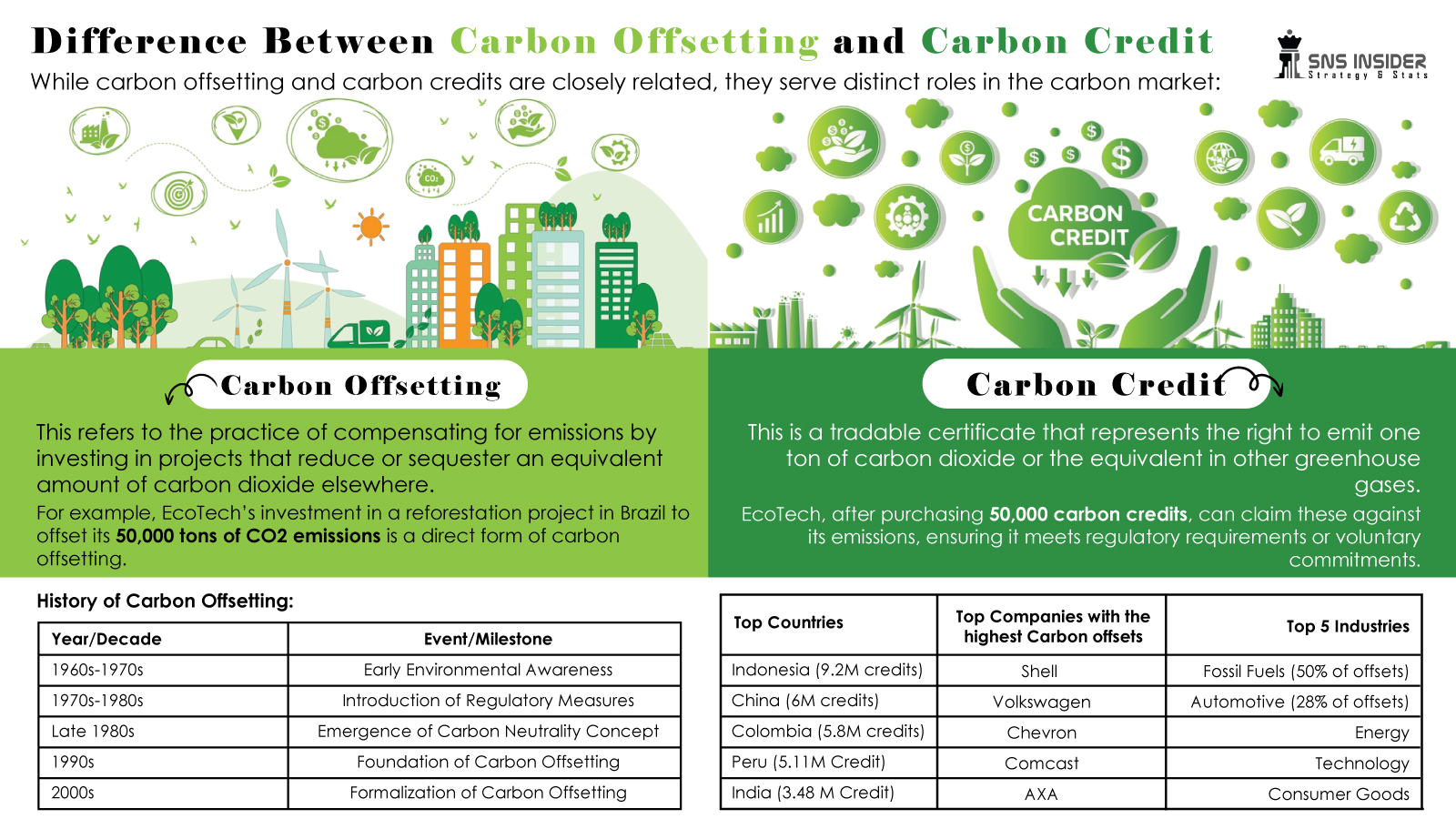

In the fight against climate change, carbon offsetting and carbon credits play a huge part in global strategy. Carbon offsetting means buying carbon credits from projects that either reduce or remove greenhouse gases in the atmosphere. Carbon credits are certificates that represent the right to emit one ton of carbon dioxide or equivalent greenhouse gases.

e.g. EcoTech (an electronics manufacturing company in Germany)

Due to its production processes, EcoTech emits 50,000 tons of CO2 per year. To remedy this, EcoTech spends some money on reforesting a piece of land in Brazil that will consume 50,000 tons of CO2 over a few years. Here, EcoTech buys 50K carbon credits. These credits contribute to a company having net-zero emissions on paper. At the same time, this move also helps to position EcoTech as an eco-friendly company when it comes to its brand and attracting like-minded consumers (and investors).

Though modern carbon offsetting practices are relatively nascent, the concept of carbon neutralization has been around for well over a hundred years. So before carbon offset schemes gained popularity, how did the efforts to lower CO2 emissions take shape?

The Industrial Revolution saw a massive rise in carbon emissions due to the widespread use of fossil fuels. During the mid-20th century industrial activities began to cause environmental problems, such as air pollution and deforestation.

In the 1960s and '70s, environmental movements demanding cleaner air and less pollution began to grow. In 1970 Earth Day began, which was crucial in increasing public awareness and governmental action to protect our environment.

Legislation was enacted by governments to reduce air pollution and preserve the environment. To be sure, the Clean Air Act of 1970 in the United States established emission standards for industrial sources and was an important step toward pollution control.

As an international example, the Montreal Protocol of 1987 was a successful global change to protect our ozone layer by limiting the production and use of substances that deplete it. Despite being ostensibly about ozone depletion, it would establish an important precedent for later global environmental agreements aimed at carbon emissions.

The Concept of Carbon Neutrality (Late 1980s-1990s)

As businesses and governments started to explore methods of limiting their total carbon footprint, the phrase "carbon neutral' appeared. At first, the emphasis was on enhancing power productivity and moving to environmentally friendly techniques of vitality transformation while limiting waste.

In the 1990s, this resulted in the formation of the Kyoto Protocol (adopted in 1997 and entered into force by 2005). The first international treaty to require countries to cut their emissions (thus paving the way for carbon trading and offsetting).

Foundation of Carbon Offsetting (1990s-2000s)

Although carbon offsetting, as a formal mechanism still in its early phase, the late 1990s did see some early moves towards such mechanisms with these instances demonstrating a nascent application of carbon markets. National and company emission trading systems that trader in emissions reductions were the concept markets, another foundation of present carbon offset practices.

The early versions of the voluntary carbon markets also started taking shape where businesses could put money into projects that reduced or sequestered carbon and claim to be neutral concerning their actions related to CO2.

How Can Carbon Offsetting and Carbon Credits Help the Environment?

The core values that make them work for the environment include: reducing greenhouse gas emissions and zero carbon living:

Reduction of Carbon Footprint: Though this would not decrease greenhouse gas emissions, by supporting projects that either directly or indirectly mitigate GHGs

Promotion of Renewable Energy: Investment in renewable energy projects helps to reduce reliance on fossil fuels, and therefore encourages the use of cleaner sources.

Biodiversity Conservation: Projects such as reforestation and afforestation sequester carbon, whilst maintaining natural ecosystems of biodiversity.

Encouragement of Sustainable Practices: The very nature of these approaches is that they push businesses to engage in sustainable practices by choice or as necessity.

The concept of carbon offsetting and related products such as carbon credits are becoming very promising money-making ideas, especially for businesses in a world realizing more about environmental matters. Firms can trade carbon credits, enabling the brokering of money by selling that particular amount of excess emissions to other firms. Additionally, brands investing in offset projects receive a competitive advantage: they are seen as more sustainable and ethical, which also allows them to catch the attention of green-oriented consumers or investors. Businesses can also invest in new technologies, in the development of programs to lower carbon emissions, and overall create new markets that will bring revenue as a payback.

Growth Potential of the Carbon Credit Market

The market for carbon credits is about to grow rapidly, with analysts forecasting the global market will go from $7 billion in 2021 to around $100 billion by 2030. Cited opportunities for growth include the global focus on climate change, tightening of environmental regulations, and a growing list of companies setting ambitious net-zero emissions commitments. The market is expected to exhibit substantial growth over the forecast period, as numerous industries get entrance under regulatory frameworks mandating carbon credits.

Global and Country-Level Regulations Favouring Carbon Credit Businesses

Various global and country-level regulations are catalysing the growth of the carbon credit market:

Paris Agreement: The Paris Agreement is an international treaty that requires countries to reduce their greenhouse gas emissions and establishes a global framework for carbon credit trading

EU Emissions Trading System (EU ETS): The EU ET is a large cap-and-trade scheme that imposes an obligation on the heaviest industrial entities in Europe to buy carbon credits for their emissions.

California Cap-and-Trade Program: This U.S. program limits emissions and permits companies to buy carbon credits in order to meet compliance requirements.

China’s National Carbon Market: Launched in 2021, it is now the world’s largest carbon trading system, covering several key industries.

In addition to carbon offsetting and credits, businesses should consider other ways of reducing their carbon output.

Carbon Capture and Storage (CCS): this captures CO2 produced by industrial processes so it is not released into the atmosphere, storing it underground.

Energy Efficiency Improvements: Improved energy metrics mean that companies will be less reliant on carbon credits because they are directly benefiting from the reduction of their emissions

Direct Air Capture (DAC): This technology actually pulls CO2 directly out of the atmosphere and then locks it away, providing a means to remove atmospheric carbon

Adoption of Renewable Energy: As green energy is essentially non-dependent on fossil fuels, it will aid in the reduction of carbon footprint

Knowing the ins and outs of each region is essential for businesses looking to tap into this lucrative new market. These rules and regulations bring about varying market maturity that adversely affect the opportunities for different regions

Europe: Looking to conform with the EU Emissions Trading System (EU ETS). Secondarily, newcomers should consider building some connections to current carbon markets as well: learning more of the cap-and-trade mechanisms and investing in offset projects based out of Europe (think reforestation or renewable energy)

North America: Both the U.S. and Canada split on regulations, in which California cap-and-trade is A BIG THING. This includes engagement with state and regional markets such as the Western Climate Initiative, collaboration, and partnership around carbon capture technologies – urgent care of mechanisms that can provide meaningful commercial application

Asia-Pacific: China is the key player in carbon trading, and a boom can be expected, opening up opportunities for new entrants. So it is necessary to have an insight into the operation of the national carbon market and concentrate on sectors that are included in this system. Besides, the increasing thrust on sustainability in India opens up the scope for Voluntary Carbon Markets as well.

Emerging Markets: Many of these markets are voluntary, such as projects in Argentina or Africa. Potential new entrants, who should focus on investing in local community-based projects such as forestry and renewable energy that contribute to an array of sustainable development goals along with carbon credits.

|

Country/Region |

Initiative |

Description |

|---|---|---|

|

European Union |

EU Emissions Trading System (EU ETS) |

Cap-and-trade system for reducing industrial greenhouse gas emissions. |

|

United States |

California Cap-and-Trade |

Market-based regulation to reduce greenhouse gases. |

|

China |

National Carbon Market |

World's largest carbon trading system, launched in 2021, covering major industries. |

|

Canada |

Carbon Pricing |

National carbon pricing framework that requires provinces to have carbon pricing mechanisms. |

|

Japan |

Joint Crediting Mechanism (JCM) |

Bilateral offset crediting mechanism with partner countries to reduce emissions. |

|

Australia |

Emissions Reduction Fund (ERF) |

Provides incentives for businesses to reduce emissions through projects. |

|

India |

Perform, Achieve and Trade (PAT) Scheme |

Market-based mechanism to enhance energy efficiency in energy-intensive industries. |

This article provides a complete guide to carbon offsetting and the carbon credits replete with background info for what we like to call beginners-guide-to-carbon-offset investing for businesses. With a nuanced understanding of how these concepts differ and interrelate, the size of their potential market, and future regulatory trends companies can take the necessary actions to place themselves at head-of-class in tackling climate change on a global scale.

Contact Us:

Akash Anand – Head of Business Development & Strategy

info@snsinsider.com

Phone: +1-415-230-0044 (US)