Peripheral Neuropathy market Report Scope & Overview:

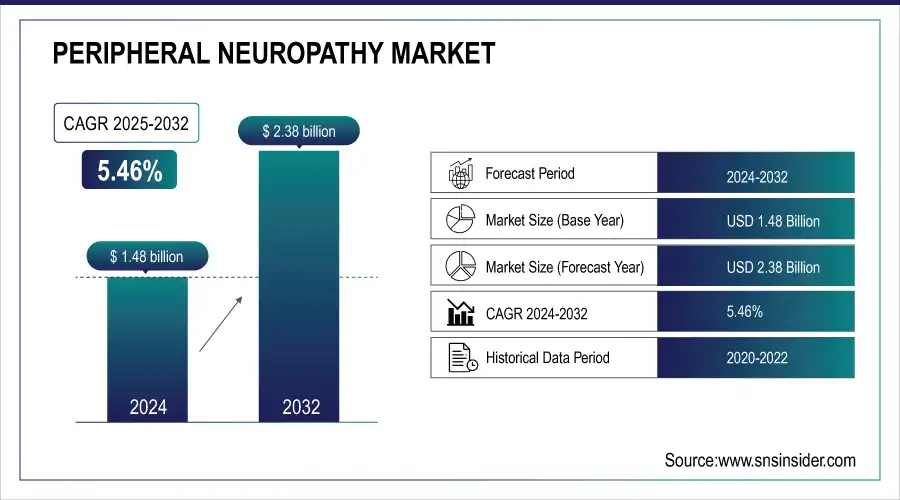

The Peripheral Neuropathy Market valued USD 1.48 billion in 2024, estimated to surpass USD 2.38 billion by 2032 with a compound annual growth rate of 5.46% over the forecast period 2025-2032.

Peripheral neuropathy is not age or background specific, but some are more affected than others. Although diabetes is the most common cause, many other potential factors can raise risk as well that is infections of any kind, metabolic issues in general inherited diseases traumatizing events toxins aging itself. The overarching term for multiple types of nerve damage is peripheral neuropathy, which affects many people in a range scenario which is likely the case for approximately 2.4% of people worldwide. Among those over 45 years of age, the rate rises to anywhere from 5% to 7%, showing an increased risk with aging.

Peripheral Neuropathy Market Size and Forecast:

-

Market Size in 2024 USD 1.48 Billion

-

Market Size by 2032 USD 2.38 Billion

-

CAGR of 5.46% From 2025 to 2032

-

Base Year 2024

-

Forecast Period 2025-2032

-

Historical Data 2021-2023

Get More Information on Peripheral Neuropathy Market - Request Free Sample Report

Key Peripheral Neuropathy Market Trends:

• Rising prevalence of diabetes and aging populations drives demand for diabetic peripheral neuropathy treatments.

• Increasing cancer survival rates boost the incidence of chemotherapy-induced peripheral neuropathy, expanding the patient pool.

• Advancements in pharmacological therapies, including sodium channel blockers and monoclonal antibodies, improve treatment efficacy and safety.

• Growing adoption of non-pharmacological therapies, such as physical therapy, TENS, and acupuncture, complements traditional treatments.

• Expanding healthcare infrastructure and awareness campaigns in Asia-Pacific are fueling market growth in emerging regions.

• Hospitals and clinics remain the dominant end-users, while ambulatory centers are rapidly increasing due to cost-effective outpatient care.

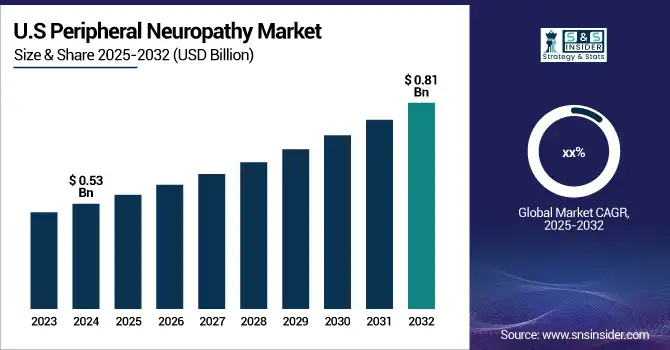

According to a study, the U.S. Peripheral Neuropathy Market size was USD 0.53 billion in 2024 and is expected to reach USD 0.81 billion by 2032.

Peripheral Neuropathy Market Driver:

-

Increasing Prevalence of Diabetes and Aging Populations Fuel Peripheral Neuropathy Market Expansion

The market growth is primarily driven by the increasing prevalence of diabetes and the aging population, which leads to higher instances of peripheral nerve disorders. Rising awareness about neuropathic pain management, expansion of healthcare infrastructure, availability of specialized treatment centers, government initiatives for improved neurological healthcare, and adoption of novel treatment options further stimulate market demand. These factors collectively accelerate treatment adoption and contribute to sustained market expansion over the forecast period.

For example, diabetic peripheral neuropathy patients are increasingly seeking effective treatments, leading to rapid adoption of advanced pharmacological therapies and supportive care solutions. The rising number of elderly patients with diabetes has created a consistent demand for specialized medications and therapies, ensuring continuous growth in the peripheral neuropathy treatment sector.

Peripheral Neuropathy Market Restraint:

-

High Treatment Costs and Limited Access to Advanced Therapies Impede Market Growth

High treatment costs and limited accessibility to advanced therapies remain significant barriers to market growth. Diagnosing and treating peripheral neuropathy can be complex, as symptoms vary widely and often overlap with other medical conditions, causing delayed or inaccurate diagnosis. Additionally, expensive advanced therapies and medications can be unaffordable for patients, especially in developing regions. These factors restrict widespread adoption of effective treatment options, slowing overall market growth and limiting patient access to comprehensive care.

For example, many patients in rural and underserved areas face challenges accessing specialized medications or modern therapeutic devices, resulting in delayed treatment and worsened disease outcomes. Even in urban areas, high out-of-pocket costs for advanced therapies deter some patients from pursuing optimal care.

Peripheral Neuropathy Market Opportunities:

-

Advancements in Non-Opioid Pain Treatments Present Growth Potential

Advancements in non-opioid pain treatments offer a significant opportunity for market growth. The rising focus on personalized medicine allows treatments to be tailored to individual patient needs, improving efficacy while minimizing side effects. Novel pharmacological therapies targeting neuropathic pain without relying on opioids are gaining popularity, driving innovation and adoption across healthcare providers. Increased investment in research and development for safer, more effective treatments presents new revenue streams, especially in the growing diabetic and chemotherapy-induced neuropathy patient segments.

For example, the development of new non-opioid drugs for diabetic peripheral neuropathy is enabling clinicians to provide safer alternatives for chronic pain management. Early clinical successes and positive patient outcomes are encouraging wider adoption of these therapies in both hospitals and outpatient centers.

Peripheral Neuropathy Market Segmentation Analysis:

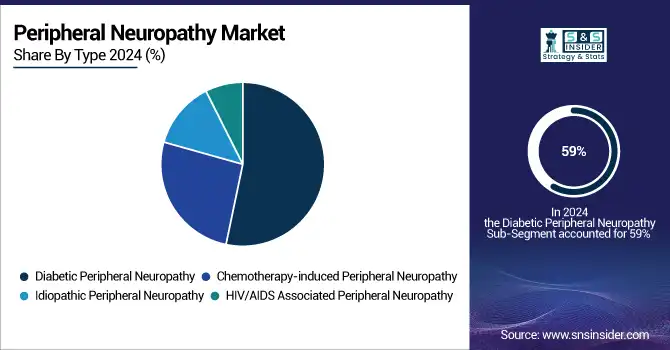

By Type, Diabetic Peripheral Neuropathy Dominates with 59% Revenue Share in 2024, Chemotherapy-Induced Peripheral Neuropathy Growing at 7.13% CAGR

The Diabetic Peripheral Neuropathy (DPN) segment holds the largest revenue share of 59% in 2024, driven by the growing prevalence of diabetes and the aging population. This causes increased demand for targeted therapies and advanced monitoring devices, leading to product development in specialized pharmacological treatments and wearable diagnostic tools. As a result, the Peripheral Neuropathy Market experiences higher revenue generation, with hospitals and clinics prioritizing DPN management programs, further reinforcing the segment’s market dominance and sustained growth trajectory. The Chemotherapy-Induced Peripheral Neuropathy (CIPN) segment is projected to grow at a CAGR of 7.13% during the forecast period due to the rising number of cancer survivors and ongoing chemotherapy treatments. This causes increased demand for effective pain management therapies and supportive care products, prompting pharmaceutical companies to develop safer, targeted medications. Consequently, the Peripheral Neuropathy Market benefits from expanded product portfolios, enhanced clinical solutions, and rising adoption of CIPN-focused therapies in hospitals and ambulatory centers.

By Treatment, Pharmacological Therapies Lead with 48% Revenue Share in 2024, Non-Pharmacological Therapies Expanding at 6.11% CAGR

The Pharmacological Therapies segment commands the largest revenue share of 48% in 2024, driven by high adoption of anticonvulsants, antidepressants, and topical analgesics. This causes pharmaceutical firms to focus on innovative drug development, combination therapies, and clinical trials to enhance efficacy and safety. As a result, the Peripheral Neuropathy Market experiences significant growth, with healthcare providers relying heavily on pharmacological treatments, ensuring consistent demand, improved patient outcomes, and strengthened market leadership in treatment-based segmentation. The Non-Pharmacological Therapies segment is expanding at a CAGR of 6.11% due to increasing preference for complementary approaches like physical therapy, acupuncture, and TENS devices. This causes product development in wearable stimulators, rehabilitation devices, and home-based therapeutic solutions, improving accessibility and patient compliance. Consequently, the Peripheral Neuropathy Market benefits from broader adoption of alternative treatments, enhanced patient satisfaction, and diversified revenue streams, supporting overall market growth and increasing focus on holistic care approaches.

By End User, Hospitals and Clinics Dominate with 47% Revenue Share in 2024, Ambulatory Centers Growing at the Fastest Rate During Forecast Period

Hospitals and Clinics hold the largest revenue share of 47% in 2024, driven by centralized treatment facilities, advanced diagnostic capabilities, and availability of specialized care for neuropathy patients. This causes increased investment in medical devices, treatment protocols, and training programs. Consequently, the Peripheral Neuropathy Market benefits from high patient throughput, better clinical outcomes, and the development of integrated care pathways, reinforcing hospitals and clinics as the primary revenue contributor across the end-user segment. Ambulatory Centers are growing at the highest CAGR during the forecast period due to rising preference for cost-effective, outpatient management of peripheral neuropathy. This causes development of portable diagnostic devices, telemedicine platforms, and outpatient treatment protocols, increasing patient accessibility. As a result, the Peripheral Neuropathy Market gains momentum through expanded service offerings, wider patient reach, and enhanced adoption of innovative care models in ambulatory settings, complementing hospital-based revenue and supporting overall market growth.

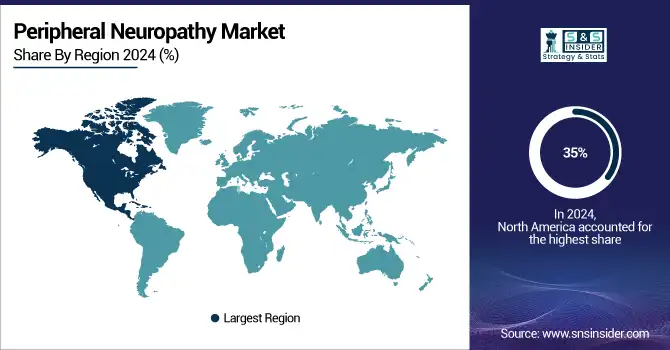

Peripheral Neuropathy Market Regional insights:

North America Peripheral Neuropathy Market Insights

North America dominated the Peripheral Neuropathy Market in 2024 with an estimated market share of 35%. The region’s strong healthcare infrastructure, high prevalence of diabetes and cancer, and growing patient awareness are driving market growth. Advanced diagnostic tools, innovative pharmacological therapies, and specialized clinics are expanding treatment access. The United States leads the market, with hospitals and research centers offering state-of-the-art neuropathy care and personalized treatment plans. Rising adoption of wearable diagnostic devices and outpatient care programs further strengthens the U.S. market dominance.

Need any customization research on Peripheral Neuropathy Market - Enquiry Now

Asia-Pacific Peripheral Neuropathy Market Insights

Asia-Pacific is the fastest-growing region in 2024 with an estimated CAGR of 7.1%. Rapid population growth, increasing diabetes prevalence, and expanding healthcare infrastructure are driving adoption of neuropathy treatments. China dominates the region due to government support, insurance expansion, and investments in advanced diagnostic and treatment facilities. Telemedicine platforms, wearable monitoring devices, and outpatient care models are improving accessibility and treatment effectiveness. Rising awareness and adoption of both pharmacological and non-pharmacological therapies are accelerating China’s leadership in regional market growth.

Europe Peripheral Neuropathy Market Insights

In 2024, Europe held a significant share of the Peripheral Neuropathy Market, driven by an aging population and chronic disease prevalence. Advanced healthcare infrastructure in Germany has increased adoption of neuropathy treatments. Germany dominates the region due to its strong medical technology, research in neurology, and well-established healthcare system. Pharmacological and non-pharmacological therapy adoption is high, enabling early diagnosis and effective management. Stringent healthcare standards and innovation in treatment approaches support Europe’s steady market growth and regional leadership.

Latin America and Middle East & Africa Peripheral Neuropathy Market Insights

In 2024, Latin America and the Middle East & Africa showed steady growth in the Peripheral Neuropathy Market. Rising diabetes and cancer cases, gradual improvements in healthcare infrastructure, and increasing awareness of neuropathic conditions are driving adoption. Governments and private providers are promoting cost-effective treatments, telemedicine solutions, and outpatient care programs. Investments in diagnostic tools and therapeutic technologies enhance patient accessibility. These developments are gradually expanding market penetration and supporting sustainable growth across both regions.

Competitive Landscape section for the Peripheral Neuropathy Market:

Pfizer Inc.

Pfizer Inc. is a U.S.-based global biopharmaceutical leader, specializing in innovative therapies for neurological disorders, including peripheral neuropathy. The company develops pharmacological treatments such as anticonvulsants, antidepressants, and topical analgesics, focusing on safety, efficacy, and patient compliance. Pfizer collaborates with healthcare providers and research institutions to advance clinical trials and deliver targeted therapies. Its role in the peripheral neuropathy market is vital, as it provides comprehensive care solutions that improve patient outcomes and support long-term disease management.

• In 2025, Pfizer expanded its neuropathy portfolio with a next-generation topical analgesic for diabetic peripheral neuropathy, offering improved pain relief and faster patient response times.

Eli Lilly and Company

Eli Lilly and Company is a U.S.-based pharmaceutical leader developing treatments for neuropathic pain and related neurological conditions. The company emphasizes innovative drug development, clinical trials, and combination therapies to improve treatment outcomes. Eli Lilly partners with hospitals and research centers to enhance accessibility and optimize therapy delivery. Its role in the peripheral neuropathy market is critical, as it addresses unmet medical needs while expanding patient access to effective, safe pharmacological options.

• In July 2025, Eli Lilly launched a new oral therapy for chemotherapy-induced peripheral neuropathy, designed to reduce neuropathic pain without compromising chemotherapy efficacy, improving patient quality of life.

Novartis AG

Novartis AG is a Switzerland-based multinational pharmaceutical company specializing in neurological and pain management therapies, including peripheral neuropathy treatments. The company focuses on research-driven development of targeted pharmacological solutions, clinical innovations, and patient-centric care models. Novartis collaborates with hospitals and specialty clinics to enhance therapy adoption and optimize treatment outcomes. Its role in the peripheral neuropathy market is pivotal, providing advanced treatment options that improve symptom management and enhance patient quality of life.

• In 2024, Novartis introduced a novel sodium channel blocker for diabetic and chemotherapy-induced neuropathic pain, demonstrating enhanced efficacy and fewer side effects in clinical evaluations.

Johnson & Johnson

Johnson & Johnson is a U.S.-based healthcare and pharmaceutical leader, offering innovative therapies and medical devices for peripheral neuropathy management. The company focuses on pharmacological treatments, complementary care products, and integrated patient support programs. Johnson & Johnson partners with hospitals, clinics, and research institutions to expand access and improve treatment outcomes. Its role in the peripheral neuropathy market is essential, as it provides comprehensive solutions that combine pharmacological therapy with patient education, clinical guidance, and supportive care strategies.

• In 2024, Johnson & Johnson launched a combination therapy program for neuropathic pain, integrating oral medication with wearable neuromodulation devices to enhance pain relief and patient adherence.

Peripheral Neuropathy Market Key Players:

-

Pfizer Inc.

-

Eli Lilly and Company

-

Novartis AG

-

Johnson & Johnson

-

AbbVie Inc.

-

Merck & Co., Inc.

-

AstraZeneca plc

-

GlaxoSmithKline plc (GSK)

-

Teva Pharmaceutical Industries Ltd.

-

Amgen Inc.

-

Sun Pharmaceutical Industries Ltd.

-

Cipla Limited

-

Lupin Limited

-

Dr. Reddy's Laboratories Ltd.

-

Cadila Pharmaceuticals Ltd.

-

Mylan N.V.

-

Hikma Pharmaceuticals PLC

-

Apotex Inc.

-

Grünenthal GmbH

-

Lexicon Pharmaceuticals

| Report Attributes | Details |

| Market Size in 2024 | US$ 1.48 Bn |

| Market Size by 2032 | US$ 2.38 Bn |

| CAGR | CAGR of 5.46% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Diabetic Peripheral, Neuropathy, Chemotherapy-induced Peripheral Neuropathy, Idiopathic Peripheral Neuropathy, HIV/AIDS Associated Peripheral Neuropathy) • By Treatment (Pharmacological Therapies, Non-Pharmacological Therapies, Others) • By End User (Hospitals & Clinics, Ambulatory Care, Other) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles |

Pfizer Inc., Eli Lilly and Company, Novartis AG, Johnson & Johnson, AbbVie Inc., Merck & Co., Inc., AstraZeneca plc, GlaxoSmithKline plc (GSK), Teva Pharmaceutical Industries Ltd., Amgen Inc., Sun Pharmaceutical Industries Ltd., Cipla Limited, Lupin Limited, Dr. Reddy's Laboratories Ltd., Cadila Pharmaceuticals Ltd., Mylan N.V., Hikma Pharmaceuticals PLC, Apotex Inc., Grünenthal GmbH, Lexicon Pharmaceuticals |