Tangential Flow Filtration Market Size Analysis:

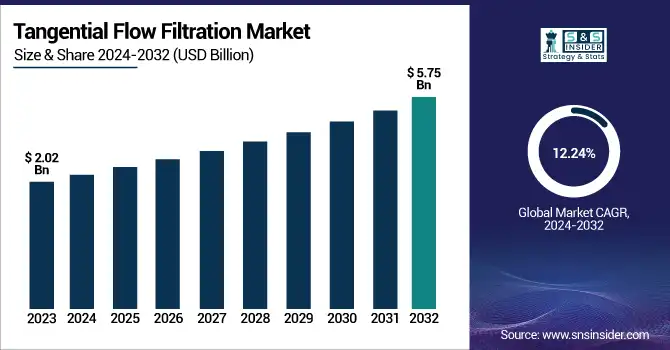

The Tangential Flow Filtration Market size was valued at USD 2.02 billion in 2023 and is expected to reach USD 5.75 billion by 2032, growing at a CAGR of 12.24% from 2024-2032.

The Tangential Flow Filtration (TFF) Market report provides insights into the total number of TFF systems installed in the world in 2023, which gives a proper understanding of market penetration. The report analyzes the trends of single-use and reusable TFF system adoption, highlighting industry affinity as well as operational advantages. The study also examines the increasing use of TFF in bioprocessing, including its application in protein purification, vaccine manufacturing, and antibody development. It also provides a cost analysis with the price, maintenance, and operational costs of TFF systems in various geographies. It delves into advances in membrane filtration technology, specifically innovations in efficiency, automation, and material development for better performance.

To Get more information on Tangential Flow Filtration Market - Request Free Sample Report

The U.S. Tangential Flow Filtration Market size was USD 0.56 billion in 2023 and is expected to reach USD 1.59 billion by 2032, growing at a CAGR of 12.3% over the forecast period of 2024-2032.

The market is driven by the increasing adoption of tangential flow filtration (TFF) in biopharmaceutical production, vaccine manufacturing, and gene therapy applications. The growing demand for high-purity biologics and monoclonal antibodies has further accelerated the need for efficient filtration technologies. Technological advancements in membrane materials and automation have enhanced the efficiency and scalability of TFF systems. Additionally, the rising focus on personalized medicine and cell-based therapies is expected to create lucrative opportunities for market expansion in the coming years.

Tangential Flow Filtration Market Dynamics

Drivers

- Growth in demand for biologics and biosimilars is a key growth driver for the Tangential Flow Filtration (TFF) market.

Biologics such as monoclonal antibodies, recombinant proteins, and cell therapies need sophisticated filtration methods to achieve purity and effectiveness. Based on industry reports, the biologics industry has experienced a growth in approvals, with the FDA granting more than 50 new biologic drug approvals in 2023. Biosimilars are also picking up steam with their cost advantage, with worldwide biosimilar sales set to experience double-digit growth shortly. TFF is of paramount importance in the downstream purification of these therapeutics, with scalability and process efficiency being guaranteed. New developments, including single-use TFF systems, are also driving market adoption by minimizing the risk of contamination and enhancing manufacturing flexibility in biopharmaceutical manufacturing.

- Advances in membrane filtration technology and the increasing use of single-use TFF systems are driving market growth.

Conventional stainless-steel filtration systems are being increasingly replaced by disposable, single-use TFF systems based on their ability to minimize cross-contamination, reduce downtime, and maximize process flexibility. Top industry players such as Sartorius and Merck have introduced next-generation TFF cassettes and automatic filtration systems, enhancing filtration efficiency and scalability. Furthermore, advancements in microfiltration and ultrafiltration have improved biomolecule separation, which enhances drug purity. From recent industry trends, more than 70% of biopharmaceutical producers are adopting single-use filtration systems to streamline processes. These developments in TFF technology are likely to propel its usage throughout the biopharmaceutical sector, especially for large-volume commercial production and contract research organizations (CROs).

Restraint

- High Operational Costs and Capital Investment are restraining the market growth.

One of the major constraints of the Tangential Flow Filtration (TFF) industry is the high cost of operation and substantial initial capital investment in sophisticated filtration systems. Application of TFF technology, especially for bulk biopharmaceutical production, necessitates a huge initial investment in filtration membranes, system hardware, and facilities. Ongoing maintenance expenses, periodic replacement of membranes, and adherence to strict regulatory requirements also contribute to total expenditure. Small and mid-sized bio-pharmaceutical companies tend to have tight budgets and may not be able to afford top-of-the-line TFF systems. Industry reports suggest that advanced membrane filtration and automated TFF systems are much more expensive than conventional filtration systems, making it a cost issue. Technology advancements notwithstanding in single-use systems, the cost of adoption is still a hurdle, especially in emerging economies where healthcare and biotech funding might not be adequate.

Opportunities

- One of the most significant market opportunities in the Tangential Flow Filtration (TFF) market is the growing use of single-use filtration systems.

With the biopharmaceutical industry moving towards flexible and economical manufacturing solutions, single-use TFF systems provide benefits like lower risk of contamination, reduced cleaning and validation costs, and greater scalability. With the growth of personalized medicine and cell & gene therapy, manufacturers are adopting single-use filtration for better process efficiency. Recent developments in disposable membrane technology have further enhanced the need for such systems. Furthermore, regulatory bodies like the FDA promote the adoption of single-use technologies for sterile filtration in biologics manufacturing. This trend presents a large market opportunity for industry players to create innovative and cost-efficient single-use TFF solutions to address the increasing demands of pharmaceutical and biotechnology firms.

Challenges

- The largest issue in the Tangential Flow Filtration market is consistency in filtration efficiency over various applications of bioprocessing.

TFF is prevalent across protein purification, vaccine development, and filtration of raw material, each calling for a precise configuration of the membrane and a certain set of performance criteria. Fluctuations in molecular weight, solution viscosity, and processing conditions can interfere with filtration efficiency and cause varied yields and risk to product loss. Manufacturers need to constantly optimize pore sizes of the membrane, flow rates, and system parameters to drive homogeneous results for multiple applications. Furthermore, membrane durability with fouling prevention is still a technical challenge. The industry is engaged in the development of new membrane materials and system automation to overcome these challenges, but universal efficiency across all applications is still a multifaceted problem for TFF system developers and users alike.

Tangential Flow Filtration Market Segmentation Analysis

By Product

The Single-use Tangential Flow Filtration (TFF) Systems segment dominated the market with a 43.21% market share in 2023, with its rising application in biopharmaceutical production. The trend towards disposable bioprocessing technologies has fueled the demand for single-use filtration systems, which do away with extensive cleaning and sterilization requirements, minimizing operational costs and turnaround times. They also provide more flexibility and scalability, which can be useful for the production of small-batch biologics, monoclonal antibodies, and personalized medicine. Moreover, regulatory bodies like the FDA have promoted the adoption of single-use technologies for improving sterility assurance. Developments in membrane technology as well as automation have also enhanced the efficiency of single-use TFF systems, making them the preferred option for biotech and pharma companies for clinical-scale and commercial-scale production.

By Technology

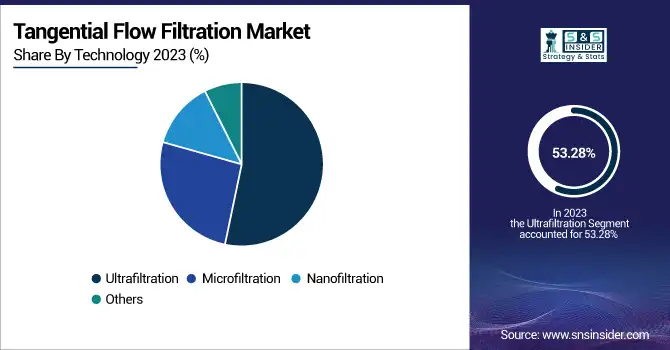

The ultrafiltration segment dominated the tangential flow filtration market with a 53.28% market share in 2023 as a result of playing a key role in the manufacturing of biopharmaceuticals, protein purification, and processing monoclonal antibodies. Ultrafiltration membranes effectively partition macromolecules based on size and are perfect for concentrating and diafiltering products like vaccines, enzymes, and gene therapies. Increasing the requirement for highly purified biologics and recombinant proteins is driving the ubiquitous usage of ultrafiltration technology. Moreover, hollow fiber and flat sheet membrane technology improvements have enhanced filtration efficiency and process scalability, further cementing ultrafiltration's supremacy. Approvals for cell and gene therapy products, which demand accurate filtration processes, have also helped the segment lead the market.

The Microfiltration segment is anticipated to register the fastest growth rate during the forecast period, with 12.74% CAGR based on its growing applications in sterile filtration, viral clearance, and purification of raw materials in biopharmaceutical production. With stringent regulatory requirements focusing on contamination control, microfiltration finds greater applications in cell culture media preparation, the removal of microorganisms, and the separation of fine particulates in drug manufacturing. Microfiltration technologies have also been spurred by the accelerating development of cell and gene therapies, mRNA vaccines, and the production of viral vectors. More investments in bioprocessing plants and contract manufacturing organizations (CMOs), especially in regions with growing markets, are also boosting the adoption of microfiltration systems as they help improve product safety and quality.

By Application

The Raw Material Filtration segment dominated the tangential flow filtration market because of its critical function in maintaining high product purity and regulatory compliance within biopharmaceutical production. Raw material filtration, including buffers, media, and excipients, is a decisive step in removing contaminants, particles, and endotoxins before drug formulation and production. Due to strict regulatory policies by organizations such as the FDA and EMA, the pharmaceutical and biotech industries focus on having strong filtration systems to ensure sterility and consistency in manufacturing. Moreover, growing use of single-use filtration systems in upstream bioprocessing has strengthened the demand for effective raw material filtration systems, and thus, it remains the leading segment in 2023.

By End Use

The pharmaceutical & biotechnology companies segment dominated the tangential flow filtration market with a 45.26% market share in 2023 because there is a heavy demand for vaccines, biopharmaceuticals, and cell & gene therapies. These biotechnology and pharmaceutical companies depend upon Tangential Flow Filtration (TFF) for most of their critical operations, like the purification of proteins, viral vector preparation, and the production of monoclonal antibodies. With greater investments in bioprocessing and large-scale drug production, the pharmaceutical industry has embraced sophisticated filtration technologies for higher product yield, purity, and regulatory compliance. Moreover, stringent FDA and EMA regulations for biopharmaceutical manufacturing compel companies to adopt high-efficiency filtration systems. The growing adoption of single-use TFF systems to increase operational flexibility and minimize contamination risks further strengthened this segment's dominance.

The Academic Institutes & Research Laboratories segment will experience the fastest growth in the forecast years because of growing emphasis on biological research, early drug development, and novel bioprocessing methods. With mounting government investment and industry partnerships, universities and research institutions are increasing their biopharmaceutical R&D activities, which require the employment of TFF systems for small-scale protein and nucleic acid purification. Also, the increasing use of single-use filtration systems in laboratory environments has enhanced process efficiency and affordability. Increasing interest in cell culture research, gene therapy development, and microfluidic-based bioprocessing is also stimulating demand for affordable, high-performance TFF solutions among research institutes and academic institutions.

Tangential Flow Filtration Market Regional Insights

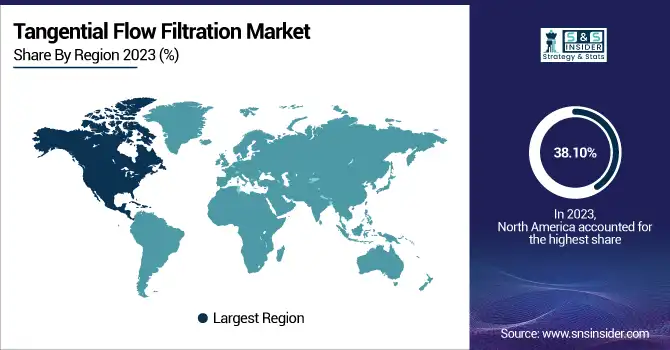

North America dominated the Tangential Flow Filtration (TFF) Market with a 38.10% market share in 2023 because of its established biopharmaceutical sector, high R&D investments, and robust regulatory environment. The region has large pharmaceutical and biotechnology organizations that widely utilize TFF systems for biologics, vaccine manufacturing, and cell therapy uses. The need for monoclonal antibodies and improvements in membrane filtration technology has increased the wide-scale applications. Moreover, with the presence of major TFF players and government support in the form of research grants for biopharmaceuticals, North America's position as the leading market is further fortified.

Asia Pacific is the fastest-growing region in the Tangential Flow Filtration Market, with 12.91% CAGR, with the fast-paced growth of its biotech industry and mounting investments in the production of pharmaceuticals. Geographies such as China, India, and South Korea are experiencing rapid growth in biologics and biosimilars manufacturing, fueling demand for TFF systems. The expansion of the focus on contract manufacturing and research services in the region, along with the supportive government programs to increase local biopharmaceutical production, is adding momentum to the growth. Moreover, the prevalence of chronic diseases and growing clinical research activities in developing economies also increase the adoption of TFF technologies at a faster pace.

Get Customized Report as per Your Business Requirement - Enquiry Now

Tangential Flow Filtration Market Key Players

-

Danaher Corporation (Pall Centramate TFF System, Pall Centrasette TFF Cassette)

-

Merck KGaA (Pellicon 3 Cassettes, Cogent M1 TFF System)

-

Sartorius AG (Sartoflow Smart TFF System, Sartocon Slice Cassette)

-

Repligen Corporation (KrosFlo TFF Systems, Spectrum Hollow Fiber Filters)

-

Parker Hannifin Corporation (SciLog TFF System, PROpor TFF Modules)

-

Alfa Laval AB (Alfa Laval LabStak M20, Alfa Laval PilotUnit Combi)

-

Thermo Fisher Scientific Inc. (TFF Systems, Pellicon Cassettes)

-

GE Healthcare (ÄKTA flux TFF System, Kvick Lab Cassette Holder)

-

Meissner Filtration Products, Inc. (TFF Systems, Hollow Fiber Filters)

-

Koch Separation Solutions (SUPER-COR TFF Modules, INDU-COR TFF Modules)

-

Novasep (Sius TFF Skid, BioSC TFF System)

-

Sterlitech Corporation (Sepa CF TFF System, CF042 Cross Flow Cell)

-

Synder Filtration, Inc. (Synder TFF Membranes, Synder TFF Systems)

-

ABEC, Inc. (Custom Single-Use TFF Systems, CSR TFF Systems)

-

Andritz AG (Andritz TFF Membranes, Andritz TFF Systems)

-

TangenX Technology Corporation (TangenX SIUS TFF Cassettes, TangenX SIUS TFF Systems)

-

Spectrum Laboratories, Inc. (KrosFlo Research II TFF System, MidiKros Hollow Fiber Modules)

-

Eaton Corporation (BECO TFF Systems, BECO TFF Membranes)

-

3M Company (3M TFF Systems, 3M TFF Membranes)

-

Cole-Parmer Instrument Company LLC (Cole-Parmer TFF Systems, Cole-Parmer TFF Membranes)

Suppliers (These suppliers provide TFF membranes, filter cassettes, and hollow fiber modules, essential components for TFF systems used in biopharmaceutical filtration.) in the Tangential Flow Filtration Market

-

MilliporeSigma

-

Asahi Kasei Corporation

-

Toray Industries, Inc.

-

Parker Hannifin Corporation

-

GEA Group

-

Pall Corporation (Danaher Corporation)

-

Sartorius Stedim Biotech

-

Membrane Solutions LLC

-

3M Purification Inc.

-

Co-better Filtration

Recent Development in the Tangential Flow Filtration Market

-

February 2025 – Thermo Fisher Scientific Inc., a world leader in scientific services, has entered into a definitive agreement to buy Solventum's Purification & Filtration business for around USD 4.1 billion in cash. The strategic buyout will further enhance Thermo Fisher's expertise in purification and filtration solutions, strengthening its portfolio in bioprocessing and life sciences.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 2.02 Billion |

| Market Size by 2032 | US$ 5.75 Billion |

| CAGR | CAGR of 12.24 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Single-use Tangential Flow Filtration Systems, Reusable Tangential Flow Filtration Systems, Membrane Filters, Filtration Accessories) • By Technology (Ultrafiltration, Microfiltration, Nanofiltration, Others) • By Application (Protein Purification, Vaccine And Viral Vectors, Antibody Purification, Raw Material Filtration, Others) • By End Use (Pharmaceutical & Biotechnology Companies, Contract Research Organizations & Contract Manufacturing Organizations, Academic Institutes & Research Laboratories) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Danaher Corporation, Merck KGaA, Sartorius AG, Repligen Corporation, Parker Hannifin Corporation, Alfa Laval AB, Thermo Fisher Scientific Inc., GE Healthcare, Meissner Filtration Products, Inc., Koch Separation Solutions, Novasep, Sterlitech Corporation, Synder Filtration, Inc., ABEC, Inc., Andritz AG, TangenX Technology Corporation, Spectrum Laboratories, Inc., Eaton Corporation, 3M Company, Cole-Parmer Instrument Company LLC, and other players. |