Video Surveillance Storage Market Report Scope & Overview:

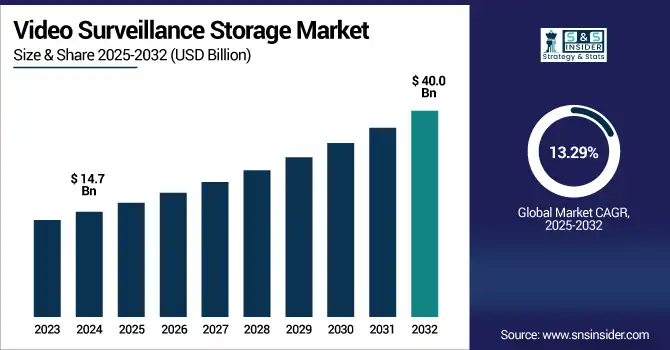

The video surveillance storage market size was valued at USD 14.7 billion in 2024 and is expected to reach USD 40.0 billion by 2032, growing at a CAGR of 13.29% during 2025-2032.

To Get more information on Video Surveillance Storage Market - Request Free Sample Report

The increasing focus on high-resolution surveillance cameras, rising security concerns, and growing smart city initiatives across the globe are some of the factors driving the video surveillance storage market growth. Balancing exploding use cases for video analytics and AI in surveillance systems increased demand for storage availability with larger scales, higher capacities, and real-time processing. With the explosion of video data, businesses and governments are investing heavily in on-premise and cloud-based storage infrastructures to handle the influx of information. Moreover, in several industries, robots are required by regulation to retain data for a longer period, driving up demand. Due to their flexibility and cost efficiency, hybrid storage models that combine the capabilities of edge and cloud are being adopted. The IT storage Market is gradually growing, predicting storage compression, AI-integrated storage systems, and 5G-enabled surveillance to revolutionize the next stage of technology progression and also the market growth.

The U.S. Video Surveillance Storage Market is witnessing strong momentum, due to increasing security requirements, a rising number of high-quality IP cameras being deployed, and a trend towards cloud and hybrid storage systems. In 2024, the U.S. market was valued at approximately USD 4.3 billion, reaching approximately USD 11.5 billion by 2032, reflecting a robust CAGR of about 13.06%. These developments underscore a dominant Video Surveillance Storage Market trend toward both public and private sectors towards scalable, intelligent, real-time data storage solutions.

Market Dynamics

Drivers:

-

Increased Use of High-Resolution Cameras Drives Demand for Larger and Smarter Storage Solutions

The increasing uptake of high-resolution IP cameras (4K and even 8K video surveillance devices) is generating a considerable increase in demand for storage at the enterprise level. This generates an avalanche of data from these cameras that needs a robust, expandable, value-for-money storage ecosystem. IHS Markit states that organizations from various industry sectors, such as government, transportation, retail, and BFSI, are increasingly deploying HD surveillance to improve public safety or loss prevention. Not only does this trend drive demand for bigger storage sizes, but also innovation in storage technologies such as compression algorithms (H.265), hybrid cloud models and edge storage. The surge in popularity of real-time analytics has led to more importance being placed on storing the video they require to operate.

Over 1.2 billion surveillance cameras were deployed globally in 2024, pushing massive video data creation that necessitates advanced storage capabilities

Restraints:

-

High Cost of Advanced Storage Infrastructure Limits Adoption Among Small and Mid-Sized Enterprises

High initial capex and operational cost on video surveillance storage solutions are a big hurdle for the capital-intensive market of video surveillance hardware solutions and an expense booster for the SMEs and price-sensitive market. High megapixel cameras require a lot of storage space, which means spending on fast server farms, networking, backup, and data centers. On top of that, compliance with data retention policies and cybersecurity standards can add another part to operational costs. While the scalability of cloud storage is appealing, ongoing subscription costs and bandwidth usage can also lead to a growing total cost of ownership over time. Such high costs usually tend to slow down adoption, especially in developing regions or among organizations having a small IT budget, thus limiting wider market penetration.

Opportunities:

-

Integration of AI and Analytics in Surveillance Enables Intelligent Storage Management and Reduces Redundancy

There is an opportunity for the market players due to the increasing integration of AI and video analytics into storage systems. Thereby, AI-enabled video surveillance not only enhances threat detection as well as real-time decision making but also contributes to smart data management. This will allow AI to identify and center essential video, thus facilitating intelligent storage allocation, lessening the repetition of data, and reducing total storage needs. It helps in faster data retrieval and improves the efficiency of the system. With the improving adoption of intelligent video surveillance by verticals such as transportation, healthcare, and city surveillance, vendors dealing in storage solutions that possess built-in analytics capabilities will continue to witness demand and an element of competitive differentiation.

A 2024 research study on an intelligent recording system combining motion and object detection (e.g., YOLOv9) showed it could reduce storage requirements by two-thirds compared to conventional recording methods, demonstrating powerful data efficiency gains

Challenges:

-

Growing Cybersecurity and Privacy Risks Impede Adoption of Cloud-Based and Networked Storage Systems

As organizations store and transmit larger volumes of surveillance data across networks, particularly cloud platforms, cybersecurity and data privacy risks have emerged as key issues. However, threats such as unauthorized access, hacking, ransomware attacks, and breach of personal privacy make it difficult to adopt video surveillance storage systems. With regulations like GDPR, HIPAA, and other regional data protection laws imposing strict obligations on enterprises, the need for strong encryption, high-grade access control, and periodic audits is essential. Deployment is also further complicated as hybrid or distributed storage infrastructures can be difficult to manage when it comes to security. Neglecting such issues can result in loss of consumer trust, legal repercussions, and harm to reputation.

Segmentation Analysis:

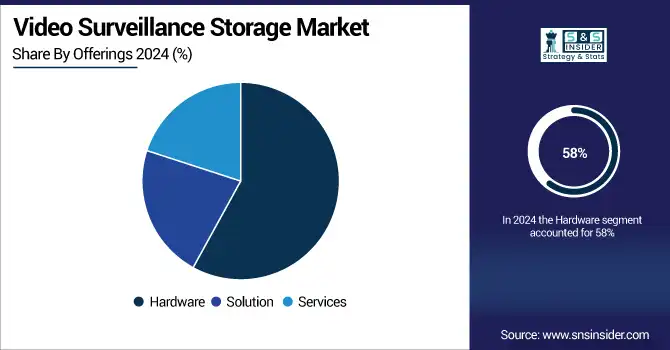

By Offerings:

The hardware segment dominated the market in 2024 and accounted for 58% of the video surveillance storage market share, owing to the large-scale deployment of IP Cameras, NVRs, DVRs, and local storage devices at a resolution above 5MP. The increasing demand from the public and private sectors will be driven by the expansion of security infrastructure. The pace of growth will stay consistent as physical devices continue to provide the building blocks for edge and hybrid surveillance storage solutions globally.

The solution segment is expected to register the fastest CAGR owing to the High initial adoption of intelligent storage management software, AI-powered analytics integration. The market will see even higher growth as organizations migrate towards cloud-based and hybrid architectures that require scalable, automated, and interoperable software solutions, pushing growth through 2032.

By Storage:

The SSD segment dominated the video surveillance storage market in 2024 and accounted for a significant revenue share, due to faster speed, sturdiness, and reliability, which is crucial in real-time surveillance applications and AI-enabled analytics, increasing widely. Continued demand is driven by growing deployments in mission-critical environments such as smart cities, transportation, and defense. The trend toward SSDs should continue as falling prices are bringing high-performance storage to more industries..

HDDs are expected to register the fastest CAGR, Due to their low cost and massive storage capacity ideal for long-term video archival. Adoption is being fueled by rising data retention regulations and mass installation of cameras, particularly in developing markets. Hybrid systems using HDDs for bulk storage and SSDs for active retrieval will underpin future growth.

By Enterprise Size:

Large enterprises dominated the video surveillance storage market in 2024 and accounted for 79% of revenue share, owing to comprehensive security infrastructure, high-definition surveillance systems, and adherence to compliance regulations. They spend a fortune on on-premise (on-prem), hybrid, and cloud-based storage for multi-site implementations. As organizations look for data-centric security solutions, this will remain a high-growth segment as well, where AI-derived visibility will augment monitoring and positioning through the integrated analytics with scalable storage architectures for centralized monitoring and archiving.

SMEs are expected to register the fastest CAGR as the Growing availability of cost-effective cloud storage, VSaaS, and plug-and-play IP camera systems. Entry barriers are lower for SMEs can scale video storage without significant capital outlay, due to pay-as-you-go models Furthermore, the transition to remote monitoring and increasing security awareness will even further accelerate SME adoption of solutions.

By Vertical:

The commercial sector dominated the video surveillance storage market in 2024 and accounted for a significant revenue share, owing to the widespread deployment of video surveillance systems in retail and hospitality, banking and financial institutions, and offices. Advanced storage solutions are needed due to requirements like high foot traffic, need of theft prevention, and compliance. Commercial enterprises will maintain a high level of demand through 2032 as artificial intelligence adoption will spur continued investments in smart buildings, facilities with remote monitoring, and cloud-based video management platforms.

The industrial segment is projected to grow at the fastest CAGR Due to widespread implementation of surveillance for operational safety, asset monitoring, and perimeter security in manufacturing, energy, and logistics. The demand is accelerating due to the increasing adoption of Industry 4.0 and the integration of AI-based analytics in the video store. Infrastructural developments and automation will further increase the storage needs.

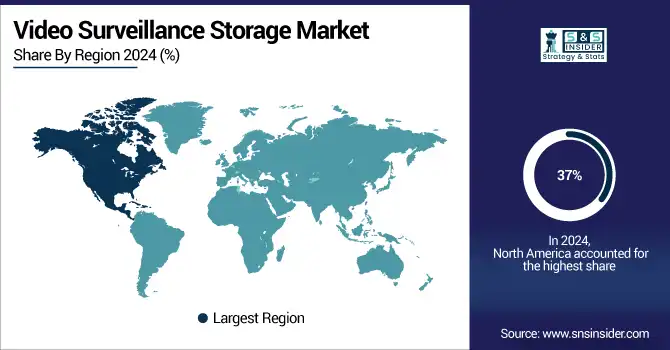

Regional Analysis:

North America dominated the video surveillance storage market in 2024 and accounted for 37% of the revenue share. Due to increased adoption of advanced surveillance systems, the high presence of leading storage and AI solutions providers, and compliance with regulations. Further demand is driven by government investments in smart cities, homeland security, and critical infrastructure. Ongoing enhancements of cloud and hybrid storage architectures will maintain regional dominance until 2032.

According to a video surveillance storage market analysis, Asia-Pacific is expected to register the fastest CAGR, owing to booming urbanization, infrastructure development, and growing safety concerns in China, India, and Southeast Asia. Market penetration is being expedited by government surveillance programs, efforts to create new industrial zones, and growing demand for low-cost IP-based systems. This will be followed by a rise in the demand for storage solutions industry due to increasing measures being taken by SME to adopt cloud storage solutions, supporting the regional growth.

Europe is witnessing steady growth as a result of stringent data protection regulations, rise in capital expenditure on public safety, and smart city surveillance programs. There is a growing demand for storage solutions that integrate AI and are built to meet GDPR requirements. This trend will help grow the market across the region with a hybrid storage architectures and secure cloud platforms.

The United Kingdom leads the European video surveillance storage market, due to Strong government surveillance initiatives, urban security demand, and quick adoption of video surveillance storage solutions, driving the revenue for the video surveillance storage market. Experiencing strong investments in smart infrastructure and AI-driven analytics, which are going to keep the UK, along with the US, firmly on the advanced video surveillance storage deployment map.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

The major video surveillance storage market companies are Seagate Technology Holdings PLC, Western Digital Corporation, Dell Technologies Inc., Hewlett Packard Enterprise (HPE), NetApp Inc., Hitachi Vantara LLC, Quantum Corporation, Avigilon, Hikvision Digital Technology Co. Ltd., Dahua Technology Co. Ltd., Hanwha Vision Co. Ltd., Bosch Security Systems, Axis Communications AB, Pelco Inc., Genetec Inc., Milestone Systems A/S, Vivotek Inc., Eagle Eye Networks Inc., QNAP Systems Inc., Synology Inc.and others.

|

Report Attributes |

Details |

|

Market Size in 2024 |

US$ 14.7 Billion |

|

Market Size by 2032 |

US$ 40.0 Billion |

|

CAGR |

CAGR of 13.29% From 2025 to 2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Historical Data |

2021-2023 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Offerings (Hardware, Solution, Services) |

|

Regional Analysis/Coverage |

North America (US, Canada), Europe (Germany, France, UK, Italy, Spain, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, ASEAN Countries, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar,Egypt, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America) |

|

Company Profiles |

Seagate Technology Holdings PLC, Western Digital Corporation, Dell Technologies Inc., Hewlett Packard Enterprise (HPE), NetApp Inc., Hitachi Vantara LLC, Quantum Corporation, Avigilon, Hikvision Digital Technology Co. Ltd., Dahua Technology Co. Ltd., Hanwha Vision Co. Ltd., Bosch Security Systems, Axis Communications AB, Pelco Inc., Genetec Inc., Milestone Systems A/S, Vivotek Inc., Eagle Eye Networks Inc., QNAP Systems Inc., Synology Inc.and others in the report |