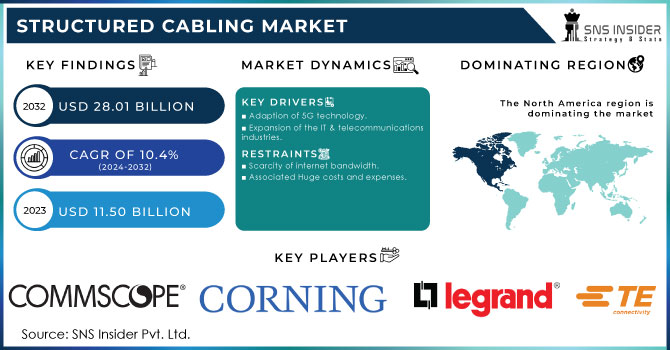

Structured Cabling Market Size:

The Structured Cabling Market Size was valued at USD 12.26 Billion in 2023 and is expected to reach USD 28.90 Billion by 2032 and grow at a CAGR of 10.0% over the forecast period 2024-2032. The Market includes key metrics such as market segmentation by component (cables, connectivity hardware, services) to identify dominant segments. Installation and maintenance cost trends provide financial insights, while adoption rates across industries like IT & telecom, data centers, and healthcare highlight sector demand. Bandwidth growth trends driven by cloud adoption, enterprise spending patterns, and the impact of 5G, IoT, and AI further shape market dynamics. Fiber optic vs. copper cable usage ratios reflect industry shifts, while sustainability trends like eco-friendly, halogen-free cables showcase environmental considerations, offering a holistic view of market evolution.

Get more information on Structured Cabling Market - Request Sample Report

Market Dynamics

Key Drivers:

-

Increasing Data Traffic and Connectivity Needs to Drive the Expansion of Structured Cabling Solutions in the IT and Telecom Sectors

The demand for higher bandwidth and faster data transfer speeds, driven by the growing adoption of digital technologies and cloud computing, has accelerated the need for advanced structured cabling solutions. In industries such as IT and telecommunications, increased reliance on network infrastructure and real-time data access necessitates the implementation of high-performance cabling systems. This is further fueled by the expansion of 5G networks, IoT devices, and connected technologies, requiring upgraded and reliable cabling solutions for seamless operation and efficient data flow, thus propelling the structured cabling market’s growth.

Restraint:

-

High Initial Installation Costs of Structured Cabling Systems impede widespread Adoption, Particularly in Developing Regions

One of the significant challenges facing the structured cabling market is the high upfront costs associated with the installation of advanced cabling systems. These initial costs, which include materials, labor, and specialized equipment, may deter small and medium-sized businesses, particularly in developing regions, from investing in upgraded cabling infrastructure. While long-term benefits such as improved network efficiency and reduced maintenance costs exist, the high initial investment can slow the adoption rate and prevent wider penetration, especially in price-sensitive markets.

Opportunity:

-

Integration of Fiber Optic Cables and 5G Networks Creates New Growth Opportunities in the Structured Cabling Market

The ongoing rollout of 5G networks presents a significant opportunity for growth within the structured cabling market, particularly in the area of fiber optic cables. As 5G technology promises faster data speeds and low latency, there is an increasing need for high-bandwidth, high-performance fiber optic cabling solutions to support these networks. This trend offers an excellent growth opportunity for companies that specialize in fiber optic infrastructure, as they can tap into the expanding market of 5G and other advanced wireless technologies, driving demand for modern structured cabling systems.

Challenge:

-

Rapid Technological Advancements Pose Challenges in Maintaining Compatibility Across Various Structured Cabling Systems

The fast-paced technological advancements in networking solutions, such as the rise of 5G, IoT, and cloud computing, have created challenges in maintaining compatibility across existing and newly installed structured cabling systems. As network technologies evolve rapidly, it becomes essential for businesses to ensure that their cabling infrastructure can support future upgrades without requiring costly replacements or reconfigurations. This challenge of ensuring seamless integration between legacy and modern cabling systems requires careful planning, expertise, and investment in adaptable solutions that can accommodate ongoing technological changes in the market.

Segments Analysis

By Type

The Copper Cables segment accounted for the largest revenue share of 48% in 2023, primarily driven by their cost-effectiveness, widespread use in legacy infrastructure, and ability to support a variety of applications, including networking, data centers, and telecommunications. Copper cables, particularly Cat 6 and Cat 6A cables, remain popular due to their relatively lower installation costs and sufficient performance for medium-range data transmission.

The Fiber Optic Cables segment is experiencing the largest CAGR of 11.44% during the forecast period, driven by the increasing need for high-speed internet, cloud services, and data-intensive applications. Companies like Corning Inc. and CommScope are actively developing and launching innovative fiber optic cabling solutions that offer enhanced data transmission capabilities, reduced latency, and greater bandwidth. With the expansion of 5G networks and the growing adoption of IoT devices, the demand for fiber optic solutions has surged, particularly for applications in data centers, telecom networks, and enterprise-level infrastructure.

By Vertical

The IT & Telecommunication segment dominated the structured cabling market with the largest revenue share of 33% in 2023. The demand for robust and reliable network infrastructure is particularly high in this vertical due to the rapid expansion of telecommunications networks and IT services worldwide. Companies like Cisco Systems Inc. and CommScope have launched advanced cabling solutions optimized for high-speed data transmission, such as high-performance fiber optic cables and networking infrastructure systems. With the increasing reliance on cloud computing, 5G technology, and IoT, the IT & telecom industry is investing heavily in upgrading its network systems, further driving the demand for structured cabling.

The Industrial segment is expected to grow at the largest CAGR of 11.69% during the forecast period, as industries increasingly adopt automation, smart manufacturing, and IoT-driven processes. With the rise of Industry 4.0, companies like Panduit and Schneider Electric are developing new structured cabling products designed to support advanced industrial applications, such as industrial Ethernet solutions and high-performance cables. The growth of industrial automation, robotics, and connected devices in factories and warehouses drives the need for more reliable, scalable, and durable cabling solutions.

By Application

The LAN segment dominated the structured cabling market in 2023, accounting for the largest share of revenue. This dominance can be attributed to the widespread use of LAN systems in commercial, industrial, and residential buildings to support network communication and data transfer. The rising trend of digital transformation and the growing dependence on cloud computing further boost the need for robust LAN systems. The growth of smart office environments and remote working solutions also drives the demand for efficient LAN solutions, which ensures seamless connectivity and high-speed communication.

The Data Center segment is projected to grow at the largest CAGR during the forecasted period, driven by the rapid expansion of cloud computing, big data analytics, and IoT. The surge in e-commerce, video streaming, and the increasing adoption of remote work further accentuates the need for scalable and high-performance cabling solutions in data centers. Structured cabling plays a critical role in maintaining efficient data transfer, minimizing downtime, and ensuring optimal network performance. As data centers evolve to meet the demands of next-generation technologies such as 5G and AI, the need for advanced and flexible cabling solutions continues to grow, making the data center segment one of the fastest-growing applications in the structured cabling market.

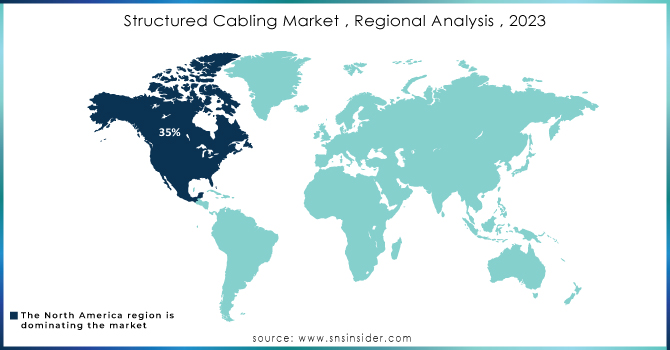

Regional Analysis

North America Region dominated the structured cabling market in 2023, holding a significant market share of approximately 34%. This dominance can be attributed to robust infrastructure investments, high demand for data centers, and advancements in communication technologies such as 5G and cloud computing. Major companies like CommScope, Belden Inc., and Cisco Systems are based in North America, and their continuous product development and innovation in high-performance cabling solutions further drive market growth in the region.

Asia Pacific is the fastest-growing region in the structured cabling market, with an estimated CAGR of 11.11% during the forecasted period. This rapid growth is driven by increasing industrialization, urbanization, and the adoption of advanced technologies like 5G, IoT, and cloud computing. Countries such as China, India, and Japan are experiencing a surge in data center development, telecommunications infrastructure, and IT network upgrades, creating a high demand for efficient structured cabling solutions.

For instance, major telecom companies in Asia are investing heavily in fiber optic cabling to support the growing need for higher bandwidth and faster data speeds. The government’s push for smart cities and industrial automation in this region is also propelling the demand for structured cabling solutions, making Asia Pacific the fastest-growing market for structured cabling systems.

Get a Customized Report as per your Business Requirement - Request For Customized Report

Key Players

Some of the major players in the Structured Cabling Market are:

-

ABB Ltd. (Structured Cabling Solutions, Data Center Cabling Systems)

-

Anixter International Inc. (Network Cabling Solutions, Fiber Optic Cables)

-

Belden Inc. (Copper Cabling Systems, Fiber Optic Connectivity Solutions)

-

Legrand SA (LAN Cabling Systems, Intelligent Cable Management)

-

Panduit Corp (Category 6A Copper Cabling, Fiber Optic Patch Panels)

-

CommScope Holding Co. Inc. (SYSTIMAX Structured Cabling, FiberGuide Fiber Management)

-

Furukawa Electric (FITEL Fiber Optic Cables, MPO/MTP Connectivity Solutions)

-

Cisco Systems Inc. (Cisco Structured Cabling, Data Center Networking Solutions)

-

Corning Inc. (Pre-Terminated Fiber Optic Cables, EDGE Data Center Solutions)

-

Datwyler Holding Inc. (IT Infrastructure Cabling, High-Density Data Center Cabling)

-

Furukawa Electric Co. Ltd. (Optical Fiber Cables, High-Speed Data Cabling)

-

Hubnetix Corp. (Smart Building Cabling, High-Performance Network Cabling)

-

Nexans (LANmark Cabling Solutions, Fiber Optic Distribution Systems)

-

Schneider Electric (Actassi Structured Cabling, Data Center Cabling Solutions)

-

TE Connectivity (Category 6A Shielded Cables, Optical Fiber Connectivity)

Recent Trends

-

In May 2024, ABB expanded its electrification portfolio by acquiring Siemens' Wiring Accessories business in China. This strategic move broadened ABB's market reach and complemented its regional offerings in smart buildings. The acquisition included wiring accessories, smart home systems, smart door locks, and other home automation products, which continued under the Siemens brand through a licensing agreement.

-

In March 2024, Belden Inc. launched new solutions to enhance connectivity, increase speeds, and provide more power for mission-critical environments. The releases featured Belden's I/O Plenum Stadium Cables and Access Control Cables, a LioN-X IO-Link Hub from Lumberg Automation, and enhancements to Belden’s REVConnect Connectivity System, Belden Horizon Console, and Hirschmann Industrial HiVision.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 12.26 Billion |

| Market Size by 2032 | US$ 28.90 Billion |

| CAGR | CAGR of 10.0 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Copper Cables, Fiber Optic Cables, Others) • By Application (LAN, Data Center) • By Vertical (Government, Industrial, IT & Telecommunication, Residential & Commercial, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | ABB Ltd., Anixter International Inc., Belden Inc., Legrand SA, Panduit Corp, CommScope Holding Co. Inc., Furukawa Electric, Cisco Systems Inc., Corning Inc., Datwyler Holding Inc., Furukawa Electric Co. Ltd., Hubnetix Corp., Nexans, Schneider Electric, TE Connectivity |