Synthetic Absorbable Sutures Market Report Scope & Overview:

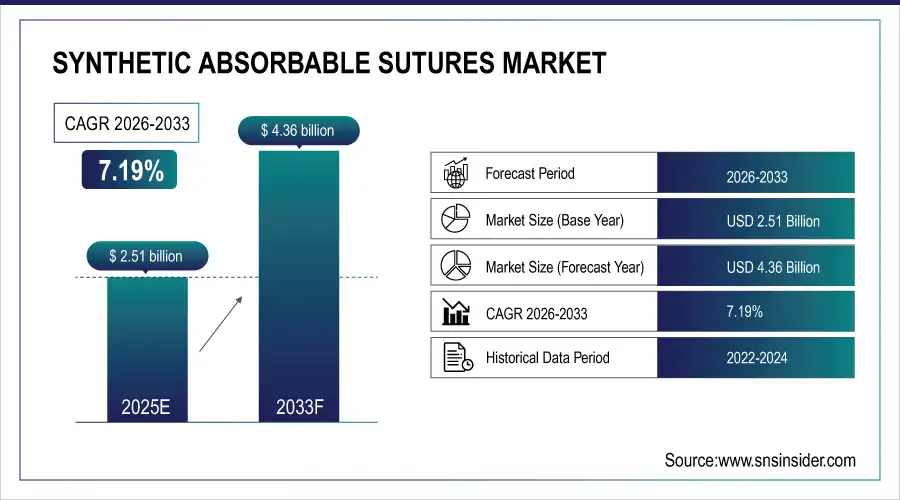

Synthetic Absorbable Sutures Market is valued at USD 2.51 billion in 2025E and is expected to reach USD 4.36 billion by 2033, growing at a CAGR of 7.19% from 2026-2033.

The growth of the synthetic absorbable sutures market is driven by the rising volume of surgical procedures worldwide, supported by increasing prevalence of chronic diseases and an expanding aging population. Growing adoption of minimally invasive surgeries is boosting demand for advanced suturing materials that offer predictable absorption, reduced infection risk, and improved wound healing. Technological advancements in polymer science, enhanced tensile strength, and better biocompatibility are further supporting market expansion. Additionally, increasing healthcare investments, improved access to surgical care, and rising awareness of postoperative outcomes are contributing to sustained market growth globally.

85% of surgical care providers globally adopted synthetic absorbable sutures as a standard of care propelled by surging procedure volumes, advances in polymer technology, and demand for safer, more efficient wound closure solidifying robust market growth across developed and emerging healthcare systems.

Synthetic Absorbable Sutures Market Size and Forecast

-

Market Size in 2025E: USD 2.51 Billion

-

Market Size by 2033: USD 4.36 Billion

-

CAGR: 7.19% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On Synthetic Absorbable Sutures Market - Request Free Sample Report

Synthetic Absorbable Sutures Market Trends

-

Rising preference for minimally invasive surgeries is driving demand for advanced absorbable suture materials

-

Increasing adoption of monofilament sutures due to lower infection risk and enhanced patient recovery outcomes

-

Growth in orthopedic, cardiovascular, and gynecological procedures is expanding overall suture market opportunities

-

Integration of antimicrobial coatings and bioactive materials improves healing and reduces postoperative complications

-

Rising focus on outpatient and ambulatory surgical centers boosts demand for cost-effective suture solutions

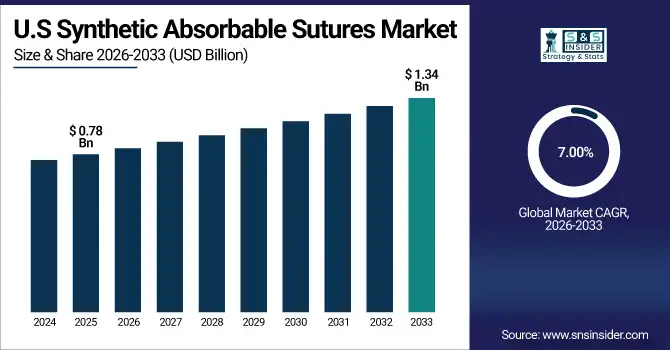

U.S. Synthetic Absorbable Sutures Market is valued at USD 0.78 billion in 2025E and is expected to reach USD 1.34 billion by 2033, growing at a CAGR of 7.00% from 2026-2033.

The growth of the U.S. synthetic absorbable sutures market is driven by rising surgical volumes, increasing adoption of minimally invasive procedures, and a growing aging population. Advancements in suture materials with improved strength, absorption profiles, and infection resistance are enhancing clinical outcomes, while strong healthcare infrastructure and high procedural standards further support steady market expansion.

Synthetic Absorbable Sutures Market Growth Drivers:

-

Rising global surgical procedures and increasing adoption of minimally invasive surgeries are driving demand for synthetic absorbable sutures across hospitals and clinics

The growing number of surgical procedures worldwide, including orthopedic, cardiovascular, and general surgeries, is increasing the demand for efficient wound closure solutions. Minimally invasive and laparoscopic surgeries, which require precise suturing and reduced tissue trauma, further drive the adoption of synthetic absorbable sutures due to their ease of handling and predictable absorption. Hospitals and clinics are increasingly prioritizing patient recovery, reduced post-operative complications, and shorter hospital stays. This trend, combined with expanding healthcare infrastructure and surgical centers globally, supports consistent growth and adoption of synthetic absorbable sutures in both developed and emerging markets.

83% of hospitals and surgical centers reported increased utilization of synthetic absorbable sutures fueled by the global rise in surgical volumes and the rapid adoption of minimally invasive techniques that demand reliable, biocompatible, and self-absorbing wound closure solutions.

-

Growing preference for advanced wound closure materials with predictable absorption and reduced infection risk supports increased use of synthetic absorbable sutures worldwide

Healthcare providers are increasingly adopting synthetic absorbable sutures because they offer consistent tensile strength, predictable absorption rates, and lower risk of infections compared to traditional sutures. These sutures eliminate the need for removal, improving patient comfort and compliance, particularly in pediatric and geriatric populations. Advanced materials reduce tissue reactions and post-surgical complications, making them preferable for critical surgeries. Surgeons and hospitals value these attributes for better clinical outcomes. Growing awareness among healthcare professionals and patients regarding wound care and safety further strengthens demand for synthetic absorbable sutures across global surgical markets.

81% of surgeons worldwide prioritized synthetic absorbable sutures driven by their predictable absorption profiles, reduced infection risk, and improved healing outcomes accelerating global adoption across a wide range of surgical specialties.

Synthetic Absorbable Sutures Market Restraints:

-

Higher costs of synthetic absorbable sutures compared to conventional sutures limit adoption in cost-sensitive healthcare systems and developing regions

Synthetic absorbable sutures are generally more expensive than traditional silk or non-absorbable sutures due to advanced manufacturing processes and superior material properties. In cost-sensitive healthcare environments, especially in developing countries, higher pricing limits widespread adoption despite their clinical benefits. Hospitals with budget constraints may prefer conventional sutures or alternative wound closure methods to reduce expenditure. Limited insurance coverage for premium surgical materials in certain regions further reduces accessibility. These economic barriers can slow market growth and restrict penetration in price-conscious markets, making affordability a significant challenge for synthetic absorbable suture manufacturers globally.

72% of healthcare providers in cost-sensitive and developing regions continued to favor conventional sutures due to the significantly higher price of synthetic absorbable alternatives slowing broader adoption despite their clinical benefits.

-

Availability of alternative wound closure methods such as staples, tissue adhesives, and non-absorbable sutures restrains market growth in certain procedures

Surgical staples, tissue adhesives, and non-absorbable sutures are widely used as alternatives to synthetic absorbable sutures, especially for cost-effective or high-speed procedures. These alternatives may offer faster application, lower immediate costs, or suitability for specific tissue types. Surgeons’ familiarity with traditional methods and institutional procurement preferences can reduce the adoption of synthetic absorbable sutures. Additionally, some procedures may not require absorbable materials, further limiting demand. The presence of multiple wound closure options in the market creates competitive pressure, restraining growth and making it challenging for manufacturers to achieve large-scale penetration across all surgical segments.

69% of surgical practices opted for alternative wound closure methods such as staples, tissue adhesives, and non-absorbable sutures in select procedures, limiting the adoption of synthetic absorbable sutures and moderating market growth in specific segments.

Synthetic Absorbable Sutures Market Opportunities:

-

Technological advancements in suture materials, including antibacterial coatings and enhanced tensile strength, create opportunities for product innovation and differentiation

Innovations in synthetic absorbable sutures, such as bioactive coatings, antibacterial properties, and improved tensile strength, provide manufacturers with opportunities to develop differentiated products. These advanced sutures reduce post-operative infections, improve wound healing, and cater to specialized surgical applications. Continuous research in polymer science and biocompatible materials allows companies to offer premium products with better performance and safety profiles. By addressing surgeon and patient needs for high-quality, reliable sutures, manufacturers can strengthen brand positioning, expand market share, and capture higher-value segments in the global surgical market.

80% of suture manufacturers introduced next-generation synthetic absorbable sutures featuring antibacterial coatings, improved tensile strength, and controlled absorption profiles enabling faster healing, reduced infection risk, and stronger competitive differentiation in a rapidly evolving surgical market.

-

Expansion of healthcare infrastructure and increasing surgical volumes in emerging markets provide significant growth opportunities for synthetic absorbable suture manufacturers

Emerging markets, particularly in Asia-Pacific, Latin America, and the Middle East, are witnessing rapid growth in healthcare infrastructure, hospital establishments, and surgical procedures. Increasing patient awareness, government healthcare initiatives, and rising disposable incomes are driving higher surgical volumes, creating strong demand for advanced wound closure solutions. Synthetic absorbable sutures, with their clinical advantages, are well-positioned to benefit from this growth. Manufacturers can capitalize on these opportunities by strengthening distribution networks, offering cost-effective solutions, and partnering with hospitals and clinics to expand penetration in rapidly developing regions, boosting global market growth.

78% of synthetic absorbable suture manufacturers reported accelerated growth in emerging markets fueled by expanding healthcare infrastructure, rising surgical procedure volumes, and greater adoption of advanced wound closure solutions.

Synthetic Absorbable Sutures Market Segment Highlights

-

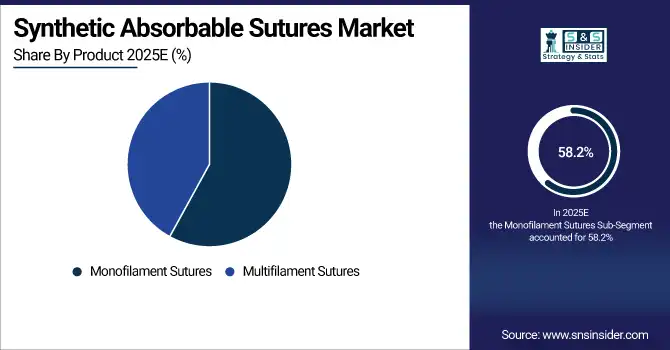

By Product: Monofilament Sutures led with 58.2% share, while Multifilament Sutures is the fastest-growing segment with CAGR of 10.1%.

-

By Material Type: Polyglactin (PG 910) led with 34.6% share, while Polydioxanone (PDO) is the fastest-growing segment with CAGR of 11.3%.

-

By Application: General Surgery led with 42.9% share, while Plastic & Reconstructive Surgery is the fastest-growing segment with CAGR of 10.7%.

-

By End User: Hospitals led with 55.4% share, while Ambulatory Surgical Centers is the fastest-growing segment with CAGR of 10.9%.

Synthetic Absorbable Sutures Market Segment Analysis

By Product: Monofilament Sutures led, while Multifilament Sutures is the fastest-growing segment.

Monofilament Sutures dominate the synthetic absorbable sutures market due to their single-strand structure, which minimizes tissue drag and reduces the risk of bacterial infection. These sutures are widely preferred across general, gynecological, and cardiovascular surgeries because they offer smooth passage through tissue, predictable absorption, and reliable tensile strength. Their non-braided design lowers inflammatory response and supports faster wound healing. High surgeon familiarity, broad availability across healthcare facilities, and consistent clinical outcomes continue to reinforce their dominant position in both routine and complex surgical procedures.

Multifilament Sutures are the fastest-growing product segment as advancements in coating technologies have significantly reduced infection risk while preserving superior knot security and flexibility. Their braided structure provides enhanced handling characteristics, making them ideal for procedures requiring precise tissue approximation and strong knot retention. Growing adoption in orthopedic, plastic, and reconstructive surgeries is accelerating demand. Surgeons increasingly prefer multifilament sutures for complex wound closures where durability and control are critical. Expanding surgical volumes and innovation in absorbable braided materials are key factors driving rapid segment growth.

By Material Type: Polyglactin (PG 910) led, while Polydioxanone (PDO) is the fastest-growing segment.

Polyglactin (PG 910) dominates the material segment due to its balanced absorption profile, strong tensile properties, and extensive clinical acceptance across multiple surgical disciplines. It is widely used in general, gynecological, and pediatric surgeries because it provides reliable wound support during the critical healing phase while minimizing tissue reaction. The material’s predictable absorption and ease of handling make it a preferred choice among surgeons. Broad product availability, cost-effectiveness, and long-standing regulatory approvals further strengthen Polyglactin’s leadership in the synthetic absorbable sutures market.

Polydioxanone (PDO) is the fastest-growing material segment due to its prolonged tensile strength retention and slow absorption rate, making it suitable for long-healing tissues. It is increasingly adopted in cardiovascular, orthopedic, and plastic surgeries where extended wound support is critical. PDO’s monofilament structure reduces infection risk while ensuring flexibility and durability. Rising demand for advanced surgical procedures and minimally invasive techniques is driving PDO usage. Continuous innovation in PDO formulations and increased surgeon awareness of its long-term performance benefits are accelerating segment growth.

By Application: General Surgery led, while Plastic & Reconstructive Surgery is the fastest-growing segment.

General Surgery dominates the application segment as it accounts for a large volume of procedures requiring absorbable sutures for soft tissue closure. Synthetic absorbable sutures are extensively used in abdominal, gastrointestinal, and routine surgical interventions due to their predictable absorption and reduced need for suture removal. Surgeons favor these sutures for improving patient comfort and lowering post-operative complications. The high frequency of general surgical procedures globally, combined with increasing hospital admissions and surgical interventions, ensures consistent demand, making general surgery the largest application area.

Plastic & Reconstructive Surgery is the fastest-growing application segment due to the rising number of cosmetic, trauma-related, and reconstructive procedures worldwide. These surgeries require sutures that offer high tensile strength, minimal scarring, and controlled absorption for optimal aesthetic outcomes. Growing awareness of cosmetic appearance, increased access to advanced surgical techniques, and expanding medical tourism are supporting segment growth. Surgeons increasingly prefer advanced absorbable sutures for precision wound closure, driving strong adoption in facial, dermatological, and reconstructive surgical applications.

By End User: Hospitals led, while Ambulatory Surgical Centers is the fastest-growing segment.

Hospitals dominate the end-user segment as they perform a high volume of surgical procedures across multiple specialties, including general, orthopedic, cardiovascular, and gynecological surgeries. They are primary purchasers of synthetic absorbable sutures due to centralized procurement systems and consistent procedural demand. Hospitals offer advanced surgical infrastructure, skilled surgical teams, and access to complex procedures, ensuring steady consumption of sutures. Their ability to manage both elective and emergency surgeries reinforces their leading position in overall suture utilization.

Ambulatory Surgical Centers (ASCs) are the fastest-growing end-user segment due to the increasing shift toward outpatient and minimally invasive surgeries. These facilities prioritize cost efficiency, faster patient turnover, and reduced hospital stays, driving higher demand for absorbable sutures that support rapid recovery. Rising investments in ASC infrastructure and growing patient preference for same-day surgical procedures are accelerating growth. As more procedures transition from hospitals to outpatient settings, ASCs are becoming a key growth driver in the synthetic absorbable sutures market.

Synthetic Absorbable Sutures Market Regional Analysis

North America Synthetic Absorbable Sutures Market Insights:

North America dominated the Synthetic Absorbable Sutures Market with a 40.00% share in 2025 due to advanced healthcare infrastructure, high adoption of minimally invasive surgeries, and the presence of leading suture manufacturers. Strong research and development, favorable reimbursement policies, and growing surgical volumes further reinforced the region’s leadership in the market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia Pacific Synthetic Absorbable Sutures Market Insights

Asia Pacific is expected to grow at the fastest CAGR of about 9.31% from 2026–2033, driven by rising healthcare expenditures, increasing number of surgical procedures, and growing awareness of advanced suture technologies. Expanding hospital infrastructure, improving access to modern surgical care, and rapid adoption of minimally invasive techniques accelerate the region’s market growth.

Europe Synthetic Absorbable Sutures Market Insights

Europe held a significant share in the Synthetic Absorbable Sutures Market in 2025, supported by advanced healthcare systems, high adoption of minimally invasive surgical procedures, and the presence of leading suture manufacturers. Strong regulatory frameworks, rising geriatric population, and continuous innovation in surgical technologies further strengthened Europe’s position in the market.

Middle East & Africa and Latin America Synthetic Absorbable Sutures Market Insights

The Middle East & Africa and Latin America together showed steady growth in the Synthetic Absorbable Sutures Market in 2025, driven by expanding healthcare infrastructure, increasing surgical volumes, and rising awareness of advanced suture technologies. Growing investments in modern hospitals, improving access to quality surgical care, and adoption of minimally invasive procedures supported the regions’ emerging market presence.

Synthetic Absorbable Sutures Market Competitive Landscape:

Johnson & Johnson (Ethicon)

Johnson & Johnson, through its Ethicon division, is a global leader in surgical solutions, including synthetic absorbable sutures. Ethicon offers a broad portfolio of advanced suturing materials designed to support optimal wound healing, strength retention, and predictable absorption. The company emphasizes innovation, clinical safety, and surgeon-centric design. With a strong global distribution network and continuous investment in research, Ethicon plays a pivotal role in advancing surgical outcomes across multiple medical specialties worldwide.

-

April 2024, Ethicon (part of Johnson & Johnson MedTech) launched an enhanced version of its Monocryl Plus synthetic absorbable suture, featuring optimized polymer crystallinity for more predictable tissue absorption and reduced inflammatory response.

Medtronic plc

Medtronic plc is a leading global medical technology company with a strong presence in surgical products, including synthetic absorbable sutures. The company focuses on improving surgical efficiency, patient safety, and healing outcomes through innovative biomaterials and minimally invasive solutions. Medtronic leverages extensive research, clinical expertise, and global reach to deliver reliable suturing solutions. Its commitment to technology-driven healthcare positions Medtronic as a key contributor to modern surgical wound management practices.

-

October 2023, Medtronic introduced Caprosyn, a next-generation fast-absorbing synthetic suture made from poliglecaprone 25, designed for superficial soft tissue closure with minimal scarring.

B. Braun Melsungen AG

B. Braun Melsungen AG is a prominent medical device and pharmaceutical company offering a comprehensive range of synthetic absorbable sutures. The company emphasizes quality, biocompatibility, and consistency in its surgical products to support effective wound closure and healing. B. Braun’s sutures are widely used across general surgery, orthopedics, and specialty procedures. With a strong focus on innovation, sustainability, and global healthcare partnerships, B. Braun remains a significant player in the surgical sutures market.

-

February 2025, B. Braun launched Monosyn GREEN, an eco-conscious version of its monofilament polyglyconate suture, featuring 100% recyclable paper-based packaging and carbon-neutral manufacturing.

Synthetic Absorbable Sutures Market Key Players

Some of the Synthetic Absorbable Sutures Market Companies are:

-

Johnson & Johnson (Ethicon)

-

Medtronic plc

-

B. Braun Melsungen AG

-

Smith & Nephew plc

-

Boston Scientific Corporation

-

Teleflex Incorporated

-

DemeTECH Corporation

-

ConMed Corporation

-

Integra LifeSciences Holdings Corporation

-

Lotus Surgicals Pvt Ltd

-

Suture Planet

-

Healthium Medtech Limited

-

Internacional Farmacéutica

-

Sutures India Pvt Ltd

-

Assut Medical Sarl

-

CP Medical, Inc.

-

Kono Seisakusho Co., Ltd.

-

Unik Surgical Sutures MFG

-

Dolphin Sutures

-

Meril Life Sciences

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 2.51 Billion |

| Market Size by 2033 | USD 4.36 Billion |

| CAGR | CAGR of 7.19% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Monofilament Sutures, Multifilament Sutures) • By Material Type (Polyglycolic Acid (PGA), Polyglactin (PG 910), Polydioxanone (PDO), Poliglecaprone, Other Synthetic Polymers) • By Application (General Surgery, Gynecological Surgery, Orthopedic Surgery, Cardiovascular Surgery, Plastic & Reconstructive Surgery) • By End User (Hospitals, Ambulatory Surgical Centers, Clinics, Specialty Surgical Centers, Academic & Research Institutes) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Johnson & Johnson (Ethicon), Medtronic plc, B. Braun Melsungen AG, Smith & Nephew plc, Boston Scientific Corporation, Teleflex Incorporated, DemeTECH Corporation, ConMed Corporation, Integra LifeSciences Holdings Corporation, Lotus Surgicals Pvt Ltd, Suture Planet, Healthium Medtech Limited, Internacional Farmacéutica, Sutures India Pvt Ltd, Assut Medical Sarl, CP Medical, Inc., Kono Seisakusho Co., Ltd., Unik Surgical Sutures MFG, Dolphin Sutures, Meril Life Sciences |