Polymer Bearing Market Report Scope & Overview:

Get E-PDF Sample Report on Polymer Bearing Market - Request Sample Report

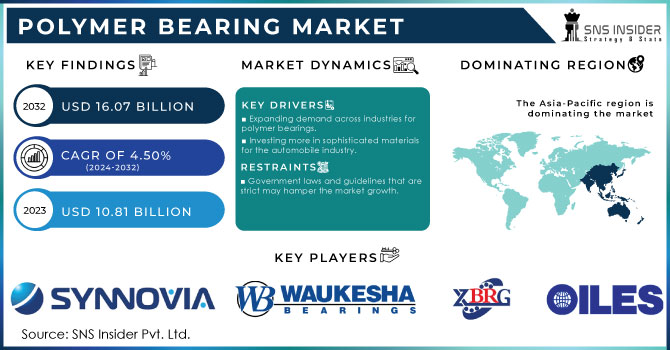

The Polymer Bearing Market Size was valued at USD 10.81 billion in 2023 and is expected to reach USD 16.07 billion by 2032 and grow at a CAGR of 4.50% over the forecast period 2024-2032.

Polymer bearings’ increasing use in electric vehicles is largely due to this technology’s lightweight and low friction properties and self-lubricating properties. This is important as reducing friction is crucial for an electric vehicle’s efficiency. Polymer bearings have become popular with companies manufacturing electric vehicles on a mass scale. By reducing the weight of the vehicles, they reduce the energy used and the distance an electric vehicle can travel. Thus, if in the past manufacturers were looking to find a class of materials that would reduce friction loss for various uses, today a growing number of manufacturers of electric vehicles have become major consumers of energy-efficient design.

Moreover, the products of such advanced technologies are already being implemented in well-known brands. For example, some of the major manufacturers of electric vehicles, including Tesla and BMW, have utilized polymer bearings in their electric vehicles. Governmental programs to increase electric vehicle use also contribute to this trend. The International Energy Agency has reported that as of 2022, sales of electric vehicles exceeded 10 million units. This technology will continue to develop since increasing the vehicles' life and energy efficiency in line with the trend for sustainable technologies.

Another factor is the growth of automation and Industry 4.0 leads to a strong increase in the demand for polymer bearings in machinery and robotics. These appliances are highly appreciated in the automated high-speed, high-precision environment due to their durability, lack of need for maintenance, and versatility. The industries adopt automated processes and smart manufacturing at an increasing pace, consequently raising the need for such components as polymer bearings. Recently, robotics and automated systems have become more prominent, with polymer bearings being one of the key elements necessary for their effective operation. Nowadays, polymer bearings see the widest use in automated production lines and robotic arms. These elements decrease the downtime of the machinery and prolong its life span.

The governments also contribute to this trend by promoting Industry 4.0. For instance, the European Union has initiated the “Digital Europe Programme” with USD 8.38 billion allocated for the digital transformation of smart manufacturing and automation.

Market Dynamics:

Drivers

- Expanding demand across industries for polymer bearings.

- Lower cost of maintenance.

- Investing more in sophisticated materials for the automobile industry.

The trend to invest more in sophisticated materials used in the automobile industry is driven by the continuous growth in the demand for lighter, stronger, and more energy-efficient vehicles. These trends result from environmental regulations and the surge for electric vehicles to some extent. The utilization of sophisticated materials, such as high-strength steel, aluminium, carbon fiber, and advanced polymers, allows to decrease the weight of vehicles, thus improving fuel efficiency and producing fewer gases. For example, due to significant efforts to decrease vehicle weight due to its lightweight, the use of aluminum has been rising markedly, resulting in better fuel economy. One of the latest examples of this trend was highlighted by major commercial vehicle makers, such as Ford and BMW, which have been increasingly incorporating sophisticated metals into their automobile designs not only because of state and international green car regulations but also because of clients’ and shareholders’ desire for cleaner energy and environmentally-friendly decisions. Therefore, such tendencies have been supported by the U.S. State Department of Energy with its new funding source for lightweight materials for automobiles, the LIFT program, which is focused on the development and deployment of lighter materials for automotive production. In Europe, the issue has been highlighted by the advancements of Horizon Europe, which allocates considerable sums for researching and developing advanced materials for sustainable mobility.

Government regulations largely contribute to the necessity of investments in sophisticated materials. For example, according to European Union CO2 standards, by 2025, no new car in Europe will be allowed to emit more than 95 grams of CO2 per kilometer 2025, which forces automobile makers to incorporate lighter materials. Similar legislation in the United States is the Corporate Average Fuel Economy standards. As a matter of fact, due to these facts, OE parts are expected to use lightweight materials to remain competitive as automakers are trying to meet these standards.

Restrain

- Government laws and guidelines that are strict may hamper the market growth.

Strict government laws and guidelines could be a big restraint to any industry. Mostly, the automotive, manufacturing and energy industries have to deal with strict government laws. Companies have to comply with these regulations, which are somehow very rigorous requirement regarding the type of cars produced, the pollution situation, and the type of energy produced. The compliance makes the cost of production very high, and the company’s flexibility in production is also limited. As a result, the manufacturers have to spend a lot of money developing new technologies and new materials to reduce the pollutants in the produced vehicles. While the regulations will save the ecosystems as well as the general public from pollution, the financial costs of compliance may be too high. Smaller companies that may not have money to invest in compliant technology will be forced out of business.

Market segmentation

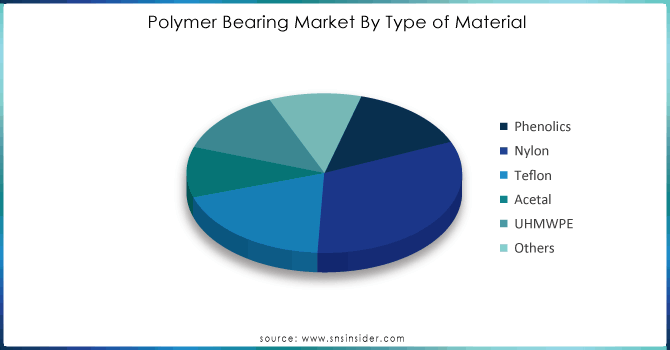

By Type of Material

In 2023, the Nylon segment dominated the polymer-bearing market, holding the largest proportion of the market at about 32.23%. Nylon’s popularity is further driven by its versatility and cost-effectiveness compared to other high-performance polymers. It offers good chemical resistance, can operate under moderate to high loads, and is capable of functioning effectively in a variety of temperatures, making it a preferred choice in many industries. Recent developments in reinforced nylon materials, such as glass-filled nylon, have enhanced its performance, allowing it to compete with more expensive materials like Teflon and UHMWPE in certain applications.

Get Customized Report as per your Business Requirement - Request For Customized Report

By End-Use Industry

The automobile industry is the leading end-use segment in the polymer bearings market. This dominance is driven by the automotive sector's continuous push for lightweight, durable, and low-maintenance components, which are essential for enhancing fuel efficiency and meeting stringent emissions regulations. Polymer bearings are increasingly used in various automotive applications, including steering systems, suspension, gearboxes, and electric vehicle components, due to their ability to reduce weight, lower friction, and resist corrosion.

With the global shift towards electric vehicles, the demand for polymer bearings in the automotive industry has further accelerated. EVs require bearings that can operate efficiently under high-speed and high-temperature conditions, making polymer bearings an ideal choice. Recent advancements in polymer materials, such as high-performance nylons and Teflon, have also expanded their application range within the automotive sector, enabling manufacturers to meet the demands of modern vehicle designs.

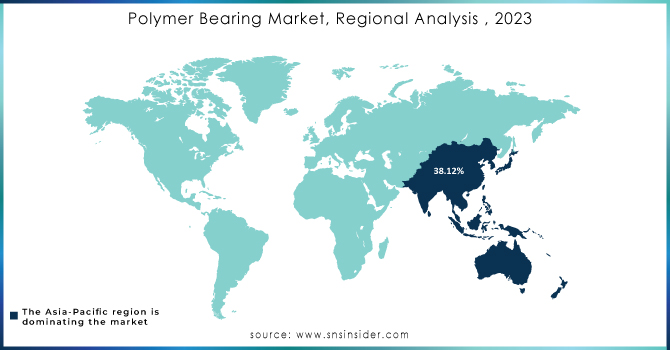

Regional Analysis:

In 2023, the Asia-Pacific region dominated the polymer-bearing market, holding an estimated market share of approximately 38.12%. riven by its robust manufacturing base, rapidly growing automotive and industrial sectors, and increasing investments in infrastructure development. Countries like China, Japan, and South Korea are major contributors to this dominance due to their strong automotive industries, which are significant consumers of polymer bearings. China, in particular, stands out as the largest automotive producer globally, and its push towards electric vehicles has further fueled the demand for lightweight and durable components like polymer bearings.

Moreover, the region's commitment to infrastructure development and urbanization is driving demand in sectors like elevators, packaging, and food processing, where polymer bearings are increasingly preferred for their low maintenance and high durability. As a result, the Asia-Pacific region continues to be the most significant market for polymer bearings, with ongoing growth expected in the coming years.

Key Players:

The key players arw ISB Industries (Italy), Waukesha Bearings (US), SKF (Sweden), OILES CORPORATION (Japan), Xinzhou Bearing Industrial Inc. (China), Synnovia (UK), Igus (Germany), Dotmar Engineering Plastics (Australia), Kashima Bearings, Inc. (Japan), OILES CORPORATION (Japan), KMS Bearings, Inc. (US), TOK, inc. (Japan) and Others.

Recent Development:

- In 2023: SKF Group announced the launch of its new line of polymer bearings designed for the food processing industry. These bearings are made from food-grade materials and are optimized for hygiene and corrosion resistance, aligning with the stringent safety requirements of the sector.

- In 2022: NSK Ltd. launched a new series of self-lubricating polymer bearings targeted at industrial machinery applications. These bearings are designed to operate in high-speed and high-precision environments, reducing the need for regular maintenance and downtime.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 10.81 Billion |

| Market Size by 2032 | US$ 16.07 Billion |

| CAGR | CAGR of 4.50% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type of Material (Phenolics, Nylon, Teflon, Acetal, UHMWPE (Ultra High Molecular Weight Polyethylene),Others) • By End-Use Industry (Automobile, Textile, Medical & Pharmaceutical, Packaging, Elevators, Food Processing, Office Products, Chemical Industry, Photography, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | ISB Industries (Italy), Waukesha Bearings (US), SKF (Sweden)n, OILES CORPORATION (Japan), Xinzhou Bearing Industrial Inc. (China), Synnovia (UK), Igus (GermanyIgus (Germany), Dotmar Engineering Plastics (Australia), Kashima Bearings, Inc. (Japan), OILES CORPORATION (Japan), KMS Bearings, Inc. (US), TOK, inc. (Japan) |

| DRIVERS | • Expanding demand across industries for polymer bearings. • Investing more in sophisticated materials for the automobile industry. • Lower cost of maintenance. |

| Restraints | • Government laws and guidelines that are strict. |