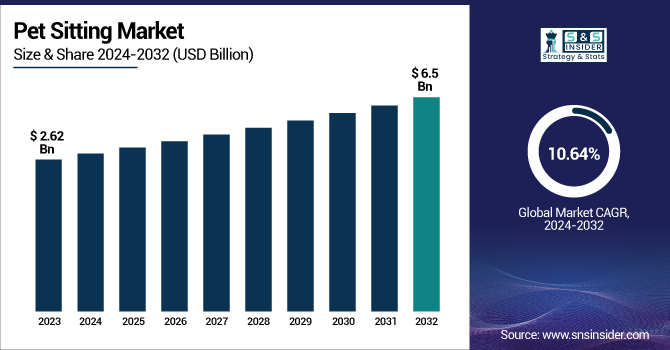

Pet Sitting Market Size Analysis:

The Pet Sitting Market Size was valued at USD 2.62 billion in 2023 and is expected to reach USD 6.5 billion by 2032, growing at a CAGR of 10.64% over the forecast period 2024-2032.

To Get more information on Pet Sitting Market - Request Free Sample Report

This report also explains the latest trend developments and statistics in the Pet Sitting Market industry which are helpful for businesses. It features pet ownership trends, including growth rates and demographics. Rates of service utilization analyze the use of pet-sitting services including the frequency and type of services utilized. Regional breakdown of expenditures, including pet insurance and premium services. The report explores pet health and wellness trends, examining veterinary visits and medication administration by sitters. Tech adoption also measures the use of booking platforms, GPS tracking, and monitoring apps. Regulatory and compliance trends describe changing industry norms, certification policies, and archival data on outlooks in the pet-sitting industry.

U.S. Pet Sitting Market Size & Forecast

The Pet Sitting Market in the US is experiencing steady growth, with values of USD 0.73 Billion in 2023, reflecting a strong annual growth rate of 10.66%. Growth of pet ownership, increasing disposable income, and increasing preference for professional pet care are the global factors contributing to this upward trend. Increasing pet ownership and humanization trends drive the pet-sitting market. According to the latest statistics from the government, pet ownership has plateaued at 63% of U.S. households, 44% of them with at least one dog. This trend is bolstered by rising spending on pet care and services.

Pet Sitting Market Dynamics

Growth Drivers in the Pet Sitting Industry

-

Increasing pet ownership and humanization of pets boost demand for pet sitting services.

The pet humanization trend has significantly propelled the growth of pet-sitting services due to the growing number of pet owners. There are an estimated 89.7 million dogs in the United States (45.5% of households own dogs), while 73.8 million cats (32.1% of households own cats). This widespread pet ownership reflects a substantial need for pet care services, including pet sitting. Pet humanization refers to the growing trend of perceiving pets as family members, a global phenomenon. In Thailand, the trend has pushed the pet care market to above 40 billion baht (about $1.1 billion) and is set to rise to 60 billion baht ($1.8 billion) in three years. This positive development suggests an increasing propensity among pet owners to spend money on services that enhance the wellness of their pets, such as professional pet-sitting services. Also, younger generations are adding to this demand. According to the Office for National Statistics, in the UK, Generation Z pet owners spend an average of £145 a month on their pets which is 30% higher than the national average of £112. This spending has expanded to include a range of pet care services, indicating a willingness to spend money on quality pet sitting. Innovations in pet care only deepen this trend. Devices such as the Shazam voice-activated collar to mimic human-animal interaction are a few of the extremes owners are willing to go to improve their pets’ lives. These innovations serve as a testimony to the emphasis on meticulous pet care, justifying the need for credible pet-sitting services.

Restraints

-

Lack of standardized regulations and certifications can hinder trust in pet sitters.

The pet-sitting industry faces significant challenges due to the lack of standardized regulations and certifications. For example, pet sitting is not regulated in many parts of the world including the UK, which means anyone can offer to pet sit without any qualifications or insurance. Without this supervision, the quality of service can vary and pet safety can be compromised. But, be warned, while dog boarding services need licenses from the local council, not all pet sitting services are as strictly scrutinized. This lack of regulations creates a problem for pet owners as they may have to lend their trust to a stranger without knowing for sure whether they will treat their pet with the same love and care as their own. To alleviate these worries, experts advise pet owners to use sitters who carry public liability insurance and are ideally registered with the Disclosure and Barring Service (DBS). However, without standardized regulations in place, the responsibility falls on pet owners to perform adequate due diligence, which may not be possible in all circumstances. The pet-sitting industry lacks standardized regulations and certifications, making it difficult for pet owners to gauge the service quality and ensure their pets' safety. Though certain regions require licenses to perform certain services, many areas are completely unregulated, leaving it up to pet owners to thoroughly vet sitters. Standardized regulations could lead to consistent trust and reliability across this new-age industry.

Opportunities

-

The growing use of technology enables platforms connecting pet owners with reliable sitters.

The pet-sitting industry has benefited greatly from the integration of technology and it can help improve the convenience and reliability for pet owners seeking pet sitters. Providers like TrustedHousesitters and PetBacker are examples of that transition. TrustedHousesitters, for example, has more than 119 house sits available in France, connecting owners with sitters who’ll take care of their furry friends in exchange for a place to sleep. Similarly, PetBacker boasts 2,247 pet sitters in France, offering services like boarding, walking, and grooming. With pet owners choosing to maintain their pets in familiar areas, the requirement for at-home pet treatment in the United States is growing. Pet sitters usually make about $16 an hour, and overnight stays can be $60 to $115. This trend is further supported by the growing number of pet-friendly accommodations; approximately 75% of U.S. hotels now welcome pets, reflecting the increasing number of pet owners who travel with their companions. These innovations are not just making it easier for pet parents to find a trusted pet sitter, but also meeting the needs of pet owners who have changed what they are looking for in a reliable and convenient care solution.

Challenges

-

Ensuring the safety and well-being of pets in the absence of comprehensive industry oversight.

The absence of standardized regulations and certifications makes the pet sitting industry, one of the challenges of pet safety and health. Without stringent regulations in place, the quality of care can vary significantly amongst pet sitters, leading to pet safety concerns. In the US, the pet-sitting industry is made up of more than 160,000 businesses, 99% of which are independently owned. This enormous chorus of independent operators accounts for the wide range of service quality and compliance with safety protocols. Rules like one supervisor for every 15 dogs like in daycare settings like to Colorado emphasize oversight, but such standards differ state by state. This challenge is further highlighted in countries like India where the pet industry has boomed. With around 30 million pet dogs and 5.5 million domestic cats in the country, the need for pet care services is on the rise. But as the industry has grown, regulations have failed to keep up, resulting in a patchwork landscape where pet sitters may lack appropriate training or supervision.

Pet Sitting Market Segmentation Analysis

By Service Type

The care visits segment accounted for the highest revenue in the 2023 pet sitting market. This success is due to the demand for long-term care services that support the health and routine of pets. Pet owners are increasingly looking for trained personnel who can dispense medications as well as provide companionship, security and bonding, according to government reports. The growth of care visits segment is also supported by the increasing recognition of pet health and well-being issues, which has been emphasized in recent government documents. For example, the U.S. Department of Agriculture stresses the importance of proper pet care, which is in line with the kind of services care visits provide.

Personal interaction is an important aspect of keeping pets healthy both emotionally and physically; with that in mind, this segment is the most attractive. Also, pet owners tend to need services for pets with special requirements including older pets or pets with medical needs. One such area of specialization is along the lines of providing care to those stray pets who need attention and medication; care visits with these professionals are among the most preferred things to do. Moreover, government interventions that entail promotion of animal welfare have also acted as a thrust to the demand of professional pet-sitting services thus adding to this segment's leading position.

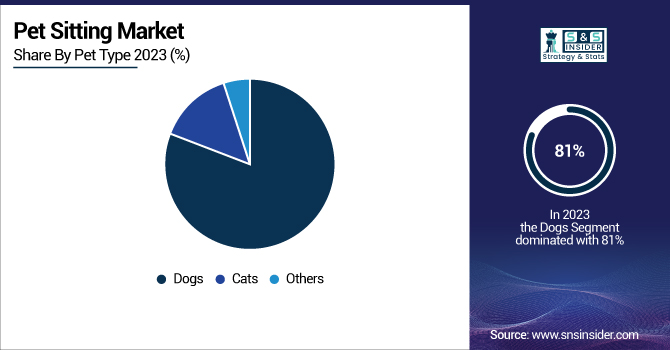

By Pet Type

The dogs segment held the largest share of 81% of the pet-sitting market in 2023. The reason for this is the number of dog owners in the world and the specific care of dogs that requires physical exercise and socialization. Government statistics show dogs are the most popular pets in most countries and they are often treated as family in the U.S. According to the U.S. Census Bureau, many households currently have dogs, so the demand for pet-sitting services that cater to their needs is on the rise.

Giving preference to dog sitting services is one thing which has very a strong reason related to the emotional bond between the dog and their owner. 84% of U.S. dog owners consider their dogs children, and many are prioritizing purchases for their pets over their own. Their emotional connection with their pets results in a greater tendency to pay for high-quality dog sitting and other pet care services. In addition to this, the adoption of government regulations and guidelines on the care of domestic animals has driven pet owners dogs in particular to avail of professional services that can provide the required degree of attention and activity which also aids in holding a notable share of this segment.

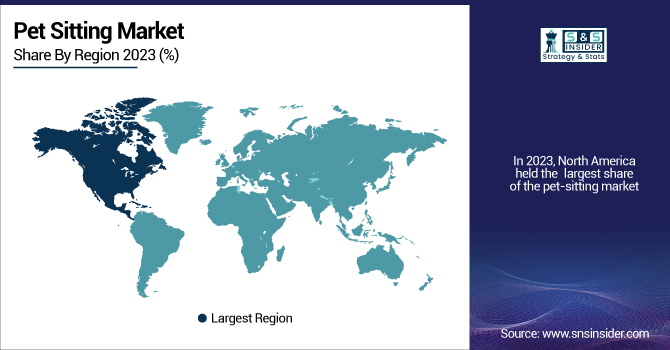

Pet Sitting Market Regional Insights

In 2023, North America held the largest share of the pet-sitting market. In 2023, North America accounted for a large share owing to the high pet ownership rates and the advanced pet care infrastructure. The U.S. government data on consumer spending underscores the region's strong demand for premium pet services. The Asia-Pacific region is expanding at the highest CAGR, on account of the high adoption of pets and increasing disposable income levels in China and India. Additionally, Asia-Pacific is emerging as the fastest-growing market for pet furniture due to government initiatives promoting knowledge of pet welfare and the rising trend of pet ownership among millennials. Japan and South Korea are pet humanization's main markets where, high-class pet care service, such as pet sitting, has a high demand. Technological innovations like mobile applications that allow pet owners to find professional sitters are also driving growth in the region, providing more convenience and accessibility.

Get Customized Report as per Your Business Requirement - Enquiry Now

Leading Companies in the Pet Sitting Industry

Key Service Providers/Manufacturers

-

Rover

-

Wag! Group Co.

-

Pawshake

-

TrustedHousesitters

-

Care.com

-

Fetch! Pet Care

-

Dogtopia

-

Camp Bow Wow

-

PetStay

-

Petsville

-

The Bark Club

-

Doggiie Dog World

-

Pet Boarding Mumbai

-

Petnefits

-

Bhubhu House Pet Care Centre

-

Pet sitter Mumbai

-

BARK-iNN

-

PawPurrfect

Recent Development in the Pet Sitting Market

-

In May 2024, research from IBISWorld, opened a window on the increasing amount of pets in the U.S., revealing an estimated 196.9 million pets nationally and strong demand for pet care services, such as pet sitting.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 2.62 Billion |

| Market Size by 2032 | USD 6.5 Billion |

| CAGR | CAGR of 10.64% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Service Type (Care Visits, Drop-in Visits) • By Pet Type (Dogs, Cats, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Rover, Wag! Group Co., PetBacker, Pawshake, TrustedHousesitters, Care.com, DogVacay, Fetch! Pet Care, Dogtopia, Camp Bow Wow, PetStay, Petsville, The Bark Club, Doggiie Dog World, Pet Boarding Mumbai, Petnefits, Bhubhu House Pet Care Centre, Pet Sitter Mumbai, BARK-iNN, PawPurrfect |