Switchgear Market Size & Overview:

Get more information on Switchgear Market - Request Sample Report

The Switchgear Market size was valued at USD 97.76 Billion in 2023. It is estimated to reach USD 165.01 Billion by 2032, growing at a CAGR of 6.00% during 2024-2032.

The switchgear market is essential in the electrical industry, serving as a key component in distributing and controlling electrical power. Recent years have witnessed substantial growth in the switchgear market, propelled by a rising need for electricity, the development of industrial and commercial infrastructure, and a focus on renewable energy sources. With the increase in global population and the acceleration of urbanization, there has been a sharp rise in the need for a dependable electricity supply. In 2024, the United States government's funding of electricity infrastructure and associated projects demonstrates a significant dedication to updating and innovating. In 2023, the Infrastructure Investment and Jobs Act (IIJA) was passed, with a focus on directing around USD 77 billion towards upgrading power infrastructure, modernizing grids, and advancing clean energy technologies in the upcoming years. Similarly, the Department of Energy (DOE) is also heavily involved in these investments, allocating approximately USD 46 billion for the fiscal year 2024. This budget provides funding for various initiatives such as updating the grid, programs to improve energy efficiency and research on new technologies. This has resulted in the building of new power generation facilities and the improvement of current electrical infrastructure, both of which need advanced switchgear systems to control the distribution and safety of electrical power.

Switchgear is crucial for ensuring the safe functioning of electrical equipment and machinery in the industrial field. Manufacturing, mining, oil and gas, and chemical processing sectors depend significantly on switchgear for safeguarding their electrical systems and ensuring uninterrupted functioning. In a manufacturing facility, switchgear is utilized to regulate the flow of electricity to different machines and equipment, guaranteeing their secure and effective operation. For instance, Siemens utilizes switchgear in large industrial facilities to effectively control and distribute electrical power. Their "Sentron" and "8DJH" lines are specifically created for use in medium voltage situations, offering dependable power distribution and safety elements within industries like car manufacturing and chemical processing. Swiftly identifying and correcting faults with switchgear reduces downtime and prevents expensive machinery damage. Modern switchgear systems are becoming more commonly outfitted with intelligent sensors and communication functions, allowing for remote monitoring and control.

Switchgear Market Dynamics:

Drivers

-

Modern Switchgear Plays a Crucial Role in Upgrading Power Infrastructure.

Upgrading and expanding power infrastructure is essential to meet increasing energy needs and maintain the dependability and effectiveness of power networks. This procedure includes improving current infrastructure and building new power generation, transmission, and distribution networks. Switchgear systems play a vital role in power infrastructure by carrying out important functions like circuit protection, fault detection, and load management. The aging power infrastructure presents significant challenges in various areas, such as higher chances of power outages, inefficiencies, and safety issues. Governments and utility companies are making investments to update power grids, tackling these problems, and improving the strength of power systems. This initiative involves upgrading obsolete switchgear systems with modern technologies that provide enhanced performance, reliability, and safety functions. The growth and updating of power infrastructure are key factors influencing the switchgear market. The demand for new installations is significantly increased by the requirement to update old switchgear systems to comply with modern safety and performance standards. Moreover, advanced switchgear systems are needed for efficient power distribution and grid stability when building new power plants, substations, and transmission lines.

-

Advanced Switchgear Essential for Enhancing Smart Grid Technology and Operations.

Smart grid technology is a major improvement in the control and function of power systems. Advanced switchgear systems are needed to support smart grid technology deployments to enable intelligent and automated grid operations. The growth of smart grids is motivated by the goal of improving the dependability, effectiveness, and environmental friendliness of power networks. Smart grids allow for better fault detection, load management, and energy efficiency by enabling real-time monitoring and control of electrical networks. The incorporation of smart grid technology requires advanced switchgear systems that can interact with other grid components and assist in automating grid operations. The growing investments in smart grid technology are fueling the need for modern switchgear systems. Switchgear for smart grids needs to have sensors, communication interfaces, and automation capabilities to facilitate real-time grid management. The advanced capabilities of switchgear allow it to carry out tasks like remote monitoring, identifying faults, and distributing loads, which are crucial for the smart grids to operate effectively. With the ongoing implementation of smart grid projects globally, there is anticipated growth in the need for intelligent switchgear solutions.

Restraints

-

The Effects of Stringent Environmental Regulations on the Switchgear Market.

Strict environmental rules concerning hazardous materials' usage and the environmental effects of electrical equipment are a major limitation on the switchgear market. Adhering to these rules may raise manufacturing expenses and intricacy, ultimately impacting the general market expansion. The goal of environmental regulations is to reduce the impact on the environment of industrial activities, such as the manufacturing and functioning of electrical devices. These rules frequently mandate the utilization of eco-friendly materials and the adoption of actions to minimize emissions and waste. Although necessary for protecting the environment, these regulations may result in extra expenses and operational difficulties for manufacturers of switchgear systems. Adhering to strict environmental regulations could raise manufacturing expenses for switchgear systems due to the requirement to use eco-friendly materials or adopt new practices to minimize emissions and waste. Tough environmental regulations limit the switchgear market by raising production expenses and presenting operational obstacles for manufacturers. Even though these regulations are important for protecting the environment, they can hinder market expansion, especially in areas with strict regulatory systems. Manufacturers might have to consider new ideas and different materials to address this limitation and boost market expansion.

Switchgear Market Segment Overview:

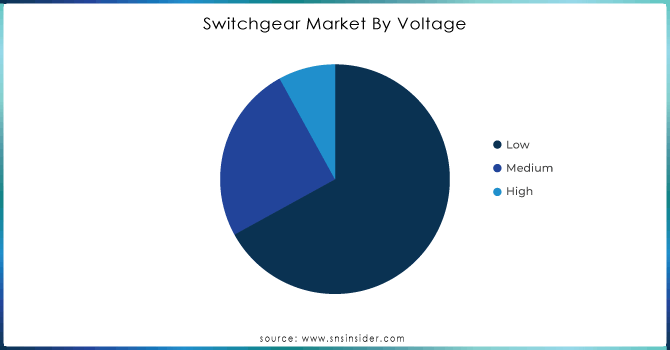

BY VOLTAGE

The low voltage segment captured nearly 67% in 2023 and led the market. This part is vital for the safe distribution of electricity at voltages of up to 1,000 volts. There is a high demand for low voltage switchgear in urban infrastructure, especially in residential buildings, data centers, and commercial complexes, where safety, reliability, and compactness are important. Schneider Electric provides low voltage switchgear solutions for various applications, offering reliable performance and protection from electrical faults. The growth of this sector is fueled by the rising urbanization and need for energy-efficient systems, solidifying its position as a key component of the Switchgear Market.

The medium voltage segment is to experience a faster CAGR during 2024-2032, which is primarily used in power distribution networks, utilities, and industrial sectors. This section generally deals with voltages ranging from 1,000 to 36,000 volts, making it suitable for distribution and sub-transmission needs. The importance of these systems lies in their role in controlling the distribution of electricity for industrial plants, substations, and large infrastructure projects. ABB and Eaton are top suppliers of medium voltage switchgear, providing solutions that improve grid reliability and facilitate the incorporation of renewable energy sources.

Need any customization research on Switchgear Market - Enquiry Now

BY INSULATION

Air-insulated switchgear (AIS) dominated with a 52% market share in 2023 because of its affordability, dependability, and simple maintenance. AIS employs air as the main insulating material, which is ideal for medium to high-voltage uses in urban and industrial environments. Its popularity in distribution networks, substations, and renewable energy integration has established it as the top choice for utilities and industries. AIS provides safety and environmental advantages, including the absence of harmful gas usage. Siemens’ 8DJH Compact Air-Insulated Switchgear is utilized in distribution networks for medium-voltage power distribution, offering dependable and affordable solutions.

Gas-insulated switchgear (GIS) is to expand rapidly during the forecast period due to its compact, efficient, and reliable design in challenging conditions. GIS utilizes sulfur hexafluoride (SF6) or alternative gases as the insulating agent, enabling increased voltage capacities within limited areas. It's perfect for urban settings, offshore platforms, and industrial uses with limited space. GIS is becoming more popular because it can function in harsh conditions with little upkeep, making it the top pick for utilities prioritizing durability in the long run. The ZX0 Gas-Insulated Switchgear from ABB is utilized in city substations with limited space, providing top-notch performance in a small area.

BY INSTALLATION

The outdoor switchgear led the market in 2023 with a 70% market share, due to the rising demand for power distribution in rural and isolated regions, along with the growth of renewable energy initiatives. Outdoor switchgear is created to endure tough weather conditions, making it appropriate for substations, transmission lines, and renewable energy setups such as wind farms and solar power plants. This switchgear is durable, able to withstand tough weather conditions and high voltage levels, and is necessary for ensuring dependable power distribution in difficult environments. For instance, ABB offers outdoor switchgear solutions like the PASS (Plug and Switch System) series, utilized in substations and renewable energy projects around the world.

The indoor switchgear is expected to grow at a faster rate during 2024-2032, as it is extensively utilized in residential, commercial, and industrial settings. Indoor switchgear is commonly placed in regulated surroundings to shield it from external elements like weather, dust, and humidity. This feature is perfect for crowded urban areas and buildings with limited space, like data centers, hospitals, and commercial buildings. Siemens utilizes indoor switchgear, such as the popular 8DA10/8DB10 gas-insulated switchgear, in various urban infrastructure projects.

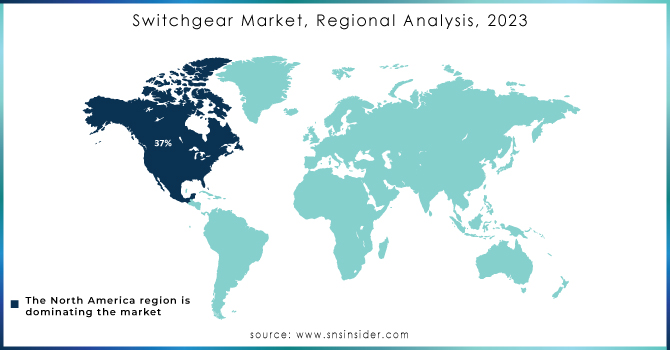

Switchgear Market Regional Analysis:

North America dominated the market in 2023 with a 37% market share, due to rising investments in updating old power infrastructure and growing renewable energy initiatives. The market is dominated by the U.S. and Canada, which have a high demand for advanced switchgear solutions that improve grid reliability and support the integration of renewable energy sources. The dedication of the area to lowering carbon emissions has led to the implementation of smart grids and energy-efficient switchgear systems. Leading companies like General Electric, Eaton, and Schneider Electric are leading the way by offering cutting-edge solutions for utilities, industrial sectors, and data centers. The growing emphasis on modernizing the grid, along with advancements in switchgear technology, places North America as a quickly expanding market in the sector.

The Asia-Pacific region is accounted to have a rapid growth rate during the forecast period 2024-2032. Nations such as China, India, and Japan play a crucial role, making substantial contributions to the demand for switchgear because of the growing requirement for dependable and effective electricity distribution systems. The strong economic growth in the area and the implementation of smart grid projects continue to support market growth. Big companies such as Siemens, Schneider Electric, and ABB are playing a significant role in providing advanced switchgear solutions to help with the growth of renewable energy projects, high-voltage substations, and urban distribution networks throughout APAC.

KEY PLAYERS:

The key players in Global Switchgear Market are Schneider Electric, Eaton Corporation Hyosung, Hyundai CG Power, Toshiba, Mitsubishi Powell, Larsen & Toubro, Elektrobudowa, Hubbell, Lucy Electric, SEL, Aterpillar, Powell Industries, Eaton Corporation, Alstom, Siemens AG, BHEL, TIPECO, Crompton Greeves, Meta Switchgear and Other Players.

Recent Development

-

In March 2024, ABB launched the new low-voltage switchgear range that uses laminated bus plate technology, where the product is focused on enhancing energy efficiency, reducing the carbon footprint, and improving safety features. The switchgear was aimed at industries that were looking for a way to modernize their electrical infrastructure with a more sustainable solution.

-

In January 2024, Schneider Electric introduced the new PrismaSeT Active switchgear, where the product takes advantage of real-time monitoring and predictive maintenance products. The solution has a focus on improving energy management and providing the user with operational insight. It was an ideal solution for smart buildings and applications used in an industrial setting.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 97.76 Billion |

| Market Size by 2032 | USD 165.01 Billion |

| CAGR | CAGR of 6.00% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Voltage (Low, Medium, High) • By Insulation (Air, Gas, Others) • By Installation (Indoor, Outdoor) • By End-Users (Industries, Commercial, Residential, T&D Utilities) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Schneider Electric, Eaton Corporation Hyosung, Hyundai CG Power, Toshiba, Mitsubishi Powell, Larsen & Toubro, Elektrobudowa, Hubbell, Lucy Electric, SEL, Aterpillar, Powell Industries, Eaton Corporation, Alstom, Siemens AG, BHEL, TIPECO, Crompton Greeves, Meta Switchgear |

| Key Drivers | • Modern Switchgear Plays a Crucial Role in Upgrading Power Infrastructure. • Advanced Switchgear Essential for Enhancing Smart Grid Technology and Operations. |

| Restraints | • The Effects of Stringent Environmental Regulations on the Switchgear Market. |