Specialty Silica Market Report Scope & Overview:

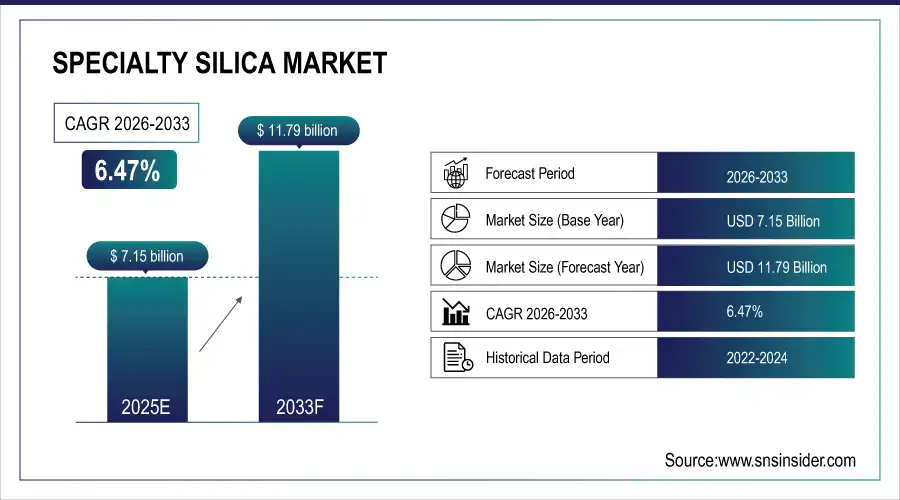

The Specialty Silica Market Size is valued at USD 7.15 Billion in 2025E and is expected to reach USD 11.79 Billion by 2033 and grow at a CAGR of 6.47% over the forecast period 2026-2033.

The Specialty Silica Market analysis, driven by rising demand from the automotive and tire industry for enhanced durability and fuel efficiency, increasing use of silica as a reinforcing filler in rubber and plastics, and expanding applications in pharmaceuticals, personal care, and food processing. According to study, Bio-silica derived from agricultural waste may reduce manufacturing carbon emissions by 28–32% per ton compared to thermal methods.

Market Size and Forecast:

-

Market Size in 2025: USD 7.15 Billion

-

Market Size by 2033: USD 11.79 Billion

-

CAGR: 6.47% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On Specialty Silica Market - Request Free Sample Report

Specialty Silica Market Trends:

-

Electric vehicle expansion boosts demand for low-rolling-resistance silica-based tire compounds.

-

Automotive OEMs increasingly replace carbon black with silica for sustainability-focused tire production.

-

Manufacturers adopt bio-silica processes to cut emissions and optimize energy efficiency.

-

Agricultural waste conversion into high-purity silica supports circular economy manufacturing models.

-

Growing preference for eco-certified raw materials enables premium pricing for green silica.

-

Advanced sol-gel and nano-structured silica technologies expand high-performance industrial applications.

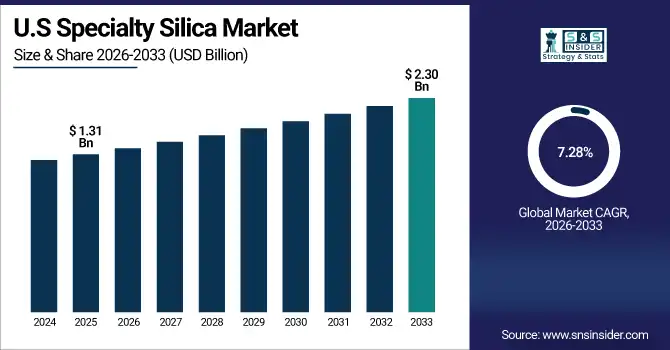

The U.S. Specialty Silica Market size is USD 1.31 Billion in 2025E and is expected to reach USD 2.30 Billion by 2033, growing at a CAGR of 7.28% over the forecast period of 2026-2033, driven by strong demand from tire manufacturing, advanced polymers, adhesives, coatings, and pharmaceutical applications. Growth in EV production, sustainability mandates, and high-dispersible silica adoption support market expansion, while local innovation and high-purity processing reinforce the country’s leadership in advanced materials.

Specialty Silica Market Growth Drivers:

-

Automotive shift to EV tires fuels surge in specialty silica demand.

The automotive sector is a major growth engine for specialty silica market, particularly precipitated silica, which is used in tire tread compounds to improve fuel efficiency, strength, grip, and wear resistance. As vehicle manufacturers move toward EVs and low-rolling-resistance tires, the demand for specialty silica is rising sharply. Silica helps extend battery range in EVs by reducing rolling friction and replacing carbon black in tire reinforcement. Additionally, global emission regulations and sustainability goals are pushing OEMs and tire producers to adopt eco-friendly materials, further accelerating silica demand.

Silica-enhanced tires can reduce fuel consumption or energy usage by 3–5% compared to carbon-black-based tires.

Specialty Silica Market Restraints:

-

High production costs and energy-intensive processes hinder silica expansion.

The High production costs & energy-intensive processes is a major restraint for the Specialty Silica Market. Specialty silica production relies on complex and energy-heavy processes such as thermal treatment, sol-gel synthesis, and chemical precipitation. These methods require expensive feedstock, controlled chemical reactions, advanced purification, and high-temperature operations, leading to elevated capital and operating costs. The costs further increase due to environmental compliance, handling of effluents, and recycling of chemical by-products.

Specialty Silica Market Opportunities:

-

Bio-silica from agricultural waste unlocks sustainable growth and premium markets.

The industries pivoting toward green manufacturing, bio-silica sourced from agricultural waste (such as rice husk ash, sugarcane bagasse, and bamboo) is emerging as a breakthrough opportunity. Bio-silica reduces carbon emissions, decreases energy consumption, and converts waste biomass into high-purity silica suitable for pharmaceuticals, cosmetics, rubber, and coatings. Governments offering incentives for circular economy projects and carbon-neutral materials further support adoption. As brands increasingly demand eco-certified raw materials, bio-silica manufacturers have a path to differentiate and command premium pricing.

Energy savings per ton of bio-silica production are estimated at 20–28% versus chemical precipitation processes.

Specialty Silica Market Segmentation Analysis:

-

By Type: In 2025, Precipitated silica led the market with a share of 40.16%, while Silica gel is the fastest-growing segment with a CAGR of 7.50%.

-

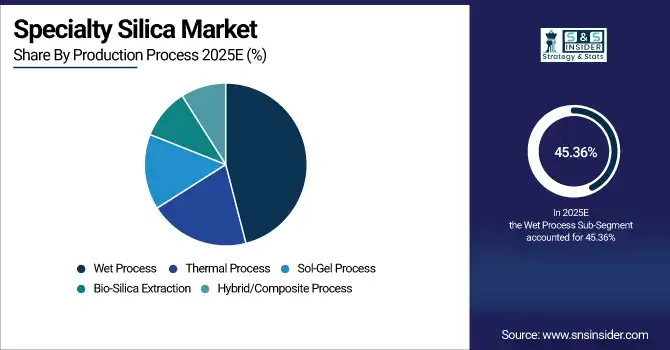

By Production Process: In 2025, Wet Process led the market with a share of 45.36%, while Sol-Gel Process is the fastest-growing segment with a CAGR of 7.10%.

-

By Application: In 2025, Reinforcing filler led the market with a share of 44.52%, while Desiccants is the fastest-growing segment with a CAGR of 6.88%.

-

By End Use: In 2025, Automotive led the market with a share of 35.10%, while Pharmaceuticals and healthcare is the fastest-growing segment with a CAGR of 9.30%.

By Type, Precipitated silica Lead Market and Silica gel Fastest Growth

The Precipitated silica leads the market in 2025, due to its extensive use as a reinforcing filler in automotive tires, rubber processing, and high-performance industrial applications, driven by demand for fuel-efficient and low-rolling-resistance tire compounds. Its dominance is supported by large-scale commercial availability and cost-effective processing.

Meanwhile, silica gel is the fastest-growing segment, propelled by rising use in pharmaceuticals, food packaging, electronics, and moisture-control logistics. Increasing demand for desiccants, drug formulation stabilizers, and humidity-regulated supply chains further accelerates growth. The shift toward eco-certified and high-purity silica grades also boosts silica gel adoption across regulated industries.

By Production Process, Wet Process Leads Market and Sol-Gel Process Fastest Growth

The Wet Process lead the market in 2025, due to its widespread industrial adoption, cost-efficient large-scale output, and suitability for producing precipitated silica used across automotive tires, rubber, plastics, and coatings. Its mature technology and lower production barriers contribute to high commercial penetration, especially in mass-volume applications.

Meanwhile, the sol-gel process is the fastest-growing segment, driven by demand for high-purity, nano-structured silica required in pharmaceuticals, cosmetics, electronics, and advanced coatings. Its ability to deliver controlled porosity, superior particle uniformity, and high surface area makes it ideal for premium-grade specialty formulations, accelerating adoption in regulated and high-performance sectors.

By Application, Reinforcing filler Lead Market and Desiccants Fastest Growth

The Reinforcing filler leads the market in 2025, driven by its extensive use in tire tread compounds, rubber components, industrial plastics, and advanced polymer formulations. Its ability to enhance tensile strength, abrasion resistance, and durability positions it as the dominant application segment, especially in automotive and manufacturing sectors.

Meanwhile, the desiccants segment is the fastest-growing, fueled by rising demand from pharmaceuticals, food packaging, electronics, and global cold-chain logistics. Increasing humidity-controlled storage needs, expanding e-commerce packaging, and higher regulatory standards for product stability are accelerating silica gel–based desiccant adoption, particularly in high-purity healthcare and sensitive product applications.

By End Use, Automotive Leads Market and Pharmaceuticals and healthcare Fastest Growth

The Automotive leads the market in 2025, due to its extensive use in tire reinforcement, rubber components, adhesives, and performance coatings. Silica-based tire formulations enhance fuel efficiency, grip, and durability, making them essential for EVs and low-rolling-resistance tires, which continue to boost demand from OEMs.

Meanwhile, the pharmaceuticals and healthcare segment is the fastest-growing, driven by increasing use of silica as a desiccant, excipient, flow enhancer, and moisture-control agent in drug formulations and medical packaging. Rising demand for high-purity, biocompatible, and regulatory-compliant materials further accelerates growth across medical, nutraceutical, and diagnostic applications.

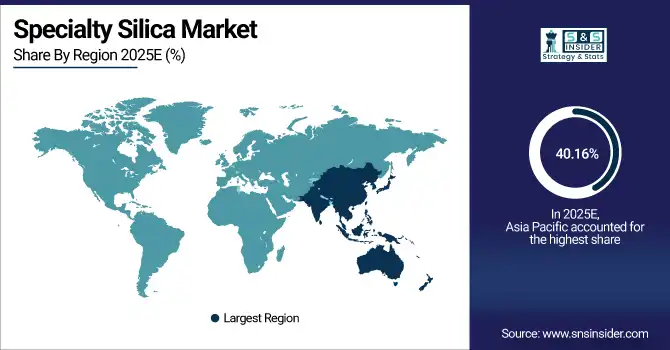

Specialty Silica Market Regional Analysis:

Asia Pacific Specialty Silica Market Insights:

The Asia Pacific dominated the Specialty Silica Market in 2025E, with over 40.16% revenue share, due to strong demand from automotive, tire manufacturing, electronics, personal care, and industrial coatings sectors. The region benefits from large-scale production capacity, availability of low-cost raw materials, and rapid expansion of EV and rubber industries. Growing adoption of silica gel in pharmaceuticals, food packaging, and moisture-controlled logistics further accelerates market growth. Rising investment in green manufacturing, bio-silica extraction from agricultural waste, and expanding local chemical production create competitive advantages. Increasing regulatory focus on sustainability and high-performance materials strengthens long-term market prospects.

Get Customized Report as per Your Business Requirement - Enquiry Now

North America Specialty Silica Market Insights:

The North America region is expected to have the fastest-growing CAGR 7.39%, driven by rising demand for advanced tire materials, high-performance coatings, pharmaceuticals, and precision packaging applications. Growth is further fueled by strong innovation ecosystems, adoption of nano-structured silica products, and increasing investments in EV-focused tire technologies. The region experiences accelerating demand from healthcare, electronics, and personal care sectors requiring high-purity, regulatory-compliant silica grades. Sustainability commitments, including carbon-neutral raw materials and circular manufacturing initiatives, are pushing industries toward eco-engineered silica.

Europe Specialty Silica Market Insights

The Europe represents a steadily growing and technologically advanced market for specialty silica, supported by strong adoption in automotive components, advanced materials, industrial coatings, and regulated sectors such as pharmaceuticals and food packaging. The region’s growth is influenced by stringent sustainability and chemical safety regulations, encouraging shifts toward eco-friendly silica production, high-purity grades, and reduced carbon-footprint manufacturing. Demand for silica in EV tire formulations, lightweight engineered plastics, and high-performance polymers continues rising. Extensive R&D investments, circular economy policies, and innovations in sol-gel and bio-derived silica further strengthen market development.

Latin America (LATAM) and Middle East & Africa (MEA) Specialty Silica Market Insights

Latin America shows steady growth in the Specialty Silica Market, driven by expanding automotive production, rubber processing, and construction activities. Increasing demand for industrial coatings, plastics, and adhesives supports usage of precipitated and fumed silica in manufacturing. Growth in pharmaceuticals and packaged food sectors is also boosting adoption of silica gel desiccants and anticaking agents. The region is gradually investing in local production capacity, although reliance on imports and limited high-purity processing infrastructure remain challenges. Sustainability programs and bio-based raw material availability create future opportunities for green silica production.

Additionally, The Middle East & Africa market is emerging, supported by rapid infrastructure development, growing rubber and industrial chemical demand, and increased adoption of silica in paints, coatings, and sealants used in construction. Expanding logistics, pharmaceuticals, and packaged food industries drive demand for silica gel desiccants and moisture-control solutions. The region is gradually exploring investments in local processing and bio-silica extraction from agricultural waste, though high dependence on imports and limited advanced material manufacturing remain restraints

Specialty Silica Market Competitive Landscape:

Evonik is a global leader in specialty silica, particularly fumed and precipitated silica under brands like AEROSIL and SIPERNAT. Its silica solutions enhance tire performance, lightweight polymers, personal care formulations, coatings, and battery technologies. With strong R&D pipelines focused on energy-efficient production and sustainable materials, Evonik drives next-generation silica innovation for EV tires, high-purity pharma excipients, and advanced composites, anchoring its dominance in high-value specialty applications.

-

In January 2025, Evonik merged its Silica and Silanes business lines into a new unit called Smart Effects (3,500 employees), aiming to streamline operations and push sustainability and circular-material solutions.

Cabot Corporation is a major producer of reinforcing and performance silica materials primarily used in automotive tires, industrial rubber, coatings, and battery applications. Through its HDS silica portfolio, Cabot supports low-rolling-resistance tires and EV-focused mobility solutions. The company integrates silica with carbon nanostructure technology, enabling high-performance energy storage materials. Its focus on sustainable manufacturing and mobility-driven innovation strengthens its position in global specialty silica demand.

-

In April 2024, Cabot reportedly launched a new hydrophobic fumed silica grade targeting the pharmaceutical sector, based on a fumed-silica market report.

Wacker supplies high-purity pyrogenic silica and silanes used in polymer modification, sealants, coatings, and pharmaceuticals. Its HDK fumed silica portfolio enhances rheology control, reinforcement, and stability in adhesives, construction chemicals, and silicone formulations. Wacker’s global production footprint and focus on electronics, healthcare, and sustainable chemical materials support demand for advanced silica across high-tech sectors, positioning the company as a key supplier in engineered performance materials.

-

In March 2025, Wacker Chemie AG Signed a long-term contract to replace fossil coal with biogenic carbon in its silicon production, progressing toward climate-neutral silicon.

Specialty Silica Market Key Players:

Some of the Specialty Silica Market Companies are:

-

Evonik Industries

-

Cabot Corporation

-

Wacker Chemie AG

-

Solvay SA

-

QEMETICA

-

Imerys

-

Merck KGaA

-

Denka Co., Ltd.

-

Fuji Silysia Chemical Ltd.

-

Fuso Chemical Co., Ltd.

-

Tata Chemicals Ltd.

-

Nouryon

-

W. R. Grace & Co.

-

3M Company

-

U.S. Silica Holdings, Inc.

-

Madhu Silica Pvt. Ltd.

-

Oriental Silicas Corporation

-

Industrias Químicas del Ebro (IQE)

-

Elkem

-

Glassven C.A.

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 7.15 Billion |

| Market Size by 2033 | USD 11.79 Billion |

| CAGR | CAGR of 6.47% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Precipitated Silica, Fumed Silica, Colloidal Silica, Fused Silica, Silica Gel, Others) • By Production Process (Wet Process, Thermal Process, Sol-Gel Process, Bio-Silica Extraction, Hybrid/Composite Process) • By Application (Reinforcing Filler, Thickening Agent, Anti-caking Agent, Desiccants, Catalyst, Others) • By End Use (Automotive, Construction, Food & Beverages, Pharmaceuticals & Healthcare, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Evonik Industries, Cabot Corporation, Wacker Chemie AG, Solvay SA, QEMETICA, Imerys, Merck KGaA, Denka Co., Ltd., Fuji Silysia Chemical Ltd., Fuso Chemical Co., Ltd., Tata Chemicals Ltd., Nouryon, W. R. Grace & Co., 3M Company, U.S. Silica Holdings, Inc., Madhu Silica Pvt. Ltd., Oriental Silicas Corporation, Industrias Químicas del Ebro (IQE), Elkem, Glassven C.A., and Others. |