Stuffed Animals and Plush Toys Market Report Scope & Overview:

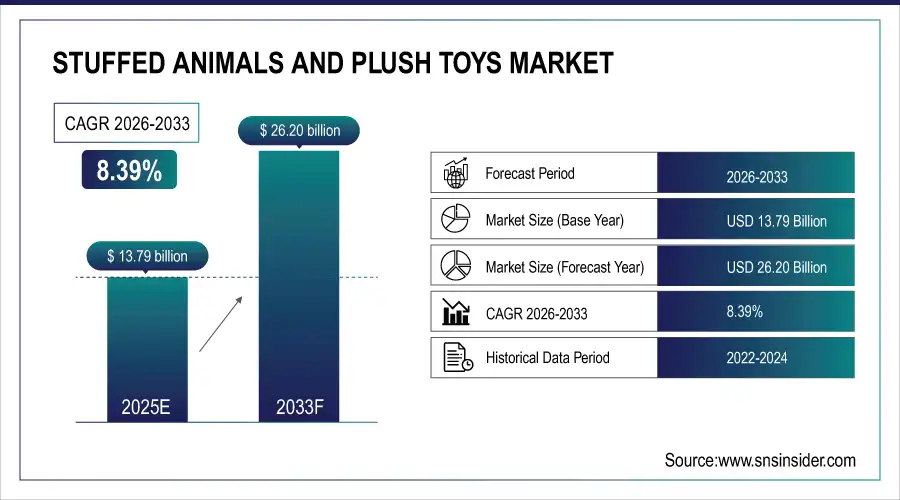

The Stuffed Animals and Plush Toys Market size is valued at USD 13.79 Billion in 2025E and is projected to reach USD 26.20 Billion by 2033, growing at a CAGR of 8.39% during the forecast period 2026–2033.

The Stuffed Animals and Plush Toys Market analysis report provides a comprehensive overview of product trends, material innovations, and size variations. Rising demand for educational, collectible, and character-based plush toys, along with growing gifting culture and online retail expansion, is expected to drive market growth.

The Stuffed Animals and Plush Toys Market is expected to see 2,200+ new launches by 2026, driven by rising demand for character and educational plush toys.

Market Size and Forecast:

-

Market Size in 2025: USD 13.79 Billion

-

Market Size by 2033: USD 26.20 Billion

-

CAGR: 8.39% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On Stuffed Animals and Plush Toys Market - Request Free Sample Report

Stuffed Animals and Plush Toys Market Trends:

-

Rising consumer preference for character-themed and collectible plush toys is driving demand for premium and limited-edition products.

-

Growth in gifting culture and special occasions is expanding opportunities for stuffed animals across all age groups.

-

Increasing e-commerce penetration and toy subscription services are accelerating plush toy sales.

-

Advancements in sustainable, organic, and hypoallergenic materials are enhancing safety, quality, and eco-friendliness of products.

-

Collaborations with entertainment franchises, designers, and lifestyle brands are creating innovative, trend-focused plush offerings.

-

Integration of AR/VR experiences and interactive digital tools is improving customer engagement and online shopping experiences.

U.S. Stuffed Animals and Plush Toys Market Insights:

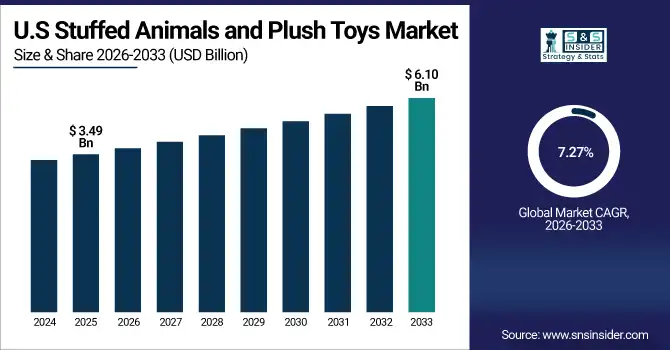

The U.S. Stuffed Animals and Plush Toys Market is projected to grow from USD 3.49 Billion in 2025E to USD 6.10 Billion by 2033, at a CAGR of 7.27%. Growth is driven by rising gifting culture, strong demand for character and collectible plush toys, and expanding e-commerce and retail channels.

Stuffed Animals and Plush Toys Market Growth Drivers:

-

Rising demand for character-themed and collectible plush toys driving rapid Stuffed Animals market growth.

Rising demand for character-themed and collectible plush toys is a key driver of Stuffed Animals Market growth. Consumers of all ages are increasingly seeking unique, high-quality, and themed products for gifting, collecting, or personal use. Growth in e-commerce, subscription boxes, and online toy platforms is accelerating accessibility and sales. Additionally, innovations in sustainable, hypoallergenic, and interactive materials, along with collaborations with entertainment franchises, are further boosting product appeal and market expansion.

The Stuffed Animals and Plush Toys Market is projected to grow over 8% by 2026, driven by rising demand for character-themed and collectible plush toys.

Stuffed Animals and Plush Toys Market Restraints:

-

High manufacturing costs, limited raw materials, and safety compliance challenges are restraining Stuffed Animals market growth.

High manufacturing costs, limited availability of quality materials, and stringent safety compliance requirements pose significant restraints for the Stuffed Animals Market. Premium fabrics, hypoallergenic stuffing, and specialized production processes increase production expenses. Supply chain delays or challenges in sourcing sustainable and certified materials can impact timely product delivery. Additionally, higher costs may limit adoption among price-sensitive consumers and small retailers. These factors restrict market scalability and moderate overall growth, despite rising demand for character-themed, collectible, and educational plush toys.

Stuffed Animals and Plush Toys Market Opportunities:

-

Increasing demand for interactive, educational, and sustainable plush toys presents significant opportunities for Stuffed Animals market growth.

Increasing demand for interactive, educational, and sustainable plush toys represents a significant opportunity for the Stuffed Animals Market. Growing consumer preference for eco-friendly materials, hypoallergenic stuffing, and tech-enabled features is encouraging manufacturers to innovate and diversify product offerings. Integration of educational content, smart sensors, and augmented reality experiences enhances engagement and learning. Rising awareness of sustainability and safe play products further supports market expansion, creating new avenues for growth, adoption, and competitive differentiation.

Interactive and sustainable plush toys are expected to account for 18% of market sales by 2026.

Stuffed Animals and Plush Toys Market Segmentation Analysis:

-

By Product Type, Traditional Plush Toys held the largest market share of 35.45% in 2025, while Character Plush Toys are expected to grow at the fastest CAGR of 9.42% during 2026–2033.

-

By Material, Fabric accounted for the highest market share of 45.12% in 2025, while Wool is anticipated to record the fastest CAGR of 9.88% through 2026–2033.

-

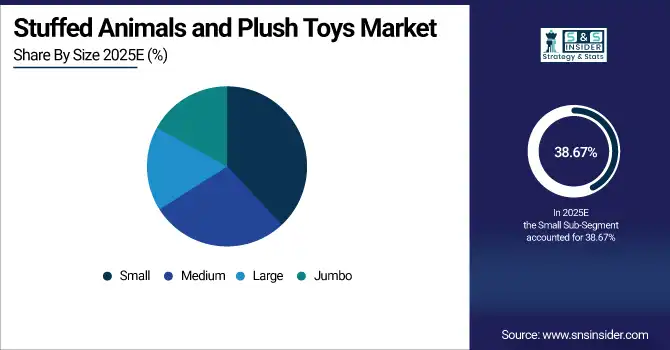

By Size, Small dominated with a 38.67% share in 2025, while Jumbo is projected to expand at the fastest CAGR of 10.02% during the forecast period.

-

By Application, Gifts held the largest share of 42.50% in 2025, while Educational Tools are expected to grow at the fastest CAGR of 9.88% during 2026–2033.

-

By Distribution Channel, Toy Stores accounted for the largest share of 36.78% in 2025, while Online Retail is forecasted to register the fastest CAGR of 10.28% during 2026–2033.

-

By End-Use, Children dominated with a 60.42% share in 2025, while Collectors are expected to witness the fastest CAGR of 11.05% during the forecast period.

By Product Type, Traditional Plush Toys Dominates While Character Plush Toys Grows Rapidly:

Traditional Plush Toys segment dominated the market due to its widespread popularity among children and collectors. In 2025, over 1,800 new traditional plush toy models were launched, establishing strong market presence and brand recognition. Strong demand across markets further reinforced its leadership.

Character Plush Toys is the fastest-growing segment, fueled by rising demand for licensed, franchise-based, and collectible characters. By 2025, more than 950 new character plush products were introduced, reflecting rapid adoption and expanding opportunities for innovative and themed plush toys.

By Material, Fabric Dominates While Wool Grows Rapidly:

Fabric segment dominated the market due to affordability, versatility, and comfort, making them a preferred choice for children. In 2025, over 2,100 new fabric plush designs were launched, reinforcing the segment’s dominance. Consumers continue favoring fabric for safety and durability.

Wool is the fastest-growing segment, driven by increasing consumer preference for premium, eco-friendly, and sustainable materials. By 2025, more than 720 wool-based plush toys were introduced, highlighting rapid adoption and growing opportunities for high-quality, luxury, and specialty products.

By Size, Small Dominates While Jumbo Grows Rapidly:

Small segment dominated the market due to portability, affordability, and suitability for gifting and personal use. In 2025, over 1,900 small plush toy models were launched, establishing dominance in key markets. Consumer preference for compact and versatile designs further reinforced growth.

Jumbo are the fastest-growing segment, driven by rising demand for novelty, statement, and collectible items. By 2025, more than 600 jumbo plush toys were introduced, indicating rapid adoption and creating opportunities for experiential, decorative, and display-oriented products.

By Application, Gifts Dominates While Educational Tools Grows Rapidly:

Gifts segment dominated the market, supported by the tradition of gifting plush toys for birthdays, festivals, and special occasions. In 2025, over 2,000 gift-oriented plush products were sold, reinforcing market leadership. Growing e-commerce and festive promotions further boosted sales.

Educational Tools is the fastest-growing segment, fueled by demand for toys that support early learning, sensory development, and interactive play. By 2025, more than 800 educational plush products were launched, highlighting rapid adoption and the rising importance of learning-focused play experiences.

By Distribution Channel, Toy Stores Dominates While Online Retail Grows Rapidly:

Toy Stores segment dominated the market due to established retail networks, strong brand presence, and high customer trust. In 2025, over 1,700 plush toy product lines were sold through physical toy stores, reinforcing dominance. Wide geographic reach further strengthened consumer accessibility and loyalty.

Online Retail is the fastest-growing segment, driven by rising e-commerce penetration, digital marketing, and convenience. By 2025, more than 1,100 new plush toy launches were available online, reflecting rapid adoption and expanding opportunities for direct-to-consumer sales and digital-first brands.

By End-Use, Children Dominates While Collectors Grows Rapidly:

Children segment dominated the market due to high consumption of plush toys for play and gifting. In 2025, over 2,300 plush toy models were purchased for children, establishing strong market dominance. Rising birthdays and festival gifting further boosted demand.

Collectors is the fastest-growing segment, driven by demand for limited-edition, franchise-based, and novelty plush toys. By 2025, more than 900 collector-focused plush products were launched, indicating rapid adoption and creating opportunities for premium, high-value, and exclusive plush collections.

Stuffed Animals and Plush Toys Market Regional Analysis:

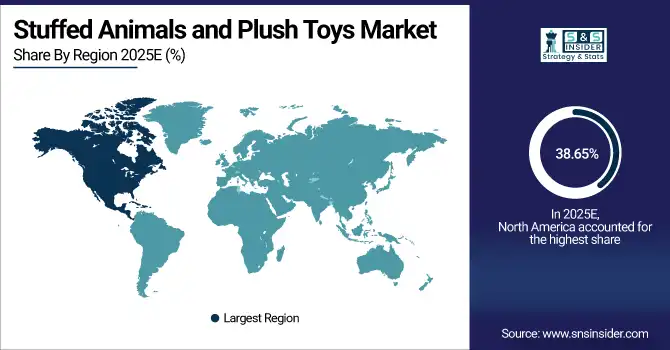

North America Stuffed Animals and Plush Toys Market Insights:

North America dominated the Stuffed Animals and Plush Toys Market, holding a 38.65% market share, driven by strong consumer demand for character, educational, and collectible plush toys. The U.S. leads regional growth, supported by established retail networks, advanced e-commerce platforms, and rising gifting culture. Increasing disposable incomes, collaborations with entertainment franchises, and growing popularity of premium and licensed plush products further strengthen North America’s position as a key hub for innovation, product variety, and market expansion in plush toys.

Get Customized Report as per Your Business Requirement - Enquiry Now

U.S. Stuffed Animals and Plush Toys Market Insights:

The U.S. Stuffed Animals and Plush Toys Market is driven by rising demand for character, collectible, and educational plush toys. Expanding e-commerce platforms, strong retail networks, and collaborations with entertainment franchises support growth. Increasing gifting culture, higher disposable incomes, and consumer preference for premium and licensed products reinforce the U.S. market’s dominant position in North America.

Asia-Pacific Stuffed Animals and Plush Toys Market Insights:

The Asia-Pacific Stuffed Animals and Plush Toys Market is the fastest-growing region, projected to expand at a CAGR of 9.53% during the forecast period. Growth is driven by rising disposable incomes, increasing urbanization, and strong demand for character, educational, and collectible plush toys across China, India, Japan, South Korea, and Australia. Expansion of e-commerce platforms, growing gifting culture, and collaborations with entertainment franchises position Asia-Pacific as a key growth engine for the plush toys market.

China Stuffed Animals and Plush Toys Market Insights:

China’s Stuffed Animals and Plush Toys Market is driven by rising disposable incomes, urbanization, and growing demand for character, educational, and collectible plush toys. Expansion of e-commerce platforms, increasing gifting culture, and collaborations with entertainment franchises position China as a major growth contributor within the Asia-Pacific plush toys market.

Europe Stuffed Animals and Plush Toys Market Insights:

The Europe Stuffed Animals and Plush Toys Market is driven by high consumer awareness, strong purchasing power, and demand for premium, character, and collectible plush toys. Countries such as Germany, France, the UK, and Italy are major contributors, supported by advanced retail infrastructure, established e-commerce platforms, and collaborations with entertainment franchises. Growing preference for educational and sustainable plush products, customization trends, and rising gifting culture reinforce Europe’s role as a key regional market for plush toys.

Germany Stuffed Animals and Plush Toys Market Insights:

Germany is a key stuffed animals and plush toys market, supported by advanced retail infrastructure, high consumer purchasing power, and strong brand presence. Growing demand for premium, educational, and character-themed plush toys, combined with expanding e-commerce platforms and specialty store networks, reinforces Germany’s position as a leading contributor within the European plush toys market.

Latin America Stuffed Animals and Plush Toys Market Insights:

The Latin America Stuffed Animals and Plush Toys Market is witnessing steady growth driven by rising urbanization, increasing disposable incomes, and growing demand for character, educational, and collectible plush toys. Countries such as Brazil, Mexico, and Argentina are key contributors, supported by expanding retail infrastructure, e-commerce adoption, and rising gifting culture.

Middle East and Africa Stuffed Animals and Plush Toys Market Insights:

The Middle East & Africa Stuffed Animals and Plush Toys Market is expanding due to rising urbanization, increasing disposable incomes, and growing demand for character, educational, and collectible plush toys. Countries such as Saudi Arabia, the UAE, and South Africa are key contributors, supported by expanding retail networks, e-commerce adoption, and rising gifting culture.

Stuffed Animals and Plush Toys Market Competitive Landscape:

Mattel, Inc., headquartered in California, is a leader in the toy industry, renowned for iconic brands such as Barbie, Fisher-Price, Hot Wheels, and licensed plush products. The company dominates the stuffed animals and plush toys market through extensive distribution, strategic licensing partnerships, and diverse product offerings that appeal to children and collectors alike. Mattel’s focus on innovation, high-quality craftsmanship, and strong brand equity strengthens consumer loyalty. Expansion into e-commerce and media-driven marketing further reinforces its market leadership.

-

In March 2025, Mattel expanded its Toy Story plush lineup, featuring a range of plush toys, action figures, and collectibles for the 30th anniversary and upcoming Toy Story 5. This extensive launch reinforces Mattel’s licensing leadership, strengthens franchise engagement, and expands its plush toy portfolio across children and collector markets.

Hasbro, Inc., based in Rhode Island, is a major U.S. toy and entertainment company with a long-standing reputation for iconic brands including My Little Pony plush, Transformers, and Monopoly. The company dominates the stuffed animals’ market by leveraging intellectual property, storytelling, and cross-media licensing. Distribution networks, family-centric products, and collaborations with entertainment franchises enhance brand visibility and engagement. Hasbro’s commitment to innovation, quality, and strategic marketing strengthens consumer trust and sustains its leadership in the plush toy segment.

-

In February 2025, at the Toy Fair, Hasbro launched Nano‑mals, interactive pocket-sized plush figures with lights and sounds, alongside a PLAY‑DOH Barbie collaboration. This launch reinforces Hasbro’s innovation in interactive and collectible toys, enhancing engagement across children and enthusiasts.

Bandai Namco Holdings, headquartered in Japan, is a multinational conglomerate focused on toys, entertainment, and media franchises. Known for character-driven products tied to anime, video games, and pop culture, it dominates the plush toy market through strong brand recognition and cross-platform licensing. Its extensive presence in Asia-Pacific, combined with expansion, strategic partnerships, and franchise-based merchandising, appeals to children, collectors, and fans. Innovation, premium quality, and media integration reinforce Bandai Namco’s leadership and competitive advantage in the stuffed animals and plush toys market.

-

In July 2025, at San Diego Comic-Con, Bandai Namco Holdings unveiled exclusive Tamagotchi and Gundam collectibles, including limited-edition plush and figures. This launch reinforces Bandai Namco’s character-driven strategy, boosts fan engagement, and strengthens its leadership in franchise-based plush and collectible markets.

Stuffed Animals and Plush Toys Market Key Players:

Some of the Stuffed Animals and Plush Toys Market Companies are:

-

Mattel

-

Hasbro

-

Bandai Namco Holdings

-

LEGO A/S

-

Simba Dickie Group

-

Spin Master

-

Ty Inc.

-

Build‑A‑Bear Workshop, Inc.

-

Budsies LLC

-

Mary Meyer Corporation

-

Sanrio

-

Melissa & Doug

-

Aurora World Corp.

-

Gund

-

Jellycat

-

NICI GmbH

-

Pop Mart

-

Pokémon Company International

-

Wild Republic

-

Douglas Company

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 13.79 Billion |

| Market Size by 2033 | USD 26.20 Billion |

| CAGR | CAGR of 8.39% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Traditional Plush Toys, Character Plush Toys, Educational Plush Toys, Others) • By Material (Fabric, Synthetic, Cotton, Wool, Others) • By Size (Small, Medium, Large, Jumbo) • By Application (Gifts, Collectibles, Educational Tools, Promotional Items, Others) • By Distribution Channel (Toy Stores, Online Retail, Department Stores, Supermarkets/Hypermarkets, Others) • By End-Use (Children, Teens, Adults, Collectors, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Mattel, Hasbro, Bandai Namco Holdings, LEGO A/S, Simba Dickie Group, Spin Master, Ty Inc., Build-A-Bear Workshop, Inc., Budsies LLC, Mary Meyer Corporation, Sanrio, Melissa & Doug, Aurora World Corp., Gund, Jellycat, NICI GmbH, Pop Mart, Pokémon Company International, Wild Republic, Douglas Company |