Point of Care Lipid Test Market Report Scope & Overview:

Get More Information on Point of Care Lipid Test Market - Request Sample Report

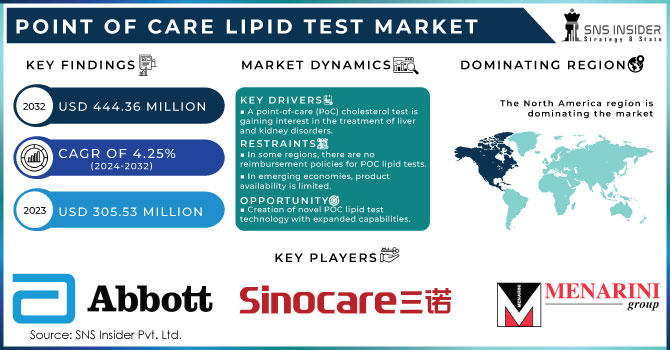

The Point of Care Lipid Test Market size was estimated USD 305.53 million in 2023 and is expected to reach USD 444.36 million by 2032 at a CAGR of 4.25% during the forecast period of 2024-2032.

Point of care lipid test are medical tests that help in the diagnosis of a condition in the human body at a precise moment. The point of care testing help to provide real-time results in minutes. As a result, a point of care (POC) lipid test is conducted to evaluate the lipid's activity in the cells. When cholesterol levels rise, the body's lipid function is disrupted, leading to significant ailments such as heart attack and coronary artery disease.

MARKET DYNAMICS

DRIVERS

-

A point-of-care (PoC) cholesterol test is gaining interest in the treatment of liver and kidney disorders.

Rising cases of chronic diseases such as liver and kidney disorders, as well as diabetes, are likely to drive the global point of care (PoC) lipid test market during the forecast period. Cardiovascular disease (CVD) is the major cause of death in chronic renal disease patients. One of the most prominent pathophysiological causes for CVD in CKD patients is the widespread and probably enhanced production of atherosclerotic plaques due to hyperlipidemia, uremic toxins, inflammation, and endothelial dysfunction. Chronic kidney disease (CKD) affects more than one out of every seven adults in the United States, or over 37 million people, according to the US Department of Health and Human Services. These are the variables that drive market expansion.

RESTRAINT

-

In some regions, there are no reimbursement policies for POC lipid tests.

-

In emerging economies, product availability is limited.

-

Issues with quality control linked with POC lipid testing devices.

OPPORTUNITY

-

Partnerships between diagnostic businesses and healthcare providers for efficient point-of-care testing.

-

Creation of novel POC lipid test technology with expanded capabilities.

-

Increasing need for technological advances

Rising need for technical developments that improve speed, accuracy, and usability, as well as rising market penetration rates for technologies such as self-testing handheld devices, are likely to fuel demand. Polymer Technology Systems Inc., for example, developed the CardioChek Plus analyzer in 2013, an upgraded version of their point-of-care multi-analyte device. Sedentary and unhealthy lifestyle choices are likely to supply manufacturers with a growing customer base.

CHALLENGES

-

High price

The rising cost of point-of-care (POC) cholesterol diagnostics will restrain market expansion. It has an additional cost of $2500.00. Furthermore, a lack of lab services in rural areas, particularly in developing countries, would stymie market growth. The scarcity of trained personnel in these domains would further hinder market growth prospects.

IMPACT OF RUSSIAN UKRAINE WAR

The war has significantly increased psychological pain and distress. According to health care professionals around the country, the most common request right now is for help with sleeplessness, anxiety, mourning, and psychological distress. WHO has increased staff and repurposed infrastructure, particularly the logistics system, in response to changing health demands in Ukraine. This has allowed for the delivery of over 543 metric tonnes of medical supplies and equipment to the country, which are being distributed mostly in the east, south, and northern oblasts where the need is highest. Among the materials sent are trauma surgical supplies, ambulances, Ukrainian-made ventilators that can continue to work even when power is down, electric generators, and oxygen equipment, including the construction of oxygen plants.

IMPACT OF ONGOING RECESSION

Three years after the pandemic immobilized the world, its aftermath continues to send the world into a frenzy as the recession siren becomes louder with each passing day. Several businesses, particularly scientific research, are concerned about the current recession warning. The pandemic has reduced the number of new programs and shifted financing to virology and vaccine development. This has a negative impact on research outside of the field of virology and life sciences in general. With several countries in recession, economists forecast a slight recession this year as economic uncertainty grows. Despite the promise of a surge in research funding in 2023, the scientific community is concerned about the consequences of the recession on research financing.

KEY SEGMENTS

By Product Type

-

Devices

-

Consumables

By Application

-

Endogenous Hyperlipemia

-

Combined Hyperlipidemia

-

Familial Hypercholesterolemia

-

Others

By End User

-

Hospitals and Clinics

-

Diagnostic Laboratories

-

Others

REGIONAL ANALYSES

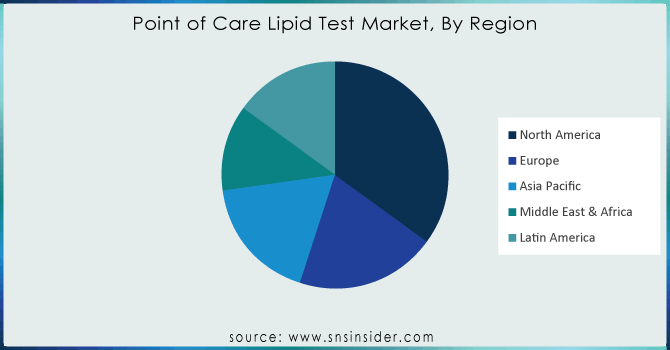

North America held a significant market share in 2023 due to Rising R&D investments and brisk private funding for healthcare infrastructure development are propelling the industry forward. Furthermore, various market competitors are concentrating on developing testing solutions that will provide early results, thereby improving the regional market picture. In May 2023, Sensible Diagnostics, a Los Angeles-based startup, produced a tiny, low-cost sample-to-answer system that can do PCR in 10 minutes, along with economical test cartridges, with the initial focus on infectious disease testing at the point of care.

Asia-Pacific is witness to expand fastest CAGR rate during the forecast period owing to the region's aging population and the increased need for point-of-care testing devices for patients. Furthermore, the region's rising chronic illness burden, combined with the increased emphasis of significant corporations in emerging markets such as China, Japan, and others, is increasing demand for and adoption of point-of-care (PoC) cholesterol test devices.

Get Customized Report as per Your Business Requirement - Request For Customized Report

REGIONAL COVERAGE

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key Players

The major key players are Abbott Laboratories,Nova Biomedical Corporation, Menarini Group, Sinocare Inc.,Zoetis Inc.,Callegari, VivaChek Biotech (Hangzhou) Co.,Ltd, F. Hoffmann-La Roche Ltd,Biosensor,Inc., Mico Bio Med and Others.

RECENT DEVELOPMENT

In July 2023, Vital Biosciences introduced VitalOne, a new point-of-care lab testing technology that allows clinicians to conduct tests, diagnose patients, and treat them all in a single visit.

In January 2022, in regions where the CE Mark is accepted, Roche launched the Cobas pulse system, which combines professional blood glucose control with mobile digital medical capabilities to improve patient care.

| Report Attributes | Details |

| Market Size in 2023 | US$ 305.53 million |

| Market Size by 2032 | US$ 444.36 million |

| CAGR | CAGR of 4.25% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | By Product Type [Devices, Consumables],By Application [Endogenous Hyperlipemia, Combined Hyperlipidemia, Familial Hypercholesterolemia, Others],By End User [Hospitals and Clinics, Diagnostic Laboratories, Others] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Abbott Laboratories,Nova Biomedical Corporation, Menarini Group, Sinocare Inc.,Zoetis Inc.,Callegari, VivaChek Biotech (Hangzhou) Co.,Ltd, F. Hoffmann-La Roche Ltd,Biosensor,Inc., Mico Bio Med |

| Key Drivers | • A point-of-care (PoC) cholesterol test is gaining interest in the treatment of liver and kidney disorders. |

| Market Restrain | • In some regions, there are no reimbursement policies for POC lipid tests. • In emerging economies, product availability is limited. • Issues with quality control linked with POC lipid testing devices. |