Aerospace Adhesives & Sealants Market Report Scope & Overview:

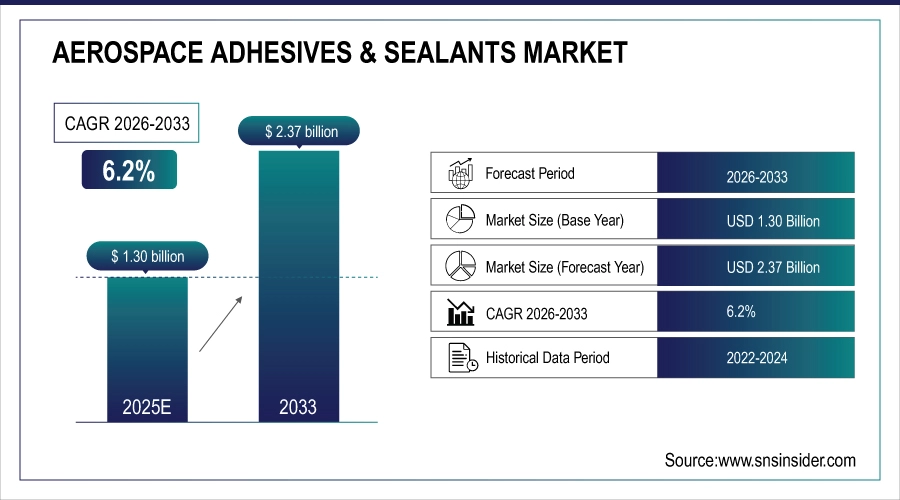

The Aerospace Adhesives & Sealants Market was USD 1.30 billion in 2025 and is expected to reach USD 2.37 billion by 2035, growing at a CAGR of 6.2% over the forecast period of 2026-2035.

The increased demand for lightweight materials in the aerospace industry is a key driver for the growing use of advanced adhesives and sealants. As the aerospace sector continues to prioritize fuel efficiency and sustainability, reducing the weight of aircraft has become a critical objective. For example, agents such as composites and aluminum alloys are more typically used in the structure of the aircraft to minimize overall weight and after that, this figure is really the biggest significant input toward a fuel and carbon-efficient jet. In this context, adhesives and sealants are the key enabling materials that not only provide the requisite bond and seal, but they also ensure that these solutions meet the demanding requirements of durability without a significant increase in weight. While aerospace applications need strength and durability, they must also be lightweight to enhance performance and efficiency, hence the use of such advanced materials. The continued demand for lightweight materials, and the adhesive and sealants that support them, will provide high growth opportunities as manufacturers seek to achieve greater fuel efficiency and meet strict environmental requirements, further fueling innovation and adoption in the aerospace industry.

Aerospace Adhesives & Sealants Market Size and Forecast:

-

Market Size in 2025: USD 1.30 Billion

-

Market Size by 2035: USD 2.37 Billion

-

CAGR: 6.2% From 2026 to 2035

-

Base Year: 2025

-

Forecast Period: 2026-2035

-

Historical Data: 2022-2024

Get More Information on Aerospace Adhesive And Sealants Market - Request Sample Report

Key Aerospace Adhesives & Sealants Market Trends.

-

Rising adoption of drones is driving demand for lightweight, high-performance adhesives and sealants.

-

Increasing production of commercial jets to serve growing passenger and cargo traffic is boosting consumption of structural bonding and sealing materials.

-

Expansion in defense spending is supporting higher production of military aircraft, which rely on advanced sealants for harsh operating environments.

-

Regulatory pressure on volatile organic compounds (VOCs) is accelerating the shift toward water-borne and eco-friendly adhesive systems.

-

Growing use of composite materials in airframes and interiors is increasing the need for high-strength epoxy bonding solutions.

Aerospace Adhesives & Sealants Market Growth Drivers:

-

Rising Adoption of Drones Drives Aerospace Adhesives & Sealants Market Growth Across Commercial Military and Surveillance Applications.

The increasing use of drones is one of the major factors boosting the aerospace adhesives & sealants market growth since these unmanned aerial vehicles (UAVs) are gaining popularity in both military and commercial application areas. Drones are applicable in diverse industries, including delivery, surveillance, agriculture, environmental monitoring, and many spinoff markets, filling the need for lightweight, robust, and low-energy materials. Drone composite materials and structures; Adhesives, and sealants are essential in bonding, aerodynamic performance, structural integrity, and long-term durability. They assist in saving weight while being resistant to moisture, dust, and temperature. With the ever-evolving drone technology and integration of drones into the daily system, the adequately specialized types of adhesives and sealants have artificially challenged innovative achievement and market growth for these systems.

This expansion is attributed to the growing adoption of drones in commercial applications such as delivery services, surveillance, and agriculture. For instance, China has recently trialed its largest cargo drone, aiming to develop its low-altitude economy, which is projected to become a 2 trillion-yuan industry by 2030.

Aerospace Adhesives & Sealants Market Restraints:

-

Volatile Raw Material Prices Hamper Aerospace Adhesives & Sealants Market Growth Amid Supply Chain Disruptions

The growth of the aerospace adhesives and sealants market is restrained by fluctuating prices for raw materials. Adhesives & sealants are manufactured using raw materials like resins, chemicals, & polymers, and since, they are key components of their production, the prices of these raw materials fluctuate based on supply chain distortions, geopolitics, & consumption changes. Such price variations can increase costs of production at the manufacturer's end making it tough to keep a constant price for the end consumers. Due to their significant contribution to operational budgets and profit margins, higher material costs could have ramifications for aerospace companies, where precision and quality are highly demanded. Furthermore, uncertain raw material prices can stymie the manufacturers from planning and scaling the production process, resulting in product delivery delays or possible price increases. Consequently, the aerospace adhesives and sealants market may struggle to maintain market growth, as well as provide the advanced adhesive technologies that have started to gain traction.

Aerospace Adhesives & Sealants Market Opportunities:

The rising output of commercial jets is largely driven by the increasing global need for passenger and cargo flights. With air travel growing in a catch over the years, as economies develop and disposable earnings belongings are on the rise, international passenger visitors are anticipated to grow at a strong charge in the future. According to the International Civil Aviation Organization (ICAO), the total number of passengers carried on scheduled services increased to 3.3 billion in 2022, a rise from the previous year. This demand has led airlines to expand and modernize their fleets, which in turn has sent aircraft manufacturers increasing output. In this process, adhesives and sealants are the key products, and these are also used for fastening & sealing major designs including fuselages, wings, and interiors. Such materials play an important role in maintaining structural integrity while reducing weight and maximizing fuel efficiency both crucial elements in contemporary air travel. Moreover, the demand for high-performance adhesives and sealants is expected to be stronger due to a strong backlog of orders from major manufacturers such as Boeing and Airbus, thereby providing a positive outlook for the aerospace industry.

In 2024, H.B. Fuller acquired H.S. Butyl Limited, of premium butyl tapes, enhancing its position in the specialty construction tapes market.

Aerospace Adhesives & Sealants Market Segment Analysis

-

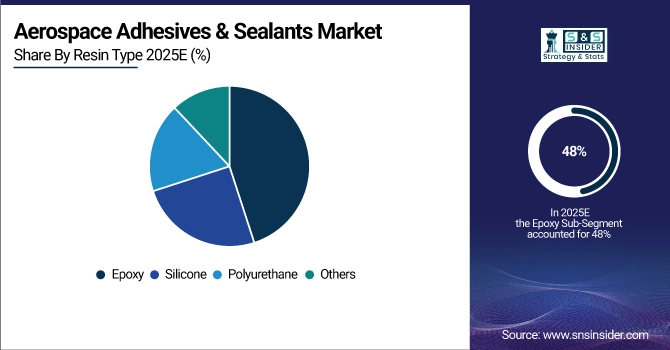

By Resin Type, Epoxy Leads Aerospace Adhesives Market With Superior Strength and Thermal Resistance

Epoxy held the largest market share around 48% in 2025. This dominance stems from their exceptional properties, making them the perfect fit for demanding aerospace applications. Large wing skins, composite ribs, sandwich panels, and other carbon composite substrates all rely heavily on epoxy adhesives for secure bonding. epoxies offer a winning combination of physical characteristics. They boast a high coefficient of thermal expansion, meaning they can withstand temperature fluctuations without compromising the bond. Their impressive compressive strength ensures they can handle significant loads without crushing. Low elongation to fracture translates to minimal stretching or breaking when under stress, crucial for maintaining structural integrity in aircraft.

-

By Technology, Solvent Borne Dominates While Water Borne Gains From Sustainability Trends

The solvent borne segment held the largest market share around 44% in 2025. This is mainly attributed to their excellent bonding properties, versatility, and compatibility with several substrates (such as metals, plastics, and composites), which are widely used in aerospace applications. Meanwhile, high-performance properties such as excellent heat resistance, flexibility, and durability can give NEA's characteristics of soluble adhesives are suitable for application in the aircraft field (aircraft interior, exterior panels, and structure) in strong environment. While the trend is gradually moving towards the usage of water-borne and other eco-friendly adhesives (because of the stringent norms regarding the sustainable limits on volatile organic compounds (VOCs)), solvent-borne adhesives continue to have a dominant share in the aerospace coating adhesives and sealants market on account of their established track record and ability to fulfil stringent demand in the aerospace industry.

-

By End User, Commercial Aviation Leads With Fleet Expansion Driving Demand

Commercial held the largest market share around 65% in 2025. This can be attributed to the large demand for aircraft in the growing commercial aviation industry. The increasing inflow of air passengers and cargo airlines is leading to the expansion of fleet size, which is supporting market growth, as aircraft assembly, maintenance and repairs require high-performance adhesives and sealants. These are essential components to ensure strength and safety of aircraft by providing strong bonding, sealing from moisture and air pressure, and increasing fuel efficiency. The growth of the commercial aviation industry, especially in developing nations, continues to drive this desire for high performance materials. Moreover, with a greater emphasis on lowering operating costs and enhancing durability from commercial airlines, the need for high-performance, durable adhesive and sealant technology solutions is imperative.

Aerospace Adhesives & Sealants Market Regional Analysis

-

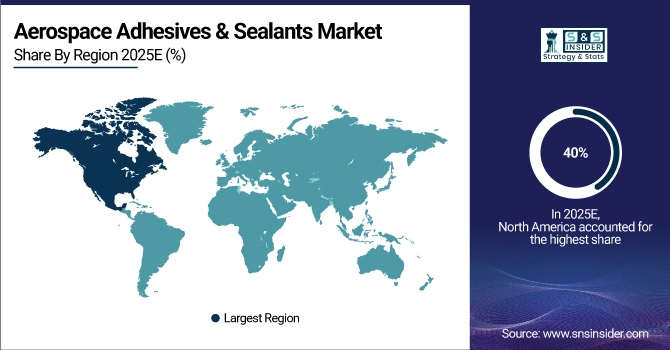

North America Aerospace Adhesives & Sealants Market Insights

North America region dominated the aerospace adhesive and sealants market, capturing over 40% of the market volume in 2025. This leadership stems largely from the US government's unwavering focus on strengthening its military forces. Increased defense spending translates to significant opportunities for contractors and their supply chains, driving demand for advanced adhesives and sealants used in modern military aircraft. This trend is expected to continue well into the future, ensuring North America remains a key player. Additionally, the increase in air travel in the region and the growing commercial aircraft fleet are also aiding the market growth. Moreover, lightweight characteristics coupled with fuel efficiency, as well as the growing adoption of composite materials tourism aviation applications are further fueling the North America aerospace adhesives and sealants market growth. Lastly, government expenditure on defense and aerospace programs in the U.S. also fuels the demand for aerospace components and materials, such as adhesives and sealants, and further strengthens the domination of the region in terms of market share.

Get Customized Report as per Your Business Requirement - Request For Customized Report

-

U.S. Aerospace Adhesives & Sealants Market Insights

Within North America, the United States dominates the aerospace adhesives and sealants market owing to its large defense budget, presence of major aircraft OEMs, and a strong MRO ecosystem. Leading manufacturers and Tier 1 suppliers rely on structural adhesives and sealants for composite integration, fuselage assembly, and interior applications. Ongoing investments in next-generation military platforms and sustainable commercial aircraft further reinforce U.S. demand for high-performance bonding technologies.

-

Europe Aerospace Adhesives & Sealants Market Insights

Europe holds strong market share in 2025, propelled by Airbus production, growing defense initiatives, and adoption of composites in commercial aviation. Advanced manufacturing in Germany, France, and UK supports demand for high-strength, heat-resistant adhesives. Regulatory push for low-VOC formulations accelerates shift toward water-borne technologies.

-

Germany Aerospace Adhesives & Sealants Market Insights

In Europe, Germany leads the aerospace adhesives and sealants market, backed by its aerospace engineering expertise, Airbus facilities, and premium aircraft component manufacturing. Strong automotive-aerospace synergies drive specialized sealant innovations for structural applications. Industrial focus on sustainability boosts eco-friendly adhesive development.

-

Asia Pacific Aerospace Adhesives & Sealants Market Insights

The Asia Pacific aerospace adhesives and sealants market grows rapidly, fueled by commercial aviation expansion in China, India, and Japan alongside rising MRO activities. Boeing and Airbus supply chains, plus domestic jet programs, increase demand for lightweight bonding solutions. Drone manufacturing growth further accelerates specialized sealant adoption.

-

China Aerospace Adhesives & Sealants Market Insights

In Asia Pacific, China dominates the aerospace adhesives and sealants market through COMAC aircraft production, military modernization, and booming commercial fleets. Government aerospace investments and composite material adoption drive high-performance adhesive demand. Rapid drone sector expansion creates opportunities for durable, lightweight sealants.

-

Latin America (LATAM) Aerospace Adhesives & Sealants Market Insights

Latin America aerospace adhesives and sealants markets show steady growth in 2023, driven by commercial fleet modernization in Brazil and Mexico. MRO expansion and regional jet demand increase need for reliable bonding materials. Emerging defense programs support gradual market development for advanced sealants.

Aerospace Adhesives & Sealants Market Compitative Landscape:

Henkel AG & Co. KGaA leads in aerospace adhesives with premium products like Loctite EA 9396 and Loctite 7705, specializing in high-strength bonding for aircraft structures and composites. The company drives innovation in lightweight, durable solutions for commercial and military aviation, enabling fuel-efficient designs across fuselages, wings, and interiors.

- In 2024, Henkel expanded its aerospace portfolio through strategic acquisitions enhancing epoxy formulations for extreme temperature resistance.

3M excels in structural adhesives with Scotch-Weld DP 460 and DP 8405NS, providing superior metal-to-composite bonding for aerospace manufacturing. The company powers aircraft assembly lines with versatile, high-performance sealants that withstand vibration, pressure, and environmental stresses.

- 3M continues leading VOC-compliant innovations for next-generation sustainable aircraft production.

PPG Industries Inc. dominates aerospace sealants through PPG PR-1422 and PR-1776, critical for fuselage sealing and aerodynamic surfaces. Their advanced polymer technologies ensure long-term durability in high-altitude, extreme-temperature conditions.

- PPG invested USD 9.8 million in 2024 expanding Texas production capacity for aerospace adhesives.

Huntsman International LLC. delivers Araldite 2011 and 2021 epoxy systems renowned for composite bonding in wing structures and panels. The company supports major OEMs with tailored solutions optimizing weight reduction and structural integrity.

Solvay Group provides Cytec 5275-1 and 9235 aerospace-grade adhesives for primary load-bearing applications. Their materials enable advanced composite integration in modern aircraft designs.

- In August 2023, Solvay launched FusePly 250 for high-temperature (250°F+) aerospace bonding.

H.B. Fuller Company strengthens market position with Fuller OX-700 and 2062 sealants used in aircraft interiors and exteriors.

- In 2024, H.B. Fuller acquired H.S. Butyl Limited, enhancing specialty butyl tapes for aerospace.

Aerospace Adhesives & Sealants Market Key Players

- Henkel AG & Co. KGaA (Loctite EA 9396, Loctite 7705)

- 3M (Scotch-Weld DP 460, Scotch-Weld DP 8405NS)

- PPG Industries Inc. (PPG PR-1422, PPG PR-1776)

- Huntsman International LLC. (Araldite 2011, Araldite 2021)

- Solvay Group (Cytec 5275-1, Cytec 9235)

- Master Bond Inc. (EP42HT-2, EP21AOHT)

- Beacon Adhesives (Beacon 1007, Beacon 1211)

- DuPont (Betamate 2090, Betaforce 2070)

- H.B. Fuller Company (Fuller OX-700, Fuller 2062)

- Scigrip Adhesives (SG-500, SG-700)

- Illinois Tool Works Inc. (ITW Devcon 10360, ITW Devcon 12540)

- LORD Corporation (Lord 400, Lord 302)

- Arkema (Kraton D1102, Kynar PVDF)

- Permabond (Aero 933, A1011)

- Sika AG (Sikaflex-295 UV, Sikaflex-552)

- ITW (Devcon 12450, Devcon 13380)

- Bostik (Bostik 1130, Bostik 2121)

- Royal Adhesives & Sealants (RC-1299, RC-2001)

- Dupont (Betaseal 1745, Betaforce 1080)

- Momentive (Silopren LSR 7000, RTV 118)

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 1.30 Billion |

| Market Size by 2035 | USD 2.37 Billion |

| CAGR | CAGR of 6.2% From 2026 to 2035 |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Resin Type (Epoxy, Silicone, Polyurethane, Others) • By Technology (Solvent borne, Water borne, Others) • By User Type (Original Equipment Manufacturer, Maintenance Repair and Operations) • By End User (Commercial, Military, General Aviation) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Henkel AG & Co. KGaA, 3M, PPG Industries Inc., Huntsman International LLC., Solvay Group, Master Bond Inc., Beacon Adhesives, DuPont, B. Fuller Company, Scigrip Adhesives, Illinois Tool Works Inc., LORD Corporation, Arkema, Permabond, Sika AG, ITW, Bostik, Royal Adhesives & Sealants, Dupont, Momentive, and Others |