Smart Lighting Market Overview & Scope:

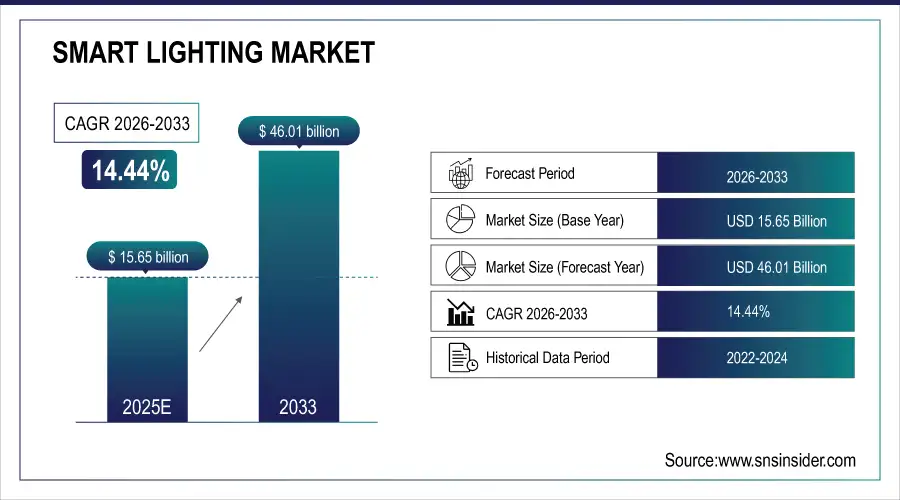

The Smart Lighting Market Size was valued at USD 15.65 billion in 2025E, and is expected to reach USD 46.01 billion by 2033, and grow at a CAGR of 14.44% over the forecast period 2026-2033.

The growth of smart lighting market is being fueled by smart cities. Cities are introducing smart streetlights to decrease energy usage and emissions, with some managing to achieve a 50% decrease. For example, having a 10-watt LED bulb that is used for 4 hours daily. During an average month, this bulb usually uses 1.2 kilowatt-hours of energy. Taking into consideration the standby power consumption and the increased connectivity to other devices, a smart bulb could increase its monthly energy usage by an additional 0.78 kWh. Showing that fact, traditional light bulbs have been reported to lose up to 90% of their energy as heat (as anyone who has attempted to replace an incandescent bulb can confirm). With a price of 14 pence per kWh, the smart light will only add around 10 pence to your monthly bill.

Market Size and Forecast: 2025E

-

Market Size in 2025E USD 15.65 Billion

-

Market Size by 2033 USD 46.01 Billion

-

CAGR of 42% From 2026 to 2033

-

Base Year 2024

-

Forecast Period 2026-2033

-

Historical Data 2021-2024

Get More Information on Smart Lighting Market - Request Sample Report

Smart Lighting Market Trends:

• Growing adoption of IoT-enabled lighting systems that offer automation, remote control, occupancy sensing, and energy optimization using connected protocols such as Zigbee, Wi-Fi, and Bluetooth.

• Rising consumer shift toward practical, need-based smart home purchases, where buyers focus on specific devices that solve immediate problems rather than full-home automation.

• Increased integration of smart lighting with voice assistants and smartphone apps, allowing seamless control, customization, and scheduling across home environments.

• Strong emphasis on energy efficiency through LED-based smart lighting combined with sensors that reduce operational costs by managing brightness based on real-time room usage.

• Expanding role of smart homes in driving demand, as users prioritize convenience, personalization, and improved quality of life, despite concerns over security and slower mass adoption.

Smart Lighting Market Growth Drivers:

Rising Internet of Things (IoT) integration in smart lighting market

The Internet of Things (IoT) is revolutionizing lighting, transforming them from static fixtures into intelligent networks. Imagine controlling lights remotely using your smartphone, scheduling them to turn on at sunrise and off at sunset, or having them automatically adjust with sensors. This creates a smarter system with features like dimming, color control, and occupancy detection – all contributing to significant energy savings. These smart lights connect via protocols like Zigbee or Wi-Fi, allowing them to integrate seamlessly with smart home systems for a holistic control of your environment. This rise of IoT in lighting offers a trifecta of benefits: convenience, personalization, and sustainability. One key driver of this growth is the energy savings potential. Smart lighting systems utilize IoT-enabled sensors, bulbs, or adapters that allow users to manage their lighting with a smartphone or smart home platform.

Smart Lighting Market Restraints:

High initial costs in the smart lighting Market.

The smart lighting market faces a challenge due to the high initial expenses. Outfitting a whole household with necessary items can come at a high cost, especially when compared to standard lighting options. A traditional 60-watt incandescent bulb is priced at $1-$2, whereas a CFL bulb can cost $2-$10. Smart bulbs, on the other hand, come with a higher starting cost, with an average of $42 per bulb. Additionally, certain systems may need a hub or bridge in order to connect, resulting in additional expenses. Conventional lighting might have a lower initial cost, but it has a shorter duration. Incandescent bulbs have a lifespan of 1,000 hours, fluorescents can last between 8,000 and 10,000 hours, and halogens typically last 2,000 to 4,000 hours. These regular changes result in increased maintenance expenses over time.

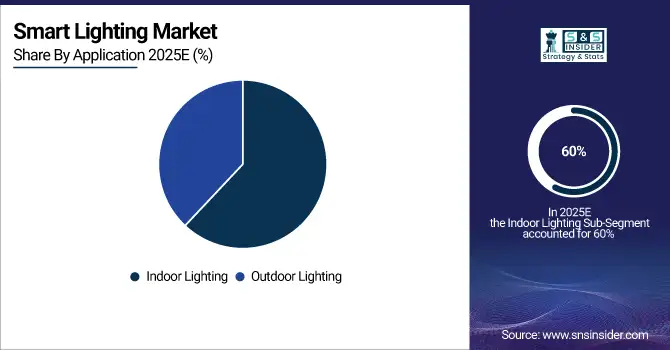

Smart Lighting Market Segment Analysis:

Based on Component, Hardware holds the largest market share in the smart lighting market at 40% in 2025E. The growth of the hardware segment is being driven by the incorporation of smart lighting systems with the Internet of Things (IoT). Smart bulbs, luminaires, and light controls come with connectivity capabilities that allow users to remotely control and monitor lighting using smartphones, tablets, or other IoT devices. Advanced technology is making smart bulbs more advanced with features like changing colors, adjustable white light, and the ability to work with voice assistants and smart home systems.

Based on Application, indoor Lighting dominates the largest market share in smart lighting market with 60% of market share in 2025E. Because of the growing trend of smart homes incorporating advanced technology to link and manage multiple devices and systems. Consumers are increasingly opting for smart lighting solutions to improve convenience, reduce energy consumption, and automate their households. This integration allows users to control indoor lighting through voice commands or a central smart home system, which helps in growing different industries.

Smart Lighting Market Regional Analysis:

Asia Pacific Smart Lighting Market Insights

Asia Pacific dominates the largest share in smart lighting market with 38% of market in 2025E, due to the growth of urban areas and a focus on smart cities. Fast urban growth leads to a need for lighting solutions that are energy efficient. Smart city initiatives are being heavily invested in by cities throughout Asia, with smart lighting playing a crucial role. It aids in saving energy, enhancing public safety, and improving the quality of life for residents. The market in China prospers because of urbanization, technological advancements, and the expansion of smart homes. Japan prioritizes efficiency, as eco-friendly smart lighting becomes popular in both residences and commercial establishments. This country, known for its advanced technology and high standard of living, is an ideal market for cutting-edge smart lighting products.

Need any customization research on Smart Lighting Market - Enquiry Now

North America Smart Lighting Market Insights

North America is the fastest growing in smart lighting market with 31% of market share in 2025E. Innovation and an increasing emphasis on energy conservation are brightening the U.S. smart lighting market. The increasing popularity of smart homes and the Internet of Things (IoT) is driving consumer curiosity in smart lighting for residential and commercial spaces. In the U.S, Lumileds, a leading LED producer, has increased production to meet the growing demand. Government regulations promoting energy efficiency also brighten the prospects for smart lighting in the country.

Europe Smart Lighting Market Insights

The Europe smart lighting market is expanding steadily due to strong sustainability goals, strict energy-efficiency regulations, and widespread adoption of LED and IoT-based lighting solutions. Growing investments in smart cities, advanced building automation, and retrofitting initiatives across commercial and public infrastructure are accelerating demand. Integration with smart home ecosystems, combined with rising consumer focus on convenience and reduced operational costs, further drives market growth, positioning Europe as a leading global adopter.

Latin America (LATAM) and Middle East & Africa (MEA) Smart Lighting Market Insights

The LATAM and MEA smart lighting markets are gaining momentum as governments invest in smart city projects and modernize urban infrastructure. Rising electricity costs, increasing LED adoption, and demand for energy-efficient systems support market expansion. While adoption is slower than developed regions, growing smartphone penetration, improvements in connectivity, and interest in IoT-based lighting for residential, commercial, and outdoor applications are fueling gradual but steady growth across both regions.

Smart Lighting Market Key Players:

-

Signify Holding

-

Legrand

-

Acuity Brands, Inc.

-

ams-OSRAM AG

-

Honeywell International Inc.

-

Zumtobel Group

-

Wipro Lighting

-

Lutron Electronics Co., Inc.

-

LEDVANCE GmbH

-

Inter IKEA Systems B.V.

-

Schneider Electric

-

ABB

-

Synapse Wireless Inc.

-

Panasonic Corporation

-

Leviton Manufacturing Co., Inc.

-

Syska

-

Building Robotics Inc. (BRI), a Siemens Company

-

Siemens

-

Helvar

-

LIFX

Competitive Landscape for Smart Lighting Market:

Govee is a leading innovator in connected LED lighting, offering smart ambient and decorative lighting solutions for homes. The company focuses on app-controlled, IoT-enabled products that support dynamic color effects, automation, and seamless integration with major smart home platforms. Govee’s affordability, strong customization features, and rapid product innovation position it as a key player in the growing consumer smart lighting market.

-

In April 2024, Govee introduced two new intelligent floor lamps - the Floor Lamp 2 and Floor Lamp Pro. The Floor Lamp 2 provides enhanced lighting, works with Matter, and allows for personalized lighting options. The Floor Lamp Pro comes with 324 color and white light beads for the best lighting, a light bar that can rotate 300 degrees, and a built-in Bluetooth speaker.

Siemens is a global technology leader advancing intelligent building automation and energy-efficient infrastructure. In the smart lighting market, Siemens delivers IoT-integrated lighting controls, occupancy-based management, and building management system (BMS) integration. Its solutions optimize energy consumption, enhance operational efficiency, and support large-scale smart city and commercial projects. Siemens’ strong digitalization capabilities make it a strategic player in next-generation smart lighting ecosystems.

-

In February 2024, Siemens and Enlighted, a leading property technology company within Siemens, announced a strategic partnership with Zumtobel Group, a well-known international lighting solutions provider. This collaboration seeks to advance the adoption of smart building technologies, specifically IoT lighting, setting new standards for efficiency and sustainability in building operations worldwide.

Legrand is a prominent provider of electrical and digital building infrastructure, delivering advanced smart lighting solutions across residential, commercial, and industrial environments. The company specializes in connected switches, IoT-based lighting controls, and energy-management systems that integrate smoothly with modern smart home platforms. Legrand’s focus on user convenience, safety, and sustainability strengthens its role as a key contributor to global smart lighting adoption.

-

In January 2024, Legrand, a well-known global expert and leading provider of electrical wiring solutions, introduced the latest product in the radiant collection of smart lighting at the Consumer Electronics Show in Las Vegas, NV. This newest release includes upcoming Matter-compatible smart devices that will be launched in 2024. This development signifies the progression of Smart Lighting with Wi-Fi by incorporating the Matter standard into light switches, dimmers, and outlets. It highlights Legrand's continuous commitment to innovating in the field of intelligent lighting.

| Report Attributes | Details |

| Market Size in 2025E | USD 15.65 Billion |

| Market Size by 2033 | USD 46.01 Billion |

| CAGR | CAGR of 14.44% From 2026 to 2033 |

| Base Year | 2024 |

| Forecast Period | 2026-2033 |

| Historical Data | 2021-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Hardware, Software, Services) • By Installation Type (New Installations, Retrofit Installations) • By (Wired, Wireless) • By Application (Indoor Lighting, Outdoor Lighting) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Signify Holding, Legrand, ACUITY BRANDS, INC., ams-OSRAM AG, Honeywell International Inc., Zumtobel Group, Wipro Lighting , Lutron Electronics Co., Inc, LEDVANCE GmbH, Inter IKEA Systems B.V., Schneider Electric, ABB , Synapse Wireless Inc., Panasonic Corporation , Leviton Manufacturing Co., Inc. , Syska, BUILDING ROBOTICS INC. (BRI), A SIEMENS COMPANY, Helvar, LIFX , Nanoleaf, Sengled GmbH, and TVILIGHT Projects B.V. and others. |