Carbon Offset/Carbon Credit Market Report Scope & Overview:

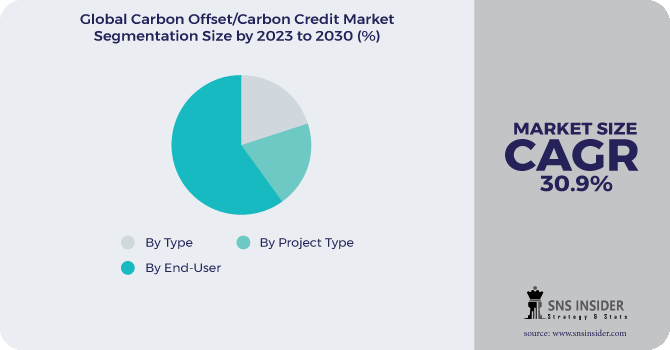

The Carbon Offset/Carbon Credit Market size was valued at USD 428.80 billion in 2023 and is expected to grow to USD 3541.13 billion by 2031 and grow at a CAGR of 30.2% over the forecast period of 2024-2031.

Carbon offset and carbon credits are terms used in the field of environmental sustainability. Carbon offset refers to the practice of compensating for carbon emissions by investing in projects that reduce or remove carbon from the atmosphere. Carbon credits, on the other hand, are a tradable commodity that represents a reduction in greenhouse gas emissions. To put it simply, carbon offset and carbon credits are ways to mitigate the negative impact of carbon emissions on the environment. By investing in carbon offset projects or purchasing carbon credits, individuals and businesses can take responsibility for their carbon footprint and contribute to the fight against climate change. It is important to note that carbon offset and carbon credits are not a substitute for reducing carbon emissions. They should be used in conjunction with efforts to reduce emissions in order to achieve a more sustainable future.

.png)

To Get More Information on Carbon Offset/Carbon Credit Market - Request Sample Report

The carbon offset/carbon credit market has gained significant attention in recent years as a means of mitigating the impact of climate change. However, it is important to note that the carbon offset/carbon credit market is not a silver bullet solution to climate change. It is just one tool in a larger toolkit that must be used in conjunction with other measures, such as reducing emissions at the source and transitioning to renewable energy sources. Furthermore, the carbon offset/carbon credit market is not without its criticisms and challenges. Some argue that it allows individuals and organizations to continue emitting carbon without making significant changes to their behavior or operations. Others point out that the market can be complex and difficult to navigate, with varying standards and regulations across different countries and industries.

Market Dynamics

Drivers

-

Increasing awareness about global warming due to the emission of greenhouse gases

-

Policies and regulations imposed by the Government to reduce carbon emissions

-

Rising investment in carbon capture and removal technologies

-

Growing number of markets allowing partial use of carbon offsets

The partial use of carbon offset is increasing in a number of markets. This trend is gaining momentum as more and more companies seek to reduce their carbon footprint and meet sustainability goals. Carbon offsets are a way for companies to offset their carbon emissions by investing in projects that reduce greenhouse gas emissions elsewhere. However, some markets only allow a portion of a company's emissions to be offset through carbon credits. This is where the partial use of carbon offsets comes into play. Companies can still invest in carbon reduction projects, but only a portion of their emissions can be offset through these projects. This approach has its advantages and disadvantages. On the one hand, it allows companies to take steps towards reducing their carbon footprint, even if they cannot completely eliminate it. This factor boosts the growth of the carbon offset/carbon credit market.

Restrain

-

High costs associated with carbon offset/carbon credit strategies

Opportunities

-

Expansion of the carbon offset projects

-

Development of carbon trading schemes internationally

-

Increasing environmental concern with government support

The government has implemented strict rules and regulations to mitigate the impact of carbon footprints. The industrialization has led to an increase in greenhouse emissions, which has polluted the environment and necessitated the development of techniques to reduce these effects. Carbon offset and carbon credits are strategies that aid in reducing carbon footprints. As a result, the carbon offset/carbon credit market presents numerous opportunities in the upcoming year.

Challenges

-

Volatile prices of carbon credits

Impact of COVID-19

The COVID-19 pandemic impacted the carbon offset/carbon credit market. During the COVID-19 period, there were 13 carbon credit bubbles that exhibited the LPPL signature when re-calibrated using the Filimonov and Sornette (2013) LPPL equation. Additionally, it was observed that the average drawdown of these bubbles was twice that of S&P-500 listed stocks (54% vs. 27%) under the challenging conditions of the COVID-19 pandemic. carbon credit bubbles refer to the fluctuation in the price of carbon credits, which are tradable permits that allow companies to emit a certain amount of carbon dioxide. The significant drawdown observed in these bubbles during the COVID-19 period highlights the vulnerability of carbon credit markets to external shocks

The market, which was already facing challenges due to the lack of a global carbon pricing mechanism, has been further disrupted by the pandemic. One of the main impacts of COVID-19 on the carbon offset/carbon credit market has been the reduction in demand. With many businesses and industries shutting down or reducing their operations, there has been a decrease in the amount of carbon emissions being produced. This has led to a decrease in the demand for carbon offsets and credits, as companies are not as motivated to offset their emissions. Another impact of COVID-19 on the carbon offset/carbon credit market has been the disruption of supply chains. Many carbon offset projects, such as renewable energy projects, have been delayed or canceled due to the pandemic. This has led to a decrease in the supply of carbon offsets and credits, which has further impacted the market. However, there have been some positive developments in the carbon offset/carbon credit market during the pandemic. For example, some companies have continued to invest in carbon offset projects as part of their sustainability goals. Additionally, there has been a growing interest in nature-based solutions, such as reforestation and conservation projects, which can help to offset carbon emissions.

Impact of Russia-Ukraine War:

Russia's invasion of Ukraine has had a significant impact on the global energy market, leading to an increase in fossil fuel demand and carbon emissions. As a result, companies are now seeking carbon credits to offset their emissions, which is driving up carbon prices. The volatility of carbon prices has been particularly evident since the start of the conflict in March 2022, with EU carbon allowance prices plummeting by almost 42% in just one week before rebounding sharply. Despite the recent increase in carbon prices, the EU Emissions Trading System (ETS) has experienced a significant crash since the start of the conflict. Inflation and rising energy prices had previously driven the price of a carbon permit to a high of €97 in early February, but the imposition of sanctions against Russia has caused a sharp decline in the market. In addition to the economic impact, the war has also had environmental consequences. The conflict has led to an increase in emissions from military activities, which has further contributed to climate change. This has made it even more important for the global community to support carbon offset and carbon credit projects in other regions.

Impact of Recession:

The recent recession impacted various sectors including the carbon offset/carbon credit market. The recession has caused many businesses to cut back on their carbon reduction efforts, as they focus on staying afloat and maintaining profitability. This has led to a decrease in demand for carbon offsets and credits, as companies are less willing to invest in these initiatives. Additionally, the recession has led to a decrease in overall economic activity, which has resulted in a decrease in carbon emissions. This has further reduced the demand for carbon offsets and credits. The decline in demand for carbon offsets and credits has led to a decrease in prices, which has made it more difficult for companies that rely on these markets to generate revenue. This has had a ripple effect throughout the industry, as companies that provide carbon offset and credit services have also been impacted.

Key Market Segmentation

By Type:

-

Voluntary Market

-

Compliance Market

By Project Type:

-

Removal Project

-

Avoidance/Reduction projects

By End-user:

-

Energy

-

Transportation

-

Aviation

-

Power

-

Buildings

-

Industrial

-

Others

Do You Need any Customization Research on Carbon Offset/Carbon Credit Market - Enquire Now

Regional Analysis

The Asia Pacific region is projected to experience the highest compound annual growth rate (CAGR) in the carbon offset/carbon credit market during the forecast period. This is attributed to the region's increasing focus on sustainability and environmental protection, as well as the growing demand for carbon credits from businesses and governments. One of the main drivers of growth in the Asia Pacific carbon offset/carbon credit market is the region's commitment to reducing greenhouse gas emissions. Many countries in the region have set ambitious targets for reducing their carbon footprint, and are actively seeking ways to achieve these goals. This has led to a surge in demand for carbon credits, which allow businesses and governments to offset their emissions by investing in projects that reduce carbon emissions elsewhere. Another factor contributing to the growth of the Asia Pacific carbon offset/carbon credit market is the region's rapidly expanding economy. As more businesses and industries emerge in the region, there is a greater need for sustainable practices and environmental protection. This has led to an increase in demand for carbon credits, as businesses seek to demonstrate their commitment to sustainability and reduce their environmental impact.

REGIONAL COVERAGE:

-

North America

-

USA

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Rest of Europe

-

-

Asia-Pacific

-

Japan

-

south Korea

-

China

-

India

-

Australia

-

Rest of Asia-Pacific

-

-

The Middle East & Africa

-

Israel

-

UAE

-

South Africa

-

Rest of the Middle East & Africa

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

Key Players

The major players are 3Degrees, Finite Carbon, South Pole Group, EKI Energy Service Limited, Terrapass, Carbon Credit Capital, CarbonBetter, Carbon Care Asia Limited, NativeEnergy, Climate Trade, and other key players will be included in the final report.

3Degrees-Company Financial Analysis

Recent Developments:

-

In March of 2023, EKI, a prominent developer and supplier of carbon credits worldwide, made its partnership with WOCE Solutions Pvt. Ltd. This collaboration will enable organizations to better comprehend and implement the concept of capturing carbon footprints through innovative product offerings.

-

EKI Energy Services experienced a 1.80% rise in stock value, reaching Rs 700.30. This increase was due to the company's recent signing of a Memorandum of Understanding (MOU) with UK-based Inclusive Energy.

-

In June of 2022, CarbonBetter launched its Certified Offset Portfolio 22-1. This innovative program provides businesses with immediate access to a carefully curated selection of carbon credits from the 2020-2021 vintage. These credits are fully vetted and hand-picked to offset greenhouse gas emissions across all three scopes. The Certified Offset Portfolio 22-1 includes a diverse range of projects, such as a run-of-river hydroelectric power plant, an improved forest management initiative, an N20 abatement project, and a wind farm. Each unit of the Portfolio offsets one metric ton of carbon emissions, and every purchase includes offsets from each project in the Portfolio.

| Report Attributes | Details |

| Market Size in 2023 | US$ 428.80 Bn |

| Market Size by 2032 | US$ 3541.13 Bn |

| CAGR | CAGR of 30.2% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Voluntary Market and Compliance Market) • By Project Type (Removal Project and Avoidance/Reduction projects) • By End-user (Energy, Transportation, Aviation, Power, Buildings, Industrial, and Others) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | 3Degrees, Finite Carbon, South Pole Group, EKI Energy Service Limited, Terrapass, Carbon Credit Capital, CarbonBetter, Carbon Care Asia Limited, NativeEnergy, Climate Trade |

| Key Drivers | • Increasing awareness about global warming due to the emission of greenhouse gases • Policies and regulations imposed by the Government to reduce carbon emissions |

| Market Opportunities | • Expansion of the carbon offset projects • Development of carbon trading schemes internationally |