Pharmaceutical Cartridges Market Report Scope & Overview:

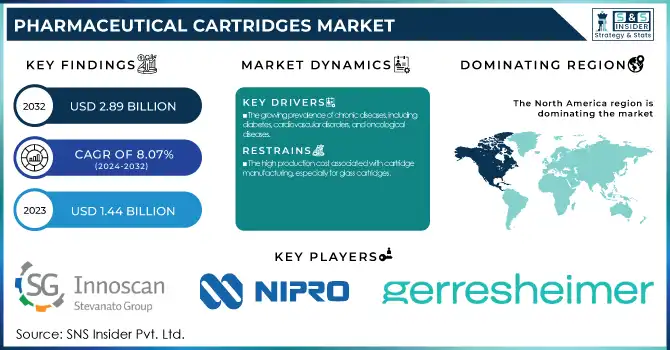

The Pharmaceutical Cartridges Market was valued at USD 1.44 Billion in 2023 and is projected to reach USD 2.89 Billion by 2032, growing at a compound annual growth rate (CAGR) of 8.07% from 2024 to 2032. This study emphasizes the market's rate of expansion, the development of sophisticated cartridge technologies, and their growing use in the delivery of specialized and biologic medications. With an emphasis on how market trends are being shaped by the need for more precise, effective, and user-friendly medication delivery systems, the study also looks at patient preferences and behavior. The report evaluates the impact of e-commerce on the distribution and accessibility of pharmaceutical cartridges and the expanding significance of these devices in customized medicine and healthcare delivery.

Get More Information on Pharmaceutical Cartridges Market - Request Sample Report

Market Dynamics

Drivers

-

The growing prevalence of chronic diseases, including diabetes, cardiovascular disorders, and oncological diseases

As increasing numbers of individuals need injectable drugs for these diseases, demand for prefilled pharmaceutical cartridges is growing at a very fast rate. For example, the prevalence of diabetes worldwide is anticipated to increase from 463 million in 2019 to 700 million by 2045, which will significantly increase the demand for insulin delivery devices that use pharmaceutical cartridges. The growing use of biologics and biosimilars for the treatment of many diseases is another key driver. Biologic drugs tend to need specialized packaging, including reconstitution dual-chamber cartridges. The industry is also gaining from technology, like smart syringes and automatic injectors, that enhance patient compliance. Additionally, the increased trend towards home-based care and self-injection devices is speeding up the need for prefilled pharmaceutical cartridges, which are easy to use and portable.

Restraints

-

The high production cost associated with cartridge manufacturing, especially for glass cartridges.

Glass cartridges, although the preferred option for biologics are more costly to manufacture because of the rigorous manufacturing and sterilization processes involved. This translates to increased overall costs for both the pharmaceutical industry and patients. In addition, regulatory barriers pose a challenge to market expansion. Rigorous regulations, including those of the FDA and EMA, require extensive testing and approval procedures, which slow down product launches and extend the time-to-market. Small and medium enterprises, especially, find it difficult to cope with the hefty expenses and regulatory requirements, restricting their scope for competition. Also, environmental sustainability issues concerning the environmental footprint of plastic cartridges are causing growing pressure from regulators and consumers for more environmentally friendly options.

Opportunities

-

Technological advancements and the growing demand for biologics and personalized medicine.

The emergence of smart cartridges, with built-in RFID monitoring and patient compliance sensors, is opening new areas of growth for drug delivery systems. Additionally, the growing market for biologics, predicted to reach USD 700 billion in 2025, offers significant opportunities for prefilled pharmaceutical cartridges, since many biologic medicines are presented with unique packaging needs. Finally, the trend towards personalized medicine and customized dosages is creating new demand for small, specialty-sized cartridges specific to individual patient conditions. The increasing uptake of homecare healthcare and self-injection systems also offers opportunities, with the global market for self-injection devices expected to expand considerably. With patient care becoming increasingly personalized and biologic demand increasing, the demand for innovative pharmaceutical cartridges is also likely to increase, and the resulting market potential in the coming years will be enormous.

Challenges

-

Ensuring the safety and quality of pharmaceutical cartridges presents a key challenge, particularly for biologics and other sensitive drug formulations.

Contamination, degradation, or improper dosing may have serious consequences on health, and thus strict quality control and sterilization procedures are mandatory but hard to achieve. In addition, high-quality raw material, e.g., specialized glass and plastic for cartridges, is not always available, and therefore production is delayed and the cost may vary. The pharmaceutical cartridge market is also threatened by competition from other drug delivery systems, including prefilled syringes and vial-based systems, which are perceived to be more versatile and economical. Furthermore, the increasing pressure for sustainability is a major challenge, with consumers and regulators calling for environmentally friendly materials. Firms need to overcome this challenge by producing recyclable or biodegradable cartridges, posing both a barrier and an opportunity for innovation in the market.

KEY MARKET SEGMENTATION

By Material Type

Glass cartridges dominated the market in 2023 and maintained a share of about 65%, powered by their excellent compatibility with biologics, great barrier capabilities, and chemical stability. Glass cartridges are in general popular within injectable drug delivery systems on account of being leach-proof and possessing stringent sterility standards. The plastic cartridges segment is likely to be the fastest-growing as a result of the growing demand for lightweight, shatter-resistant options. With improvements in polymer technology, plastic cartridges are increasingly being used in self-injection devices and wearable drug delivery systems.

By Application

The pen injectors segment dominated the market in 2023 with a 40% share, driven mainly by the increasing rate of diabetes and the high popularity of insulin pens. Pen injectors are convenient, accurate, and easy to use, thus being the choice for managing chronic diseases. The wearable injectors segment is also expected to develop at the fastest rate, due to the move towards home therapy and the need for continuous and controlled drug delivery systems, especially for biologics and cancer therapies.

By Chamber Type

The dual chamber segment led the market in 2023 with a 55% share, thanks mainly to its extensive application in lyophilized drug products that need reconstitution before injection. These cartridges improve drug stability, and shelf life, and deliver accurate dosing, which is perfect for life-critical medications like biologics and potent drugs. The segment is also the fastest-growing, led by the growing demand for sophisticated drug delivery solutions. While pharmaceutical firms continue to develop intricate formulations, dual chamber cartridges are becoming increasingly necessary for ensuring drug potency and patient safety, again driving their uptake in numerous therapeutic applications.

By Size

The 3ml cartridges segment occupied the highest market share in 2023 with 35% share, which is mainly because of its large application in biologic drug formulation and insulin drug delivery systems. This volume is most commonly used for both multidose and single-use applications with an ideal compromise between volume and convenience of use. The segment is also growing at the fastest rate, driven by the increasing usage of self-injection pens and the growing universe of biologic therapies that are needed in prefilled cartridges. With patient choice moving towards ready-to-use drug delivery systems that are convenient, demand for 3ml cartridges will grow rapidly in the years to come.

By Therapeutic Area

The diabetes segment dominated the market in 2023 with a 45% market share because of the extensive prevalence of diabetes and the huge use of insulin pens and cartridges. The rise in the population of diabetics and convenience preference for self-administered drug delivery systems have driven the dominance. The diabetes segment continues to be the fastest-growing, with the driving forces being the rising incidence of type 1 and type 2 diabetes and advancing insulin delivery technology.

By End Use

The pharmaceuticals segment led the market in 2023 with 60% of the market share, given that pharmaceutical companies are the biggest end users of injectable drug cartridges, especially for chronic diseases and biologics. Rising R&D spending on injectable formulations also underpinned the leadership. The other segment comprising compounding pharmacies and specialty drug manufacturers will witness the highest growth, as there will be more demand for personalized drug delivery solutions and personalized medicine.

REGIONAL ANALYSIS

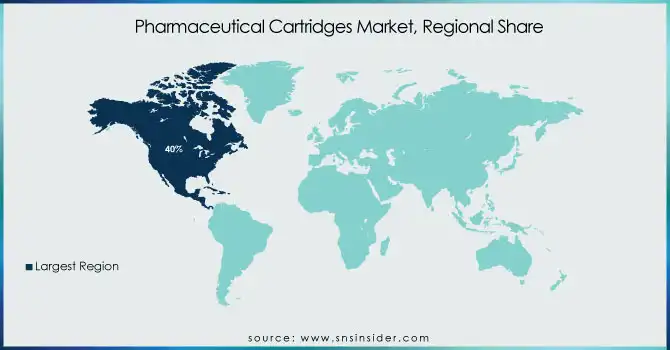

North America led the pharmaceutical cartridges market in 2023 with 40% of the global market share due to the high penetration of biologics, advanced healthcare infrastructure, and extensive presence of top-tier pharmaceutical companies. The rising number of chronic conditions like diabetes and autoimmune diseases has driven demand for prefilled cartridges utilized in self-injection systems. Furthermore, strict regulatory measures in the United States and Canada have promoted the utilization of high-quality, pre-sterilized cartridges.

Europe had the second-highest share, backed by increasing production of biologics, government policies towards eco-friendly drug packaging, and the availability of major market players like Gerresheimer AG and Schott AG. Germany, France, and the UK are the top contributors, with an increasing emphasis on novel drug delivery solutions.

The Asia-Pacific market is predicted to be the fastest-growing one, led by fast-growing pharma industries in China, India, and Japan, growing investments in healthcare, and an expanding patient pool for chronic diseases. The trend of self-administration and homecare is also contributing to market growth.

Do You Need any Customization Research on Pharmaceutical Cartridges Market - Enquire Now

Key Players

-

Stevanato Group – EZ-fill Cartridges

-

NIPRO – Nipro Cartridges

-

Gerresheimer AG – Gx RTF Cartridges

-

West Pharmaceutical Services, Inc. – NovaPure Cartridges

-

Schott AG – SCHOTT TOPPAC Cartridges

-

Transcoject GmbH – Transcoject Cartridges

-

Shandong Medicinal Glass Co., Ltd. – Shandong Glass Cartridges

-

Dätwyler Holding Inc. – Datwyler Cartridge Components

-

AptarGroup, Inc. – Aptar Pharma Cartridges

-

Sonata Rubber – Sonata Cartridge Components

-

Bormioli Pharma – Bormioli Cartridges

-

SGD Pharma – SGD Pharma Cartridges

-

Corning Inc. – Valor Glass Cartridges

-

Berry Global Inc. – Berry Pharma Cartridges

-

Pacific Vial Manufacturing Inc. – Pacific Cartridges

Recent Developments

In Jan 2025, HYTN Innovations Inc., a pharmaceutical-grade cannabis manufacturer, partnered with SNDL Inc., a leading vertically integrated cannabis company, to co-develop GMP-compliant vape cartridges for global markets. This collaboration aims to enhance quality standards and expand market reach in the pharmaceutical and cannabis sectors.

In Sep 2024, Sandoz was awarded USD 137 million in damages by a New Jersey district court, after a yearslong dispute with United Therapeutics over a generic version of the pulmonary arterial hypertension drug treprostinil. The court ruled that Sandoz, a former Novartis subsidiary, is entitled to compensation for lost profits following a breach of contract dating back to 2015.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.44 billion |

| Market Size by 2032 | USD 2.89 billion |

| CAGR | CAGR of 8.07% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Material Type [Glass Cartridges (Type 1, Type 2, Type 3), Plastic Cartridges (Polypropylene (PP), Cyclic Olefin Copolymer (COC), Cyclic Olefin Polymer (COP), Polyethylene), Rubber] • By Application [Dental Anesthesia, Pen Injectors, Autoinjectors, Wearable Injectors] • By Chamber Type [Dual Chamber, Large Volume] • By Size [0.5 ml, 1.8 ml, 2ml to 2.5 ml, 3 ml, 5 ml, More than 10 ml] • By Therapeutic Area [Ophthalmology, Respiratory, Neurology, Oncology, Immunology, Cardiology, Diabetes, Dental, Others] • By End Use [Pharmaceuticals, Biotechnology, Research Organizations, Others] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Stevanato Group, NIPRO, Gerresheimer AG, West Pharmaceutical Services, Inc., Schott AG, Transcoject GmbH, Shandong Medicinal Glass Co., Ltd., Dätwyler Holding Inc., AptarGroup, Inc., Sonata Rubber, Bormioli Pharma, SGD Pharma, Corning Inc., Berry Global Inc., Pacific Vial Manufacturing Inc. |