict regulatory standards for energy savings, drives market expansion. Rapid replacement of aging outdoor lighting with intelligent, low-maintenance solutions further strengthens its leadership across commercial, municipal, and residential applications.

Get Customized Report as per Your Business Requirement - Enquiry Now

U.S. Outdoor Lighting Market Insights

The U.S. and Canada lead in outdoor lighting adoption due to extensive smart city projects, energy-efficiency initiatives, and replacement of aging infrastructure. High demand for LED and IoT-enabled streetlights, along with regulatory support and urban development, drives consistent market growth.

Asia Pacific Outdoor Lighting Market Insights:

The Asia-Pacific region is expected to have the fastest-growing CAGR 8.44%, supported by rapid urbanization, infrastructure expansion, and large government-led smart city projects. Massive investments in highways, public spaces, and industrial zones fuel the need for modern LED and solar-powered outdoor lighting. Growing construction activity in China, India, and Southeast Asia accelerates demand for energy-efficient, durable, and cost-effective lighting solutions across diverse applications.

China and India Outdoor Lighting Market Insights

China and India are rapidly expanding markets driven by urbanization, infrastructure development, and large-scale smart city programs. Adoption of energy-efficient LED and solar-powered outdoor lighting across highways, public spaces, and industrial areas accelerates growth, supported by government initiatives and increasing construction activities.

Europe Outdoor Lighting Market Insights

Europe maintains steady growth driven by sustainability targets, strict energy-efficiency regulations, and active adoption of smart outdoor lighting technologies. Widespread LED retrofitting projects, modernization of public infrastructure, and focus on smart mobility corridors support market expansion. Environmental policies promoting low carbon emissions and advanced lighting control systems further strengthen the region’s outdoor lighting development.

Germany and U.K. Outdoor Lighting Market Insights

The Germany and the U.K. maintain steady growth due to sustainability targets, strict energy-efficiency regulations, and widespread LED retrofitting in public infrastructure. Smart outdoor lighting systems, including connected streetlights and adaptive controls, enhance efficiency, safety, and environmental compliance, ensuring stable market development.

Latin America (LATAM) and Middle East & Africa (MEA) Outdoor Lighting Market Insights

Latin America shows moderate growth in the Outdoor Lighting Market, driven by rising urban development, infrastructure upgrades, and increased adoption of LED streetlighting. Countries such as Brazil and Mexico are investing in public safety, smart city programs, and energy-efficient lighting for roads, parks, and commercial areas. Budget constraints slow large-scale transformation, but government initiatives promoting sustainable lighting and expanding construction projects continue to support steady market expansion.

Additionally, The Middle East & Africa region is experiencing growing demand for outdoor lighting due to rapid urbanization, smart city developments, and large infrastructure projects. High investments in commercial complexes, highways, and tourism-led public space enhancements especially in the UAE, Saudi Arabia, and South Africa drive adoption of LED and solar-powered lighting. Climate-resilient, durable outdoor lighting systems are increasingly preferred, supporting consistent market growth across the region.

Outdoor Lighting Market Competitive Landscape:

Philips Lighting, a global leader in lighting solutions, offers energy-efficient outdoor lighting systems including LED streetlights, smart lighting controls, and connected urban lighting solutions. Its products focus on sustainability, long lifespan, and reduced energy consumption for cities, commercial spaces, and industrial areas. Philips leverages IoT-enabled technologies for remote monitoring, adaptive lighting, and predictive maintenance. With a strong global presence and innovative R&D, Philips drives smart, eco-friendly urban lighting solutions that enhance safety, reduce operational costs, and improve quality of life in outdoor environments.

-

In October 2025, Philips launched the “Aura Floodlight” in India, a new outdoor LED floodlight blending decorative style with professional‑grade outdoor illumination.

Zumtobel Group specializes in high-quality, innovative lighting solutions for outdoor and architectural applications. Its portfolio includes energy-efficient LED streetlights, façade illumination, and smart lighting systems integrated with IoT controls. Zumtobel emphasizes design, sustainability, and adaptive lighting technologies to enhance urban and commercial spaces. The company focuses on smart city initiatives, predictive maintenance, and environmental efficiency. With global operations and strong technological expertise, Zumtobel contributes to transforming outdoor lighting with aesthetically appealing, cost-effective, and environmentally responsible solutions.

-

In May 2025, Zumtobel launched “TECTON II”, the second‑generation continuous‑row lighting system, offering high lumen output (210 lm/W) and enhanced durability for urban/outdoor installations.

General Electric Company (GE) provides a comprehensive range of outdoor lighting solutions, including LED streetlights, industrial lighting, and smart connected systems. GE emphasizes energy efficiency, durability, and advanced control technologies that optimize lighting performance in urban, commercial, and industrial settings. Its solutions support smart city infrastructure, predictive maintenance, and IoT-enabled lighting networks. With a global footprint, innovative R&D, and focus on sustainability, GE plays a significant role in modernizing outdoor lighting systems and enabling cost-effective, reliable, and intelligent illumination.

-

In February 2025, GE (Current) unveiled a new outdoor lighting line “CityGlow Pro” featuring integrated sensors, wireless connectivity, and advanced optics for large‑scale roadway, campus and municipal lighting.

Outdoor Lighting Market Key Players:

Some of the outdoor lighting market Companies are:

-

Philips Lighting

-

Acuity Brands, Inc.

-

Eaton Corporation

-

Cree, Inc.

-

General Electric (GE Lighting)

-

Osram Licht AG

-

Hubbell Incorporated

-

Zumtobel Group

-

Thorn Lighting

-

Panasonic Corporation

-

Syska LED (Syska LED Lights Private Ltd.)

-

Dialight plc

-

Schréder Group

-

Havells India Ltd.

-

Hinkley Lighting

-

LEDVANCE

-

Lutron Electronics

-

Legrand S.A.

-

Toshiba Lighting & Technology

-

Fagerhult Group

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 28.23 Billion |

| Market Size by 2033 | USD 49.69 Billion |

| CAGR | CAGR of 7.34% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (LED Lights, Plasma Lamps, High-Intensity Discharge Lamps, Fluorescent Lights) • By Lumen Output (Below 1,000, 1,000–4,000, Above 4,000) • By Application (Residential, Commercial) • By Distribution Channel (Offline, Online) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Philips Lighting, Acuity Brands Inc., Eaton Corporation, Cree Inc., General Electric (GE Lighting), Osram Licht AG, Hubbell Incorporated, Zumtobel Group, Thorn Lighting, Panasonic Corporation, Syska LED (Syska LED Lights Private Ltd.), Dialight plc, Schréder Group, Havells India Ltd., Hinkley Lighting, LEDVANCE, Lutron Electronics, Legrand S.A., Toshiba Lighting & Technology, and Fagerhult Group |