Protective Relay Market Report Scope & Overview:

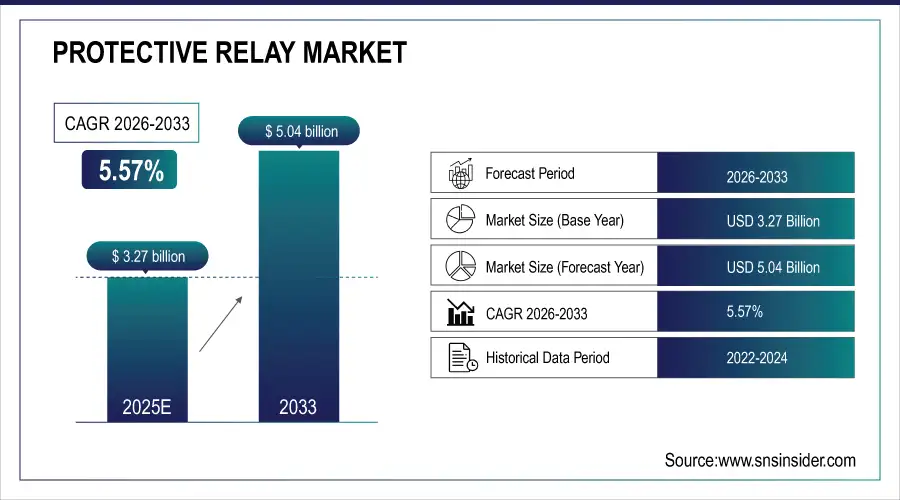

The Protective Relay Market Size is valued at USD 3.27 Billion in 2025E and is expected to reach USD 5.04 Billion by 2033 and grow at a CAGR of 5.57% over the forecast period 2026-2033.

The Protective Relay Market analysis, driven by large-scale investments in power infrastructure upgrades, grid modernization, and rapid electrification across developing and developed economies. As aging transmission and distribution networks are replaced and new substations are added, the need for accurate and reliable protection systems grows.

According to study, the addition of solar and wind assets increases grid variability by 30–60%, requiring smarter, numerical relays that can process real-time load fluctuations up to 5× faster than legacy electromechanical relays.

Market Size and Forecast:

-

Market Size in 2025: USD 3.27 Billion

-

Market Size by 2033: USD 5.04 Billion

-

CAGR: 5.57% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information on Protective Relay Market - Request Free Sample Report

Protective Relay Market Trends:

-

Rising adoption of microprocessor-based and digital protective relays across utilities worldwide.

-

Increasing renewable energy integration driving need for intelligent, adaptive grid protection systems.

-

Rapid shift toward IEC 61850-enabled devices supporting seamless automation and communication.

-

Growing investments in smart grids and digital substations strengthening relay deployment demand.

-

Industrial automation expansion boosting requirement for high-precision fault detection technologies.

-

IoT-enabled and cloud-connected relays gaining popularity for predictive maintenance capabilities.

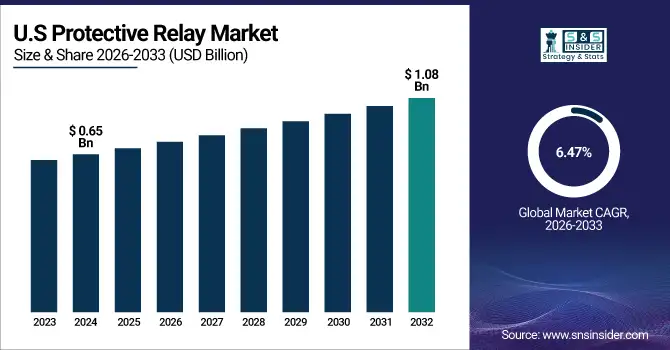

The U.S. Protective Relay Market size is USD 0.65 Billion in 2025E and is expected to reach USD 1.08 Billion by 2033, growing at a CAGR of 6.47% over the forecast period of 2026-2033,

The U.S. Protective Relay Market is rapidly growing due to extensive grid modernization, renewable energy integration, and rising industrial automation. High adoption of digital and intelligent relays with real-time monitoring and predictive fault detection, combined with regulatory support and infrastructure upgrades, drives strong demand across transmission and distribution networks.

Protective Relay Market Growth Drivers:

-

Growing Investments in Grid Modernization and Power Infrastructure Upgrades

A major driver for the protective relay market growth is the rapid modernization of electrical grids across developed and developing regions. Ageing transmission and distribution infrastructure, rising electricity demand, and the need to reduce outages are pushing utilities to deploy advanced relays that offer higher accuracy, faster fault detection, and enhanced communication capabilities. The integration of renewable energy sources such as solar, wind, and distributed generation is creating more complex and bidirectional power flows, which require intelligent relays to maintain grid stability.

Electricity demand growth—projected at 3–4% annually—could boost relay deployments by nearly 20% in utility applications.

Protective Relay Market Restraints:

-

High Upgrade Costs and Integration Complexity Slow Relay Modernization Initiatives

A Major restraint for the market is the high cost of deploying modern protection systems, especially in large-scale substations and transmission networks. Upgrading from electromechanical or static relays to intelligent electronic devices (IEDs) requires substantial investment in hardware, communication interfaces, and real-time monitoring systems. Additionally, integrating advanced relays with legacy infrastructure can be complex and time-consuming, often requiring skilled engineers and customized solutions. Smaller utilities and industries in developing countries may delay upgrades due to budget constraints, limiting the pace of adoption.

Protective Relay Market Opportunities:

-

Digital Substations and IoT-Enabled Smart Relays Create Massive Future Growth Opportunities

A major opportunity lies in the market due to shift toward digital substations and IoT-enabled protection systems, paving the way for next-generation relays with real-time monitoring, remote diagnostics, and predictive fault detection. Utilities are increasingly adopting relays that support IEC 61850, cloud connectivity, and advanced analytics to improve grid efficiency and reduce downtime. As industrial automation expands across sectors like oil & gas, manufacturing, mining, and transportation, demand for intelligent relays with enhanced communication protocols and AI-driven decision-making is rising.

IEC 61850-supported relay installations are projected to increase by nearly 50% between 2025–2030 due to digitalization initiatives.

Protective Relay Market Segmentation Analysis:

-

By Voltage Range: In 2025, Medium Voltage led the market with a share of 48.60%, while High Voltage is the fastest-growing segment with a CAGR of 7.80%.

-

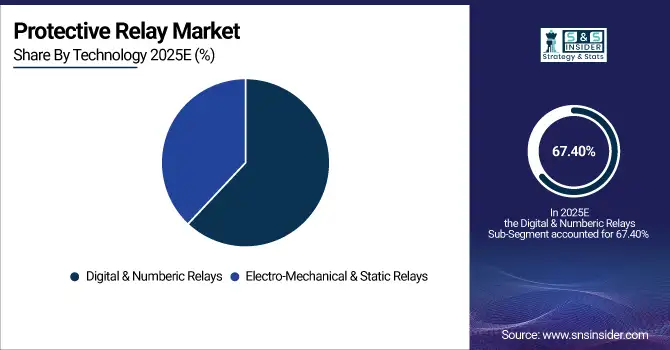

By Technology: In 2025, Digital & Numeric Relays led the market with a share of 67.40%, while Electro-Mechanical & Static Relays is also the fastest-growing segment with a CAGR of 8.90%.

-

By Application: In 2025, Feeder Protection led the market with a share of 28.50%, while Transmission Line Protection is the fastest-growing segment with a CAGR of 7.30%.

-

By End-user: In 2025, Utilities led the market with a share of 52.10%, while Industries is the fastest-growing segment with a CAGR of 7.10%.

By Technology, Digital & Numeric Relays Leads Market and Electro-Mechanical & Static Relays Fastest Growth

In 2025, Digital and numeric relays dominate the market, due to their advanced protection algorithms, precise fault detection, monitoring capabilities, and integration with SCADA systems. Their reliability, programmable features, and ability to reduce downtime make them the preferred choice across utilities and industrial setups.

Meanwhile, Electro-mechanical and static relays are the fastest-growing segment, especially in emerging economies where cost-sensitive upgrades or retrofitting legacy systems drive adoption. Their simplicity, robustness, and evolving hybrid designs make them attractive for medium-to-high voltage applications, accelerating market penetration.

By Voltage Range, Medium Voltage Lead Market and High Voltage Fastest Growth

In 2025, Medium voltage relays dominate the protective relay market, as they are widely used in distribution networks, commercial installations, and industrial facilities. Their reliability, cost-effectiveness, and suitability for most standard applications ensure large-scale adoption.

Meanwhile, High voltage relays are the fastest-growing segment, driven by expanding power transmission infrastructure, renewable energy integration, and modernization of national grids. The growing deployment of smart grids and high-voltage substations requires advanced high-voltage protective relays to ensure safety, fault detection, and system stability, fueling rapid market growth.

By Application, Feeder Protection Lead Market and Transmission Line Protection Fastest Growth

In 2025, Feeder protection dominates the protective relay market, as it is crucial for ensuring safe, reliable distribution of electricity to end-users. High-volume deployment across urban and industrial feeders, combined with growing automation in distribution networks, reinforces dominance.

Meanwhile, Transmission line protection is the fastest-growing segment, driven by expanding long-distance transmission infrastructure, renewable energy interconnections, and smart grid projects. The need for faster fault detection, reduced outages, and improved system stability is pushing adoption of advanced relays in transmission networks globally. Transformer, generator, motor protection, and ESD applications continue steady growth.

By End-user, Utilities Leads Market and Industries Fastest Growth

In 2025, Utilities dominate the protective relay market, being the primary users for power generation, transmission, and distribution systems. Their large-scale infrastructure and regulatory compliance requirements ensure high-volume relay adoption.

Meanwhile, Industries are the fastest-growing segment, fueled by rapid electrification, industrial automation, and expansion of process and manufacturing facilities. Industrial adoption of high-speed protection systems, smart monitoring, and energy optimization solutions drives faster growth compared to traditional utility-focused deployments. Railways and other end-users continue moderate adoption as infrastructure modernizes.

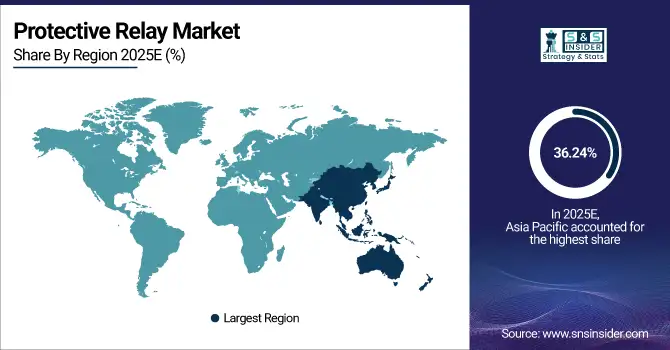

Protective Relay Market Regional Analysis:

Asia Pacific Protective Relay Market Insights:

The Asia Pacific dominated the protective relay market in 2025E, with over 36.24% revenue share, due to rapid investments in power infrastructure, grid modernization, and increasing electricity demand. Expanding renewable energy integration, aging transmission and distribution networks, and large-scale industrialization drive the adoption of digital, numeric, and advanced protection relays. Strong government initiatives for smart grid deployment, coupled with growing manufacturing and energy sectors, fuel market growth. The availability of skilled technical professionals and regional manufacturing hubs further enhances adoption, solidifying Asia’s position as the largest market for protective relays globally.

Get Customized Report as per Your Business Requirement - Enquiry Now

China and India Protective Relay Market Insights

The China and India dominate the protective relay market due to large-scale grid modernization, rising electricity demand, and industrial expansion. Adoption of digital and numeric relays for substations, feeders, and transformers, supported by skilled technical workforce and government initiatives, drives rapid market growth in both countries.

North America Protective Relay Market Insights:

The North America region is expected to have the fastest-growing CAGR 6.51%, driven by increasing grid modernization projects, advanced smart grid initiatives, and rising investments in renewable energy infrastructure. Utilities are adopting digital and intelligent relays with real-time monitoring, remote diagnostics, and predictive fault detection. The focus on upgrading aging power infrastructure, combined with regulatory support and high adoption of IEC 61850 standards, accelerates market growth. Expanding industrial automation and increasing demand for reliable transmission and distribution systems contribute to rapid adoption of advanced protective relay technologies in the region.

U.S and Canada Protective Relay Market Insights

The U.S. and Canada are the fastest-growing markets, fueled by investments in smart grids, renewable energy integration, and aging infrastructure upgrades. High adoption of digital and intelligent relays, predictive maintenance, and regulatory support accelerates deployment across transmission, distribution, and substation applications.

Europe Protective Relay Market Insights

Europe maintains a strong position in the protective relay market due to the modernization of aging electrical networks, renewable energy integration, and stringent safety regulations. Utilities focus on deploying digital and numeric relays for reliable transmission, distribution, and substation protection. Growing emphasis on smart grids, industrial automation, and predictive maintenance supports steady market growth. The region benefits from advanced manufacturing capabilities, technical expertise, and government incentives for energy efficiency. Continuous adoption of advanced protective systems enhances grid reliability and reduces downtime, making Europe a significant contributor to the global market.

Germany and U.K. Protective Relay Market Insights

The U.K. and Germany maintain steady market presence, driven by grid modernization, renewable energy integration, and industrial automation. Adoption of digital and numeric protective relays ensures reliable transmission and distribution. Strong engineering capabilities and compliance with regulatory standards support consistent growth in both countries.

Latin America (LATAM) and Middle East & Africa (MEA) Protective Relay Market Insights

Latin America shows moderate growth in the protective relay market, driven by electrification projects, industrial expansion, and modernization of aging grids. Adoption of digital and numeric relays for substations, feeders, and transformers is gradually increasing. Brazil and Mexico are key contributors, leading investments in power infrastructure and industrial applications. Challenges such as limited technical expertise and uneven rural grid coverage persist. However, government initiatives, infrastructure upgrades, and rising electricity demand are steadily boosting the adoption of advanced protective relay solutions across the region.

In Addition, The Middle East & Africa market is experiencing gradual growth due to investments in smart grids, renewable energy, and industrial expansion. Adoption of digital and numeric relays for substations, feeders, and transformers is increasing steadily. UAE, Saudi Arabia, and South Africa are leading countries driving growth through government-backed electrification projects and urban infrastructure development. Market penetration is constrained in some areas by cost and technical skill gaps.

Protective Relay Market Competitive Landscape:

Siemens Energy offers comprehensive protective relay solutions for power generation, transmission, and distribution systems. Its relays integrate digital technology, real-time monitoring, and fault detection to safeguard electrical infrastructure. Siemens focuses on reliability, cybersecurity, and seamless integration with smart grids and automation platforms. Leveraging global expertise and advanced analytics, Siemens Energy enables utilities and industrial customers to optimize asset protection, reduce operational risks, and ensure uninterrupted power delivery, establishing itself as a leading player in the protective relay market.

-

In March 2025, Siemens Energy (part of Siemens) announced a collaboration with Hitachi Energy to co‑develop advanced digital protective relays and substation automation solutions for modern grids

OMICRON electronics GmbH specializes in advanced testing, diagnostic, and monitoring solutions for power system protection. Its protective relay testing equipment ensures accurate commissioning, maintenance, and troubleshooting of relays in transmission, distribution, and industrial networks. OMICRON emphasizes high-precision instruments, software-driven automation, and global technical support. By enabling utilities and industries to enhance reliability, minimize downtime, and ensure compliance with international standards, OMICRON plays a critical role in advancing protective relay performance and operational efficiency.

-

In January 2025, OMICRON unveiled the “CMC 500” —a modular, multi‑phase protection‑relay test set and commissioning tool. It aims to drastically reduce testing effort (up to 80 %) and supports modern IEC‑61850 digital substations.

ABB provides a wide range of protective relays, devices, and digital protection systems for industrial, utility, and renewable energy applications. Its solutions deliver precise fault detection, system monitoring, and automation capabilities to enhance electrical network safety and reliability. ABB emphasizes innovation, cybersecurity, and integration with smart grid technologies. With extensive global presence, R&D expertise, and service networks, ABB supports customers in minimizing downtime, optimizing grid performance, and ensuring regulatory compliance, making it a key contributor in the protective relay market.

-

In April 2024, ABB introduced the new Relion REX615 protection‑and‑control relay, offering modular, IEC 61850‑enabled medium‑voltage protection ideal for generation, distribution, industrial, data‑center, marine and rail applications.

Protective Relay Market Key Players:

Some of the protective relay market Companies are:

-

Doble Engineering Company

-

Eaton

-

Littelfuse, Inc.

-

ABB Group

-

Schneider Electric SE

-

Siemens

-

Mitsubishi Electric Corporation

-

General Electric Company

-

Fanox

-

Toshiba Corporation

-

NR Electric

-

Larsen & Toubro Limited

-

Basler Electric Company

-

Rockwell Automation, Inc.

-

Solcon

-

ZIV Automation

-

Terasaki Electric Co., Ltd.

-

OMICRON electronics GmbH

-

CG Power and Industrial Solutions

-

Woodward, Inc.

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 3.27 Billion |

| Market Size by 2033 | USD 5.04 Billion |

| CAGR | CAGR of 5.57% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Voltage Range (Low, Medium, High) •By Technology (Digital & Numeric Relays, Electro-Mechanical & Static Relays) •By Application (Feeder Protection, Transmission Line Protection, Transformer Protection, Generator Protection, Motor Protection, Emergency Shutdown Systems (ESD), Other Applications) •By End-user (Utilities, Industries, Railways, Other) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Doble Engineering Company, Eaton, Littelfuse Inc., ABB Group, Schneider Electric SE, Siemens, Mitsubishi Electric Corporation, General Electric Company, Fanox, Toshiba Corporation, NR Electric, Larsen & Toubro Limited, Basler Electric Company, Rockwell Automation Inc., Solcon, ZIV Automation, Terasaki Electric Co. Ltd., OMICRON electronics GmbH, CG Power and Industrial Solutions, and Woodward Inc., |