ADME Toxicology Testing Market Report Scope & Overview:

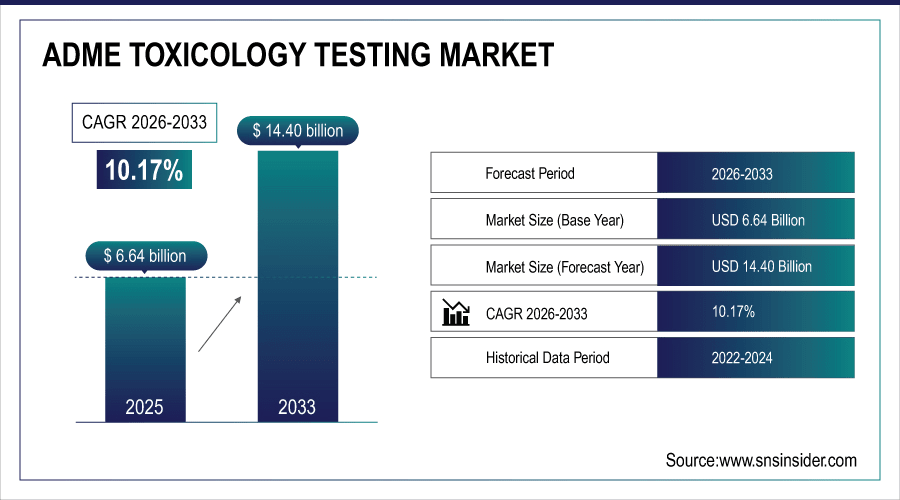

The ADME Toxicology Testing Market size was valued at USD 6.64 billion in 2025E and is projected to reach USD 14.40 billion by 2033, growing at a CAGR of 10.17% during 2026-2033.

The global ADME toxicology testing market trend is being strongly driven by rising drug development activities. Increasing discovery of new molecular entities (NMEs), biologics, and gene therapies requires extensive preclinical ADME/Tox studies to ensure safety and efficacy. Additionally, the outsourcing trend to CROs is accelerating market growth, as pharmaceutical and biotechnology companies increasingly seek cost-efficient, specialized testing solutions, aligning with the trend of faster, streamlined preclinical development.

For instance, in July 2024, WuXi AppTec reported biologics ADME/Tox studies accounted for 42% of preclinical workload, reflecting the market growth trend.

To Get More Information On ADME Toxicology Testing Market - Request Free Sample Report

Market Size and Forecast:

-

Market Size in 2025: USD 6.64 billion

-

Market Size by 2033: USD 14.40 billion

-

CAGR: 10.17% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

ADME Toxicology Testing Market Trends

-

Rising drug discovery and preclinical research activities are driving global demand for ADME Toxicology Testing services.

-

Outsourcing to Contract Research Organizations (CROs) is increasing adoption of specialized ADME/Tox testing solutions by pharmaceutical and biotechnology companies.

-

Advancements in in vitro, organ-on-chip, and AI-based predictive toxicology platforms are supporting faster and more accurate preclinical assessments.

-

Growing biologics and gene therapy pipelines are creating demand for customized ADME/Tox testing and specialized metabolic studies.

-

Increasing investments by pharmaceutical companies and government grants are fueling preclinical R&D and new ADME/Tox method development.

-

Adoption of FDA, EMA, and ICH-compliant testing protocols is enhancing regulatory acceptance, safety, and quality assurance in drug development.

-

Expansion of CRO services in emerging regions, including Asia-Pacific, offers cost-effective preclinical solutions and new growth opportunities for market players.

U.S. ADME Toxicology Testing Market Insights

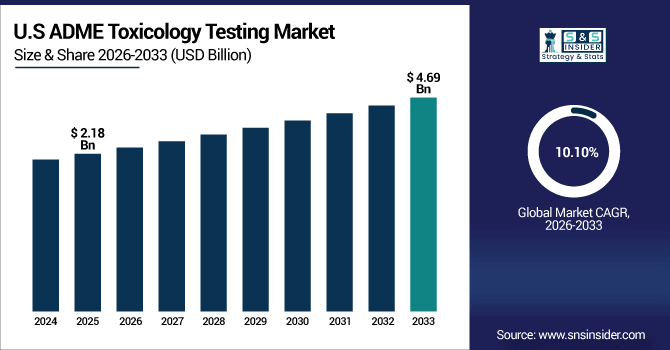

The U.S. ADME Toxicology Testing Market size was valued at USD 2.18 billion in 2025E and is projected to reach USD 4.69 billion by 2033, growing at a CAGR of 10.10% during 2026-2033.

The U.S. ADME toxicology testing market analysis shows dominance due to its high pharmaceutical and biotechnology R&D spending, enabling extensive preclinical ADME/Tox studies. Additionally, the strong presence of leading CROs, including Charles River and Covance, drives market growth, as outsourcing to these specialized organizations ensures speed, quality, and regulatory compliance, reinforcing the US’s leadership in global ADME/Tox testing.

ADME Toxicology Testing Market Growth Drivers:

-

Outsourcing to Contract Research Organizations Driving ADME Toxicology Testing Consumption Growth

Outsourcing to Contract Research Organizations (CROs) is a major driver of the ADME toxicology testing market. Pharmaceutical and biotechnology companies increasingly rely on CROs for preclinical ADME/Tox studies to reduce costs, access specialized expertise, and accelerate development timelines. This trend allows companies to focus on core research while ensuring high-quality, regulatory-compliant testing, fueling global market growth.

For instance, in January 2025, over 30% of their ADME/Tox workload now comes from US-based pharma outsourcing contracts, indicating sustained market reliance on CROs.

ADME Toxicology Testing Market Restraints:

-

Complexity of Biologics and Novel Therapies Limits Market Expansion Globally

The complexity of biologics and novel therapies is a key restraint for the ADME toxicology testing market growth. Emerging treatments, including gene therapies, cell therapies, and biologics, require highly specialized ADME/Tox testing protocols, increasing both time and operational costs. This complexity can slow adoption, particularly for smaller companies, potentially limiting the overall expansion of the global market.

ADME Toxicology Testing Market Opportunities:

-

Adoption of Advanced In Vitro and In Silico Models Creates Growth Opportunities for the ADME Toxicology Testing Market

The adoption of advanced in vitro and in silico models presents a significant opportunity for the ADME toxicology testing market. Techniques including organ-on-chip systems, 3D cell cultures, and AI-driven predictive toxicology enable faster, more accurate, and cost-effective preclinical testing. These innovations reduce reliance on traditional animal models, improve early-stage safety predictions, and allow pharmaceutical and biotechnology companies to streamline drug development, driving market growth and technological advancement.

For instance, in July 2024, Frontage Laboratories reported that 25% of their ADME/Tox projects utilize AI-based predictive toxicology tools, improving the speed and accuracy of preclinical studies.Top of Form

ADME Toxicology Testing Market Segmentation Analysis

-

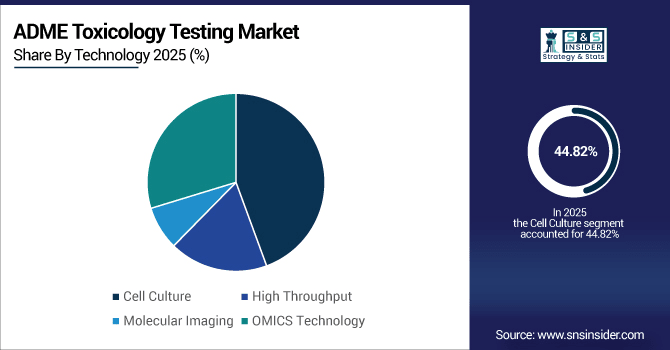

By technology, cell culture led the ADME toxicology testing market with a 44.82% share in 2025e, while high throughput is the fastest-growing segment with a CAGR of 10.81%.

-

By application, the systemic toxicity dominated the market with a 54.88% share in 2025e, whereas the renal toxicity segment is expected to grow fastest with a CAGR of 10.96%.

-

By method, cellular assay led the market with a 45.84% share in 2025e, while biochemical assay platforms are registering the fastest growth with a CAGR of 10.69%.

-

By end-user, pharmaceutical & biotechnology companies held 45.86%share in 2025e, while contract research organizations (CROs) are growing the fastest with a CAGR of 10.49%.

By Technology, Cell Culture Lead Market While High Throughput Register Fastest Growth

The cell culture segment dominated the ADME toxicology testing market with a revenue share of about 44.82% in 2025E, due to its high-throughput, cost-effective, and predictive in vitro capabilities, driven by rising drug discovery, biologics development, and adoption of 3D and organ-on-chip technologies. The high throughput segment will grow at the highest CAGR of nearly 10.81% CAGR between 2026 and 2033, due to increasing demand for rapid, large-scale compound screening, efficiency in drug discovery, and adoption of automated, AI-driven, and predictive toxicology technologies.

By Application, Systemic Toxicity Dominates While Renal Toxicity Shows Rapid Growth

The systemic toxicity segment was estimated to be the largest revenue generator with an approximate 54.88% of the total market share in 2025E, as it evaluates overall drug safety across organs, driven by stringent regulatory requirements, rising biologics development, growing preclinical testing demand, and the need to prevent late-stage clinical failures, ensuring safer therapeutics. For instance, the renal toxicity segment is anticipated to be the fastest growing with a CAGR of around 10.96%, by 2026-2033, due to increasing incidence of kidney-related drug side effects, rising biologics and small-molecule development, and demand for early, predictive preclinical toxicity assessment.

By Method, Cellular Assay Lead While Biochemical Assay Platforms Register Fastest Growth

The cellular assay segment accounted for the highest share of revenues in the ADME toxicology testing market at 45.84% in the year 2025E, owing to it enable precise, high-throughput evaluation of drug effects at the cellular level, driven by growing drug discovery, biologics development, adoption of 3D cultures, and demand for predictive, cost-effective preclinical testing. While the biochemical assay platforms segment is expected to achieve the fastest CAGR of approximately 10.69% during the predicted period from 2026-2033, due to increasing demand for rapid enzyme and protein interaction analysis, rising small-molecule drug development, and adoption of high-throughput, automated preclinical testing technologies.

By End-user, Pharmaceutical & Biotechnology Companies Lead While Contract Research Organizations (CROs) Grow Fastest

The pharmaceutical & biotechnology companies segment accounted for the largest share of the ADME toxicology testing market at around 45.86%in 2025E, as they conduct extensive drug discovery and preclinical studies, driven by rising R&D investments, biologics development, regulatory compliance requirements, and the need for accurate, predictive ADME/Tox testing. The contract research organizations (CROs) segment will have the highest CAGR of nearly 10.49% during 2026–2033, due to increasing outsourcing by pharmaceutical and biotech companies, cost-efficiency, access to specialized expertise, and demand for faster, high-quality preclinical testing services.Top of Form

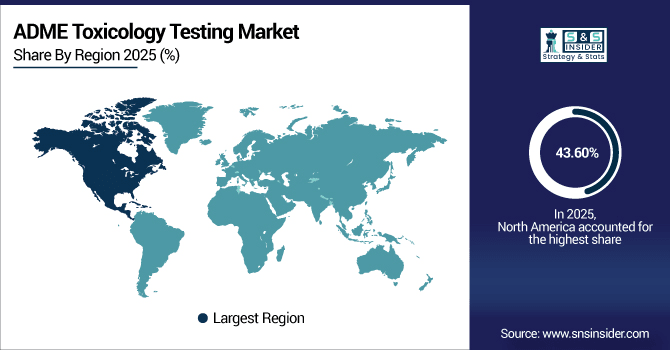

ADME Toxicology Testing Market Regional Analysis:

North America ADME Toxicology Testing Market Insights

North America dominates the ADME toxicology testing market with a market share of 43.60% 2025E, due to its large concentration of pharmaceutical and biotechnology companies, high R&D expenditure, and advanced preclinical infrastructure. The presence of leading CROs, widespread adoption of cutting-edge technologies including organ-on-chip, 3D cell cultures, and AI-based predictive toxicology, and stringent regulatory frameworks including FDA guidelines further drive market dominance, ensuring high-quality, compliant ADME/Tox testing and sustained regional growth.

Get Customized Report as Per Your Business Requirement - Enquiry Now

U.S. ADME Toxicology Testing Market Insights

The U.S. ADME toxicology testing market analysis shows dominance due to its high pharmaceutical and biotechnology R&D spending, enabling extensive preclinical ADME/Tox studies. Additionally, the strong presence of leading CROs, including Charles River and Covance.

Asia-Pacific ADME Toxicology Testing Market Insights

Asia-Pacific is the fastest-growing region in the ADME toxicology testing market, registering a CAGR of 11.10% over the forecast period, due to increasing pharmaceutical and biotechnology R&D activities, cost-effective preclinical testing, and the expanding presence of Contract Research Organizations (CROs) in countries including China and India. Rising adoption of advanced technologies including organ-on-chip, 3D cell cultures, and AI-driven predictive toxicology, along with supportive government initiatives and growing biologics and gene therapy pipelines, is fueling demand, making the region a key driver of global market growth.

China ADME Toxicology Testing Market Insights

China dominates the Asia-Pacific ADME toxicology testing market due to its large pharmaceutical R&D investments, extensive CRO infrastructure, cost-effective preclinical testing services, and government support, attracting global outsourcing and accelerating the adoption of advanced ADME/Tox technologies.Top of Form

Europe ADME Toxicology Testing Market Insights

Europe is the second-dominating region in the ADME toxicology testing market due to its strong pharmaceutical and biotechnology sector, high R&D expenditure, and well-established Contract Research Organizations (CROs). Strict regulatory frameworks from the EMA and ICH drive demand for compliant ADME/Tox studies. Additionally, growing adoption of advanced in vitro and in silico technologies, along with the expansion of biologics and gene therapy pipelines, supports preclinical testing growth, making Europe a key market contributor.

Germany ADME Toxicology Testing Market Insights

Germany dominates the European ADME toxicology testing market due to its robust pharmaceutical and biotech industry, advanced preclinical research infrastructure, strong regulatory compliance with EMA guidelines, and adoption of innovative technologies, positioning it as a key regional hub.

Latin America (LATAM) and Middle East & Africa (MEA) ADME Toxicology Testing Market Insights

The Middle East & Africa and Latin America are emerging regions in the ADME toxicology testing market. Growth is driven by increasing pharmaceutical and biotech R&D, rising outsourcing to local Contract Research Organizations (CROs), and cost-effective preclinical testing services. Government initiatives supporting healthcare innovation and regulatory compliance, along with the gradual adoption of advanced in vitro and predictive toxicology technologies, are further expanding market opportunities in these regions, positioning them for steady growth.

ADME Toxicology Testing Market Competitive Landscape:

Covance is a global contract research organization providing comprehensive ADME and toxicology testing services. With expertise across small molecules and biologics, it supports preclinical and clinical drug development. Its extensive laboratory network and regulatory compliance focus make it a leader in high-quality, end-to-end ADME/Tox solutions globally.

-

In March 2024, expanded US toxicology lab; October 2025: Launched AI-driven predictive toxicology platform, enhancing preclinical ADME/Tox study speed and accuracy.

Eurofins Scientific offers extensive ADME/Toxicology services through its network of laboratories. Specializing in in vitro and in vivo testing, it supports pharmaceutical, biotech, and chemical industries. The company emphasizes innovative testing methods, regulatory compliance, and rapid service delivery, driving global adoption in preclinical safety assessment.

-

In June 2024, opened Singapore ADME/Tox lab for biologics and gene therapies; February 2025: Introduced high-throughput 3D cell culture services, improving predictive accuracy.

Lonza provides integrated preclinical ADME/Toxicology testing and biopharmaceutical development services. Known for its biologics and cell-based testing expertise, the company delivers scalable, high-quality solutions. Its global presence, regulatory alignment, and focus on cutting-edge in vitro models make it a key player in ADME/Tox testing.

-

In July 2024, expanded in vitro ADME/Tox portfolio with organ-on-chip integration; January 2025: Partnered with global pharma for customized preclinical ADME/Tox solutions.

ADME Toxicology Testing Market Key Players:

Some of the ADME toxicology testing market Companies are:

-

Thermo Fisher Scientific Inc.

-

Promega Corporation

-

Agilent Technologies Inc.

-

Beckman Coulter Inc.

-

Catalent Inc.

-

Charles River Laboratories

-

Eurofins Scientific

-

GE HealthCare Technologies Inc.

-

Miltenyi Biotec

-

IQVIA Inc.

-

BioIVT LLC

-

Albany Molecular Research Inc. (AMRI)

-

Cyprotex PLC (Evotec AG)

-

WuXi AppTec

-

Evotec SE

-

Pharmaron

-

Shanghai Medicilon Inc.

-

Sai Life Sciences

-

Tecan Group Ltd.

-

Bio-Rad Laboratories Inc.

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 6.64 Billion |

| Market Size by 2033 | USD 14.40 Billion |

| CAGR | CAGR of 10.17 % From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology (Cell Culture, High Throughput, Molecular Imaging, OMICS Technology) • By Application (Systemic Toxicity, Renal Toxicity, Hepatotoxicity, Neurotoxicity, Other Toxicities) • By Method (Cellular Assay, Biochemical Assay, In-Silica, Ex vivo) • By End-user (Pharmaceutical & Biotechnology Companies, Contract Research Organizations (CROs), Academic & Research Institutes, Regulatory & Government Agencies) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Covance Inc., Eurofins Scientific, Lonza Group Ltd., PRA Health Sciences, WuXi AppTec, Thermo Fisher Scientific, Envigo, Frontage Laboratories, Inc., MPI Research, Absorption Systems, LLC, ChemPartner, PharmaLegacy Labs, Altasciences, Covance Preclinical Services, BioDuro, Toxikon, Corporation, Absorption, Systems, SRI, Biosciences, ChemPartner, Global, Services, Frontage, Global, Services and other players. |