Thermal Scanners Market Report Scope & Overview:

Get More Information on Thermal Scanners Market - Request Sample Report

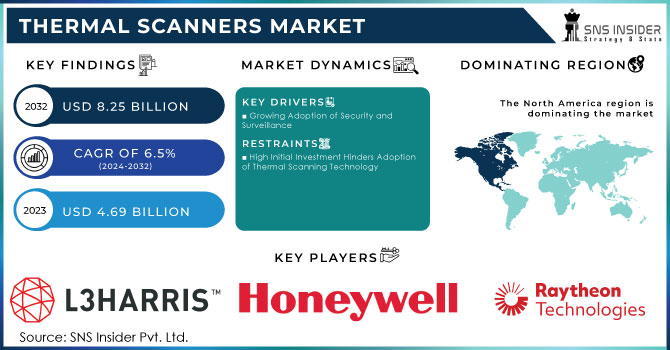

The Thermal Scanners Market Size was valued at USD 4.69 Billion in 2023 and is expected to reach USD 8.25 Billion by 2032 and grow at a CAGR of 6.5% over the forecast period 2024-2032.

Thermal cameras may prove to be a more discreet, efficient, and effective approach to identifying people with tests for viruses. Thermal screening technology has already been employed in facilities consisting of transportation agencies, factories, businesses, and government offices as part of EH&S and the EBT detection method. As most industries are on the verge of resuming operations with the loosening of lockdown restrictions, screening of employees is being done through thermal cameras. At least two companies - General Motors Company, and Wynn Resorts Ltd., admitted to their use of thermal scanners for screening purposes. Other companies experimenting with the use of thermal camera solutions that could be used once this pandemic is over include Tyson Foods Inc. and Intel Corp.

These solutions are deployed for security and surveillance besides increasing demand from the commercial and healthcare industry. For example, the investments into clean technology manufacturing in semiconductors are approximately double 2021 levels and almost 20-fold higher than their 2019 counterpart. Since the IRA was enacted, nearly 200 new clean technology manufacturing facilities have been announced, representing US$ 88 Billion in investment expected to create over 75,000 new jobs. The manufacturing industry construction spending rose highly after the laws were passed. In the past July 2023, the annual construction spending in manufacturing stood at US$ 201 billion and rose by 70% year-over-year, thus adequately preparing for further industry growth in 2024.

Thermal Scanners Market Dynamics

KEY DRIVERS:

-

Growing Adoption of Security and Surveillance

Thermal scanners are also widely applied in the security and surveillance sectors, especially in critical infrastructure, military, and defence uses. Since it can detect thermal signatures of warm objects even where visibility is low, security significantly improves, thus making it an apparatus in very high demand. Technology supports security and surveillance through the availability of different kinds of technical solutions that include alarms, devices for control of access, and video surveillance. The global information security products and services market was approximately 190 billion U.S. dollars in 2023 and stood at around 170 billion U.S. dollars for the year 2022. Video surveillance is one of the fastest-growing sub-segments, where IP video surveillance systems will generate high revenues, totaling 35% of the entire video surveillance market. A more recent profitable model that has emerged is video surveillance as a service (VSaaS), which further opens up the market while also indicating growing dependence on advanced technologies like thermal scanners in trying to craft safe and secure environments in various sectors.

RESTRAIN:

• High Initial Investment Hinders Adoption of Thermal Scanning Technology

The initial investment in thermal scanning technologies may prove to be very high. This ranges from the scanner appliances themselves to any software, installation, and training for personnel. Small and medium enterprises may not have an budgetary allocation for such technologies, thus narrowing penetration into the market. One of the major deterrents to the adoption of thermal scanning technology is its relatively high initial investment costs, which can fall between $2,000 and $25,000 per unit depending on the sophistication level of the system. Besides the cost of the scanners, companies also have costs for necessary software and installation and training needs, which collectively can add an additional 30% to 50% onto the initial expenditure. For instance, according to a recent survey, initial costs stand out as the most important barrier to implementing thermal scanning solutions, affecting around 68% of SMEs. In most cases, in fact, research findings indicate that most SMEs budget less than 10% of their annual budget for technology upgrades, thus making it quite difficult to justify investments in thermal scanning. This high upfront cost subsequently prevents extensive penetration in the market and slows up the general uptake of thermal scanning technology across various industries, even though a lot of potential lies in health and safety management.

Thermal Scanners Market Segmentation Overview

BY TYPE

The Fixed thermal scanner segment accounted for more than 64% of revenues in the year 2023, owing to increased adoption in industrial and healthcare industries. These scanners have managed to offer a versatile, accurate, and reliable scanning solution for continuous temperature measurement applications in ceramics, steel, and other processing industries. Further, they also reduce human interference and can be installed with systems that exist, such as security gates or biometric entrances.

The Portable thermal scanner segment is the fastest growing segment with the highest CAGR of 8.08%in the forecasted period 2024-2032 The device enables temperature capture at a distance encouraging the fact of social distancing, especially in crowded places. In one published study by the National Institutes of Health, thermal scanning to successfully detect individuals with higher than usual body temperatures has led to mass distribution of these devices- which includes airlines and workplaces for constant usage. It is with such devices that users can obtain easy readings from a safe distance, thereby promoting better social distancing, especially in crowded settings. Handheld thermal scanners would gain manifold use in an environment where companies continuously hope to improve security measures.

By Wavelength Type

Long-Wave Infrared (LWIR) the total revenue share, of more than 37% was registered in 2023 and is expected to sustain its dominance over the forecast period. Some of the advantages that LWIR possesses include low power, weight, and size as compared to MWIR. Furthermore, LWIR has been an important component for many decades in the defense and security sector as it can identify objects regardless of ambient lighting. Advances in the fabrication and at low cost have made LWIR scanners accessible to industrial and consumer applications easily.

The MWIR segment is expected to grow significantly during the review period. Generally, applications in long-range surveillance, satellite-based weather profile monitoring, medical diagnosis, and deforestation mapping use MWIR. The research and development undertaken with High Operating Temperature MWIR and dual-color detector designs enabled the use of cameras of both these technologies in wide applications previously dominated by LWIR cameras.

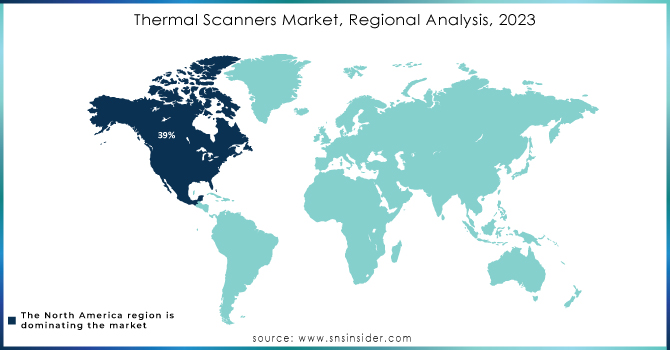

Thermal Scanners Market Regional Analysis

The North American regional market had the largest revenue share of over 39% in 2023. The U.S. is going to witness growth at an impressive rate due to the growth in the defence sector. The presence of leading companies like FLIR Systems, Inc.; Fluke Corporation; and L3harris Technologies, Inc. in the North American region is further boosting the growth in the regional market. The growing adoption of commercial applications in Canada is also expected to fuel the regional market. Recently, that is, in August 2019, British Columbia Ferry Services Inc. placed thermal-imaging cameras to monitor threatened marine mammals.

Asia Pacific is expected to grow at the highest CAGR over the forecast period. China accounted for the highest revenue share in the region. The growth can be attributed to various vendors offering low-cost solutions, which in turn is expected to increase demand in this pandemic. The breakout in China has led to an exponential demand for thermal scanners compelling companies towards mass production. The region is working in research and development to fight back the outbreak. Therefore, Wuhan Guide Infrared Co., Ltd declared that Chinese public transport infrastructure must be fitted with a thermal scanner system powered by AI facial detection technology.

Need any customization research on Thermal Scanners Market - Enquiry Now

Key Players in Thermal Scanners Market

Some of the major players in the Thermal Scanners Market are:

-

FLIR Systems, Inc. (FLIR E8-XT Thermal Imaging Camera, FLIR T540 Professional Thermal Camera)

-

Fluke Corporation (Fluke Ti401 PRO Thermal Camera, Fluke VT04 Visual IR Thermometer)

-

Testo SE & Co. KGaA (Testo 872 Thermal Imager, Testo 883 Thermal Imaging Camera)

-

Seek Thermal, Inc. (Seek Thermal Compact Pro, Seek ShotPRO Thermal Camera)

-

L3Harris Technologies, Inc. (L3Harris X200xp Handheld Imager, L3Harris Thermal Weapon Sight)

-

Axis Communications AB (AXIS Q2901-E Temperature Alarm Camera, AXIS Q8742-E Bispectral PTZ Network Camera)

-

Honeywell International Inc. (Honeywell T5 Smart Thermostat with Thermal Sensor, Honeywell ThermoRebellion Temperature Monitoring System)

-

Leonardo S.p.A. (Janus Full HD Thermal Camera, Leonardo Medusa Infrared Thermal Camera)

-

Thermoteknix Systems Ltd. (Thermoteknix FevIR Scan Fever Screening System, Thermoteknix Miricle 110K Thermal Imager)

-

InfraTec GmbH Infrarotsensorik und Messtechnik (InfraTec VarioCAM HD head, InfraTec ImageIR 9400)

-

Opgal Optronic Industries Ltd. (Opgal EyeCGas 2.0 Optical Gas Imaging Camera, Opgal Therm-App MD)

-

Raytheon Technologies Corporation (Raytheon Thermal Targeting System, Raytheon Integrated Thermal Imager)

-

Drägerwerk AG & Co. KGaA (Dräger UCF 9000 Thermal Imaging Camera, Dräger UCF 8000 Thermal Imaging Camera)

-

Bullard (Bullard T4 Max Thermal Imager, Bullard NXT Thermal Imager)

-

Thales Group (Sophie Ultima Thermal Binoculars, Thales Catherine XP Thermal Camera)

-

Optotherm, Inc. (Optotherm Thermalyze Fever Screening System, Optotherm Infrasight Thermal Camera)

-

NEC Corporation (NEC NeoFace Thermal Scanner, NEC HSR Thermal Scanning Robot)

-

Dali Technology (Dali S240 Handheld Thermal Imager, Dali T4 Thermal Camera)

-

Bosch Security Systems, Inc. (Bosch MIC Thermal 7000 HD Camera, Bosch DINION IP Thermal 8000 Camera)

-

Rapiscan Systems (Rapiscan ORION 920CX with Thermal Scanning Capability, Rapiscan 628XR Advanced Screening System)

RECENT TRENDS

-

In September 2024, Fluke Corporation introduced a new compact and versatile See Mobile Thermal Camera for safe and accurate on-site electrical inspection. This high-resolution thermal camera allows electricians, HVAC technicians, and contractors to access thermal imaging through their smartphones by accurately taking temperature measurements where it is hard to reach for inspection.

-

In December 2023, the developer of the eVTOL aircraft, Lilium, selected Honeywell for the supply of the thermal management system for its all-electric Lilium Jet. For cabin cooling and electric battery temperature regulation in the aircraft, Honeywell's MicroVCS was selected to optimize both cabin cooling and electric battery temperatures for improving efficiency and sustainability in flight.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 4.69 Billion |

| Market Size by 2032 | US$ 8.25 Billion |

| CAGR | CAGR of 6.5% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Vertical Type (Industrial, Commercial, Aerospace & Defence, Automotive, Healthcare & Life Sciences, Oil & Gas, Other Verticals) • By Wavelength Type (Short-Wave Infrared (SWIR), Mid-Wave Infrared (MWIR), Long-Wave Infrared (LWIR)) • By Application Type (Thermography, Security & Surveillance, Search & Rescue, Other Applications) • By Type (Fixed, Portable) • By Technology Type (Cooled, Uncooled) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | FLIR Systems, Inc., Fluke Corporation, Testo SE & Co. KGaA, Seek Thermal, Inc., L3Harris Technologies, Inc., Axis Communications AB, Honeywell International Inc., Leonardo S.p.A., Thermoteknix Systems Ltd., InfraTec GmbH Infrarotsensorik und Messtechnik, Opgal Optronic Industries Ltd., Raytheon Technologies Corporation, Drägerwerk AG & Co. KGaA, Bullard, Thales Group, Optotherm, Inc., NEC Corporation, Dali Technology, Bosch Security Systems, Inc., Rapiscan Systems |

| Key Drivers | • Growing Adoption of Security and Surveillance |

| Restraints | High Initial Investment Hinders Adoption of Thermal Scanning Technology |