Agricultural Enzymes Market Report Scope & Overview:

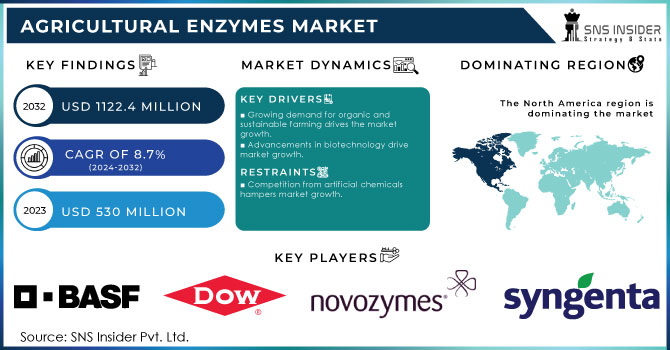

The Agricultural Enzymes Market Size was valued at USD 530 Million in 2023. It is expected to grow to USD 1122.4 Million by 2032 and grow at a CAGR of 8.7% over the forecast period of 2024-2032.

An increase in the interfacing of antibiotics or organic chemical compounds has led to a rising preference for agricultural enzymes, driving the agriculture enzymes market in diverse regions. Enzymes boost various biological processes of plants, soil, and animals these products which are termed as agricultural enzymes, are growth-regulator products for crops. Various kinds of agricultural enzymes can be produced through biotechnological methods, as well as natural sources.

Agricultural Enzymes Market Size and Forecast

-

Market Size in 2023: USD 530 Million

-

Market Size by 2032: USD 1,122.4 Million

-

CAGR: 8.7% from 2024 to 2032

-

Base Year: 2023

-

Forecast Period: 2024–2032

-

Historical Data: 2020–2022

Get More Information on Agricultural Enzymes Market - Request Sample Report

Agricultural Enzymes Market Trends

-

Rising demand for organic and sustainable farming is increasing adoption of enzyme-based agricultural inputs.

-

Growing focus on improving soil fertility, nutrient availability, and crop productivity is driving enzyme usage.

-

Advancements in biotechnology and fermentation technologies are enhancing enzyme efficiency and stability.

-

Increasing use of enzymes in seed treatment, soil conditioning, and crop protection applications.

-

Rising adoption of eco-friendly alternatives to reduce dependence on synthetic fertilizers and pesticides.

-

Increasing integration of agricultural enzymes with precision farming and smart agriculture technologies.

-

Growing investments in research and development to develop advanced and crop-specific enzyme solutions.

-

Expanding demand in emerging markets due to increasing awareness of sustainable agriculture practices.

According to the U.S. Department of Agriculture (USDA), over 16 million acres of U.S. farmland were dedicated to organic production in 2022, reflecting a strong push towards natural solutions like agricultural enzymes to enhance crop yield and soil health. This aligns with global trends toward reducing chemical inputs and fostering more biotechnological methods in agriculture.

Additionally, some of these products have outstanding features and functionalities that can help in raising the activity of enzymes. Presently, enzymes are also used to increase the efficiency of agricultural activities and reduce the usage of operational costs on some procedures. Some enzymes also support the process of soil conditioning, seed treatment, and digestion of food for consumption by animals. In order to cope with the rising commercial activities, farmers are majorly interested in adopting cost-effective solutions, which may not hike the operational cost and yet give a good finish to yield higher productivity.

Research and development are driving the growth of enzyme technology, resulting in the innovative development of novel products. Agricultural enzymes have improved features and provide enzyme stability, which is why they can carry out specific functions with higher efficiency. As a result, the increase in processes and applications determines and increases the range of applications of these products.

Environmental challenges that cause soil degradation, pollution of water bodies, and loss of biodiversity are reasons for driving more interest in looking for alternatives that do not harm the environment. Enzymes offer alternatives to traditional applications of chemicals for farmland. However, enzyme production and formulation are not cheap, especially in the case of specialized products or the genetic designing of these enzyme products which are more expensive. The costly production determines the cost of enzymes that come out with the production costs. Hence, the relatively high cost of these products has restrained their rise in usage among small-scale farmers as well as farmers within low-income regions. They are only sold in markets that are well-situated for market purposes. These products, which are sold in chemical markets, find it difficult to get through the sales of enzyme agriculture products. There is no entry into the interior because of the distance as well as the unavailability of adequate places for storage.

Agricultural Enzymes Market Dynamics

Drivers

-

Growing demand for organic and sustainable farming drives the market growth.

-

Advancements in biotechnology drive market growth.

The evolution in biotechnology techniques has remarkably improved the effectiveness and affordability of chemical enzymes across the agricultural industry, substantiating their rising prevalence among farmers. More specifically, the introduction of various enzyme production methods, such as genetic modification and efficient fermentation procedures, has facilitated the creation of powerful chemicals that are especially suitable for a particular target. For instance, with the introduction of a novel line of nutrients, activators, and fungicides, BASF has developed a product that enhances the general health of the soil and the presence of essential substances as of 2023. To manufacture this product, BASF uses cutting-edge fermentation technology, which enables extensive enzyme production. As another illustrative case, in 2022, Novozymes adopted biotechnological techniques to manufacture a set of bio-based enzyme products, promoting the productivity of nutrient absorption in plants. In this way, advances in biotechnology have allowed the creation of more productive solutions that result in higher crop yields. At the same time, the examples provided above prove that the latest progress in agricultural enzymes enhances the sustainability of the already indispensable trend.

Restraint

-

Competition from artificial chemicals hampers market growth.

One of the major limiting factors for the agricultural enzymes market is competition from synthetic chemicals. Synthetic fertilizers and pesticides are more readily available and are in widespread use in conventional farming. While they are no longer viewed as environmentally friendly, they are considered to be more efficient by most farmers. Synthetic pesticides allow the killing of all parasites on the farm within a day, while the effect of natural ones may take days or weeks to transpire, which further cements their current preference. At the same time, supply chains are already established, traditional products are marketed and re-sold, and the initial potential return rate on investment in synthetic chemicals is lower. For natural enzyme products, the main limitation is the fact that farmers, while showing a growing demand among their consumer base, remain leery of them. Not as easy to work with and maintain, as well as potentially requiring different land management practices, they face a barrier to market entry based on the comfort of existing systems.

Opportunity

-

Integration with smart farming technologies

-

Innovative Delivery Mechanisms

Agricultural Enzymes Market Segmentation Analysis

By Product

The market for phosphatase accounted for a share of roughly 38% in the year 2023. Phosphatase enzymes facilitate the hydrolysis of organic phosphates, releasing phosphate ions that are more accessible to the plant. Increasing the availability of phosphorous through these products will enhance plant nutrient uptake and subsequently crop yield. Furthermore, phosphorus fertilizers are extensively used in agriculture to promote soil phosphorous content. However, a significant percentage of the applied phosphorous may become bound to the soil particles or immobilized in an organic form, making it unavailable to the plant. Phosphatase enzymes can mobilize and mineralize organic phosphorus, enhancing phosphorus fertilizer efficiency and reducing the need for excessive phosphorous application on soil.

The dehydrogenase enzymes are useful biomarkers that indicate soil microbial activity and general soil health. The dehydrogenase enzyme catalyzes the transfer of hydrogen atoms that occurs during the metabolic process of soil microorganisms. The product’s activity level mirrors the microbial biomass and the number of living cells in the soil. As a significant concern in agriculture is soil health, farmers and other industrial experts will increase the use of such products on soil fertility, quality, and sustainability assessment. Moreover, the dehydrogenase enzyme is also dominant in the decomposition of organic matter and pollutants present in the soil. Hence, these products may increase as they are used during the microbial decomposition of organic compounds such as pesticides, herbicides, and hydrocarbons, and agriculture as a whole is struggling with soil remediation and pollution problems.

By Crop Type

Cereals & grains took over the market and held a share of about 38% in 2023. Amylases and proteases and some of the enzymes used that enhance the digestibility of cereal grains. By incorporating enzymes into animal feed, enzymes break down complex carbohydrates and the proteins of cereals into simpler forms that are absorbed in the body of the animals. This enhances the improvement in nutrient utilization and the feed conversion rate, implying better performance in livestock production and poultry. Cereal grains are affected by fungal contamination hence producing mycotoxins which include; aflatoxins, ochratoxins, and fumonisins. The aflatoxins are very toxic substances to animals causing liver cancer. Esterases break down the ester bond in the fungal cell wall degrading it. The enzyme in the fungal cell wall helps in averting the production of mycotoxins. Products like cellucanes and glucans help in catalyzing the breakdown of the fungal cell wall hence they reduce mycotoxin contamination and the food or feed will be safe when consumed. Proteases and cellulase enzymes have been efficient in the extraction of oil in oilseeds and protein from pulses respectively.

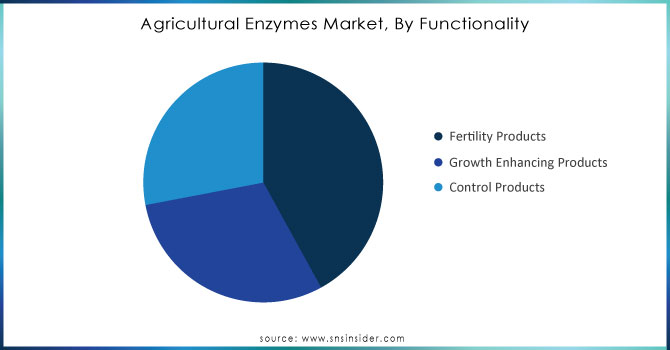

By Functionality

Fertility function held the largest market share around 42% in 2023. The enzymes facilitate soil health by promoting microbial activity, nutrient cycling, and organic matter decomposition which drive the market growth. As a result, when soils are healthy and when microbial populations are balanced, plants are more likely to grow and stand up better to environmental stress. Agricultural enzymes, in turn, reduce the reliance on chemical fertilizers since they are able to enhance the efficiency of nutrient usage. In other words, by boosting the availability of nutrients that can be found in passages of the soil or organic amendments, these goods provide the capability to decrease the usage of artificial fertilizers, together with the overall economic and environmental burdens that are associated with their application.

Need Any Customization Research On Agricultural Enzymes Market - Inquiry Now

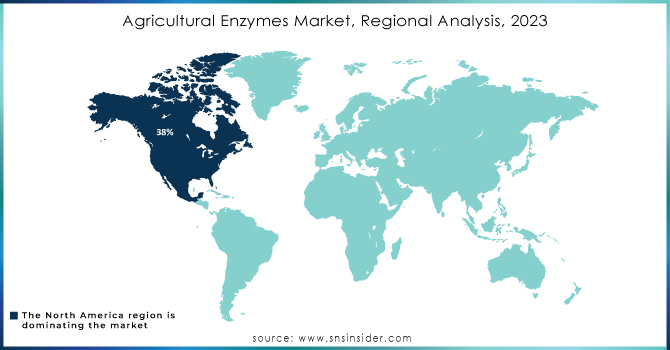

Agricultural Enzymes Market Regional Analysis

North America held the largest market share around 38% in 2023. The North American market has become a pioneering region for the development and large-scale implementation of advanced agricultural solutions based on ENZYMES. This situation is mainly caused by its well-developed agricultural sector that is highly oriented on innovation and technology advancement. Modern North America-based farmers and agricultural producers tend to focus on the use of sustainable approaches that would allow them to increase their crop yield and minimize environmental influence. Therefore, the interest in the use of agricultural enzymes has considerably increased owing to the strong sides that this solution may bring.

The simultaneous existence of large investments into research, development, and partial prefabrication results in a number of highly specific, efficient, and innovative enzyme products that can effectively meet the needs of the region’s agricultural sector. The rapidly developing interest in the use of sustainable, organic products places additional pressure on manufacturers that favor the use of synthetic chemicals in their production and promotes the use of enzyme-based alternatives. It is also crucial to note that the Governments of such large North American countries as the USA and Canada tend to actively promote the comprehensive development of sustainable agriculture and soil health. In general, these factors ensure the further development of the North American region as the leading geographical area of the market whose potential for growth in this market segment is currently the highest in the world.

Key Players in Agricultural Enzymes Market

-

Novozymes A/S (BioAg Symbiosis)

-

BASF SE (BASF ComCat)

-

DuPont de Nemours, Inc. (Axtra PHY)

-

Syngenta AG (EnzOx)

-

Bayer CropScience AG (BioAct)

-

Aries Agro Limited (Rhizozome)

-

Monsanto Company (Acceleron B-300 SAT)

-

Bioworks, Inc. (RootShield)

-

Agrinos AS (HYT A)

-

Stoller USA Inc. (Bio-Forge)

-

AB Enzymes GmbH (Ronozyme)

-

Nutraferma Inc. (Nutraferm)

-

GreenMax AgroTech (Greenzyme)

-

American Biosystems Inc. (Enz-A-Bac)

-

BioAtlantis Ltd. (Super Fifty)

-

Enzyme India Pvt. Ltd. (Agrizyme)

-

Specialty Enzymes & Biotechnologies Co. (Enzyme Solutions)

-

Advanced Enzyme Technologies Ltd. (DigeGrain)

-

Creative Enzymes (Cellulase Pro)

-

Kemin Industries, Inc. (Kemzyme)

Recent Development:

-

In 2024, Novozymes launched BioGrowth Plus, an advanced enzyme-based product targeting soil regeneration and nutrient uptake efficiency, aiming to enhance yield sustainability in crops amid changing climate conditions.

-

In 2024, BASF introduced EnviroZyme 360, an enzyme solution developed to optimize nutrient release in low-quality soils, focusing on increasing agricultural output while reducing dependency on chemical fertilizers.

-

In 2023, Creative Enzymes introduced Cellulase Pro, targeting improved plant biomass breakdown in the soil, which leads to better soil structure and nutrient recycling for crops.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 530 Million |

| Market Size by 2032 | USD 1122.4 Million |

| CAGR | CAGR of 8.7% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Product (Phosphatases, Dehydrogenases, Sulfatases, Other) • By Crop Type (Cereals & Grains, Oilseeds & Pulses, Fruits & Vegetables, Turf & Ornamentals, Others), • By Functionality (Fertility Products, Growth Enhancing Products, Control Products) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Novozymes A/S, BASF SE, DuPont de Nemours, Inc., Syngenta AG, Bayer CropScience AG, Aries Agro Limited, Monsanto Company, Bioworks, Inc., Agrinos AS, Stoller USA Inc., AB Enzymes GmbH, Nutraferma Inc., GreenMax AgroTech, American Biosystems Inc., BioAtlantis Ltd., Enzyme India Pvt. Ltd., Specialty Enzymes & Biotechnologies Co., Advanced Enzyme Technologies Ltd., Creative Enzymes, Kemin Industries, Inc. and Others |