Terrain Awareness and Warning System (TAWS) Market Size & Growth:

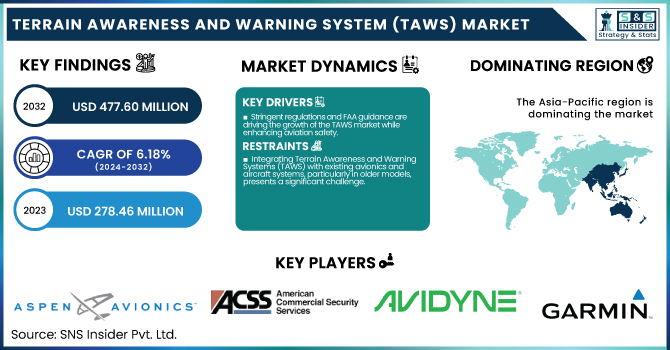

The Terrain Awareness and Warning System (TAWS) Market was valued at 278.46 Million in 2023 and is projected to reach USD 477.60 Million by 2032, growing at a CAGR of 6.18% from 2024 to 2032.

To Get More information about Terrain Awareness and Warning System (TAWS) Market - Request Free Sample Report

This growth is fueled by technological advancements such as AI, machine learning, and real-time data processing, which enhance system reliability and predictive capabilities. Regulatory measures, particularly from the FAA and ICAO, have significantly contributed to market expansion by making TAWS mandatory on commercial aircraft, thereby improving safety and reducing controlled flight into terrain (CFIT) incidents.

In the United States, the market was valued at USD 49.02 million in 2023 and is expected to reach USD 87.40 million by 2032, with a CAGR of 6.61%. Airlines benefit from the operational impact of TAWS, which enhances safety protocols and may reduce insurance premiums. However, challenges such as high installation costs, system integration with older aircraft, and regional disparities in regulatory enforcement continue to hinder broader adoption, especially in smaller fleets and emerging markets.

Terrain Awareness Warning System Market Dynamics:

Drivers:

-

Stringent regulations and FAA guidance are driving the growth of the TAWS market while enhancing aviation safety.

The Terrain Awareness and Warning System (TAWS) market is driven by stringent safety regulations from authorities like the FAA and ICAO, which mandate the installation of TAWS on commercial aircraft to prevent controlled flight into terrain (CFIT) accidents. These regulations have led to broader adoption of TAWS across the aviation industry to enhance safety and meet compliance requirements. The FAA’s Advisory Circular (AC) provides essential guidance for obtaining airworthiness approval for TAWS systems under Technical Standard Order (TSO)-C151A for Part 23 airplanes, ensuring systems comply with safety and performance standards. However, the TSO only covers design and performance approval, not installation approval, highlighting the importance of specific guidance for acceptable installations. This regulatory framework fosters market growth by encouraging manufacturers, operators, and suppliers to adopt TAWS systems, thereby improving aviation safety and reducing the risks of terrain-related accidents, ultimately driving the market forward.

Restraints:

-

Integrating Terrain Awareness and Warning Systems (TAWS) with existing avionics and aircraft systems, particularly in older models, presents a significant challenge.

Older aircraft often lack the necessary infrastructure to seamlessly integrate modern Terrain Awareness and Warning Systems (TAWS), making installation a challenging and costly process. These aircraft may require significant upgrades to their avionics systems, including modifications to wiring, displays, and other subsystems. These integration challenges push back TAWS adoption for many operators, particularly those with an older fleet, and may impede overall market penetration of the system. The substantial expenses related to these improvements can also discourage airlines, particularly smaller companies or those with tight budgets. Consequently, TAWS is not implemented on many aircraft, and its use is limited across the aviation industry. This is a restraint factor for the TAWS market, as the adoption of this system is slow and thus limits the growth of the TAWS market in aviation safety.

Opportunities:

-

Modernizing older aircraft fleets presents a significant opportunity for the TAWS market as airlines retrofit planes to meet evolving safety standards.

The modernization of older aircraft fleets presents a significant opportunity for the Terrain Awareness and Warning System (TAWS) market. Many airlines operating older aircraft must retrofit these planes with modern avionics systems to comply with evolving safety standards and regulations. Older aircraft are often not equipped with the necessary infrastructure to support the latest TAWS technology, creating a need for costly and time-consuming upgrades. Such activity is especially prevalent in areas where these aging fleets are predominant, and airlines are compelled to comply with a higher standard of safety regulation in order to safeguard travelers. As a consequence, this demands TAWS installation and retrofitting services because it provides significant market potential. The process will ensure that airlines are not just compliant with industry regulations, but that they provide a safer airspace environment, and serves as a major enabler of fleet modernization and the widespread adoption of TAWS within the aviation community.

Challenges:

-

Resistance to adopting TAWS technology due to operational disruptions and lack of immediate financial incentives.

Resistance to adopting Terrain Awareness and Warning System (TAWS) technology is a key challenge for its market growth. Many operators, particularly those with established fleets and operational practices, may be hesitant to implement new safety technologies. This resistance often stems from concerns about the disruption that the integration of TAWS might cause to existing systems and workflows. Furthermore, if regulations do not mandate the installation of TAWS, some operators may see little immediate financial incentive to invest in retrofitting or upgrading their aircraft. For smaller carriers or those operating older fleets, the cost of integration and training may also be seen as an unnecessary expense, leading to delayed adoption. As a result, this reluctance to change can hinder the widespread implementation of TAWS, limiting its market penetration and delaying the enhancement of safety standards in aviation.

TAWS Industry Segmentation Analysis:

By System

The Class A system segment dominates the Terrain Awareness and Warning System (TAWS) market, capturing the largest share of revenue, approximately 45%, in 2023. This dominance is driven by the widespread adoption of Class A systems in commercial aviation, particularly in larger aircraft that operate in more complex and varied terrains. Class A systems are designed to provide robust alerts and warnings, ensuring enhanced safety during flight. Their ability to integrate with advanced avionics and provide real-time terrain data makes them a preferred choice for commercial airlines and operators. As regulatory requirements for safety continue to tighten, the demand for Class A TAWS systems is expected to grow, maintaining their leading position in the market. Their market share is expected to remain strong as both new aircraft and retrofitted older fleets increasingly adopt these advanced systems to meet safety standards.

The Class C system segment in the Terrain Awareness and Warning System (TAWS) market is expected to experience significant growth from 2024 to 2032. Class C systems are what we normally see in smaller aircraft and general aviation, they provide basic terrain awareness features, but are less sophisticated than Class A and B. Class C systems, which are more cost-effective, thus appealing for smaller operators and private as these are becoming more common over time. With regulations surrounding safety continuing to shift, the demand for Class C systems is likely to increase, particularly in areas with growing general aviation industries. Their low cost and capability to provide basic safety alerts in less demanding operating environments make them well suited for increased market penetration during the forecast period. A rise in safety awareness, combined with the need for operators to find more accessible, lower-cost solutions will drive growth through the Class C segment.

By Engine

The Turbine Engine segment dominated the Terrain Awareness and Warning System (TAWS) market, capturing approximately 60% of the total revenue in 2023. This segment's dominance is attributed to the widespread use of turbine engines in commercial aviation, especially in large aircraft and long-haul flights, where advanced safety systems like TAWS are critical for ensuring operational safety. Turbine engines are known for their efficiency and reliability, making them the preferred choice for airlines globally. The integration of TAWS with turbine engines enhances safety by providing real-time terrain alerts, reducing the risk of controlled flight into terrain (CFIT) incidents. As the aviation industry continues to expand, especially in commercial fleets, the demand for turbine engine-equipped aircraft with advanced safety systems like TAWS is expected to grow, further solidifying the turbine engine segment's dominant position in the market over the coming years.

The Piston Engine segment is expected to experience the fastest growth in the Terrain Awareness and Warning System (TAWS) market from 2024 to 2032. Piston engines, commonly used in smaller aircraft and general aviation, are becoming more integrated with advanced safety technologies like TAWS as operators seek to improve safety standards and meet evolving regulatory requirements. Piston engine aircraft form the lower sector of visionaries for the growth of this segment as they are generally more affordable and easier to operate than turboshaft-powered helicopters, enabling more operators to meet their business requirements, thus creating a need for cost-effective safety equipment like TAWS. The global general aviation is growing and the expansion for the segment is expected in the forecast period owing to the demand for improved safety systems in piston engine powered aircrafts.

By Application

The Commercial Aircraft segment is expected to dominate the Terrain Awareness and Warning System (TAWS) market, holding approximately 51% of the revenue share by 2023. The increasing demand for improved aviation safety, particularly as regulatory authorities including the FAA and ICAO are more frequently requiring TAWS for commercial aircraft, is driving this leadership. In addition to the increased demand for TAWS system installations, many of those currently installed are not compliant with the latest regulations; therefore, airlines are focusing on the required safety upgrades. Segment occupied in the upcoming period between 2024 and 2032, which is due to increasing global air traffic and updating a fleet of aircraft equipped with new technologies to maintain the safety of the latest trends. TAWS is likely to increase in usage during the retrofit of older aircraft, integrating new systems to comply with new regulations. Given the growing commercial aviation fleet, this segment is expected to dominate the TAWS market, accounting for the largest share throughout the forecast period.

Terrain Awareness and Warning System Market Regional Outlook:

The Asia-Pacific region is poised to dominate the Terrain Awareness and Warning System (TAWS) market, holding around 50% of the revenue share by 2033. This dominance is driven by the rapid growth of the aviation industry in key countries like China, India, and Japan. These nations are witnessing a surge in air travel demand, leading to a substantial expansion of their commercial aviation fleets. As countries in the region modernize their fleets to meet increasing safety standards and comply with international regulations from bodies such as the FAA and ICAO, the adoption of advanced safety systems like TAWS is becoming essential. Additionally, major aviation hubs in the region, including China and India, are investing in infrastructure and modern aircraft technology, further boosting the demand for TAWS. This growing emphasis on safety, combined with regulatory compliance, ensures that the Asia-Pacific region is a dominant force in the global TAWS market, driving significant market share and expansion.

The North America region is expected to be the fastest-growing market for Terrain Awareness and Warning Systems (TAWS) over the forecast period from 2024 to 2032. This growth is driven by continued advancements in commercial aviation, particularly in the United States, where stringent safety regulations by the FAA and ICAO are pushing for the adoption of TAWS. As air travel demand rises and older fleets are upgraded, the integration of TAWS in both new and retrofitted aircraft is accelerating. Additionally, the region's focus on enhancing safety features and meeting regulatory standards contributes to the increasing adoption of TAWS. With strong investments in modern aviation technologies and the need for improved safety protocols, North America will experience significant market expansion in the coming years, making it the leading growth market for TAWS in the forecast period.

Get Customized Report as per Your Business Requirement - Enquiry Now

Terrain Awareness and Warning System (TAWS) Market Key Players:

-

Aspen Avionics, Inc. (USA) - Primary products: Evolution EFD1000 Pro, EFD1000 MFD, Stratus ADS-B Receiver.

-

Aviation Communication & Surveillance Systems, LLC (USA) - Primary products: ACSS TCAS, ACSS ADS-B, ACSS Mode S Transponders.

-

Avidyne Corporation (USA) - Avidyne IFD Series GPS/Nav/Com , Avidyne TAS600 Traffic Advisory System.

-

Garmin Ltd. (USA) - Garmin G3000, G5000, G1000 avionics systems, GDL 88 ADS-B Transceiver.

-

Genesys Aerosystems (USA) - S-TEC 3100 Autopilot, Genesys GFC700 Autopilot.

-

Honeywell International Inc. (USA) - Honeywell Primus Epic, Honeywell Aspire 200 SATCOM.

-

L3 Technologies (USA) - L3 Lynx NGT-9000, L3 ProLine Fusion avionics systems.

-

Mid-Continent Instrument Co., Inc. (USA) - MD41-200 Standby Instrument, MD42-200 Attitude Indicator.

-

Rockwell Collins (USA) - ProLine Fusion, Head-up Display Systems (HUD), Satellite Communications.

-

Sandel Avionics, Inc. (USA) - Sandel SN3500 Primary Flight Display, Sandel HXr Electronic Flight Instrument.

-

Universal Avionics Systems Corporation (USA) - InSight 3D Synthetic Vision System, SBAS Flight Management System.

-

Nighthawk Flight Systems Inc. (USA) - Nighthawk GPS/ADS-B System.

-

Leonardo S.p.A. (Italy) - Leonardo Osprey, Leonardo AW139.

-

Thales (France) - Thales TopDeck Avionics Suite, Thales ADS-B Systems, Thales Ground Proximity Warning Systems

List of Companies that supply raw materials and components for the Terrain Awareness and Warning System (TAWS) market:

-

Honeywell International Inc.

-

Garmin Ltd.

-

Rockwell Collins (Collins Aerospace)

-

Thales Group

-

L3 Technologies (L3Harris Technologies)

-

Avidyne Corporation

-

Genesys Aerosystems

-

Sandel Avionics, Inc.

-

Universal Avionics Systems Corporation

-

Mid-Continent Instrument Co., Inc.

-

Aspen Avionics, Inc.

Recent Development:

-

In 21 Feb 2024, Malaysia Airlines partners with Thales to enhance flight safety by equipping 20 Airbus A330neo aircraft with Thales' Flight Management System (FMS) and ACSS' Traffic Collision Avoidance Systems (T3CAS), featuring Terrain Awareness Warning System (TAWS) for better navigation in challenging terrains. The avionics installation will be managed by Thales’ Aviation Global Services in Singapore.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 278.46 Million |

| Market Size by 2032 | USD 477.60 Million |

| CAGR | CAGR of 6.18% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By System (Class A System, Class B System, Class C System) • By Engine (Turbine Engine, Piston Engine) • By Application (Commercial Aircraft, Military & Defense Aircraft, Helicopter and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia-Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia-Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Aspen Avionics, Aviation Communication & Surveillance Systems, Avidyne Corporation, Garmin, Genesys Aerosystems, Honeywell, L3 Technologies, Mid-Continent Instrument, Rockwell Collins, Sandel Avionics, Universal Avionics, Nighthawk Flight Systems, Leonardo S.p.A., and Thales. |