Wellness Management Apps Market Report Scope & Overview:

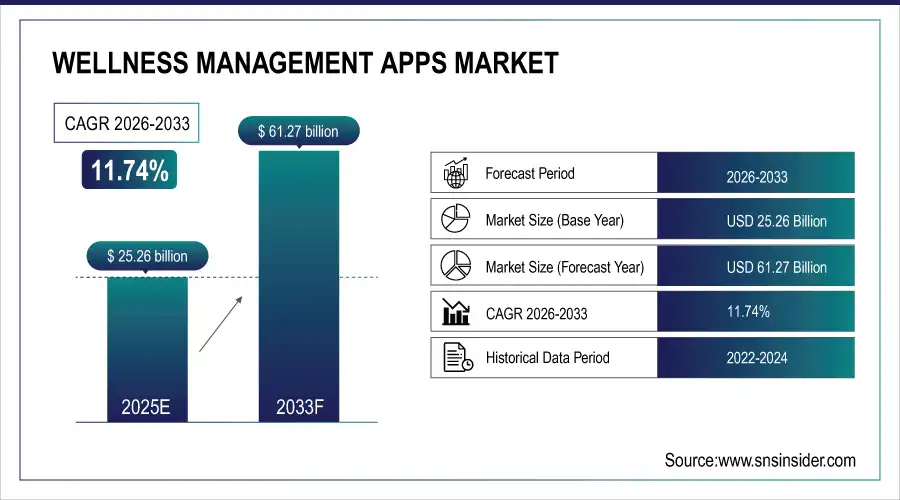

Wellness Management Apps Market is valued at USD 25.26 billion in 2025E and is expected to reach USD 61.27 billion by 2033, growing at a CAGR of 11.74% from 2026-2033.

The growth of the wellness management apps market is driven by rising consumer focus on preventive healthcare, mental well-being, and lifestyle disease management. Increasing smartphone penetration, widespread use of wearable devices, and improved internet connectivity are expanding user access and engagement. Employers and insurers are adopting digital wellness platforms to reduce healthcare costs and improve workforce productivity. Additionally, advancements in AI-driven personalization, data analytics, and remote health monitoring, along with growing awareness of fitness, stress management, and holistic wellness, are accelerating sustained market growth.

87% of wellness management app providers reported accelerated growth fueled by consumer demand for preventive care, AI-powered personalization, and enterprise adoption solidifying digital wellness as a cornerstone of modern health engagement globally.

Wellness Management Apps Market Size and Forecast

-

Market Size in 2025E: USD 25.26 Billion

-

Market Size by 2033: USD 61.27 Billion

-

CAGR: 11.74% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On Wellness Management Apps Market - Request Free Sample Report

Wellness Management Apps Market Trends

-

Rising adoption of AI-driven wellness apps providing personalized health insights, fitness tracking, and mental wellbeing recommendations

-

Increasing integration of wearable devices to monitor real-time biometrics, sleep patterns, and physical activity within apps

-

Growing preference for holistic wellness platforms combining nutrition, fitness, mindfulness, and mental health support in a single app

-

Expansion of subscription-based and freemium models enabling broader access to premium wellness features and personalized plans

-

Integration of telehealth services for virtual consultations, therapy sessions, and remote health monitoring within wellness apps

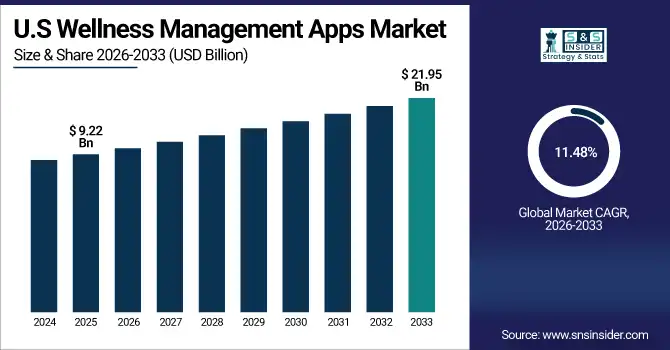

U.S. Wellness Management Apps Market is valued at USD 9.22 billion in 2025E and is expected to reach USD 21.95 billion by 2033, growing at a CAGR of 11.48% from 2026-2033.

The U.S. wellness management apps market is growing due to strong consumer emphasis on fitness, mental health, and preventive care. High smartphone and wearable adoption, rising employer-sponsored wellness programs, and increased healthcare digitization support demand. AI-based personalization, remote monitoring features, and growing acceptance of subscription-based digital health solutions further drive sustained market expansion.

Wellness Management Apps Market Growth Drivers:

-

Rising awareness of mental health, fitness tracking, and preventive healthcare is increasing adoption of wellness management apps among health-conscious consumers worldwide

Consumers are increasingly prioritizing physical and mental well-being, creating strong demand for digital tools that monitor health, track fitness, and encourage preventive care. Wellness management apps provide personalized workout plans, meditation guidance, nutrition tracking, and stress management support, helping users achieve holistic health goals. The global focus on lifestyle diseases and mental health awareness has further accelerated app adoption. Governments, healthcare providers, and fitness organizations are promoting digital health solutions, enabling widespread acceptance. This growing emphasis on self-care and proactive health monitoring continues to drive growth in the wellness management app market globally.

84% of health-conscious consumers actively used wellness management apps driven by heightened awareness of mental well-being, fitness tracking, and preventive care propelling global adoption and reinforcing digital health as a mainstream component of personal wellness.

-

Growing smartphone penetration and widespread internet connectivity enable easy access to digital wellness platforms, supporting continuous user engagement and market growth

The proliferation of smartphones, tablets, and wearable devices has made wellness apps more accessible to users across demographics. High-speed internet and mobile network expansion, especially in emerging markets, allow seamless app downloads, real-time health tracking, and cloud-based data synchronization. These technological enablers support continuous engagement, personalized notifications, and remote health monitoring, making wellness apps convenient and attractive. As digital literacy increases and devices become more affordable, more consumers are integrating wellness apps into daily routines, boosting adoption and encouraging app developers to introduce innovative features, ultimately driving market expansion.

86% of global wellness app users accessed digital health platforms via smartphones powered by near-ubiquitous internet connectivity and rising mobile adoption fueling consistent engagement and accelerating market expansion worldwide.

Wellness Management Apps Market Restraints:

-

Data privacy concerns, cybersecurity risks, and lack of user trust limit adoption of wellness apps, especially those handling sensitive personal health information

Wellness management apps collect extensive personal data, including fitness metrics, dietary habits, and medical information, which raises privacy concerns. Users are increasingly wary of data breaches, unauthorized sharing, or misuse of sensitive health information. Strict data protection regulations, such as GDPR and HIPAA, require apps to implement robust security measures, increasing development costs. A lack of trust in app reliability and data confidentiality may discourage adoption, particularly among older or privacy-conscious users. Addressing cybersecurity challenges and demonstrating secure, transparent data practices is essential for enhancing credibility and increasing market penetration.

70% of potential users hesitated to adopt wellness apps that collect sensitive health data citing data privacy concerns, cybersecurity vulnerabilities, and insufficient transparency significantly constraining market penetration and user trust.

-

Low user retention rates and limited long-term engagement reduce revenue stability and challenge sustainable growth for wellness management app providers

Despite high initial downloads, many wellness apps experience low user retention due to loss of interest, complex interfaces, or limited personalized content. Users may abandon apps after a short period, affecting recurring subscription revenues and overall profitability. Maintaining engagement requires continuous updates, gamification, social community integration, and personalized wellness recommendations. Low retention rates make it challenging for developers to achieve sustainable growth and attract long-term investors. Companies must focus on enhancing user experience, delivering meaningful insights, and providing ongoing motivation to maintain engagement and ensure steady revenue streams in a competitive market.

74% of wellness app providers struggled with user retention over 60% of users discontinued use within three months undermining revenue predictability and posing a critical barrier to long-term, sustainable growth.

Wellness Management Apps Market Opportunities:

-

Integration of AI, personalized analytics, and wearable devices creates opportunities to deliver customized wellness insights and improve user experience significantly

The integration of artificial intelligence (AI) and advanced analytics in wellness apps enables personalized recommendations based on user activity, health metrics, and behavioral patterns. Wearable devices provide real-time data, including heart rate, sleep quality, and physical activity, enhancing app accuracy and user engagement. AI-driven insights help users set achievable goals, monitor progress, and receive timely alerts or motivational nudges. This combination of technology and personalization improves adherence, encourages proactive health management, and differentiates app offerings. Developers leveraging these innovations can capture a larger market share and create premium subscription models.

82% of leading wellness apps leveraged AI-driven analytics, real-time wearable data, and behavioral personalization delivering hyper-customized insights that enhanced user engagement, adherence, and overall health outcomes.

-

Rising corporate wellness programs and employer-sponsored digital health initiatives provide opportunities for wellness apps to expand enterprise adoption and recurring revenues

Organizations worldwide are investing in employee wellness programs to improve productivity, reduce absenteeism, and enhance job satisfaction. Wellness management apps are increasingly integrated into corporate health initiatives, offering personalized fitness tracking, stress management, and virtual health coaching. These enterprise partnerships provide predictable revenue streams for app developers while expanding their user base. With the growing focus on workplace well-being and preventive healthcare, corporate adoption presents significant market potential. Developers can also offer white-label solutions or analytics dashboards for employers, enabling long-term collaborations and strengthening the overall growth prospects of the wellness management app market.

77% of large employers integrated wellness apps into corporate health programs driving enterprise adoption, boosting user retention, and creating stable recurring revenue streams for digital health platforms.

Wellness Management Apps Market Segment Highlights

-

By App Type: Fitness & Activity Tracking Apps led with 36.8% share, while Mental Wellness & Meditation Apps are the fastest-growing segment with CAGR of 15.4%.

-

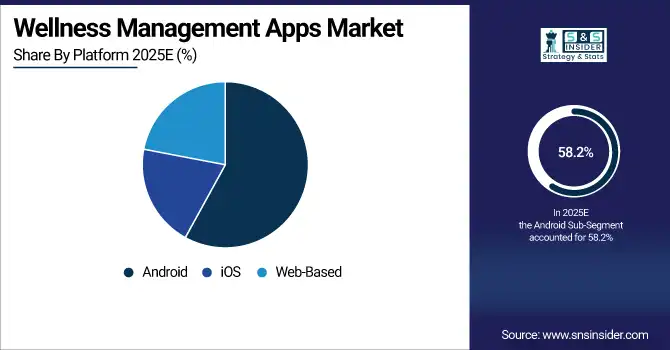

By Platform: Android led with 58.2% share, while iOS is the fastest-growing segment with CAGR of 14.6%.

-

By Deployment Model: Freemium led with 47.5% share, while Subscription-Based apps are the fastest-growing segment with CAGR of 16.1%.

-

By End User: Individuals led with 54.9% share, while Corporate / Employee Wellness Programs are the fastest-growing segment with CAGR of 17.3%.

Wellness Management Apps Market Segment Analysis

By App Type: Fitness & Activity Tracking Apps led, while Mental Wellness & Meditation Apps are the fastest-growing segment.

Fitness & Activity Tracking Apps dominate the wellness management apps market due to their broad user base, daily engagement levels, and integration with wearable devices such as smartwatches and fitness bands. These apps support step counting, calorie tracking, heart rate monitoring, and personalized fitness goals, making them highly attractive to health-conscious individuals. Their ease of use, freemium availability, and compatibility across platforms drive widespread adoption. Growing awareness of preventive healthcare and lifestyle disease management continues to sustain their leadership across both developed and emerging markets.

Mental Wellness & Meditation Apps are the fastest-growing category due to rising awareness of mental health, stress management, and emotional well-being. Increasing work-related stress, anxiety, and sleep disorders have accelerated demand for mindfulness, meditation, and cognitive behavioral therapy-based digital solutions. These apps offer guided sessions, AI-driven personalization, and discreet access to therapy support, appealing strongly to younger demographics. Corporate mental health initiatives and healthcare provider partnerships further support growth, positioning mental wellness apps as a critical and rapidly expanding segment of the digital wellness ecosystem.

By Platform: Android led, while iOS is the fastest-growing segment.

Android dominates the platform segment due to its extensive global user base, affordability of Android devices, and strong penetration in emerging economies. Wellness apps on Android benefit from wide accessibility, flexible development environments, and integration with numerous third-party wearables and health sensors. The platform’s dominance is further supported by freemium models and localized app offerings, which encourage mass adoption. Android’s presence across low- to mid-priced smartphones enables wellness app providers to reach diverse demographic groups, reinforcing its leadership in the global wellness management apps market.

iOS is the fastest-growing platform driven by higher consumer spending power, strong app monetization potential, and premium user experience. iOS users demonstrate greater willingness to subscribe to paid wellness services, particularly for fitness coaching, mental wellness, and chronic disease management. Seamless integration with Apple Health, Apple Watch, and other ecosystem features enhances data accuracy and user engagement. Growth is further supported by strong privacy standards and enterprise adoption, making iOS increasingly attractive for developers targeting high-value consumers and corporate wellness solutions.

By Deployment Model: Freemium led, while Subscription-Based apps are the fastest-growing segment.

Freemium models dominate the deployment landscape as they lower entry barriers and enable users to experience core features before committing financially. This approach supports rapid user acquisition and high engagement across fitness, nutrition, and mental wellness apps. Free basic access combined with optional premium upgrades appeals to price-sensitive users while allowing developers to upsell advanced analytics, coaching, and personalization features. The model’s flexibility, scalability, and compatibility with advertising and in-app purchases have made it the preferred deployment strategy across global wellness app platforms.

Subscription-based models are growing fastest due to increasing consumer demand for continuous, personalized wellness support and premium content. Users are willing to pay recurring fees for advanced features such as AI-driven insights, live coaching, mental health programs, and long-term health tracking. Predictable revenue streams encourage developers to invest in content quality and innovation. Corporate wellness adoption and insurer-backed wellness programs further accelerate subscription growth, making this model increasingly central to the monetization strategies of leading wellness management app providers.

By End User: Individuals led, while Corporate / Employee Wellness Programs are the fastest-growing segment.

Individuals dominate the end-user segment as personal health awareness and self-managed wellness routines continue to rise globally. Consumers increasingly rely on wellness apps for daily fitness tracking, diet planning, mental health support, and sleep improvement. The widespread availability of smartphones, wearables, and affordable internet access has fueled individual adoption. Personalized dashboards, goal tracking, and real-time feedback enhance user engagement. This segment’s dominance is reinforced by preventive healthcare trends and a growing preference for convenient, on-demand wellness solutions tailored to personal lifestyles.

Corporate / Employee Wellness Programs are the fastest-growing end-user segment as organizations prioritize workforce health, productivity, and stress reduction. Employers increasingly deploy wellness apps to support physical fitness, mental well-being, and chronic condition management among employees. These programs reduce absenteeism, improve engagement, and lower healthcare costs. Integration with HR platforms, data analytics, and incentive-based participation further drives adoption. As workplace wellness becomes a strategic priority, corporate demand for scalable, data-driven wellness app solutions is accelerating rapidly across global enterprises.

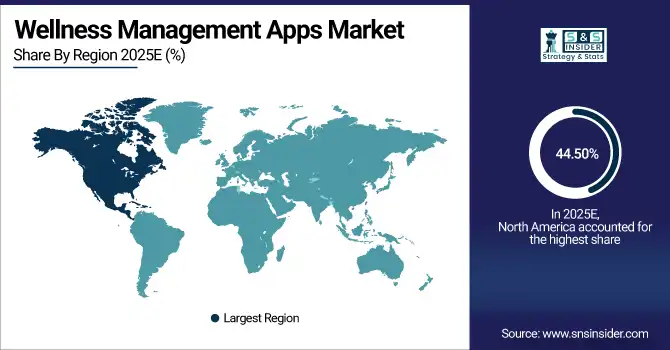

Wellness Management Apps Market Regional Analysis

North America Wellness Management Apps Market Insights:

North America dominated the Wellness Management Apps Market with a 44.50% share in 2025 due to high smartphone penetration, widespread adoption of digital health technologies, and strong consumer awareness of fitness and preventive healthcare. The presence of leading app developers, advanced healthcare infrastructure, and supportive digital wellness initiatives further reinforced regional leadership.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia Pacific Wellness Management Apps Market Insights

Asia Pacific is expected to grow at the fastest CAGR of about 13.91% from 2026–2033, driven by rising health awareness, increasing smartphone and internet penetration, and expanding adoption of wearable devices. Growing investment in digital health infrastructure, government initiatives promoting wellness, and increasing demand for personalized fitness and nutrition solutions accelerate market growth in the region.

Europe Wellness Management Apps Market Insights

Europe held a significant share in the Wellness Management Apps Market in 2025, supported by high digital health adoption, strong consumer awareness of fitness and preventive healthcare, and a well-developed app ecosystem. Government initiatives promoting digital wellness, wearable device usage, and increasing investments in telehealth and mobile health solutions further strengthened the region’s market position.

Middle East & Africa and Latin America Wellness Management Apps Market Insights

The Middle East & Africa and Latin America together showed steady growth in the Wellness Management Apps Market in 2025, driven by rising smartphone and internet penetration, increasing health awareness, and expanding digital health infrastructure. Growing adoption of mobile fitness and nutrition apps, combined with supportive government initiatives and emerging wellness-focused consumer trends, contributed to the regions’ market expansion.

Wellness Management Apps Market Competitive Landscape:

Google plays a significant role in the wellness management apps market through platforms such as Google Fit and its broader digital health ecosystem. The company leverages advanced data analytics, artificial intelligence, and cloud capabilities to track physical activity, heart health, and lifestyle patterns. Google’s wellness solutions integrate seamlessly with Android devices and third-party apps, enabling personalized health insights. Its strong focus on data-driven wellness, user engagement, and interoperability supports large-scale adoption across global consumer markets.

-

September 2024, Google relaunched Google Fit on Android and Wear OS with an AI Wellness Coach that provides personalized, contextual health nudges based on activity, sleep, heart rate, and user goals.

Apple Inc.

Apple Inc. is a major player in wellness management apps through its Apple Health and Fitness ecosystem. The company integrates hardware, software, and services to deliver comprehensive wellness tracking, including activity monitoring, heart health, sleep analysis, and mindfulness features. Apple emphasizes privacy, user-friendly design, and seamless device integration across iPhones, Apple Watch, and other devices. Its focus on preventive healthcare and personalized wellness insights has strengthened its position in the global digital wellness market.

-

June 2025, Apple enhanced Apple Health and Fitness apps with Mindful Minutes tracking, custom wellness goals, and deeper third-party app integration via HealthKit.

MyFitnessPal

MyFitnessPal is a widely used wellness management app focused on nutrition tracking, fitness monitoring, and weight management. The platform offers extensive food databases, calorie tracking, and integration with wearable devices and fitness apps. MyFitnessPal supports personalized goal setting and data-driven insights to help users maintain healthier lifestyles. Its strong global user base, intuitive interface, and focus on dietary awareness and activity tracking make it a prominent solution in the wellness management apps market.

-

October 2023, MyFitnessPal launched its AI Nutritionist, a generative AI assistant that offers personalized meal feedback, macro balancing, and habit coaching directly within the app.

Wellness Management Apps Market Key Players

Some of the Wellness Management Apps Market Companies are:

-

Mindscape

-

Calm

-

Headspace Inc.

-

Google

-

Apple Inc.

-

Withings

-

MyFitnessPal

-

Noom

-

BetterMe

-

Dacadoo

-

Ping An Good Doctor

-

Appster

-

Under Armour Inc.

-

Kayla Itsines

-

Sleepace

-

Lifesum

-

8fit

-

Talkspace

-

Meditopia

-

Clue

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 25.26 Billion |

| Market Size by 2033 | USD 61.27 Billion |

| CAGR | CAGR of 11.74% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By App Type (Fitness & Activity Tracking Apps, Nutrition & Diet Management Apps, Mental Wellness & Meditation Apps, Sleep Tracking Apps, Chronic Condition Management Apps) • By Platform (Android, iOS, Web-Based) • By Deployment Model (Subscription-Based, Freemium, Paid Apps) • By End User (Individuals, Corporate / Employee Wellness Programs, Healthcare Providers, Insurance Companies) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Mindscape, Calm, Headspace Inc., Google, Apple Inc., Withings, MyFitnessPal, Noom, BetterMe, Dacadoo, Ping An Good Doctor, Appster, Under Armour Inc., Kayla Itsines, Sleepace, Lifesum, 8fit, Talkspace, Meditopia, Clue |