Respiratory Syncytial Virus Vaccines Market Report Scope & Overview:

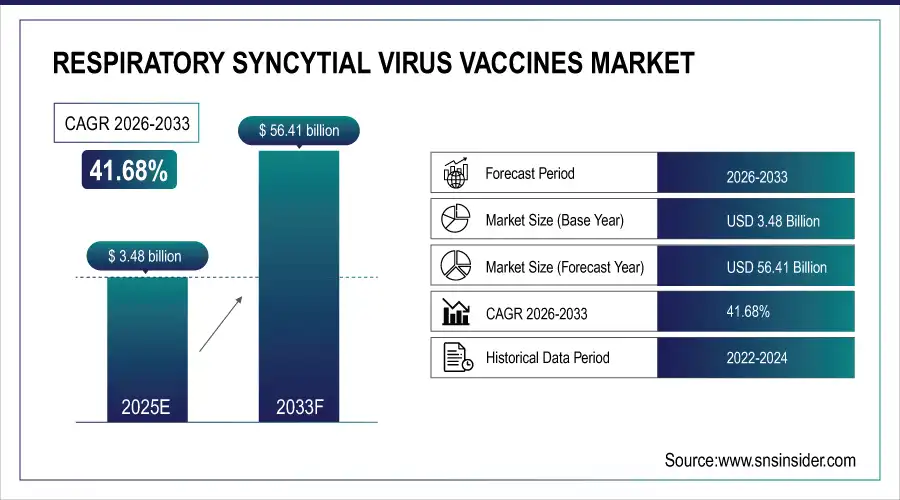

The respiratory syncytial virus vaccines market size was valued at USD 3.48 billion in 2025E and is expected to reach USD 56.41 billion by 2033, growing at a CAGR of 41.68% over the forecast period of 2026-2033.

The respiratory syncytial virus (RSV) vaccines market is growing rapidly due to rising awareness of RSV-related complications among infants, elderly, and immunocompromised populations. Increasing hospitalization rates and unmet medical needs are accelerating vaccine adoption. Strong clinical outcomes of newly approved RSV vaccines, expanding immunization programs, and supportive regulatory approvals are further boosting market expansion. Additionally, growing healthcare investments and continuous R&D activities by pharmaceutical companies are driving sustained market growth.

For instance, in April 2024, the CDC launched a national RSV awareness campaign targeting older adults and pregnant women to boost vaccine uptake, combat hesitancy, and promote newly approved RSV vaccines in the U.S.

Respiratory Syncytial Virus Vaccines Market Size and Forecast

-

Market Size in 2025: USD 3.48 Billion

-

Market Size by 2033: USD 56.41 Billion

-

CAGR: 41.68% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On Respiratory Syncytial Virus Vaccines Market - Request Free Sample Report

Respiratory Syncytial Virus Vaccines Market Trends

-

Rising awareness of respiratory syncytial virus (RSV) prevention is driving vaccine adoption across vulnerable populations.

-

Growing focus on protecting infants, older adults, and high-risk groups is boosting market demand.

-

Advancements in vaccine technologies, including recombinant and mRNA-based platforms, are enhancing efficacy and safety.

-

Increasing regulatory approvals and expanded immunization recommendations are supporting market growth.

-

Strong investments in R&D and clinical trials are accelerating product development pipelines.

-

Expansion of healthcare access and immunization programs is improving vaccine uptake.

-

Collaborations between pharmaceutical companies, biotech firms, and public health organizations are strengthening global market expansion.

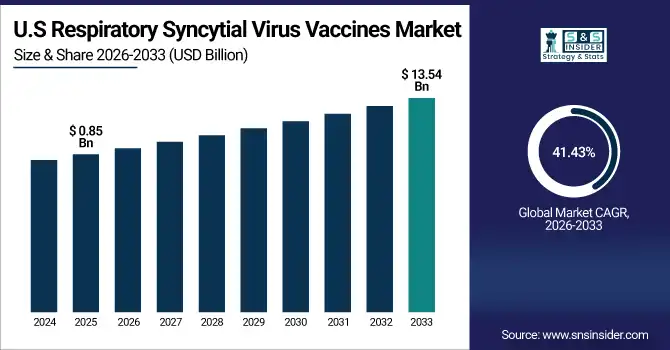

The U.S. Respiratory Syncytial Virus Vaccines Market was valued at USD 0.85 billion in 2025E and is expected to reach USD 13.54 billion by 2033, growing at a CAGR of 41.43% over 2026-2033.

With strong R&D investment, advances in mRNA and monoclonal antibody platforms, and regulatory know-how, large pharmaceutical companies take the lead in the US respiratory syncytial virus vaccines market.

For instance, according to IQVIA data (May 2024), Pfizer’s Abrysvo and GSK’s Arexvy collectively held over 90% of the U.S. RSV vaccine market share within one year of approval, highlighting their strong market access, production scale, and distribution networks.

Respiratory Syncytial Virus Vaccines Market Growth Drivers:

-

mRNA vaccine technology is Driving the Respiratory Syncytial Virus Vaccines Market Growth

The mRNA vaccine is projected to be a highly contributing factor in growing the demand for the respiratory syncytial virus (RSV) vaccine. You can develop fast, potent, and focused immunity, and dosing can be repeated safely. The solution is both scalable and affordable, contributing to greater global access. The successful implementation of COVID-19 vaccines has added confidence and investment, driving the innovation and adoption of RSV vaccines, thereby increasing market volume and providing better protection of high-risk populations.

For instance, in June 2024, the FDA approved Moderna’s mRNA-1345 RSV vaccine with 83.7% efficacy in adults aged 60+.Top of Form

Respiratory Syncytial Virus Vaccines Market Restraints:

-

Vaccine Liability Concerns are a Significant Restraint on the Respiratory Syncytial Virus Vaccines Market

Vaccine liability issues stand as a major threat in the respiratory syncytial virus vaccines market. For developers of experimental coronavirus vaccines, including Moderna and the National Institute of Allergy and Infectious Diseases, that risk calculus is heightened by history, including vaccine-enhanced disease in the 1960s, and by legal and financial risks, especially with vulnerable populations like infants and pregnant women. These issues result in conservative investment, highly complex clinical trial design, and pressure for legislative protection.

For instance, in February 2024, the U.S. HHS proposed expanding the Vaccine Injury Compensation Program (VICP) to include RSV vaccines like Arexvy and Abrysvo, reducing liability risks and encouraging manufacturer participation.

Segmentation Analysis:

By Technology

Monoclonal Antibodies are the dominant segment in the global respiratory syncytial virus vaccines market, with a 42.97% market share in 2025, as they have demonstrated strong efficacy in preventing severe RSV among infants, particularly in infants under six months. Beyfortus (nirsevimab) is the kind of game-changer we need in R.S.V. prevention.

The Recombinant Protein + Adjuvant segment is emerging as the fastest growing with a CAGR of 42.05% in the respiratory syncytial virus vaccines market trend, because of its high immunogenicity and safety, especially in the elderly. Vaccines, including GSK’s Arexvy, have advanced adjuvants that boost immune response and are in broad use in the U.S. and Europe.

By Type

In 2025, the Passive Immunization segment dominated the Respiratory Syncytial Virus Vaccines Market trend with a 78.80% market share, because it can protect high-risk infants using monoclonal antibodies including Beyfortus (nirsevimab). It confers passive immunity and does not require the immune response of the infant, which makes it great for newborns.

The Preventive Vaccines segment is the fastest growing aspect of the respiratory syncytial virus vaccines market analysis, as approvals for vaccination for the elderly and pregnant women, like Arexvy and Abrysvo, have been on the rise. Their uptake is increasing due to growing awareness, high efficacy rates, and government-funded vaccination programs.

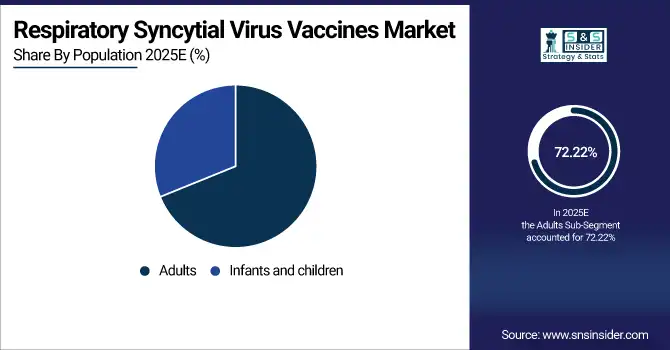

By Population

Adults held a dominant share in the respiratory syncytial virus vaccines market of 72.22% in 2025, owing to the burden of disease among elderly people. Vaccines including Arexvy and Abrysvo, for example, have been specifically approved for use in older adults, leading to massive vaccination campaigns. Favorable government recommendations, increasing awareness, and improved access to healthcare further fuel demand, thereby driving the overall respiratory syncytial virus vaccines market and sustaining expansion.

Infants and children are emerging as the fastest-growing segment in the respiratory syncytial virus vaccines market with the highest CAGR of 42.36%, because they are at high risk of severe RSV disease. The approval and availability of long-acting monoclonal antibodies for newborns, including Beyfortus (nirsevimab), have also greatly extended protection. The efforts by governments in policies for immunization, rising parents’ knowledge, and better clinical outcomes are leading to the growing adoption, thereby escalating the respiratory syncytial virus vaccines market share in pediatrics.

By Channel

Hospital & Retail Pharmacies are the largest segment of end users for the respiratory syThe ncytial virus vaccines industry, because of their extensive availability and administration of adult and pediatric vaccinations. It provides convenience, professional guidance, and convenient cold-chain storage, achieving timely vaccination. Rising partnerships among the drug manufacturing companies with pharmacy chains and others promoting distribution are also stimulating the growth of the market.

The Government Suppliers segment is witnessing the highest growth in the global respiratory syncytial virus vaccines industry. Government vendors are the fastest in the Respiratory Syncytial Virus (RSV) vaccines market share, with the emergence of public immunization programs initiating the new market for infants, pregnant women, and older people. Robust government financing, global and national partnerships increase reach and affordability.

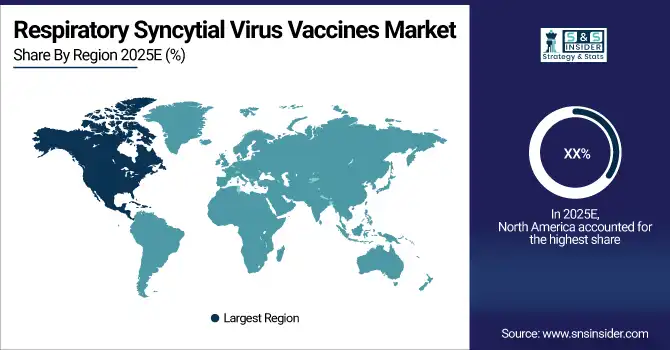

Regional Analysis:

North America Respiratory Syncytial Virus Vaccines Market Insights

North America is the second leading revenue-generating region in the respiratory syncytial virus vaccines industry. Early adoption of regulations, availability of well-developed healthcare infrastructure, and higher awareness among people in the target demographic are the contributing factors. Vaccines, including GSK’s Arexvy and Pfizer’s Abrysvo for adults and use in pregnancy, have also helped key areas contribute to regional demand.

Get Customized Report as per Your Business Requirement - Enquiry Now

Europe Respiratory Syncytial Virus Vaccines Market Insights

The European market is certain to account for a notable portion of the respiratory syncytial virus (RSV) vaccines industry owing to well-established healthcare, early approvals sanctioned by the EMA, and government-supported inoculation programs aimed at the aged and infant populations. The UK and Germany, and France reportedly have significant uptake of vaccines, including Arexvy and therapies like Beyfortus.

Asia Pacific Respiratory Syncytial Virus Vaccines Market Insights

The Asia-Pacific is the largest and fastest-growing region in the global respiratory syncytial virus (RSV) vaccines industry respiratory syncytial virus vaccines share, with a market share of 32.15% and a CAGR of 42.14% owing to its large population, high RSV burden in children, aging population, and growing investment in healthcare. Countries including China, Japan, and India are scaling up immunization programs and have approved RSV vaccines and monoclonal antibodies.

Middle East & Africa and Latin America Respiratory Syncytial Virus Vaccines Market Insights

The respiratory syncytial virus vaccines market in the Middle East & Africa and Latin America is at an early growth stage, driven by rising awareness of RSV’s impact on infant health. While healthcare infrastructure and vaccine access remain limited, especially in developing and rural areas, increasing government initiatives, public–private partnerships, global support from organizations such as WHO and Gavi, and inclusion of monoclonal antibodies are gradually improving immunization coverage and supporting regional market growth.

Respiratory Syncytial Virus Vaccines Market Competitive Landscape:

GSK plc

GSK plc is a global biopharmaceutical company focused on vaccines, specialty medicines, and general therapeutics. The company holds a strong leadership position in vaccines, supported by deep R&D capabilities and global manufacturing scale. GSK prioritizes respiratory, infectious, and immune-related diseases, leveraging advanced adjuvant technologies to deliver long-lasting protection and improve public-health outcomes across diverse age groups worldwide.

-

April 2024: GSK’s vaccine Arexvy received regulatory approval in Japan for adults aged 60 and above, expanding the company’s global presence and reinforcing its position in adult immunization.

Sanofi S.A.

Sanofi is a leading global healthcare company specializing in vaccines, immunology, rare diseases, and chronic conditions. Through its vaccines division, Sanofi plays a critical role in infectious-disease prevention, supported by extensive manufacturing capacity and global distribution networks. The company emphasizes innovation, scalability, and access, focusing on protecting vulnerable populations and addressing unmet medical needs in respiratory and pediatric care.

-

May 2024: Sanofi increased production of Beyfortus (nirsevimab) to meet rising global demand, ensuring broader infant access and reinforcing its leadership in the respiratory syncytial virus market.

Moderna, Inc.

Moderna is a biotechnology company pioneering messenger RNA (mRNA) therapeutics and vaccines. Built on its proprietary mRNA platform, the company rapidly develops vaccines across infectious diseases, oncology, and rare conditions. Moderna leverages scalable manufacturing and advanced clinical development to expand beyond COVID-19, positioning itself as a key innovator in next-generation vaccines addressing significant global health challenges.

-

June 2024: Moderna’s mRNA-1345 RSV vaccine received FDA approval for adults aged 60 and above, marking its first non-COVID vaccine and supporting its expansion into the RSV vaccine market.

Respiratory Syncytial Virus Vaccines Market Key Players

Some of the Respiratory Syncytial Virus Vaccines Market Companies

-

Pfizer Inc.

-

GlaxoSmithKline plc

-

Sanofi S.A.

-

AstraZeneca plc

-

Moderna, Inc.

-

Merck & Co., Inc.

-

Johnson & Johnson

-

Bavarian Nordic A/S

-

Novavax, Inc.

-

Icosavax, Inc.

-

Meissa Vaccines, Inc.

-

Codagenix, Inc.

-

Blue Lake Biotechnology, Inc.

-

Vaxart, Inc.

-

Clover Biopharmaceuticals

-

Advaccine Biopharmaceuticals

-

Nuance Pharma

-

Emergent BioSolutions Inc.

-

Seqirus (CSL Limited)

-

Immunovant, Inc.

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 3.48 billion |

| Market Size by 2033 | USD 56.41 billion |

| CAGR | CAGR of 41.68% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology (Monoclonal AntibodiesRecombinant Protein + Adjuvant, mRNA-Based Vaccine, Virus-Like Particle (VLP) • By Type (Passive Immunization, Preventive Vaccines) • By Population (Adults, Infants and Children) •By Channel (Hospital & Retail Pharmacies, Government Suppliers, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | GSK plc, Pfizer Inc., Moderna, Inc., Pfizer Inc., GlaxoSmithKline plc, Sanofi S.A., AstraZeneca plc, Moderna, Inc., Merck & Co., Inc., Johnson & Johnson, Bavarian Nordic A/S, Novavax, Inc., Icosavax, Inc., Meissa Vaccines, Inc., Codagenix, Inc., Blue Lake Biotechnology, Inc., Vaxart, Inc., Clover Biopharmaceuticals, Advaccine Biopharmaceuticals, Nuance Pharma, Emergent BioSolutions Inc., Seqirus (CSL Limited), Immunovant, Inc.. |