Polyphenol Market Report Scope & Overview:

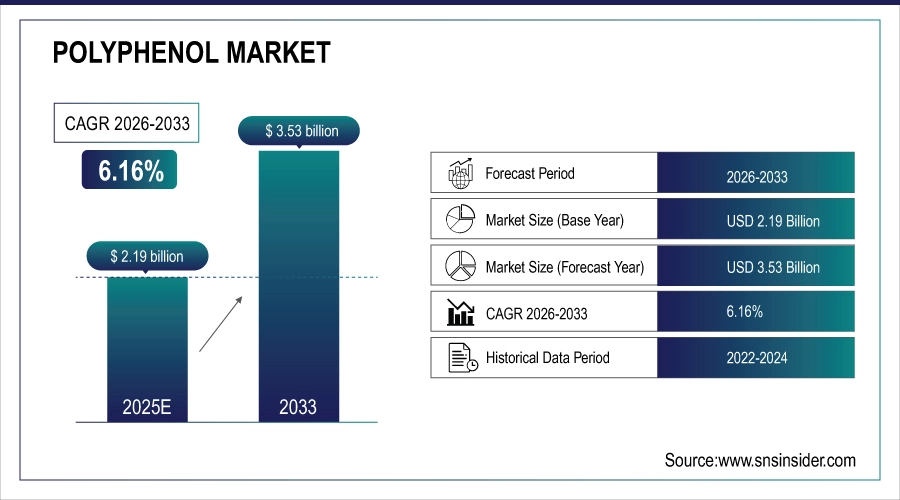

The Polyphenol Market size is valued at USD 2.19 Billion in 2025E and is projected to reach USD 3.53 Billion by 2033, growing at a CAGR of 6.16% during 2026-2033.

The Polyphenol Market analysis highlights the increasing consumer demand for natural antioxidants due to increased health consciousness. Rising applications in functional foods, dietary supplements and cosmetics drive market growth. Advances in extraction and formulation technology have improved the quality of the finished product, as well as the products bioavailability.

In 2025, 68% of global consumers actively sought products with natural antioxidants like polyphenols for heart health, anti-aging, and inflammation reduction

Market Size and Forecast:

-

Market Size in 2025E: USD 2.19 Billion

-

Market Size by 2033: USD 3.53 Billion

-

CAGR: 6.16% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information on Polyphenol Market - Request Free Sample Report

Polyphenol Market Trends

-

Increasing demand of natural antioxidants for health, wellness and disease prevention in food, beverage and nutraceutical industry.

-

Increasing demand for green extraction technologies enhancing yield, purity, and sustainable aspect of polyphenol production processes.

-

Rising demand for polyphenols in cosmetics for anti-aging, skin-repair and UV protection products is boosting the market.

-

Rising functional food usage amid increasing consumer demand for plant-based, clean-label products with antioxidant capabilities demonstrated by research.

-

Strategic partnerships and R&D investments of major key players for developing novel polyphenol blends and improve bioavailability.

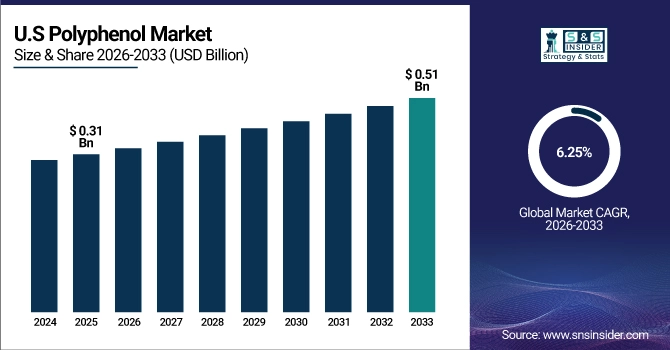

The U.S. Polyphenol Market size is valued at USD 0.31Billion in 2025E and is projected to reach USD 0.51 Billion by 2033, growing at a CAGR of 6.25% during 2026-2033. Polyphenol Market growth is driven by increasing consumer desire for natural and functional ingredients. Growing awareness regarding health and preference for antioxidant rich products drive the food & beverages antioxidants market. Increasing acceptance in cosmetic and pharmaceutical industries provide additional market opportunities.

Polyphenol Market Growth Drivers:

-

Rising Demand for Natural Antioxidants and Functional Ingredients Across Food, Beverage, and Nutraceutical Sectors

Growing consumer interest in natural, plant-based ingredients has helped drive demand for polyphenols. Owing to their demonstrated antioxidant, anti-inflammatory and antigenerative properties they are indispensable in functional food, dietary supplements and beverages. Growing health consciousness and lifestyle diseases such as obesity and cardiovascular problems are work this market. Additionally, increasing use in cosmetics and pharmaceuticals to provide anti-aging and therapeutic activities is boosting the overall market growth globally.

In 2025, 72% of global consumers preferred products with plant-derived bioactives like polyphenols, citing “clean label” and “natural origin” as key purchase drivers

Polyphenol Market Restraints:

-

High Production Costs and Limited Raw Material Availability Affecting Market Scalability and Pricing Competitiveness

The extraction and purification of polyphenol is a complicated, expensive series process which requires sophisticated apparatus and superior natural raw materials. Due to seasonality of the raw materials, including fruit, tea and cocoa in particular, there are fluctuations in supply and prices. Variable yields and the influence of environmental stress, including climate change, limit production. Absence of quality benchmarks and regulatory disparities between countries also interfere with large-scale commercialization, thereby restricting the ability of consumer-focused outfits to offer cost-effective solutions while maintaining purity, potency & ultimately sustainability.

Polyphenol Market Opportunities:

-

Technological Innovations and Expanding Applications in Pharmaceuticals, Nutraceuticals, and Personal Care Industries Worldwide

Extraction methods are developed to increase the yield and bio-accessibility of polyphenols. Increasing preference for clean-label, sustainable ingredients creates significant opportunities for innovation and expanding product ranges. The well-established chronic disease prevention and skin health benefits of polyphenols justify their inclusion for nutraceuticals, pharmaceuticals, and cosmetic purpose. Further compounding this, growing R&D investment and collaborations by industry leaders are opening up access to a broader global customer base with long-term growth opportunities in many high-value sectors.

In 2025, green extraction technologies (e.g., ultrasound, enzyme-assisted, and supercritical CO₂) increased polyphenol yield by 35–50% while preserving bioactivity and reducing solvent waste

Polyphenol Market Segment Analysis

-

By source, tea led the polyphenol market with a 35.68% share, while cocoa emerged as the fastest-growing segment with a CAGR of 8.50%.

-

By application, functional foods and beverages dominated the market with a 35.24% share, whereas dietary supplements recorded the fastest growth at a CAGR of 9.10%.

-

By type, flavonoids accounted for the largest share of 45.37% in 2025, with phenolic acids projected to grow fastest at a CAGR of 8.41%.

-

By form, powder held the dominant 63.52% share, while liquid form is expected to grow at the fastest CAGR of 7.50%.

By Form, Powder Lead While Liquid Grow Fastest

The powder form is the largest and can also be stored for longer period, convenient to store, and can be used in multiple food & beverage as well nutraceuticals applications. The powders are chosen by the manufacturer for easy mixing and constant concentration of the active ingredient. While, the liquid form is growing fastest due to their high solubility, solubilization and application in ready-to-drink beverages as well as cosmetic products. An increasing preference for functional beverages and liquid nutritional supplements is driving demand, with liquid polyphenols being the fastest growing segment of the world market.

By Source, Tea Leads Market While Cocoa Registers Fastest Growth

Tea leading the market due to its rich catechin and flavonoid content, widely used in beverages, supplements, and cosmetics. High consumer preference for green tea and herbal infusions supports dominant market share. Meanwhile, cocoa-based polyphenols are witnessing the fastest growth, driven by increasing recognition of their cardiovascular and antioxidant benefits. Expanding use of cocoa extracts in functional foods, chocolates, and nutraceuticals, coupled with research highlighting their health-enhancing properties, continues to strengthen cocoa’s rapid market expansion globally.

By Application, Functional Foods & Beverages Dominate While Dietary Supplements Shows Rapid Growth

The functional foods and beverages category owns the majority of the polyphenol market as consumer focus gradually shifts towards wellness and disease prevention. Polyphenols increase nutritional value and antioxidant properties of juices, teas, or fortified foods. While, dietary supplements are the fastest growing segment, driven by increasing awareness about preventive health care and formulations based on natural ingredients. Rising nutraceutical industry and growing consumption of concentrated polyphenol capsules, powders, tablets following consumer preference to promote immunity, metabolism and general well-being is also driving the growth.

By Type, Flavonoids Lead While Phenolic Acids Registers Fastest Growth

Flavonoids segment is dominating this market due to their wide range of health promoting properties and high content in fruits, vegetables and teas. They are commonly added to different functional foods, pharmaceuticals, and cosmetics due to their antioxidant and anti-inflammatory properties. Meanwhile, phenolic acids are experiencing the most rapid growth driven by growing uses in dietary supplement and food preservation. The exceptional antimicrobial and antioxidant properties further promote the stability of products and shelf-life, resulting in their adoption by a variety of industries that strive to produce clean label, and natural formulations.

Polyphenol Market Regional Analysis:

Asia-pacific Polyphenol Market Insights

In 2025 Asia-Pacific dominated the Polyphenol Market and accounted for 44.69% of revenue share, this leadership is due to the availability of raw material and increasing health consciousness. Growth in demand is driven by more tea, fruits and other plant-based supplements being consumed. Growing usage in food, cosmetics & pharmaceuticals augments market penetration. China, Japan and India are the main regional producers and exporters. Growing nutraceutical and functional food sectors will continue to drive the Asia-Pacific as leader in global polyphenols consumption and innovation.

Get Customized Report as per Your Business Requirement - Enquiry Now

China Polyphenol Market Insights

China is the largest producer and exporter of these compounds. The plant-based product development is heavily supported by the government strongly boosting growth prospects. The nation benefits from its strong manufacturing industry and innovative extraction techniques to maintain a high-quality output.

North America Polyphenol Market Insights

North America is expected to witness the fastest growth in the Polyphenol Market over 2026-2033, with a projected CAGR of 6.61% due to rising consumer demand of natural & clean label ingredients. The polyphenol rich foods are incorporated for the antioxidant and anti-inflammatory properties in the food processing and nutraceutical industry of the region. Market growth is led by the US and Canada, with strong in R&D and product innovation. Growing information about prevention of chronic diseases, supports supplement and functional beverage consumption.

U.S. Polyphenol Market Insights

The U.S. market is evolving rapidly and consumers have a strong appetite for plant-based, healthy products. Applications Lean heavily towards functional beverages, supplements and clean-label foods. Extraction technologies development enhances product quality and bioavailability and so as competitiveness.

Europe Polyphenol Market Insights

In 2025, Europe emerged as a promising region in the Polyphenol Market, due to high demand in the food, beverage and cosmetics sectors thanks to the EU clean label movement. Germany, France and Italy produce and innovate the most. Antioxidant-rich diets are taking a toll Preferring for consumer is being outlived of the steady market. Furthermore, continued studies on polyphenol bioactivity and associated health benefits underpin product formulation diversity and market confidence.

Germany Polyphenol Market Insights

Germany is a central European location for polyphenol innovation, manufacturing and research. The French and functional food and nutraceutical markets have many high-quality polyphenol ingredients. Growing consumer preference for natural, organic products keeps demand in ascendancy.

Latin America (LATAM) and Middle East & Africa (MEA) Polyphenol Market Insights

The Polyphenol Market is experiencing moderate growth in the Latin America (LATAM) and Middle East & Africa (MEA) regions, due to the rising urbanization and work culture is making consumers more dependent on functional based products along with increasing disposable incomes. However, the lack of processing facility and material standardization are barriers towards upscaling. Booming foreign investment and technology transfers are the most likely way of fuelling regional manufacturing ability and export capacity.

Polyphenol Market Competitive Landscape:

Naturex is the global leader in specialty plant-based natural antioxidant solutions, with specific expertise in natural polyphenol extraction. The company offers a broad array of antioxidant-rich extracts for use in the food, beverage, nutraceutical and cosmetic industries. Its emphasis on sustainable sourcing and clean-label formulas dovetails with the burgeoning trend among consumers for natural products. The company is increasingly going global and has grown to become more of a polyphenol brand, by working alongside innovative researchers and through strategic partnerships.

-

In April 2025 Naturex announced expansion of its polyphenol production facility in France to meet rising global demand for plant-based antioxidants, enhancing supply chain resilience and sustainable sourcing for food, beverage and nutraceutical applications.

Indena S.p.A., world's premiere company in the identification, development and production of active principles derived from plants, for use in Pharmaceutical, health food and cosmetics industries. Through the application experience of standardized plant extracts, our products can provide high efficacy and safety. Indena’s cutting-edge extraction and purification technologies provide first-rate polyphenols with guaranteed bioactivity. Responsible sourcing and eco-friendly production is all part of its sustainability-driven approach.

-

In May 2024 Indena partnered with dsm-firmenich to debut biotic and botanical combination concepts at Vitafoods Europe, targeting gut, brain and healthy-aging markets with scientifically backed botanical extract solutions.

Chr. Hansen Holding A/S," a global bioscience company that develops natural ingredient solutions for the food, nutritional, pharmaceutical and agricultural industries. In the polyphenol industry, it designs premium extracts with antioxidant and antimicrobial properties for food, beverages and health use. The company has excellent R&D strengths to lead the innovation in natural preservation and functional well-being.

-

In January 2024 Chr. Hansen completed its merger with Novozymes A/S to form Novonesis, a global biosolutions partner enhancing its ability to serve food, health and nutrition markets.

Ajinomoto OmniChem N.V., which is known for natural ingredient extraction and custom manufacture. The company applies cutting-edge biotechnological processes to manufacture high-performance antioxidants for use in foods, dietary supplements, and pharmaceuticals. Its focus on scientific research and quality control leads to the steady product yields. The Global presence of Ajinomoto OmniChem, ensures broader reach and partnerships with the leading Nutriceutical brands.

-

In April 2024, Ajinomoto OmniChem introduced two new brands — Ajinomoto Agro Solutions and Ajinomoto Sustainable Solutions — to strengthen its portfolio in green chemistry, plant-based biostimulants, and natural extraction technologies, supporting sustainability and agricultural innovation.

Polyphenol Market Key Players:

-

Naturex

-

MB-Holding GmbH & Co. KG

-

Indena S.p.A.

-

Frutarom

-

Chr. Hansen Holding A/S

-

Diana Group

-

Guilin Layn Natural Ingredients Corp.

-

Archer Daniels Midland Company

-

DuPont Nutrition & Health

-

Cargill Incorporated

-

Nestlé S.A.

-

Koninklijke DSM N.V.

-

HERZA Schokolade GmbH & Co. KG

-

Kemin Industries Inc.

-

Sabinsa Corporation

-

Xi’an Haotian Bio-engineering Technology Co. Ltd.

-

FutureCeuticals Inc.

-

Tate & Lyle PLC

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 2.19 Billion |

| Market Size by 2033 | USD 3.53 Billion |

| CAGR | CAGR of 6.16% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Source (Fruits, Vegetables, Cocoa, Tea, and Others) • By Application (Functional Foods & Beverages, Dietary Supplements, Pharmaceuticals, Cosmetics, and Animal Feed) • By Type (Flavonoids, Phenolic Acids, Polyphenolic Amides, and Others) • By Form (Liquid and Powder) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Naturex, MB-Holding GmbH & Co. KG, Ajinomoto OmniChem N.V., Indena S.p.A., Frutarom, Chr. Hansen Holding A/S, Diana Group, Guilin Layn Natural Ingredients Corp., Archer Daniels Midland Company, DuPont Nutrition & Health, Cargill Incorporated, Barry Callebaut AG, Nestlé S.A., Koninklijke DSM N.V., HERZA Schokolade GmbH & Co. KG, Kemin Industries Inc., Sabinsa Corporation, Xi’an Haotian Bio-engineering Technology Co. Ltd., FutureCeuticals Inc., Tate & Lyle PLC |