Zero Liquid Discharge Systems Market Report Scope & Overview:

Get E-PDF Sample Report on Zero Liquid Discharge Systems Market - Request Sample Report

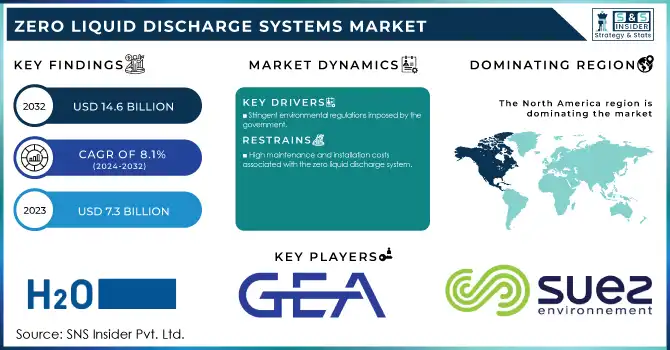

The Zero Liquid Discharge Systems Market Size was valued at USD 7.25 Billion in 2023 and is expected to reach USD 14.54 Billion by 2032, growing at a CAGR of 8.04% over the forecast period of 2024-2032.

The Zero Liquid Discharge System Market is growing rapidly due to strict environmental regulations and industrial sustainability goals. Our report presents a cost analysis and price trends, detailing installation, operational expenses, and pricing shifts. The impact of government regulations and compliance data is examined, alongside grants and incentives for Zero Liquid Discharge systems, easing financial constraints. A thorough economic and environmental impact analysis showcases cost savings and resource efficiency. The role of digitalization and smart technologies is explored, highlighting automation, IoT, and AI-driven advancements. Lastly, a benchmarking analysis against competing technologies assesses the cost, performance, and scalability of Zero Liquid Discharge systems compared to alternative wastewater treatment solutions.

Market Dynamics

Drivers

-

Growing Water Scarcity and Depleting Freshwater Resources Drive Zero Liquid Discharge System Market Expansion

Rising water scarcity due to climate change, rapid urbanization, and industrialization is a major factor driving the adoption of Zero Liquid Discharge Systems. Industries dependent on large water volumes for operations, such as power generation, oil and gas, and chemical manufacturing, face mounting pressure to optimize water consumption and reduce wastewater discharge. Zero Liquid Discharge Systems help industries recycle and reuse wastewater, ensuring sustainable water management amid growing freshwater shortages. Many countries are implementing stringent water conservation policies, encouraging industries to adopt advanced Zero Liquid Discharge System technologies to minimize water wastage. Furthermore, growing investments in desalination and water reuse projects are fueling market demand. Companies are leveraging Zero Liquid Discharge System solutions to address water-intensive processes, enhance operational efficiency, and reduce dependency on external freshwater sources. As global water stress continues to rise, industries are increasingly adopting Zero Liquid Discharge Systems to meet regulatory standards, maintain production continuity, and achieve long-term water sustainability.

Restraints

-

Complexity in System Design and Integration Limits the Zero Liquid Discharge System Market Growth

Zero Liquid Discharge Systems involve a combination of multiple water treatment technologies, making their design, installation, and operation highly complex. Industries require customized solutions based on wastewater composition, production scale, and regulatory requirements, leading to prolonged implementation timelines and increased engineering challenges. The integration of various treatment processes, such as membrane filtration, reverse osmosis, thermal evaporation, and crystallization, necessitates advanced technical expertise. Additionally, system malfunctions, inefficiencies in water recovery rates, and scaling issues in heat exchangers pose operational risks. The complexity of Zero Liquid Discharge Systems often discourages industries from adopting them, especially when alternative wastewater treatment options offer simpler implementation. The lack of skilled professionals and insufficient technical knowledge further hinder market growth, making it difficult for companies to achieve seamless system integration and optimize performance.

Opportunities

-

Government Incentives and Public-Private Partnerships Foster Zero Liquid Discharge System Market Growth

Governments worldwide are offering financial incentives, subsidies, and funding programs to encourage industries to implement Zero Liquid Discharge Systems. Public-private partnerships are playing a crucial role in supporting the adoption of advanced wastewater treatment technologies, particularly in water-stressed regions. Incentives such as tax credits, low-interest loans, and grants are reducing the financial burden on industries, making Zero Liquid Discharge Systems more accessible. Additionally, international organizations and environmental agencies are collaborating with industries to develop cost-effective and scalable Zero Liquid Discharge System solutions. The expansion of government-led water conservation initiatives and wastewater treatment infrastructure is further driving market growth. With increasing support from regulatory bodies, industries are expected to accelerate the adoption of Zero Liquid Discharge System technologies, creating lucrative opportunities for market players.

Challenge

-

Energy-Intensive Operations and Sustainability Concerns Pose Challenges for the Zero Liquid Discharge System Market

Zero Liquid Discharge Systems require high energy consumption for processes such as evaporation, crystallization, and membrane filtration, leading to concerns regarding sustainability and operational efficiency. Industries with limited energy resources find it challenging to integrate Zero Liquid Discharge Systems without significantly increasing their carbon footprint. The dependency on thermal-based technologies further escalates electricity costs, making Zero Liquid Discharge System solutions less viable for cost-sensitive industries. Companies are actively seeking energy-efficient alternatives and renewable energy integration to mitigate high power consumption. However, technological advancements are still needed to develop Zero Liquid Discharge Systems with reduced energy dependence. Until sustainable energy solutions become mainstream, high energy requirements will continue to challenge the market’s growth trajectory.

Segmental Analysis

By System

Conventional Zero Liquid Discharge Systems dominated the market in 2023 with a 60% share. Their dominance is attributed to their proven efficiency, cost-effectiveness, and widespread adoption in industries with high wastewater discharge. Many regulatory bodies, such as the Environmental Protection Agency (EPA) in the United States and the European Environment Agency, have imposed strict wastewater discharge norms, compelling industries to implement these systems. Conventional systems, which utilize thermal evaporation and crystallization, are preferred in power plants and chemical manufacturing units due to their ability to handle high-salinity wastewater. For instance, in India, the National Green Tribunal (NGT) has mandated Zero Liquid Discharge Systems for textile and dyeing industries in states like Tamil Nadu, boosting the adoption of conventional systems over hybrid solutions.

By Process

Crystallization/Evaporation dominated the Zero Liquid Discharge Systems Market in 2023, holding a 36.5% market share. This dominance is driven by the process's ability to recover maximum reusable water while converting wastewater into solid waste for safe disposal. Industries such as power generation and chemicals rely on evaporation and crystallization to achieve stringent Zero Liquid Discharge mandates. The increasing adoption of thermal evaporation systems in water-scarce regions, such as the Middle East, is further accelerating demand. Additionally, organizations like the United Nations Industrial Development Organization (UNIDO) promote energy-efficient crystallization technologies to enhance sustainability in industrial wastewater treatment. The U.S. Department of Energy has also funded research into advanced evaporation methods to improve energy efficiency in Zero Liquid Discharge applications.

By Technology

Membrane-based dominated the Zero Liquid Discharge Systems market in 2023, accounting for 53.4% market share. Their dominance is fueled by their lower energy consumption compared to thermal-based systems and increasing advancements in membrane filtration technology. Reverse osmosis (RO) and nanofiltration (NF) are widely adopted in industries such as pharmaceuticals, textiles, and food and beverages to achieve high water recovery rates before the final evaporation stage. Government initiatives promoting sustainable water treatment, such as the European Union’s Water Framework Directive, have encouraged industries to integrate membrane-based systems. Moreover, companies like Veolia Water Technologies and Suez are investing in advanced membrane separation techniques, further driving the adoption of this technology in Zero Liquid Discharge applications.

By End-use Industry

The Energy & Power segment dominated the Zero Liquid Discharge Systems Market in 2023 with a 21.5% share. This leadership is driven by the sector's high-water consumption and stringent regulations for wastewater discharge. Thermal power plants and coal-fired stations require Zero Liquid Discharge Systems to comply with wastewater disposal mandates set by regulatory authorities like the U.S. Environmental Protection Agency (EPA) and India’s Central Pollution Control Board (CPCB). For example, China’s Ministry of Ecology and Environment has enforced strict Zero Liquid Discharge policies for coal-based power plants to mitigate water pollution. Furthermore, growing investments in renewable energy projects and sustainable water management practices have further accelerated the adoption of Zero Liquid Discharge Systems in the energy sector.

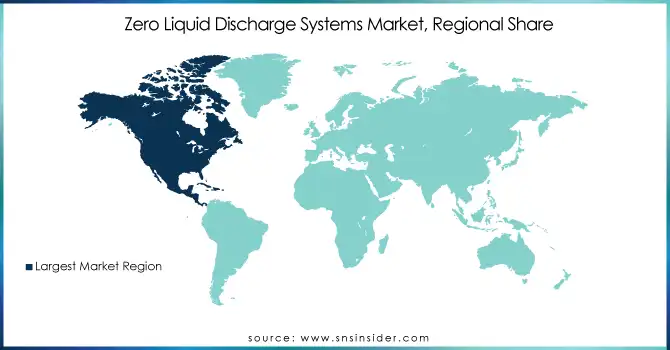

Regional Analysis

Asia Pacific dominated the Zero Liquid Discharge Systems Market in 2023, holding a market share of 38.7%. The region's dominance is driven by rapid industrialization, stringent environmental regulations, and severe water scarcity issues in key countries. China, the largest contributor, has implemented strict wastewater management policies, such as the Water Pollution Prevention and Control Action Plan, enforcing Zero Liquid Discharge in industries like power generation, textiles, and chemicals. The Ministry of Ecology and Environment in China has mandated Zero Liquid Discharge Systems for new coal-fired power plants, boosting adoption. India is another major player, with the National Green Tribunal enforcing Zero Liquid Discharge in industries like pharmaceuticals and textiles, particularly in Tamil Nadu and Gujarat. According to the Central Pollution Control Board (CPCB), over 75% of industrial wastewater in India is now treated using advanced systems. Southeast Asian nations, including Indonesia and Thailand, are also implementing stricter wastewater discharge laws, further propelling the demand for Zero Liquid Discharge Systems.

Looking ahead, North America emerged as the fastest-growing region in the Zero Liquid Discharge Systems Market, projected to register a significant CAGR during the forecast period. This growth is driven by increasing regulatory pressures, rising water reuse initiatives, and growing investments in sustainable wastewater treatment technologies. The United States is the dominant country in the region, with the Environmental Protection Agency (EPA) enforcing stringent wastewater discharge standards under the Clean Water Act. Power plants, oil refineries, and chemical manufacturers in the U.S. are mandated to implement Zero Liquid Discharge Systems to meet compliance requirements. The U.S. Department of Energy has invested significantly in research on advanced membrane-based and thermal-based Zero Liquid Discharge technologies to enhance efficiency. Canada is also seeing growing adoption, particularly in the oil sands industry, where the Alberta Energy Regulator has imposed strict water reuse guidelines. Increasing investments in industrial water recycling and sustainable water management solutions are expected to drive further growth in North America.

Get Customized Report as Per Your Business Requirement - Request For Customized Report

Key Players

-

Alfa Laval (AlfaFlash Evaporator, Spiral Heat Exchangers)

-

Aqua Filsep Inc. (Zero Liquid Discharge Evaporators, Multi-Effect Evaporation Systems)

-

Aquarion AG (Zero Liquid Discharge Reverse Osmosis Systems, High Recovery Evaporation Systems)

-

Aquatech International LLC (Aquavap Evaporators, High-Efficiency Evaporation Systems)

-

Arvind Envisol–Samco Technologies, Inc. (Multiple Effect Evaporators, Membrane-Based Zero Liquid Discharge Systems)

-

Condorchem Envitech (Vacuum Evaporators, Crystallization Systems)

-

Evoqua Water Technologies (Brine Concentrators, Reverse Osmosis Zero Liquid Discharge Systems)

-

Fluence Corporation Limited (Nirobox Membrane Systems, Self-Contained Zero Liquid Discharge Units)

-

GEA Group AG (Mechanical Vapor Recompression Evaporators, Falling Film Evaporators)

-

GE Water & Process Technologies (now SUEZ) (Vaprox Evaporators, Brine Concentrators)

-

Goldfinch Evaporators (Thermal Evaporators, Forced Circulation Evaporators)

-

H2O GmbH (Vacudest Vacuum Evaporators, Clearcat Technology)

-

Hydro Air Research (High Recovery Reverse Osmosis Systems, Zero Liquid Discharge Filtration Units)

-

Lenntech (Advanced Membrane Systems, High Recovery Desalination Units)

-

Praj Industries (Hybrid Zero Liquid Discharge Systems, Membrane Distillation Systems)

-

SafBon Water Technology (Integrated Zero Liquid Discharge Solutions, Membrane Bioreactor Reverse Osmosis Based Zero Liquid Discharge Systems)

-

Shiva Global Environmental Private Limited (Thermal Evaporation Systems, Effluent Recycling Systems)

-

Thermax Limited (Thermal Desalination Systems, Multiple Effect Evaporation)

-

Toshiba Infrastructure Systems & Solutions Corporation (Brine Management Systems, Wastewater Recovery Units)

-

Veolia Water Technologies (HPD Evaporation Systems, Opus Zero Liquid Discharge Technology)

Recent Developments

-

July 2024: UCC Environmental and Vacom Systems formed a strategic partnership to improve Zero Liquid Discharge technology in power generation. The collaboration aims to enhance wastewater management solutions, aligning with environmental regulations and sustainability goals.

-

March 2024: The Energy and Resources Institute (TERI) introduced new technology for achieving Zero Liquid Discharge in industrial wastewater. The innovation aims to help industries meet Central Pollution Control Board standards, particularly for textile and effluent treatment plants.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 7.25 Billion |

| Market Size by 2032 | USD 14.54 Billion |

| CAGR | CAGR of 8.04% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By System (Hybrid, Conventional) •By Process (Pre-treatment, Filtration, Crystallization/Evaporation) •By Technology (Membrane Based, Thermal Based) •By End-use Industry (Energy & Power, Food & Beverages, Chemicals & Petrochemicals, Pharmaceutical, Textiles, Oil and Gas, Metallurgy & Mining, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Aquatech International LLC, Alfa Laval, Praj Industries, H2O GmbH, Evoqua Water Technologies, GEA Group AG, Veolia Water Technologies, Thermax Limited, GE Water & Process Technologies (now SUEZ), Aqua Filsep Inc. and other key players |