Photonic Integrated Circuit Market Size:

Get More Information on Photonic Integrated Circuit Market - Request Sample Report

Photonic Integrated Circuit Market Overview

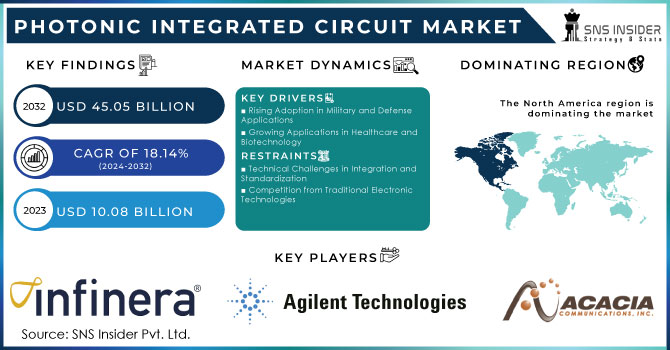

The Photonic Integrated Circuit Market size was valued at USD 10.08 billion in 2023 and is expected to reach USD 45.05 billion by 2032 and grow at a CAGR of 18.14% over the forecast period 2024-2032.

Photonic Integrated Circuit has been significantly growing due to the need for higher speeds of data transmission. PIC helps increase the speed of devices or machines. Also, the process of miniaturization is progressively evolving in all sectors, boosting the growth of the photonic integrated circuit market. Miniaturized devices are more functional; their size decreased proportionally to the pace of their functionality growth. Thus, it is possible to do even more things with our tiny but powerful gadgets. A switch from big expensive satellites toward small cheap ones is central to 21st-century business, and a typical item in the list of industries is the satellite business. Specifically, in the last seven years, 663 commercial small-sats have been designed, over 80% of them to be used in remote sensing. More recently, ISRO’s PSLV-C44 placed Microsat-R and Kalam-sat V2 satellites successfully in orbit. The latter pint-sized satellite, built by schoolchildren for just 1.2 million rupees, is the world’s smallest, weighing only 1.2 kg and measuring 4 cm in each direction. These devices are gradually transforming into processing centers performing various functions.

Emerging technologies, such as artificial intelligence and autonomous vehicles, are increasingly dependent on real-time data processing. Moreover, the expanding implementation of cloud computing and the Internet of Things is fostering the growth of the photonic integrated circuit market, as cloud computing and IoT bring a sufficient capacity to be suitable mechanisms for the functionality of modern-day apparatus that are reliant on PICs. For Example, Infinera Corporation has introduced innovative PIC-based products to improve the efficiency of optical communication networks. Recent mergers and acquisitions, such as the acquisition of Luxtera by Cisco Systems, highlight the strategic importance of PIC technology in the industry.

Market Dynamics

Drivers

-

Rising Adoption in Military and Defense Applications

Photonic technologies are gaining demand in the military and defense sectors, addressing the needs of communication, sensing, and imaging systems, among others. The unique properties of photonic integrated circuits make them highly applicable in the military and defense. First, they offer high bandwidth and speedy data delivery due to low dissipative resources. In modern military operations, PICs make sure that huge volumes of insensible information are transported from the source to the destination and vice versa. Second, PICs have low power consumption as they can be easily integrated into the flow of energy, which is connected to the other systems. PICs are also durable as they are less subjected to radiation levels in the environment and are protected from electromagnetic interference.

-

Growing Applications in Healthcare and Biotechnology

The healthcare and biotechnology sectors have dramatically increased the use of photonic technologies in recent years. PICs are highly sensitive to light, enabling their high precision in various applications. Moreover, PICs are suitable for research in these sectors because of their miniaturization characteristics. PIC applications in these areas are diverse. For example, PICs are used in medical diagnostics devices, where photonic technologies are integrated into optical coherence tomography (OCT) systems for high-resolution imaging of human tissues, allowing researchers to gain comprehensive information that could be useful in the detection of cancer and early monitoring of the cardiovascular condition. In addition, PICs have applications in lab-on-chip devices, enabling the fast processing of samples and accurate and efficient diagnostics. PIC applications in biotechnology include the development of picocells, and nano-sized holes used to detect and manipulate minute samples of DNA and protein for research in genomics and proteomics.

Restraints

-

Technical Challenges in Integration and Standardization

Integrating photonic components with electronic circuits is nontrivial due to severe technical limitations. For example, despite appropriate designs and manufacturing processes, such devices can still demonstrate poor performance and low reliability. Notably, material properties and thermal issues can distort PIC effectiveness, as well as signal loss on interfaces between photonic and electronic parts. Alternatively, the absence of standards in this technology’s design and fabrication can limit the PIC market expansion. These issues require solutions that already form the basis for the development of new standards. In conclusion, such standards play a crucial role in responsive technologies’ further development.

-

Competition from Traditional Electronic Technologies

Due to the strong market position and competition advanced by traditional electronic technologies, such as electronic integrated circuits and semiconductor devices, there is a high probability of slow PIC adoption. There is a wide range of applications for electronic technologies, for which established infrastructure, low costs, and high reliability are important advantages. The transition from electronic to photonic technologies requires changes in design, manufacturing, and infrastructure. However, the use of silicon as a basis for both types of circuits provides some prospects for increasing PIC spread. Other ways of photonics’ promotion into markets, where PIC benefits are not immediately obvious, will require a significant amount of time or remain unapplicable.

Photonic Integrated Circuit Market Segmentation

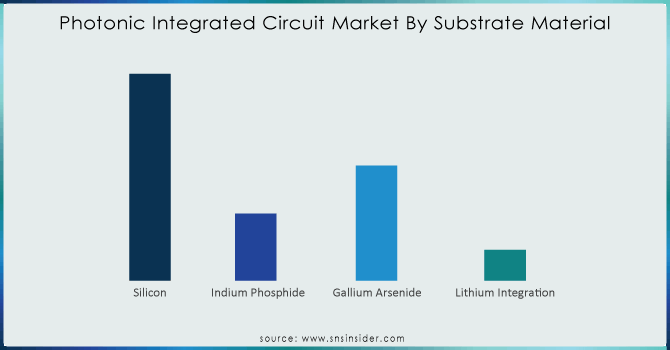

By Substrate Material

Silicon had the biggest market share of 56.45% in 2023 and was the dominant market. A silicon photonic integrated circuit merges the goodness of silicon-based electronics with photonics, which helps transmit and process data at high speeds. Silicon PICs are used in telecommunications, data centers, optical interconnects, etc. to process a large amount of data much faster and more reliably.

Gallium arsenides have a fast CAGR of 18.61% during the forecast period 2024-2032. GaAs PICs have a quicker response time than silicon, the material most frequently used in electronics. High-speed data transmission can be accomplished with PICs made of GaAs.

Need any customization research on Photonic Integrated Circuit Market - Enquiry Now

By Integration Type

The Hybrid Integrated PIC was the leader of the market in 2023 with a share of 53.55%. Hybrid Integrated PIC is the technology that combines the electronic and photonic components on a chip. The built-in optics are better for interconnecting circuits such as lasers, detectors, modulators, and waveguides. These enable seamless communication among them and to the necessary components, contributing to an efficient and high speed.

Monolithic Integration PICs are growing at a faster rate with a CAGR of 18.46% during 2024-2032. A monolithic photonic integrated circuit is used to generate, detect, manipulate, or otherwise process light, and the easiest way to think about them is that they are to optics the same thing that an electric microchip is to electronics.

By Integration Level

In 2022, Medium-Scale photonic integrated circuits held the majority share of 42.36%. The dominance of the segment is because the technology allows multiple optical functions, including the integration of lasers, waveguides, modulators, and detectors with the electronic circuits required for the control and processing of data. Medium-scale PIC photonic integrated circuit technology is highly efficient, with the capacity for compact photonic systems, resulting in advanced applications like high-speed optical communication, optical sensing, and quantum computing.

The Large-scale PICs have a CAGR of over 18.50% during 2024-2032. The growth of the segment is due to the utilization of a very large number of minute optical components all integrated on a singularly constituted chip – much in a similar fashion to how electronic integrated circuits work.

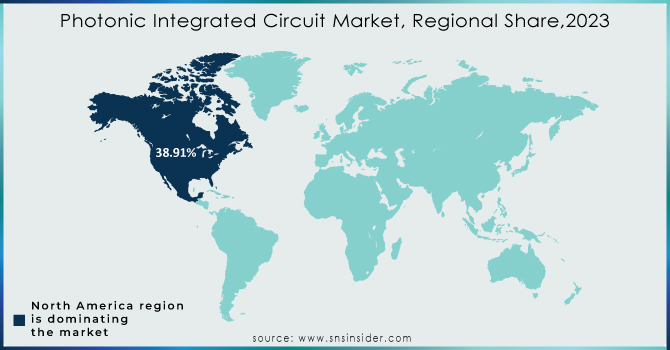

Photonic Integrated Circuit Market Regional Analysis

North America dominates the market with a share of 38.91% in 2023. The increased demand for data centers and vast area network applications of fiber optic communication, and high-speed data communication is raising the growth of the market. The U.S. military has targeted to build photonic integrated circuits for high-performance position, navigation, and timing, as it replaces GPS with no GPS signals.

Asia-Pacific is to expand at a CAGR of 19.00% during the projection period 2024-2032. The area has been a rapidly expanding electronics and telecom sector, and the swift relocation of many semiconductor manufacturing bases to Southeast Asian countries, such as China, Korea, and Japan, has made the region significant. China’s PIC technology has advanced fast over the past decade.

Key Players

Photonic Integrated Circuit manufacturers include Infinera Corp, Agilent Technology, Intel Corp, Acacia Communications Inc., TE Connectivity, Neophotonics Corp, Cyoptics Designs, Emcore Corp., Colorchip Ltd, NeoPhotonics Corp, POET Technologies, II-VI Incorporated, and others.

Recent Development

-

In April 2024, IDTechEx Research, a trusted provider of independent market intelligence, announces the availability of a IDTechEx is forecasting a 2.4x growth of the PIC market by 2034, primarily derived through growth in the transceivers for AI and 5G markets.

-

In October 2023, India’s secretary of electronics and information technology inaugurated the Centre for Programmable Photonic Integrated Circuits and Systems (CPPICS). Within the next five years, CPPICS is set to achieve self-sufficiency, drive product commercialization through startups, and provide essential training to bolster the future ecosystem of PIC manufacturing in India. CPPICS is establishing partnerships, including a collaboration with Si2 Microsystems in Bangalore, to deliver state-of-the-art System-in-a-Package solutions for silicon photonic processor cores.

-

In December 2022, Delivering new levels of performance and scalability to accelerate the design of photonic integrated circuits (PICs) for datacom applications, OpenLight today announced the availability of its first 800G DR8 PIC design targeted at datacenter interconnects. OpenLight has fabricated and tested these wafers using the world's first open silicon photonics foundry platform with integrated lasers offered by Tower Semiconductor.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 10.08 billion |

| Market Size by 2032 | US$ 45.05 Billion |

| CAGR | CAGR of 18.14% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Substrate Material (silicon, indium phosphide, gallium arsenide, lithium integration) • By Integration Type (hybrid, monolithic) • By Integration Level (small, medium, large) • By Application |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Infinera Corp, Agilent Technology, Intel Corp, Acacia Communications Inc., TE Connectivity, Neophotonics Corp, Cyoptics Designs, Emcore Corp., Colorchip Ltd, NeoPhotonics Corp, POET Technologies, II-VI Incorporated |

| Key Drivers | • Rising Adoption in Military and Defense Applications • Growing Applications in Healthcare and Biotechnology |

| RESTRAINTS | • Technical Challenges in Integration and Standardization • Competition from Traditional Electronic Technologies |