Pharmaceutical Processing Seals Market Size & Overview:

Get more information on Pharmaceutical Processing Seals Market - Request Sample Report

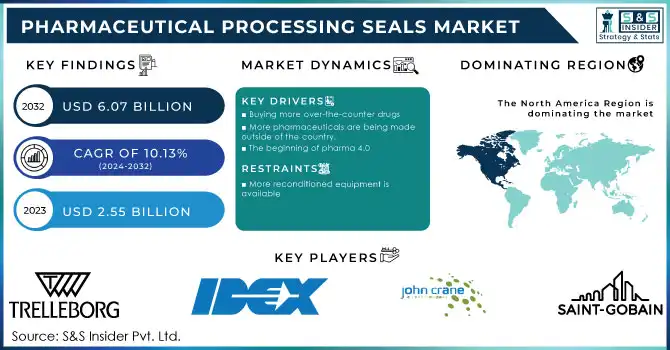

The Pharmaceutical Processing Seals Market Size was valued at USD 2.55 Billion in 2023 and is expected to reach USD 6.05 Billion by 2032 and grow at a CAGR of 10.11% over the forecast period 2024-2032.

This report underscores demand and consumption patterns, focusing on the rising demand for high-performance sealing solutions with increased pharmaceutical manufacturing and rigorous safety requirements. The research analyzes sales and revenue patterns by regions, highlighting market growth fueled by regulatory requirements and increasing use of sophisticated manufacturing processes. It also delves into supply chain patterns, evaluating the influence of raw material availability, manufacturing efficiency, and cost fluctuations on pricing patterns. The study also explores compliance and regulatory trends, with emphasis on changing industry standards and how they impact product innovation. Additionally, it assesses R&D and innovation trends, with particular emphasis on biocompatible and high-durability seal development to improve drug safety and efficiency in production. Finally, the research takes macroeconomic and industry trends into consideration, examining how global healthcare spending and technological progress are influencing the future of the pharmaceutical processing seals market.Bottom of Form

Market Dynamics

Drivers

-

The growing demand for biopharmaceuticals and generic drugs, stringent regulatory requirements, and advancements in pharmaceutical manufacturing.

The growing incidence of chronic diseases like diabetes, cardiovascular diseases, and respiratory diseases has driven the demand for high-quality pharmaceutical seals to provide contamination-free drug manufacturing. The growth of the biopharmaceutical industry, with more than 50% of newly approved drugs being biologics, is one of the main drivers. Moreover, the use of single-use systems in biopharma production has raised the demand for highly durable and compliant sealing solutions. Technological improvements, such as the availability of high-performance elastomers and metal seals, have further optimized the efficiency and reliability of equipment used in pharmaceutical processing. An increase in the number of contract manufacturing organizations (CMOs) and the externalization of drug production to specialty facilities also underpins market expansion. With regulatory authorities like the FDA, EMA, and WHO implementing stringent quality norms, companies are forced to spend on better sealing solutions that are in line with Good Manufacturing Practices (GMP). Additionally, the increased emphasis on automation and Industry 4.0 in pharmaceutical production has fueled interest in intelligent sealing technology, providing precision and process efficiency.

Restraints

-

The high material costs, stringent regulatory compliance, and limited compatibility of seals with aggressive pharmaceutical substances.

The expense of high-performance sealing materials, including PTFE (Polytetrafluoroethylene), FKM (Fluoroelastomers), and silicone-based elastomers, has a major effect on profit margins, particularly for small and medium-sized producers. In addition, the need for comprehensive testing, validation, and regulatory approvals extends the product development cycle, raising time-to-market. For example, regulatory bodies require seals to be compliant with standards like USP Class VI, FDA 21 CFR, and ISO 10993, which results in increased compliance costs. Another significant hindrance is seal breakdown and failure when subjected to high-temperature autoclaving or exposure to toxic chemicals, which necessitates multiple replacements and driving up the costs of operations. Supply chain disturbance is also prevalent in the industry, with an inconsistency in the availability of raw materials affecting timelines for production. Furthermore, standardization between varying pharmaceutical processing hardware is also an issue, triggering compatibility problems requiring manufacturers to fabricate bespoke products, further enhancing costs. These aspects all contribute to preventing the smooth uptake of pharmaceutical processing seals industry-wide.

Opportunities

-

The rise in biologics manufacturing, expansion of single-use technologies, and increasing investments in sustainable sealing solutions.

The biopharmaceutical sector, expanding at a double-digit growth rate, is creating significant demand for high-performance sealing solutions that are resistant to aggressive sterilization and contamination control processes. The use of single-use systems (SUS) in pharma manufacturing is also creating new opportunities for custom sealing solutions targeted at disposable elements. The trend towards personalized medicine, gene therapy, and vaccine manufacturing has also driven the need for advanced sealing technologies. Sustainability is fast becoming a driving opportunity, as manufacturers seek to use environmentally friendly, recyclable, and biocompatible materials to meet the global environmental regulation requirements. Coupling smart seals with IoT-empowered monitoring is another rich opportunity, providing real-time measurement of seal performance, leakage sensing, and condition-based maintenance. The growing pharma contract manufacturing trend has also generated demand for tailored sealing solutions for specialized drugs. Government policies encouraging indigenous pharmaceutical production and expanding investments in automated drug manufacturing plants also add to growth prospects. With more and more pharmaceutical firms upgrading their plants, the need for next-generation processing seals with enhanced performance and regulatory compliance is likely to surge.

Challenges

-

The Pharmaceutical Processing Seals Market faces challenges such as seal contamination risks, material compatibility issues, and technological complexities in designing highly efficient sealing solutions.

The most important challenge is maintaining contamination-free sealing, since any of their failures can cause drug contamination, recalls, and regulatory non-compliance. The pharmaceutical sector recalls about 4,500 batches of drugs every year due to contamination and process failures, which indicates how necessary high-quality seals are. The second challenge is the intricate material compatibility demands, where various drug products interact differently with sealing materials to cause chemical degradation, swelling, or leaching of particles into the drug. The manufacturers have to perform elaborate compatibility studies to ensure safety, which adds cost and time to development. Moreover, varied customization needs across various pharmaceutical processes complicate it to create an all-encompassing sealing solution, necessitating high investments by manufacturers in R&D and custom designs. The increasing regulatory intensity in various markets, with their respective compliance expectations, also prove to be challenging for manufacturers considering global expansion. Moreover, inconsistencies in raw material supply and volatility in prices also affect production, causing delays in the availability of seals for pharma manufacturers. Conquering these obstacles demands ongoing innovation, regulatory evolution, and investment in next-generation sealing technologies.

Segmentation Analysis

By Material

Metal was the leading segment in the pharmaceutical processing seals market in 2023 with a 33.2% revenue share. Metal seals' success is due to their better longevity, good resistance to harsh temperatures and chemicals, and adherence to tight regulatory compliance in pharmaceutical production. Stainless steel and aluminum seals are pervasive in high-level applications like bioprocessing and API manufacturing where contamination control and long-term performance are critical.

The most rapidly growing material segment is polymer/elastomer-based seals, which are fueled by their flexibility, affordability, and improved sealing performance in pharmaceutical processing environments. These materials provide superior chemical resistance, which makes them extremely appropriate for biopharmaceutical applications and sterile processing, where a contamination-free environment is essential.

By Product

The O-rings segment was the dominant product category in 2023, holding the highest revenue share of 32.8%. O-rings are used widely in pharmaceutical processing because of their versatility, simplicity of installation, and high sealing performance against liquids and gases. Their use in a wide range of pharmaceutical processing equipment, such as pumps, valves, and bioreactors, accounts for their dominance in the market.

The gaskets segment is anticipated to expand at the second-fastest rate during the forecast period. The rising demand for safe sealing solutions in high-pressure environments and the demand for specialized gasket materials with improved resistance to aggressive chemicals are driving its growth. Gaskets are essential for avoiding contamination and maintaining process integrity in pharmaceutical manufacturing, further supporting their use.

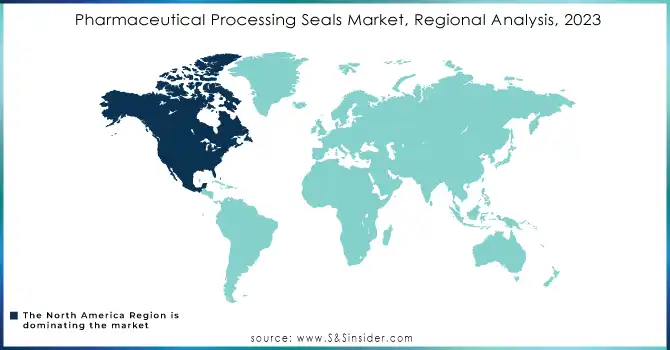

Regional Analysis

Asia Pacific led the Pharmaceutical Processing Seals Market in 2023 with a highest revenue share of 46.9%. The region leads due to the strong growth of pharmaceutical manufacturing, rising investments in biopharmaceutical manufacturing, and favorable government programs supporting domestic drug production. China and India are major contributors, fueled by low-cost production capabilities, prominent presence of contract manufacturing organizations (CMOs), and growing demand for high-quality pharmaceutical processing equipment.

North America is projected to be the most rapidly growing area, driven by the expanding adoption of innovative pharmaceutical processing technologies, high regulatory compliance needs, and high R&D spending on biopharmaceuticals. Dominance by prominent pharmaceutical corporations and a heightened interest in precision medicine and manufacturing biologics is driving the growth of the market in this area.

Get Customized Report as per your Business Requirement - Request For Customized Report

Key Players and Their Products in the Pharmaceutical Processing Seals Market

-

Flowserve Corporation – Valves, O-rings, Gaskets, Mechanical Seals

-

Morgan Advanced Materials PLC – Sealing Rings, Graphite Seals, High-Performance Gaskets

-

Trelleborg AB – O-rings, Gaskets, Lip Seals, Diaphragms

-

Garlock – Gaskets, Diaphragms, Compression Packings

-

Saint-Gobain S.A. – O-rings, Tubing Seals, Polymer Seals

-

Parker Hannifin Corporation – O-rings, Gaskets, Lip Seals, Metal Seals

-

IDEX Corporation – O-rings, Peristaltic Pump Seals, Sanitary Seals

-

James Walker – O-rings, Elastomer Seals, Gaskets

-

Freudenberg Group – O-rings, Diaphragms, Lip Seals, PTFE Seals

-

John Crane – Mechanical Seals, O-rings, Gaskets

Recent Developments

In June 2024, Ritedose Corporation, a leading CDMO specializing in sterile Blow-Fill-Seal (BFS) technology, expanded its production capacity to meet the rising demand for ophthalmic and respiratory medications. This expansion strengthens its position in the pharmaceutical manufacturing sector.

| Report Attributes | Details |

| Market Size in 2023 | USD 2.55 billion |

| Market Size by 2032 | USD 6.05 billion |

| CAGR | CAGR of 10.11% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Material [Metal, Rubber, Silicone, Polymer/Elastomer, Other Materials] • By Product [O-rings, Gaskets, Lip Seals, D Seals, Other Products] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Flowserve Corporation, Morgan Advanced Materials PLC, Trelleborg AB, Garlock, Saint-Gobain S.A., Parker Hannifin Corporation, IDEX Corporation, James Walker, Freudenberg Group, John Crane. |