Real-World Evidence (RWE) Solutions Market Report Scope & Overview:

The Real-World Evidence (RWE) Solutions Market Size was projected at USD 2.5 billion in 2023 and is expected to increase at a CAGR of 8.5% from 2024 to 2032, reaching USD 5.2 billion by 2032.

Get more information on Real World Evidence (RWE) Solutions Market - Request Sample Report

Significant Growth in Real-World Evidence (RWE) Solutions Market: Boosted by Regulatory Support and Technological Advances

Expanding Horizons: The Impact of RWE Solutions on Value-Based Healthcare

The Real-World Evidence (RWE) Solutions Market is experiencing substantial growth, driven by increasing regulatory support, rising R&D investments, and the shift towards value-based healthcare systems. RWE solutions are crucial for providing data on the safety, effectiveness, and value of medical products by utilizing real-world data from electronic health records, claims, and patient registries. While traditionally used for post-approval safety surveillance, recent trends show RWE’s integration into earlier stages of drug development and throughout the entire drug lifecycle.

Regulatory bodies globally are enhancing the use of RWE in decision-making processes. For instance, the U.S. FDA introduced an RWE framework in 2018, setting key initiatives for evaluating RWE’s role in supporting product label changes, including safety profile modifications and new indications. By 2022, RWE was formalized within U.S. legislation, mandating the FDA to establish a dedicated RWE program. Similarly, the European Medicines Agency (EMA) introduced guidelines emphasizing RWE in post-authorization safety studies, broadening its regulatory acceptance. Brazil’s ANVISA also released new guidelines in 2023 for using RWE to evaluate drug safety and efficacy.

Technological advancements, including artificial intelligence (AI), machine learning (ML), and the Internet of Things (IoT), are fueling the demand for RWE solutions. AI-driven insights are enabling faster, data-driven decision-making, benefiting drug development and clinical trials. For example, the partnership between Parexel and Palantir Technologies, announced in April 2024, highlights how companies leverage AI to enhance RWE capabilities and streamline clinical trials.

On the supply side, collaborations and industry coalitions drive innovation in RWE applications. A notable example is the coalition formed in May 2021 by Aetion, IQVIA, Flatiron Health, Tempus, and Syapse, aiming to expand RWE’s use beyond clinical trials. This coalition works with pharmaceutical firms, medical device manufacturers, and regulators to advance RWE applications in pharmacovigilance, post-marketing surveillance, and drug development. As regulatory frameworks evolve and technological innovations transform data analysis, the RWE solutions market is set for continued growth, meeting the rising demand for real-world insights in healthcare decision-making.

Market Dynamics

Drivers

-

Enhanced Drug Development and Cost Reduction:

RWE solutions significantly improve drug development efficiency by facilitating real-time decision-making during clinical trials. They help identify appropriate criteria for trials and potential patient candidates, enhancing the overall process. For instance, Pfizer Inc. showcased positive RWE for its combination therapy to treat metastatic breast cancer at ESMO Breast Cancer 2022. This therapy, combining IBRANCE (palbociclib) with an aromatase inhibitor, illustrates RWE’s role in optimizing drug development. RWE also contributes to reducing development costs, with ISPOR noting that RWE can cut clinical trial costs by 5-50%. This capability enables strategic real-time decision-making and offers competitive advantages, driving the demand for RWE solutions.

-

Rising R&D Spending and Increasing Clinical Trials:

The high cost and extended timeline of drug development, estimated at USD 2.60 billion per new medicine by the Tufts Center for the Study of Drug Development, highlight the challenges faced by the pharmaceutical industry. To address these challenges, pharmaceutical companies are increasingly partnering with RWE solution providers. According to a September 2022 article, R&D is a key area for leveraging RWE, and the growing investment in R&D is expected to drive RWE adoption, accelerating market growth.

Restraints

-

Lack of Standardized Regulations:

As demand for RWE solutions increases, the need for standardized regulations becomes critical. The absence of global harmonization in regulatory, legal, and ethical standards poses a challenge to market growth. Without standardized analytics for RWD and evidence, there is a risk of inconsistent analyses, limited transparency in methodologies, and unreliable outcomes. Data standardization is essential, covering data collection, quality, processing, terminology, design principles, and reporting. The gap in data standardization among regulatory bodies can compromise the quality of RWD compared to data from randomized clinical trials (RCTs), potentially impeding market growth.

Key Segmentation

By Component:

The services segment led the market with 57.6% of total revenue in 2023. This growth is driven by the widespread adoption of real-world services by pharmaceutical, biotechnology companies, and healthcare providers. Companies like IQVIA, Syneos Health, and ICON plc offer comprehensive RWE solutions, including research planning, protocol development, clinical study management, and reporting. The data sets segment is expected to grow significantly due to increasing need for insights into real-world compliance, epidemiology, and healthcare costs.

By Application:

The drug development and approvals segment dominated the market in 2023 with a 26.7% share, driven by RWE Solutions’ ability to manage operations, streamline drug development, and expedite approval timelines. Governments are promoting RWE in medical device development, with the FDA issuing draft guidance in December 2023 detailing RWD evaluation for medical device approvals. The reimbursement/coverage and regulatory decision-making segment is expected to grow rapidly, with the FDA developing protocols and guidelines for evaluating RWD.

By Therapeutic Area:

The oncology segment led the market in 2023 with a 29.0% share, accounting for the largest revenue share. RWE solutions are critical in cancer drug development, reducing clinical trial costs and accelerating product approvals. With the rising global prevalence of cancer, pharmaceutical companies are focusing on developing cancer treatments. For example, GLOBOCAN reported around 10 million new cancer cases globally in 2022. The cardiology segment is anticipated to grow notably, with RWE offering valuable insights from diverse patient data sources.

By End-Use:

Healthcare companies led the market in 2023 with a 35.0% share, driven by the importance of RWE in drug approvals and assessing drug performance. For instance, PINC AI Applied Sciences (PAS) expanded its collaboration with Datavant in February 2024 to enhance healthcare research and clinical trial operations. The healthcare payers segment is projected to grow rapidly, driven by increasing awareness of drug and medical device safety and a favorable reimbursement landscape.

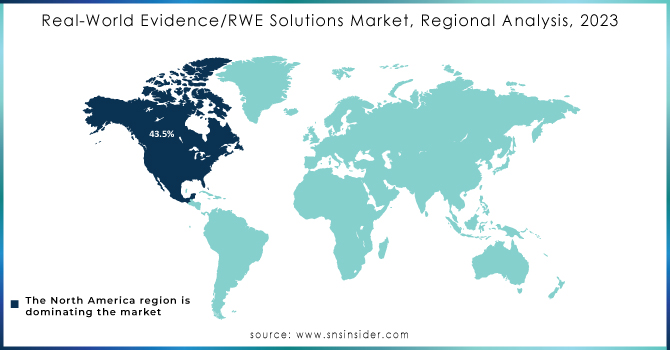

Regional Analysis

North America maintained its dominant position in the Real-World Evidence (RWE) solutions market in 2023, capturing over 43.5% of global revenue. This leadership is attributed to several key factors, including robust regulatory support, a transition to value-based care, and substantial investments in research and development. The U.S., in particular, benefits from proactive regulatory frameworks such as the FDA’s Advancing Real-World Evidence Program, which enhances the quality and application of RWE for drug approvals and healthcare decisions. This regulatory support fosters an environment conducive to innovation and efficient RWE integration across the healthcare sector.

Europe is poised for significant growth in the RWE solutions market, driven by the increasing prevalence of chronic diseases, a rapidly aging population, and heightened R&D investments. Major developments include ICON plc's strategic acquisition of PRA Health Sciences, which broadens its RWE capabilities, and Cegedim Health Data's expansion of its European RWE database, now encompassing German data. Such advancements bolster Europe's position as a key player in RWE, facilitating better healthcare insights and outcomes.

Asia-Pacific is set to experience the fastest growth, fueled by proactive government initiatives in countries like China and India, with rising demand for enhanced healthcare services. In Japan, local pharmaceutical companies are adopting RWE solutions to optimize clinical outcomes. In India, the National Digital Health Mission is expected to significantly boost RWE adoption by creating a unified digital healthcare infrastructure, further driving market growth in the region.

Need any customization research on Real World Evidence (RWE) Solutions Market - Enquiry Now

Key Players

Major market players include Syneos Health, ICON plc, Clinigen Limited, IQVIA Inc., PerkinElmer Inc., Oracle, IBM, Medpace, PPD, Inc. (Acquired by Thermo Fisher Scientific, Inc.), Cognizant, Cegedim Health Data, Parexel International (MA) Corporation, SAS Institute Inc., Optum Inc., and others.

Recent Developments

-

April 2024: IQVIA expanded its strategic partnership with Salesforce to accelerate the development of Salesforce’s Life Sciences Cloud, enhancing decision-making across RWE, discovery, clinical development, medical affairs, and patient safety.

-

April 2024: Parexel partnered with Palantir Technologies Inc. to leverage AI in improving clinical trial delivery, enhancing Parexel’s capabilities in advanced analytics, RWE, and health outcomes.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 2.5 Billion |

| Market Size by 2032 | US$ 5.2 Billion |

| CAGR | CAGR of 8.5% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Services, Data Sets)

•By Application (Drug Development & Approvals, Medical Device Development & Approvals, • Reimbursement/Coverage and Regulatory Decision Making, Post Market Safety & Adverse Events Monitoring) •By Therapeutic Area (Oncology, Cardiology, Neurology, Diabetes, Psychiatry, Respiratory, Other Therapeutic Areas) •By End-use (Healthcare Companies, Healthcare Payers, Healthcare Providers, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles |

Syneos Health, ICON plc, Clinigen Limited, IQVIA Inc., PerkinElmer Inc., Oracle, IBM, Medpace, PPD, Inc. (Acquired by Thermo Fisher Scientific, Inc.), Cognizant, Cegedim Health Data, Parexel International (MA) Corporation, SAS Institute Inc., Optum Inc., and others. |

| DRIVERS |

• Enhanced Drug Development and Cost Reduction

|

| RESTRAINTS | •Lack of Standardized Regulations |