Period Panties Market Report Scope & Overview:

Get More information on Period Panties Market - Request Free Sample Report

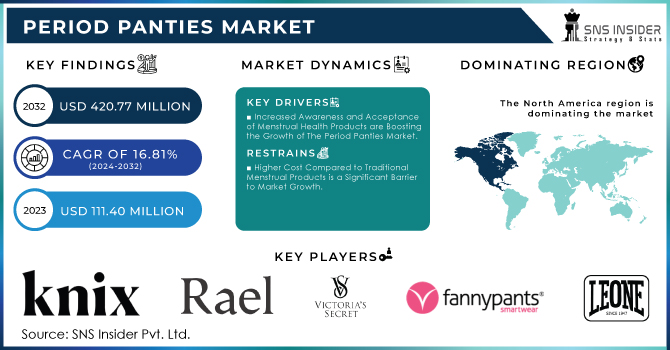

The Period Panties Market Size was valued at USD 133.24 Million in 2023 and is expected to reach USD 558.03 Million by 2032, growing at a CAGR of 17.25% over the forecast period of 2024-2032.

The Period Panties Market is redefining menstrual care with its cost-effectiveness and sustainability. Our report explores a detailed cost comparison with traditional products, proving long-term savings despite higher upfront costs. The rise of e-commerce sales is outpacing offline retail, making period panties more accessible. However, inflation and economic conditions are influencing material costs and pricing strategies. Celebrity endorsements are also shaping consumer choices, with influential figures driving awareness and demand. To assess product efficiency, our report includes a comparative analysis of absorbency levels, helping consumers make informed decisions. As pricing, sales channels, and performance metrics continue to evolve, understanding these dynamics is key to navigating this rapidly expanding market.

The US Period Panties Market Size was valued at USD 19.21 Million in 2023 and is expected to reach USD 97.83 Million by 2032, growing at a CAGR of 19.83% over the forecast period of 2024-2032.

The U.S. Period Panties Market is witnessing significant growth, driven by increasing consumer awareness of sustainable menstrual solutions and rising support from health organizations. Backed by initiatives from groups like the American Sustainable Business Network (ASBN) and The National Women's Health Network (NWHN), demand for eco-friendly alternatives is surging. U.S. based companies like Thinx, Knix, and Proof are expanding their product lines, leveraging e-commerce dominance and direct-to-consumer models. Additionally, the FDA’s regulation of menstrual products ensures safety, boosting consumer confidence. Growing social media advocacy and endorsements from influencers further accelerate adoption, making period panties a preferred choice in the evolving feminine hygiene market.

Market Dynamics

Drivers

-

Shifting Consumer Preferences Toward Cost-Effective and Long-Term Reusable Menstrual Products Instead of Disposable Hygiene Solutions

Consumers are increasingly shifting towards cost-effective and reusable menstrual products, driving the growth of the Period Panties Market. Traditional sanitary products such as pads and tampons require frequent repurchasing, leading to higher long-term expenses compared to reusable alternatives. With inflation affecting personal care product prices, consumers are seeking budget-friendly solutions that offer durability and reliability. Period panties, designed for multiple years of use, provide significant savings over time, making them an attractive choice. Many brands highlight cost-per-wear comparisons, showcasing how a single period panty can replace hundreds of disposable products over its lifespan. Additionally, financial incentives such as tax exemptions on menstrual products in various U.S. states and discounted subscription models by brands like Proof and Saalt further encourage adoption. Schools and workplaces are also contributing to the shift by incorporating sustainable menstrual products in hygiene initiatives, making period panties more accessible. The growing preference for minimal waste, convenience, and affordability is reshaping consumer buying habits, pushing brands to offer multipacks, bundle deals, and lifetime warranties to enhance product value. This trend is expected to continue as economic pressures and sustainability concerns drive further adoption of reusable menstrual products.

Restraints

-

Limited Public Awareness and Cultural Taboos Around Menstrual Hygiene Restrict the Market Growth in Certain Regions

Despite the increasing shift toward sustainable menstrual products, many regions still face deep-rooted cultural taboos and limited awareness about reusable options like period panties. In several societies, menstruation remains a stigmatized subject, leading to hesitation in trying new menstrual care alternatives. Many consumers rely on traditional practices or products passed down through generations, making it difficult for reusable solutions to gain traction. Additionally, some consumers harbor misconceptions about hygiene and maintenance, assuming that washing and reusing period panties is less sanitary than disposable alternatives. Insufficient marketing campaigns, lack of educational initiatives, and inadequate accessibility in rural areas further hinder adoption. Even in developed markets, many individuals remain unaware of the benefits of period panties, such as environmental sustainability, cost savings, and enhanced comfort. To counteract this, brands must invest in awareness campaigns, partner with healthcare professionals, and advocate for menstrual hygiene education in schools and workplaces. Without addressing these social and educational gaps, the Period Panties Market may struggle to reach its full potential, especially in culturally conservative regions.

Opportunities

-

Increasing Adoption of Sustainable Menstrual Solutions in Schools and Workplaces Drives Market Growth and Brand Visibility

The rising emphasis on sustainable menstrual hygiene solutions in schools and workplaces presents a significant opportunity for the Period Panties Market. As concerns over period poverty and environmental waste grow, many educational institutions and companies are integrating reusable menstrual products into their wellness and sustainability programs. In the United States, states like California and New York have implemented free menstrual product initiatives in public schools, increasing accessibility to sustainable options. Similarly, businesses are incorporating eco-friendly menstrual solutions into their corporate wellness programs to promote employee well-being and workplace inclusivity. The involvement of government-backed programs and non-profit organizations further strengthens the adoption rate, creating avenues for brands to expand their consumer base. Several universities have also started offering reusable menstrual products in campus hygiene dispensers, enhancing product visibility among young consumers. Additionally, companies are developing bulk-purchase partnerships with institutions, allowing them to distribute period panties at subsidized rates or through corporate health packages. By leveraging these institutional sales opportunities, manufacturers can significantly boost brand awareness and consumer trust, ultimately driving market growth.

Challenge

-

Competition from Alternative Sustainable Menstrual Products Such as Menstrual Cups and Reusable Pads Slowing Market Expansion

While the Period Panties Market is gaining traction, it faces stiff competition from other sustainable menstrual products, including menstrual cups and reusable cloth pads. Many consumers prefer menstrual cups due to their longer wear time, higher capacity, and lower maintenance compared to period panties, which require frequent washing. Additionally, menstrual cups and reusable pads tend to have a lower price point, making them more appealing to cost-sensitive consumers. Some individuals also find menstrual cups more convenient for travel, sports, and overnight protection, further reducing the appeal of period panties in certain segments. Moreover, traditional menstrual care brands have expanded their offerings, promoting eco-friendly pads and tampons with biodegradable materials, creating additional competition. To differentiate themselves, period panty manufacturers are focusing on innovative designs, hybrid products, and improved absorbency technology. Brands are also emphasizing comfort, discretion, and leak-proof guarantees to attract consumers who prioritize convenience and sustainability. Despite the competitive landscape, continuous product innovation and strategic marketing campaigns will be essential for sustained growth in the reusable menstrual care sector.

Segmental Analysis

By Type

The Reusable segment dominated the Period Panties Market in 2023, holding a 70.5% market share, primarily due to the increasing focus on sustainability and long-term cost savings. Organizations like the Environmental Protection Agency (EPA) and the United Nations Environment Programme (UNEP) have raised awareness about the growing issue of menstrual waste, which has led consumers to shift from disposable pads and tampons to reusable alternatives. Additionally, reusable period panties provide better comfort, enhanced absorbency, and reduced irritation compared to traditional products. The rise of zero-waste movements and plastic-free menstrual product campaigns has further accelerated demand. The Menstrual Health Alliance and the World Health Organization (WHO) have also emphasized the importance of affordable and sustainable menstrual solutions, which has led governments in the U.S., Canada, and the U.K. to introduce tax exemptions on reusable menstrual products. Companies like Thinx, Knix, and Modibodi have launched advanced leak-proof technologies, making reusable period panties a preferred choice among environmentally conscious consumers.

By Style

The Brief style dominated the Period Panties Market in 2023, accounting for a 42.2% market share, owing to its high coverage, secure fit, and leak-proof protection. Brief-style period panties are particularly popular among working professionals, teenagers, and postpartum women, as they offer better support and comfort during heavy flow days. Organizations such as the American College of Obstetricians and Gynecologists (ACOG) have recommended full-coverage menstrual underwear for individuals experiencing heavy menstrual bleeding (HMB), which has contributed to the demand for brief-style period panties. Additionally, brands like Saalt, Bambody, and Ruby Love have introduced brief-style options with moisture-wicking layers and odor-resistant technology, making them a preferred choice among consumers. The Menstrual Hygiene Day initiative has also emphasized the importance of comfortable and effective period solutions, which has increased consumer preference for this style. Furthermore, with women engaging more in sports and outdoor activities, the brief style provides added security and confidence, further solidifying its dominance in the market.

By Material

The Cotton segment dominated the Period Panties Market in 2023 and held a 41.3% market share in 2023, driven by its breathability, softness, and skin-friendly properties. Consumers prefer cotton-based period panties due to their natural fiber composition, which reduces the risk of irritation, allergies, and infections. According to the National Institutes of Health (NIH), synthetic fabrics like polyester and nylon can trap heat and moisture, increasing the likelihood of bacterial growth and discomfort, making cotton the superior choice. Leading brands such as Thinx, Aisle, and Rael offer 100% organic cotton period panties, which appeal to health-conscious consumers. Additionally, the Organic Cotton Accelerator (OCA) and the Global Organic Textile Standard (GOTS) have promoted the use of chemical-free, organic cotton, increasing its adoption in menstrual hygiene products. Government policies in the U.S. and Europe that support organic and sustainable textiles have further fueled the demand for cotton-based period panties. The shift toward hypoallergenic and eco-friendly menstrual solutions continues to drive the dominance of cotton in the period panties market.

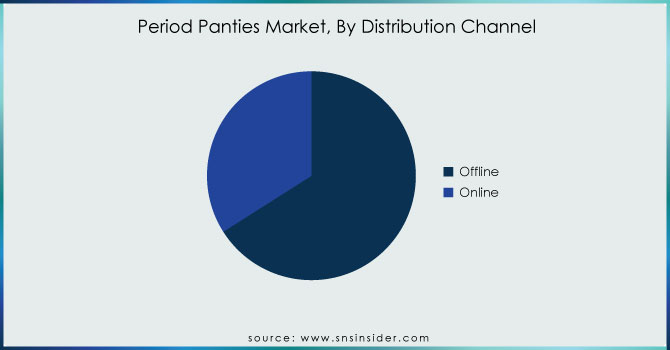

By Distribution Channel

Online Retailers dominated the Period Panties Market in 2023 and accounted for a 53.7% market share in the Period Panties Market in 2023, driven by the increasing popularity of e-commerce platforms and direct-to-consumer (DTC) brand strategies. Consumers prefer purchasing period panties online due to the wide range of options, detailed product descriptions, and easy comparison of features and prices. Companies like Amazon, Walmart, and Target, along with brand-specific websites such as Knix, Modibodi, and Saalt, have significantly expanded their online offerings, making period panties more accessible globally. The COVID-19 pandemic accelerated digital shopping trends, leading to a permanent shift in consumer behavior toward online retail platforms. According to the U.S. Census Bureau, e-commerce sales in the personal care and hygiene sector increased by 24% in 2023, indicating strong online demand. Additionally, the rise of subscription-based models and influencer marketing on platforms like Instagram and TikTok has fueled direct online sales. Discounts, free shipping, and flexible return policies offered by major online retailers further contribute to this distribution channel's dominance.

Get Customized Report as per your Business Requirement - Request For Customized Report

Regional Analysis

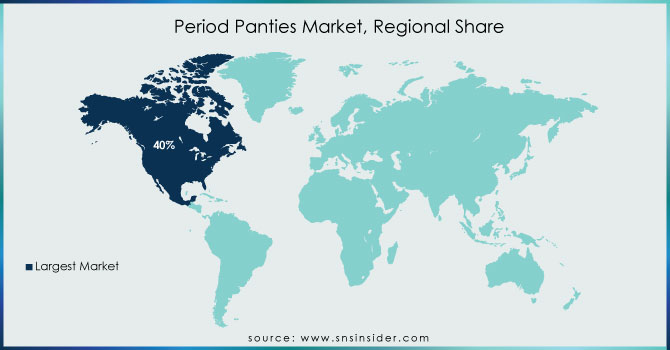

The Asia Pacific region dominated the Period Panties Market in 2023, capturing a 41.6% market share, driven by rising menstrual hygiene awareness, government initiatives, and an expanding middle-class population. Countries like China, India, and Japan have witnessed a surge in demand due to increasing disposable income and growing concerns over menstrual waste. The Indian government’s Menstrual Hygiene Scheme (MHS) and China’s initiatives to promote sustainable hygiene products have significantly contributed to this growth. The Asia-Pacific Menstrual Hygiene Coalition has actively promoted reusable menstrual products, leading to higher adoption rates. Additionally, companies like Unicharm, Wuka, and Modibodi have expanded their presence in Asia Pacific, increasing product accessibility. China, the largest contributor, benefits from strong e-commerce sales through Alibaba and JD.com, while India, the fastest-growing market, has seen a surge in demand due to brands like Sirona and Pee Safe offering affordable and eco-friendly period panties. Japan’s preference for high-tech fabric innovations in menstrual hygiene products further strengthens the region’s dominance.

Moreover, North America emerged as the fastest-growing region in the Period Panties Market, with a significant growth rate during the forecast period, driven by rising sustainability trends, increasing menstrual equity initiatives, and growing brand penetration. The United States leads the regional market, fueled by government policies promoting sustainable menstrual products, such as the Menstrual Equity for All Act. The U.S. Food and Drug Administration (FDA) has also emphasized the safety of reusable menstrual products, increasing consumer confidence. Additionally, organizations like Period.org and The Menstrual Equity Coalition actively promote awareness and accessibility of period panties. Leading brands such as Thinx, Knix, and Ruby Love have witnessed significant sales growth, with direct-to-consumer e-commerce platforms playing a vital role. Canada, the second-largest market, is expanding rapidly due to government-backed free menstrual product programs and increased consumer awareness. Meanwhile, Mexico’s growing middle-class population and increasing online retail penetration have fueled demand, making North America a highly lucrative market for period panties.

Key Players

-

Aisle (formerly Lunapads) (Lunapads Reusable Period Pads, Luna Undies, Menstrual Cup)

-

Anigan Inc. (Anigan Period Panties, Anigan Absorbent Underwear, Anigan Menstrual Cup)

-

Clovia (Clovia Period Panties, Clovia Lingerie, Clovia Maternity Wear)

-

Dear Kate (Dear Kate Period Panties, Dear Kate Activewear, Dear Kate Sleepwear)

-

FANNYPANTS (FANNYPANTS Leakproof Period Underwear, FANNYPANTS Sleepwear, FANNYPANTS Maternity Wear)

-

FLUX Undies (FLUX Undies Period Panties, FLUX Undies Sleepwear, FLUX Undies Activewear)

-

Harebrained (Harebrained Period Panties, Harebrained Leakproof Activewear, Harebrained Sleepwear)

-

Knix Wear, Inc. (Knix Leakproof Period Underwear, Knix Comfort Bra, Knix Sleep Shorts)

-

Modibodi (Modibodi Period Underwear, Modibodi Maternity Underwear, Modibodi Swimwear)

-

Monthly Gift, Inc. (Dear Kate) (Dear Kate Period Panties, Dear Kate Activewear, Dear Kate Sleepwear)

-

Neione (Neione Period Panties, Neione Absorbent Underwear, Neione Maternity Wear)

-

Panty Prop Inc. (Ruby Love) (Ruby Love Period Panties, Ruby Love Activewear, Ruby Love Sleepwear)

-

Period Panteez (Period Panteez Leakproof Underwear, Period Panteez Sleepwear)

-

Proof (Proof Period Panties, Proof Sleepwear, Proof Activewear)

-

Rael (Rael Organic Period Panties, Rael Menstrual Pads, Rael Feminine Wipes)

-

Saalt, LLC (Saalt Period Panties, Saalt Menstrual Cup, Saalt Activewear)

-

The Period Company (The Period Company Period Underwear, The Period Company Sleepwear)

-

Thinx, Inc. (Thinx Period Panties, Thinx Thong, Thinx Activewear)

-

WUKA (WUKA Period Pants, WUKA Activewear, WUKA Swimwear)

Recent Developments

-

December 2024: INTIMINA introduced Bloom Period Underwear, offering leak-proof, breathable, and eco-friendly menstrual protection. The product featured odor control, quick-dry fabric, and multiple absorbency levels, ensuring comfort beyond menstrual days. It was made available on INTIMINA’s website and select retailers.

-

September 2024: Pee Safe’s Disposable Period Panty campaign helped the brand achieve one million units sold. The high-absorbency, biodegradable design gained popularity among travelers and convenience seekers. The campaign used digital platforms and influencer marketing, strengthening Pee Safe’s market presence in India and beyond.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 133.24 Million |

| Market Size by 2032 | USD 558.03 Million |

| CAGR | CAGR of 17.25% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (Reusable, Disposable) •By Style (Brief, Bikini, Boyshort, Hi-Waist, Others) •By Material (Cotton, Polyester, Nylon, Modal, Others) •By Distribution Channel (Direct Sales, Modern Trade, Convenience Stores, Specialty Stores, Mono Brand Stores, Online Retailers, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Knix Wear, Inc., Ruby Love (PantyProp Inc.), Saalt, LLC, The Period Company, Proof, WUKA, Aisle (formerly Lunapads), FLUX Undies, Modibodi, Thinx, Inc. and other key players |