Robotics Retrofit Services Market Report Scope & Overview:

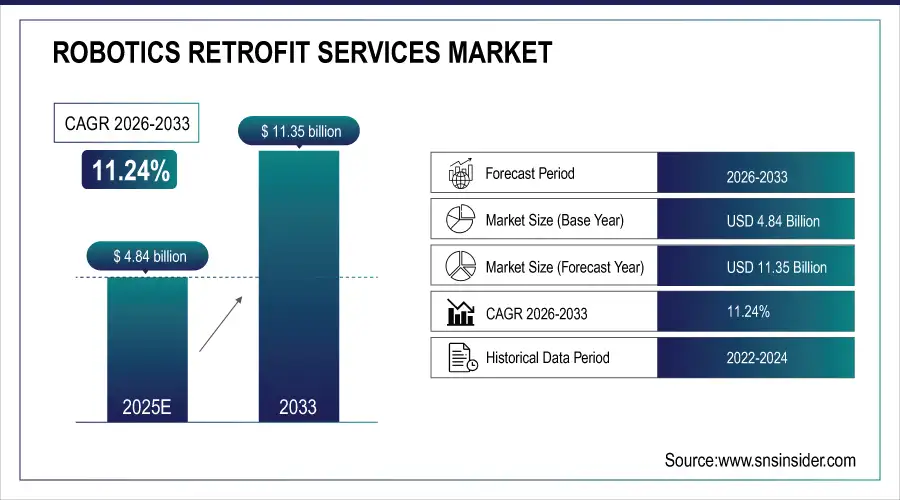

The Robotics Retrofit Services Market size was valued at USD 4.84 Billion in 2025E and is projected to reach USD 11.35 Billion by 2033, growing at a CAGR of 11.24% during 2026–2033.

The Robotics Retrofit Services market is witnessing robust growth as industries increasingly seek to modernize legacy robotic systems and extend their operational lifecycles. Rising adoption of AI-, IoT-, and cloud-enabled automation, coupled with Industry 4.0 integration, is driving demand for controller upgrades, system integration, and motion optimization services. Key sectors, including automotive, aerospace, logistics, and manufacturing, are investing in retrofitting solutions to enhance productivity, operational efficiency, and flexibility. Additionally, sustainability initiatives and energy-efficient operations are encouraging upgrades of older robots. The market offers significant opportunities for providers delivering advanced retrofit solutions, digital twin integration, and comprehensive support services across industrial applications.

In April 2025Panasonic’s TAWERS G4 Welding Robot System enables Thyssenkrupp Bilstein in Romania to digitize its damper production, enhancing speed, flexibility, offline programming, and overall efficiency on the shopfloor.

Robotics Retrofit Services Market Size and Forecast:

-

Market Size in 2025E: USD 4.84 Billion

-

Market Size by 2033: USD 11.35 Billion

-

CAGR: 11.24% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information on Robotics Retrofit Services Market - Request Free Sample Report

Robotics Retrofit Services Market Highlights:

-

AI and sustainability-driven modernization with Robotics Retrofit Services enabling secure upgrades of legacy industrial systems, integrating AI, IoT, and sustainable practices to enhance operational efficiency

-

Market growth is fueled by rising adoption of smart manufacturing, automation ecosystems, and regulatory measures like the Cyber Resilience Act driving demand for retrofit solutions

-

High investment costs, technical complexities, workforce skill gaps, and cybersecurity risks limit adoption, especially among small and medium enterprises

-

Retrofit solutions offer efficiency gains, productivity improvements, and extended asset lifecycles across automotive, aerospace, logistics, and food production sectors

-

Companies leverage advanced motion control, digital twins, and system integration to modernize robots and optimize industrial processes

-

Kawasaki and Bosch Rexroth demonstrate market innovation with high-precision, multi-system compatible robots and solutions driving digitization and operational flexibility

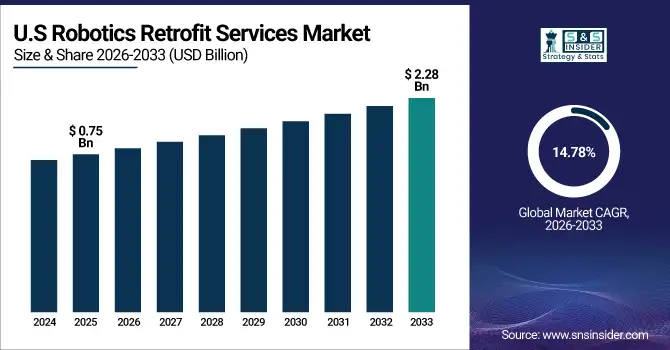

The U.S. Robotics Retrofit Services Market size was valued at USD 0.75 Billion in 2025E and is projected to reach USD 2.28 Billion by 2033, growing at a CAGR of 14.78% during 2026–2033. Growth is driven by increasing modernization of legacy robotic systems, adoption of AI- and IoT-enabled automation, and rising Industry 4.0 integration across automotive, aerospace, logistics, and manufacturing sectors. Enhanced productivity, operational efficiency, and flexibility, along with sustainability initiatives, are fueling demand for retrofit services and advanced system upgrades in U.S. industrial facilities.

Robotics Retrofit Services Market Drivers:

-

Robotics Retrofit Services enable secure, AI- and sustainability-driven modernization of legacy industrial systems.

The Robotics Retrofit Services market is poised for growth as manufacturers increasingly focus on AI-enabled automation, cybersecurity, and sustainable operations. Regulatory measures like the Cyber Resilience Act are driving demand for secure, upgradable retrofit solutions, while sustainability initiatives encourage energy-efficient and resource-optimized upgrades. Integrating AI-assisted modules into legacy systems improves productivity, operational insights, and process efficiency. Companies can leverage robotics retrofitting to modernize existing assets, reduce carbon footprints, and meet Industry 4.0 standards. With rising adoption of smart manufacturing and automation ecosystems, the market offers opportunities for efficiency gains, innovation, and competitive advantage across automotive, aerospace, logistics, and industrial sectors.

In Feb 2025, Bosch Rexroth highlights automation trends for 2025, emphasizing AI integration, cybersecurity under the Cyber Resilience Act, and sustainability initiatives, driving efficiency, innovation, and secure, energy-efficient manufacturing solutions.

Robotics Retrofit Services Market Restraints:

-

High costs, technical complexities, and workforce skill gaps limit Robotics Retrofit Services adoption.

The Robotics Retrofit Services market faces several restraints that could limit growth. High initial investment costs for upgrading legacy robots and integrating advanced AI/IoT technologies remain a barrier, especially for small and medium enterprises. Technical complexities in system integration, compatibility issues with older equipment, and the need for skilled workforce further hinder adoption. Additionally, cybersecurity risks associated with connected automation systems and resistance to change from traditional manufacturing processes can slow deployment. Regulatory compliance, especially in safety-critical industries, adds another layer of challenge, making careful planning and investment essential for successful retrofit projects.

Robotics Retrofit Services Market Opportunities:

-

Robotics Retrofit Services modernize robots, integrate AI/IoT, and boost industrial efficiency and productivity.

The Robotics Retrofit Services market presents significant opportunities as manufacturers seek to modernize legacy robotic systems and extend asset lifecycles. Growing adoption of AI-, IoT-, and cloud-enabled automation, coupled with Industry 4.0 integration, drives demand for controller upgrades, motion optimization, and system integration services. Kawasaki can leverage its versatile industrial robot portfolio, advanced motion control, and safety features to provide retrofit solutions that enhance productivity, operational efficiency, and flexibility across automotive, aerospace, logistics, and food production sectors. Expanding into brownfield facilities and emerging markets further strengthens growth potential.

Aug 7, 2025, Kawasaki showcased its heavy-duty industrial robots, highlighting high-precision motion, multi-system compatibility, and safety features, reinforcing its role in automotive, aerospace, logistics, and food production automation.

Robotics Retrofit Services Market Segment Highlights:

-

By Service Type: Dominant – Hardware Retrofit (37.50% in 2025E → 35.00% in 2033); Fastest-Growing – Integration Services (CAGR 19.90%)

-

By Robot Type: Dominant – Industrial Robots (68.75% in 2025E → 61.25% in 2033); Fastest-Growing – Collaborative Robots (CAGR 16.09%)

-

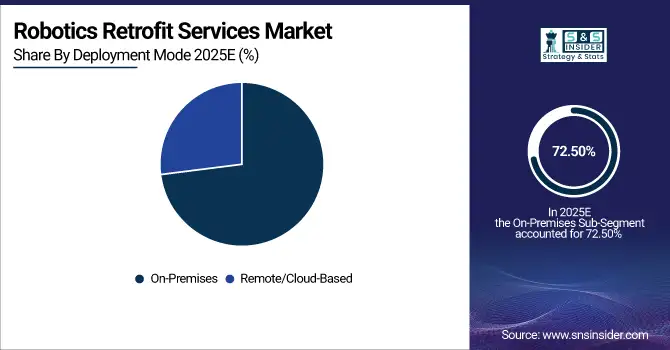

By Deployment Mode: Dominant – On-Premises (72.50% in 2025E → 57.50% in 2033); Fastest-Growing – Remote/Cloud-Based (CAGR 17.27%)

-

By End User: Dominant – Automotive (29.38% in 2025E → 25.63% in 2033); Fastest-Growing – Healthcare (CAGR 23.58%)

Robotics Retrofit Services Market Segment Analysis:

By Deployment Mode, On-Premises Dominating and Remote/Cloud-Based Fastest-Growing

On-premises deployment continues to dominate the Robotics Retrofit Services market in 2025 and 2033, driven by data security concerns, real-time control requirements, and legacy factory infrastructure. In contrast, remote and cloud-based deployment is the fastest-growing segment, supported by rising adoption of IoT platforms, predictive maintenance, remote monitoring, and software-driven retrofit solutions.

By Service Type, Hardware Retrofit Dominating and Integration Services Fastest-Growing

Hardware Retrofit remains the dominant service segment in both 2025 and 2033, holding the largest market share due to its widespread adoption for extending the lifespan of legacy robotic systems through component replacement and mechanical upgrades. In contrast, Integration Services emerge as the fastest-growing segment, driven by rising demand for seamless system integration, AI and IoT enablement, cloud connectivity, and the need to modernize brownfield automation environments without full system replacement.

By Robot Type, Industrial Robots Dominating and Collaborative Robots Fastest-Growing

Industrial robots remain the dominant robot type in both 2025 and 2033, supported by their extensive installed base across automotive, electronics, and heavy manufacturing, which drives continuous retrofit demand. Meanwhile, collaborative robots represent the fastest-growing segment, fueled by flexible deployment, human–robot collaboration, and increasing adoption in SMEs seeking cost-effective automation upgrades.

By End User, Automotive Dominating and Healthcare Fastest-Growing

The automotive sector remains the dominant end user in both 2025 and 2033, owing to its high robot density, mature automation infrastructure, and continuous need for productivity upgrades. Conversely, healthcare is the fastest-growing end-user segment, driven by increasing automation in medical manufacturing, laboratory robotics, and hospital logistics modernization.

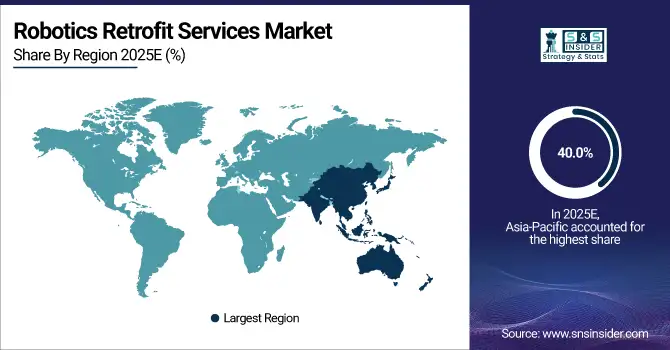

Robotics Retrofit Services Market Regional Highlights:

-

Asia-Pacific: In 2025 40.00% → 33.88%, Dominating Region, Moderate Decline (CAGR 8.93%)

-

North America: In 2025 26.17% → 34.25%, Significant Market, Fastest Growth (CAGR 14.98%)

-

Europe: In 2025 24.90% → 21.50%, Mature Market, Slight Decline (CAGR 9.20%)

-

South America: In 2025 3.98% → 5.25%, Emerging Market, Strong Growth (CAGR 15.09%)

-

Middle East & Africa: In 2025 4.95% → 5.13%, Developing Market, Moderate Growth (CAGR 11.73%)

Robotics Retrofit Services Market Regional Analysis:

Asia-Pacific Robotics Retrofit Services Market Insights:

Asia-Pacific leads the Robotics Retrofit Services market, driven by its large manufacturing base, high robot density, and ongoing investments in industrial automation. The region maintains the largest market share despite gradual decline from 2025 to 2033. Strong retrofit demand in China, Japan, and South Korea, combined with adoption of Industry 4.0 technologies, supports continued modernization of legacy robotic systems.

Get Customized Report as per Your Business Requirement - Enquiry Now

China Robotics Retrofit Services Market Insights:

China dominates the Robotics Retrofit Services market, driven by extensive industrial automation, high robot adoption, and continuous retrofitting of legacy systems to enhance efficiency, productivity, and Industry 4.0 integration.

North America Robotics Retrofit Services Market Insights:

North America is the fastest-growing region in the Robotics Retrofit Services market, fueled by increasing adoption of Industry 4.0 technologies, modernization of legacy robotic systems, and investments in AI- and IoT-enabled automation solutions, enabling manufacturers to enhance operational efficiency, reduce labor dependency, and improve overall production flexibility across industries.

U.S. Robotics Retrofit Services Market Insights:

The U.S. is dominating the North America Robotics Retrofit Services market, driven by advanced automation technologies, strong retrofit solutions adoption, and strategic partnerships supporting modernization of industrial robots across key manufacturing sectors.

Europe Robotics Retrofit Services Market Insights:

The Europe Robotics Retrofit Services market is witnessing emerging trends, including increased adoption of collaborative robots, digital twin integration, and AI-enabled retrofit solutions. Manufacturers are focusing on modernizing legacy systems to enhance productivity, energy efficiency, and sustainability, while meeting evolving Industry 4.0 standards across automotive, electronics, and aerospace sectors.

Germany Robotics Retrofit Services Market Insights:

Germany is the dominating country in the Robotics Retrofit Services market, driven by its strong automotive and industrial manufacturing base, high robot adoption, and advanced automation infrastructure.

Latin America Robotics Retrofit Services Market Insights:

The Latin America Robotics Retrofit Services market is steadily expanding, supported by growing industrial automation investments, modernization of legacy manufacturing facilities, and increasing adoption of cost-effective retrofit solutions. Key countries like Brazil and Mexico are driving demand, enabling improved productivity, operational efficiency, and gradual integration of Industry 4.0 technologies across the region.

Brazil Robotics Retrofit Services Market Insights:

Brazil is dominating the Latin America Robotics Retrofit Services market, driven by extensive manufacturing activities, high adoption of industrial robots, and growing demand for retrofitting legacy systems to enhance efficiency and productivity.

Middle East & Africa Robotics Retrofit Services Market Insights:

The Middle East and Africa Robotics Retrofit Services market is witnessing moderate growth, fueled by increasing industrial automation investments, modernization of existing manufacturing systems, and gradual adoption of AI- and IoT-enabled retrofit solutions, enabling improved operational efficiency, productivity, and competitiveness across key sectors such as oil & gas, automotive, and logistics.

Saudi Arabia Robotics Retrofit Services Market Insights:

Saudi Arabia is dominating the Middle East and Africa Robotics Retrofit Services market, driven by extensive industrial automation initiatives, investments in smart manufacturing, and modernization of legacy robotic systems across key sectors.

Robotics Retrofit Services Market Competitive Landscape:

ABB Ltd. Establish in 1883, is a global technology leader specializing in electrification, automation, robotics, and digitalization. The company provides industrial automation systems, robotic solutions, and retrofit services that enhance productivity, efficiency, and sustainability across manufacturing, energy, utilities, transportation, and infrastructure sectors worldwide.

-

In October 2025, ABB to Sell Robotics Business to SoftBank for USD 5.4 Billion The deal supports SoftBank’s push to merge AI with robotics, while ABB will use the proceeds to strengthen core technologies, with completion expected in 2026.

FANUC Corporation Established in 1956, is a global leader in industrial automation, specializing in CNC systems, industrial robots, and robotics retrofit services that upgrade legacy machines with advanced controllers, cobots, and IoT integration to improve productivity, flexibility, and lifecycle performance across manufacturing industries worldwide.

-

In Sept 2025, FANUC showcased advanced CNC–robot integration, cobots, and IoT solutions at the Manufacturing Technologies Series West Show, highlighting robotics retrofit capabilities that enable legacy CNC machines and production lines to be upgraded with flexible, connected automation.

Robotics Retrofit Services Market Key Players:

-

ABB Ltd.

-

FANUC Corporation

-

KUKA AG

-

Yaskawa Electric Corporation

-

Siemens AG

-

Mitsubishi Electric Corporation

-

Rockwell Automation, Inc.

-

Omron Corporation

-

Universal Robots A/S

-

Kawasaki Heavy Industries, Ltd.

-

Denso Corporation

-

Staubli International AG

-

Comau S.p.A.

-

Epson Robots

-

Nachi-Fujikoshi Corp.

-

Bosch Rexroth AG

-

Schneider Electric SE

-

Panasonic Corporation

-

Toshiba Machine Co., Ltd.

-

Hyundai Robotics

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 4.84 Billion |

| Market Size by 2033 | USD 11.35 Billion |

| CAGR | CAGR of 11.24% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Service Type(Hardware Retrofit, Software Retrofit, Control System Upgrade, Integration Services and Others) • By Robot Type(Industrial Robots, Collaborative Robots, Mobile Robots and Others) • By Deployment Mode(On-Premises and Remote/Cloud-Based) • By End User (Automotive, Electronics, Aerospace, Food & Beverage, Healthcare, Logistics and Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Key players in the Robotics market include ABB Ltd., FANUC Corporation, KUKA AG, Yaskawa Electric Corporation, Siemens AG, Mitsubishi Electric Corporation, Rockwell Automation, Omron Corporation, Universal Robots, Kawasaki Heavy Industries, Denso Corporation, Staubli International, Comau, Epson Robots, Nachi-Fujikoshi, Bosch Rexroth, Schneider Electric, Panasonic, and Toshiba Machine. |