Saliva Collection and Diagnostics Market Size Analysis:

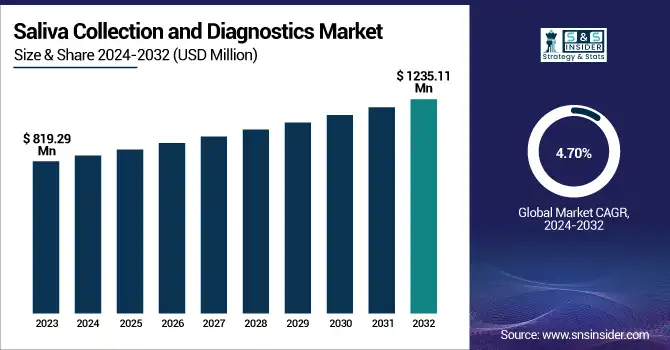

The Saliva Collection and Diagnostics Market size was valued at USD 819.29 million in 2023 and is expected to reach USD 1235.11 million by 2032, growing at a CAGR of 4.70% from 2024-2032.

Saliva Collection and Diagnostics Market analysis provides unique insight by including regional saliva collection device volume trends, market penetration by significant areas, in-depth incidence and prevalence rates for saliva-based diagnostics in 2023, reflecting real-world implementation, and analysis of regulatory approval and compliance trends, with an extensive description of industry benchmarks. An extensive analysis of healthcare expenditure on saliva testing by geography in 2023 is provided, including standalone coverage on expanding home-based saliva test kits penetration, highlighting consumer-led trends influencing the market.

To Get more information on Saliva Collection and Diagnostics Market - Request Free Sample Report

The U.S. Saliva Collection and Diagnostics Market size was USD 273.98 million in 2023 and is expected to reach USD 404.96 million by 2032, growing at a CAGR of 4.47% over the forecast period of 2024-2032.

The U.S. Saliva Collection and Diagnostics Market is growing due to the increasing adoption of non-invasive diagnostic techniques for disease detection and monitoring. Saliva-based testing is gaining traction for its ease of use, accuracy, and ability to detect conditions such as infectious diseases, hormonal imbalances, and genetic disorders. Advancements in molecular diagnostics and biomarker research are further enhancing the reliability of saliva-based tests. The rising demand for at-home testing kits and the expansion of applications in personalized medicine are also driving market growth.

Saliva Collection and Diagnostics Market Dynamics

Drivers

-

Rising adoption of saliva-based diagnostics for disease detection is propelling the market growth.

Saliva diagnostics are increasingly being accepted because of their painless, non-invasive, and easy sample collection compared to the conventional blood or swab test. The rising application of saliva testing for infectious diseases (COVID-19, HIV), hormone detection, and cancer screening is the major driving factor. The CDC reports that saliva-based COVID-19 testing showed 94% accuracy in determining infections, leading to approvals for broader use. In 2023, PerkinElmer obtained CE-IVD marking for its SARS-CoV-2 Real-time RT-PCR Assay for saliva samples, which allows laboratories to embrace saliva testing as a standard procedure. Furthermore, saliva testing is reaching into precision medicine with firms formulating biomarker-based saliva tests for the early detection of diseases. Pressure for decentralized testing and increasing R&D expenditure is fueling market growth and adoption.

-

Increasing Penetration of home-based saliva testing kits is accelerating the market growth.

Demand for home-use saliva collection kits has increased for reasons of convenience, privacy, and accessibility. Firms are working on direct-to-consumer (DTC) saliva-based tests for genetic testing, hormone assessment, and detection of infectious diseases. ZRT Laboratory in 2023 introduced the Steroid LC-MS Hormone Profile 7, which allows individuals to analyze seven important hormones from a single home-collected saliva sample. Moreover, the growth of DNA and ancestry testing services has driven the market, with 23andMe and AncestryDNA announcing millions of saliva genetic tests each year. Support for home diagnostics from regulatory bodies, like FDA approvals of self-conducted COVID-19 saliva tests, also enhances market uptake. With an increase in personalized and preventive medicine in healthcare, home-based saliva testing is further growing and contributing to making diagnostics patient-friendly and convenient.

Restraint

-

Variability in saliva sample quality and standardization challenges are restraining the market from growing.

One of the most important constraints in the Saliva Collection and Diagnostics Market is sample quality inconsistency, which can alter test accuracy and reliability. While blood samples remain relatively independent of such variables, saliva composition may vary with hydration, diet, circadian rhythm, and medication, resulting in fluctuations in biomarker levels. This creates issues in standardizing diagnostic outcomes, particularly for hormone testing, infectious disease screening, and genetic testing. A recent 2023 study in Clinical Chemistry emphasized that saliva cortisol concentration varied by as much as 30% with sample collection timing, impacting diagnosis. Moreover, regulatory bodies, such as the FDA and CE authorities, necessitate rigorous validation of saliva-based tests, pushing the entry of new products into the market. Addressing these issues demands novel stabilization technologies, standardized collection practices, and additional validation studies to provide consistent and reproducible results.

Opportunities

-

Expansion of saliva-based biomarker research for early disease detection presents a significant opportunity.

The Saliva Collection and Diagnostics Market is an important opportunity area in biomarker research for detecting diseases early on. Saliva has a well-developed set of DNA, RNA, protein, and metabolite components, which make it a good candidate as a disease-detecting medium for disorders like cancer, neurological conditions, and metabolic ailments. Developments in omics technologies (genomics, proteomics, and metabolomics) have made it possible to identify saliva-based disease biomarkers for conditions such as oral cancer, Alzheimer's, and diabetes. In 2023, a team of researchers at UCLA created a saliva test that could identify pancreatic cancer in its early stage with more than 90% accuracy. This innovation showcases the promise of saliva diagnostics for non-invasive, point-of-care disease diagnosis, propelling R&D spending and prompting biotech and pharmaceutical firms to create innovative saliva-based diagnostic platforms.

Challenges

-

A major challenge in the saliva collection and diagnostics market is navigating complex regulatory approvals and reimbursement policies.

In contrast to conventional blood-based analyses, saliva diagnostics must undergo thorough validation for clinical precision, specificity, and sensitivity, which will slow down product approvals. Regulatory bodies such as the FDA and CE-IVD have strict standards for new saliva-based assays, which reduce the pace at which new diagnostic solutions appear on the market. In addition, insurance reimbursement is inconsistent and continues to rely heavily on out-of-pocket costs for patients by classifying many saliva-based tests as experimental diagnostics. According to a 2023 report from the American Clinical Laboratory Association (ACLA), only 40% of saliva-based diagnostic tests had reimbursement approvals in the U.S. To overcome these issues, industry consensus needs to develop standards for clear regulatory guidelines and increase reimbursement coverage to speed up market adoption.

Saliva Collection and Diagnostics Market Segmentation Analysis

By Site of Collection

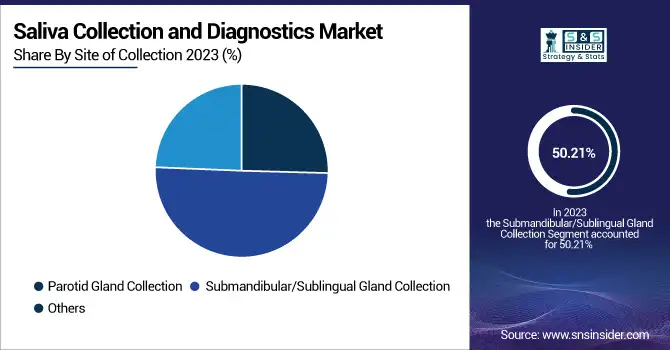

Submandibular/Sublingual Gland Collection segment dominated the saliva collection and diagnostics market with a 50.21% market share in 2023, owing mainly to its high diagnostic specificity, simplicity of collection, and high content of biomarkers. Saliva derived from submandibular and sublingual glands is used for diagnostic purposes because it has a greater concentration of major analytes, such as hormones, proteins, and genetic material, and thus represents a good specimen for the identification of diseases like cancer, infectious diseases, and metabolic disorders. Further, this collection method provides a steadier stream of saliva, minimizing sample variation and enhancing test accuracy. Advancements in the technology of saliva collection devices, e.g., standardized collection swabs and collection tubes, have also further streamlined the efficiency of submandibular/sublingual saliva testing. With advancements in 2023, researchers concentrated on creating sophisticated biomarker-based diagnostics using saliva from this glandular area, paving the way for greater adoption in oncology, neurology, and endocrinology. Its dominance in the segment also lies in its increasing application in point-of-care and home-based diagnostic testing kits, as it facilitates simple self-sample collection with little pain, qualifying it as a desired option in the widening direct-to-consumer (DTC) market.

By Application

The Disease Diagnostics segment dominated the saliva collection and diagnostics market with an 88.14% market share in 2023 due to the increasing use of non-invasive testing technologies for infectious diseases, cancer screening, and chronic diseases. Saliva diagnostics provide a painless, convenient-to-collect substitute for blood-based tests and are therefore extremely popular for disease detection, such as COVID-19, HIV, oral cancer, and diabetes. The dominance of the segment was further strengthened by the approval of regulations and greater clinical validation of saliva tests, causing them to gain wider acceptance in hospitals, diagnostic labs, and home testing.

Moreover, innovations in biomarker research have extended the application of saliva in early disease detection to include rapid, high-accuracy testing for neurological disorders, cardiovascular diseases, and endocrine disorders. In 2023, large health organizations and research centers invested in precision medicine based on saliva, driving market growth even further. Integration of PCR, next-generation sequencing (NGS), and artificial intelligence-based diagnostic platforms has also improved the scalability and reliability of saliva-based disease detection, securing its market leadership.

By End User

The Diagnostic Laboratories segment dominated the saliva collection and diagnostics market with a 78.52% market share in 2023, mostly because of their sophisticated infrastructure, high testing capacity, and the large-scale use of saliva-based diagnostic technologies. Laboratories are significant in handling large volumes of saliva samples for uses such as infectious disease detection, genetic testing, oncology screening, and analysis of hormones. The segment was boosted largely by the increasing demand for non-surgical diagnostic procedures, particularly in the areas of personalized medicine and precision diagnosis. Regulatory sanctions and advancements in PCR-based assays, liquid chromatography-mass spectrometry (LC-MS), and next-generation sequencing (NGS) have supported the accuracy and efficiency of laboratory testing through saliva-based methods. The year 2023 also allowed partnerships between diagnostic laboratories and biotechnology firms to expedite the commercialization of new saliva-based assays, reinforcing the segment's supremacy.

Saliva Collection and Diagnostics Market Regional Insights

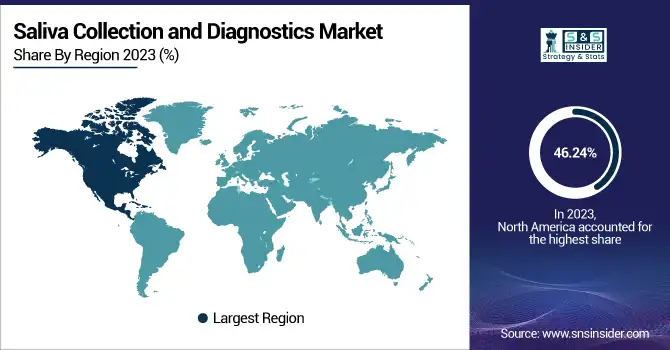

North America dominated the saliva collection and diagnostics market with a 46.24% market share in 2023 due to the presence of advanced healthcare infrastructure, robust regulatory approvals, and high usage of saliva-based diagnostics in various applications. The United States is the largest contributor to the region due to significant investments in research and development of saliva-based biomarker studies, genetic testing, and infectious disease diagnostic tests. Saliva-based diagnostic tests have been approved by various regulatory authorities like the FDA and CLIA, boosting their clinical acceptance. Furthermore, the involvement of major industry players such as Thermo Fisher Scientific, OraSure Technologies, and Quest Diagnostics fortifies market expansion. The COVID-19 pandemic also boosted demand for saliva-based testing, with prominent universities and labs embracing saliva-based RT-PCR tests for mass screening. High consumer awareness and access to direct-to-consumer (DTC) genetic and health testing kits also benefit the region, fueling its market leadership.

The Asia Pacific is witnessing the fastest growth in the saliva collection and diagnostics market with 5.31% CAGR throughout the forecast period due to growing investments in healthcare, rising awareness for non-invasive diagnostics, and growing biotechnology research. Nations such as China, Japan, and India are seeing high rates of adoption of saliva tests for infectious diseases, cancer screening, and genetic studies. The burgeoning middle-class population and the need for affordable, home-based testing kits in the region are fueling market growth. Moreover, government initiatives backing precision medicine and early disease detection are promoting research in saliva diagnostics. In 2023, China's National Medical Products Administration (NMPA) approved several saliva-based COVID-19 and genetic test kits, stimulating the market. The surge of biotech startups, growing partnerships with international diagnostic firms, and advancements in PCR and next-generation sequencing (NGS) platforms further drive market growth in Asia Pacific.

Get Customized Report as per Your Business Requirement - Enquiry Now

Saliva Collection and Diagnostics Market Key Players

-

Thermo Fisher Scientific, Inc. (SalivaDirect COVID-19 Testing Kit, SuperScript IV First-Strand Synthesis System)

-

Neogen Corporation (NeoSal Oral Fluid Collection System, AccuPoint Advanced ATP Sanitation Monitoring System)

-

Abbott Laboratories (Alere iCup Saliva Drug Test, Panbio COVID-19 Antigen Rapid Test)

-

Sarstedt AG & Co.KG (Salivette Saliva Collection System, Multivette 600 Blood Collection System)

-

AutoGen, Inc. (QuickGene SP Kit DNA Saliva, FlexSTAR+ Automated DNA Extraction System)

-

Oasis Diagnostics Corporation (Versi•Sal Saliva Collection Device, Omni•Sal Oral Fluid Collection Device)

-

Porex Technologies Corp. (Saliva Collection Swabs, Hydrophilic Filters for Diagnostics)

-

Salimetrics, LLC (SalivaBio Oral Swab, Cortisol Saliva ELISA Kit)

-

Takara Bio, Inc. (PrimeScript RT-PCR Kit, NucleoSpin RNA Virus Kit)

-

Arcis Biotechnology Ltd. (Arcis Sample Prep Kit, Arcis DNA Blood Kit)

-

OraSure Technologies, Inc. (OraQuick HIV Self-Test, Intercept Oral Fluid Drug Test)

-

Quest Diagnostics Incorporated (QHerit Carrier Screening, Blueprint for Wellness)

-

Zymo Research Corp. (DNA/RNA Shield Saliva Collection Kit, Quick-DNA/RNA Viral MagBead Kit)

-

Isohelix (GeneFiX Saliva DNA Collection Kit, SaliFix Saliva Swab DNA Collection Kit)

-

Salignostics Ltd. (SaliStick Saliva Pregnancy Test, Saliva-Based COVID-19 Test)

-

Mark Microbiotech (Saliva-Based Organ Age Test, Epigenetic Saliva Test Kits)

-

ZRT Laboratory (Saliva Hormone Testing Kits, Neurotransmitter Saliva Test)

-

PerkinElmer Inc. (Saliva Collection Kit for Newborn Screening, EnLite Neonatal TREC Kit)

-

Grifols S.A. (Erytra Eflexis Blood Typing Analyzer, Procleix Panther System)

-

DiaSorin S.p.A. (LIAISON XL Analyzer, Simplexa COVID-19 Direct Kit)

Suppliers (These suppliers commonly provide saliva collection devices and preservation solutions essential for non-invasive diagnostic testing.) in the Saliva Collection and Diagnostics Market.

-

Norgen Biotek Corp.

-

DIANA Biotechnologies

-

Taizhou Kaimi Biotech Co., Ltd.

-

Porex Technologies Corp.

-

Oasis Diagnostics Corporation

-

Isohelix

-

Zymo Research Corp.

-

Salimetrics, LLC

-

Arcis Biotechnology Ltd.

-

OraSure Technologies, Inc.

Recent Developments in the Saliva Collection and Diagnostics Market

-

December 2023 – ZRT Laboratory added to its saliva testing menu by introducing the Steroid LC-MS Hormone Profile 7. This sophisticated profile uses liquid chromatography-tandem mass spectrometry (LC-MS/MS) to quantify seven important hormones—estradiol (E2), estrone (E1), estriol (E3), progesterone (Pg), testosterone (T), dehydroepiandrosterone sulfate (DHEAS), and cortisol (C)—from a single saliva sample. The upgraded testing solution gives healthcare professionals a complete hormonal evaluation for enhanced patient care.

-

2023 – PerkinElmer was granted CE-IVD marking for its SARS-CoV-2 Real-time RT-PCR Assay, which can now be used with saliva specimens and for pooled sample testing. The approval enables laboratory adoption in CE-mark-accepting nations of saliva-based testing, providing a less invasive collection method while eliminating exposure risk for healthcare workers. The assay is highly sensitive for detecting SARS-CoV-2, even when pooled saliva samples are used.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 819.29 million |

| Market Size by 2032 | US$ 1235.11 million |

| CAGR | CAGR of 4.70% from 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Site of Collection (Parotid Gland Collection, Submandibular/Sublingual Gland Collection, Others) • By Application (Disease Diagnostics, Forensic Applications, Research) • By End Use (Dentistry, Diagnostic Laboratories, Pharmaceutical & Biotechnology Companies, Research Institutes) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Thermo Fisher Scientific, Inc., Neogen Corporation, Abbott Laboratories, Sarstedt AG & Co.KG, AutoGen, Inc., Oasis Diagnostics Corporation, Porex Technologies Corp., Salimetrics, LLC, Takara Bio, Inc., Arcis Biotechnology Ltd., OraSure Technologies, Inc., Quest Diagnostics Incorporated, Zymo Research Corp., Isohelix, Salignostics Ltd., Mark Microbiotech, ZRT Laboratory, PerkinElmer Inc., Grifols S.A., DiaSorin S.p.A., and other players. |