Animal Feed Market Report Scope & Overview:

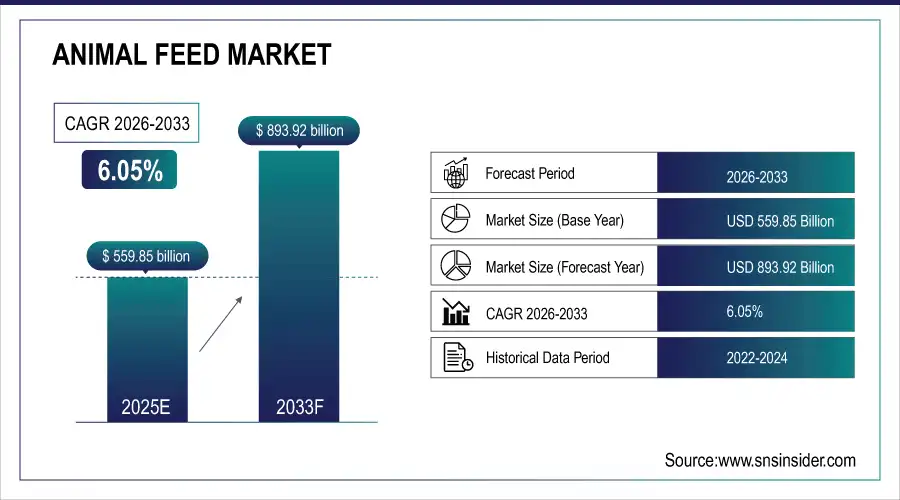

The Animal Feed Market Size was valued at USD 559.85 Billion in 2025E and is projected to reach USD 893.92 Billion by 2033, growing at a CAGR of 6.05% during the forecast period 2026–2033.

The Animal Feed Market analysis examines feed types, livestock segments, forms, end users, and distribution channels. Rising demand for protein-rich feed, livestock intensification, and focus on animal nutrition are driving growth across commercial farms, smallholder farms, and household segments globally.

Poultry and cattle feed accounted for over 320 million tons of animal feed in 2025, driven by rising demand for protein-rich diets and livestock intensification.

Market Size and Forecast:

-

Market Size in 2025: USD 559.85 Billion

-

Market Size by 2033: USD 893.92 Billion

-

CAGR: 6.05% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On Animal Feed Market - Request Free Sample Report

Animal Feed Market Trends:

-

Rising focus on livestock nutrition and high-protein diets is driving demand for specialized feed formulations across poultry, cattle, swine, and aquaculture.

-

Innovative feed technologies, such as enzyme-enriched feed, probiotics, and precision nutrition, are enhancing animal growth and productivity.

-

Customized feed solutions for smallholder farms and commercial enterprises reflect the shift toward tailored animal care practices.

-

Digital platforms and e-commerce channels are increasingly used for feed procurement, supply chain management, and farmer education.

-

Sustainability and environmentally sound practices, including organic feed, reduced antibiotic use, and circular economy approaches in feed production, are influencing purchase and production decisions.

U.S. Animal Feed Market Insights:

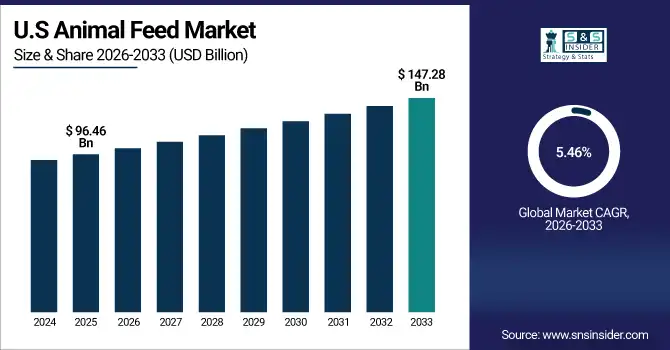

The U.S. Animal Feed Market is projected to grow from USD 96.46 Billion in 2025E to USD 147.28 Billion by 2033 at a CAGR of 5.46%. Growth is driven by rising protein-rich feed demand, expansion of commercial livestock farms, advanced feed formulations, and increasing focus on animal nutrition and sustainability.

Animal Feed Market Growth Drivers:

-

Rising demand for protein-rich, nutrient-optimized feed is driving rapid growth in the animal feed market.

The growth of the Animal Feed Market is driven by rising demand for protein-rich, nutrient-optimized feed. Feed consumption reached over 320 million tons in 2025 and is projected to surpass 510 million tons by 2033. Growth is fueled by livestock intensification, expanding poultry and cattle sectors, and increasing awareness of animal nutrition. Adoption of advanced feed technologies and digital procurement platforms further supports growth in both developed and emerging regions.

Rising adoption of protein-rich and nutrient-optimized feed supported consumption of over 320 million tons globally in 2025, driven by poultry, cattle, and aquaculture sectors.

Animal Feed Market Restraints:

-

Volatile raw material prices and high production costs are restricting growth, especially for large-scale feed manufacturers.

The growth of the Animal Feed Market is constrained by volatile raw material prices and high production costs. By 2025, over 25% of small and medium-sized feed manufacturers reduced output due to rising prices of corn, soy, and additives. Large-scale producers also face challenges from energy costs, transportation, and regulatory compliance. These cost pressures particularly affect new entrants and smaller players, limiting their expansion, even as demand for protein-rich and nutrient-optimized feed continues to grow globally.

Animal Feed Market Opportunities:

-

Increasing demand for sustainable and organic feed presents lucrative opportunities for innovative, eco-friendly, and high-margin products.

Rising demand for sustainable and organic feed is driving significant growth in the Animal Feed Market. In 2025, over 45 million tons of organic and eco-friendly feed were consumed globally, and this figure is expected to reach nearly 110 million tons by 2033. Farmers and commercial producers are increasingly adopting environmentally friendly feed solutions. Innovations in organic formulations, alternative protein sources, and sustainable production practices are expanding adoption across developed and emerging markets.

Sustainable and organic feed accounted for over 14% of animal feed consumption in 2025, driven by rising eco-conscious farming and livestock nutrition awareness.

Animal Feed Market Segmentation Analysis:

-

By Feed Type, Compound Feed held the largest market share of 48.72% in 2025, while Premixes are expected to grow at the fastest CAGR of 7.12%.

-

By Livestock Type, Poultry accounted for the highest market share of 36.41% in 2025, while Aquaculture is projected to expand at the fastest CAGR of 7.45%.

-

By End User, Commercial Farms held the largest share of 52.14% in 2025, while Smallholder Farms are expected to grow at the fastest CAGR of 6.95%.

-

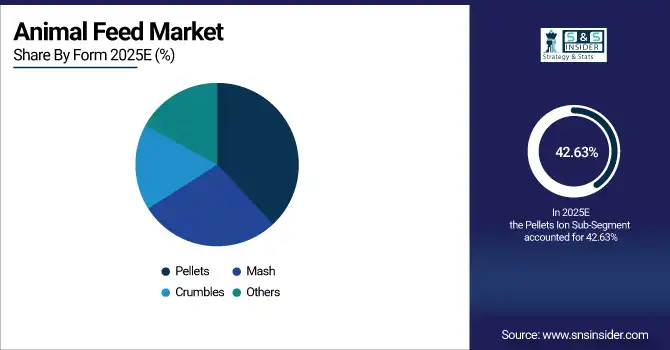

By Form, Pellets dominated with a 42.63% share in 2025, while Mash is projected to record the fastest CAGR of 7.03%.

-

By Distribution Channel, Direct Sales held the highest market share of 44.78% in 2025, while Online Retail is expected to grow at the fastest CAGR of 7.18%.

By Feed Type, Compound Feed Dominates While Premixes Expand Rapidly:

Compound Feed sector dominated the Feed Type segment in 2025, with over 155 million tons consumed globally, driven by its balanced nutrition for poultry, cattle, and swine across commercial and smallholder farms. Its established supply chains, wide adoption, and versatility maintain dominance. Premixes sector is the fastest-growing Feed Type segment, reaching over 40 million tons in 2025, fueled by demand for customized, nutrient-enriched feed solutions that optimize animal growth, productivity, and health in emerging and developed markets.

By Livestock Type, Poultry Dominates While Aquaculture Expands Rapidly:

Poultry sector dominated the Livestock Type segment with over 115 million tons consumed globally, driven by rising poultry meat and egg demand in Asia-Pacific and Europe. Established commercial farms and high protein demand support this dominance. Aquaculture sector is the fastest-growing Livestock Type segment, with consumption exceeding 32 million tons in 2025, due to expansion of fish farming, government support for sustainable aquaculture, and rising consumer preference for seafood protein in developed and emerging regions.

By End User, Commercial Farms Dominate While Smallholder Farms Expand Rapidly:

Commercial farms sector dominated the End User segment in 2025, consuming over 145 million tons of animal feed, driven by large-scale operations, higher productivity goals, and professional livestock management. Their organized supply chains and access to premium feed solutions maintain their dominance. Smallholder farms sector is the fastest-growing End User segment, with feed consumption exceeding 52 million tons in 2025, driven by government support programs, awareness of animal nutrition, and adoption of high-quality feed to improve livestock yield in rural and semi-urban regions.

By Form, Pellets Dominate While Mash Expands Rapidly:

Pellets sector dominated the Form segment in 2025, with over 120 million tons consumed globally, preferred for uniform nutrition, ease of handling, and reduced wastage in commercial livestock operations. Its durability and compatibility with mechanized feeding systems support its market dominance. Mash sector is the fastest-growing Form segment, reaching over 43 million tons in 2025, driven by demand for customizable feed formulations in smallholder and backyard farms, particularly in Asia-Pacific and Africa, where flexibility and cost-effectiveness are critical for animal growth and productivity.

By Distribution Channel, Direct Sales Dominate While Online Retail Expands Rapidly:

Direct sales sector dominated the Distribution Channel segment in 2025, accounting for over 130 million tons of feed supplied directly from manufacturers to commercial farms, supported by strong logistics, bulk orders, and established B2B networks. Online Retail sector is the fastest-growing Distribution channel segment, with over 40 million tons of feed sold in 2025, driven by digital adoption among smallholders, ease of ordering, doorstep delivery, and access to specialty and customized feed products, particularly in emerging markets.

Animal Feed Market Regional Analysis:

Asia-Pacific Animal Feed Market Insights:

Asia-Pacific dominated the Animal Feed Market with a 39.85% share in 2025, driven by high livestock population, growing demand for poultry, cattle, and aquaculture products, and rapid adoption of modern feed practices. China consumed over 60 million tons and India over 35 million tons of animal feed in 2025. Expansion of commercial farms, increasing protein-rich diets, and government initiatives supporting livestock productivity are driving strong market growth across the region.

Get Customized Report as per Your Business Requirement - Enquiry Now

-

China Animal Feed Market Insights:

China consumed over 60 million tons of animal feed in 2025, with poultry and cattle feed accounting for the majority. Growth is fueled by rising protein demand, expanding commercial farms, government support for livestock productivity, adoption of modern feed formulations, and increasing awareness of animal nutrition across rural and urban regions.

North America Animal Feed Market Insights:

North America consumed over 75 million tons of animal feed in 2025, with the United States accounting for more than 60 million tons and Canada contributing around 15 million tons. Poultry and cattle feed dominated consumption, driven by large-scale commercial farms, high protein demand, and adoption of advanced feed formulations. Rising awareness of animal nutrition, sustainable farming practices, and technological innovations in feed production are further supporting growth across both developed and emerging livestock sectors.

-

U.S. Animal Feed Market Insights:

In 2025, the U.S. consumed over 60 million tons of animal feed, with poultry at 35 million tons and cattle at 18 million tons. Growth is driven by commercial farm expansion, rising protein demand, adoption of advanced feed formulations, sustainable feed trends, and increased awareness of animal nutrition nationwide.

Europe Animal Feed Market Insights:

Europe consumed over 50 million tons of animal feed in 2025, led by Germany (15 million tons), France (12 million tons), and the UK (10 million tons). Poultry and cattle feed dominated with 35 million tons, while swine and aquaculture accounted for 15 million tons. Growth is driven by commercial farm expansion, rising demand for high-protein feed, adoption of advanced feed formulations, and increasing focus on sustainable and nutrient-rich livestock nutrition.

-

Germany Animal Feed Market Insights:

In 2025, Germany consumed over 15 million tons of animal feed, with poultry and cattle feed accounting for the majority. Commercial farms dominated consumption. Rising demand for protein-rich feed, adoption of advanced formulations, sustainable livestock practices, and increasing awareness of animal nutrition are driving growth across both large-scale and smallholder farming operations.

Latin America Animal Feed Market Insights:

The Latin America Animal Feed Market is growing at a CAGR of 7.60%, with over 50 million tons consumed in 2025. Brazil led with 22 million tons, followed by Argentina (16 million tons) and Chile (9 million tons). Poultry and cattle feed dominated with 35 million tons. Rising protein demand, commercial farm expansion, and adoption of advanced, sustainable feed solutions are driving strong regional growth.

Middle East and Africa Animal Feed Market Insights:

The Middle East & Africa consumed over 15 million tons of animal feed in 2025, with the UAE leading at 5 million tons and South Africa at 4 million tons. Poultry and cattle feed dominated with 9 million tons, while swine and aquaculture accounted for 6 million tons. Rising protein demand and sustainable feed adoption are driving regional growth.

Animal Feed Market Competitive Landscape:

New Hope Group dominates the animal feed industry, producing over 28 million tons of feed annually across 20+ countries. The company’s strong presence in livestock, poultry, and aquaculture sectors is powered by integrated operations in feed manufacturing, breeding, and processing. Backed by innovation, automation, and sustainable practices, New Hope’s expansion in Asia-Pacific and emerging markets continues to reinforce its leadership in efficient and high-performance feed solutions.

-

In September 2025, New Hope launched the “Sichuan Key Laboratory of Animal Nutrition and Efficient Feed Utilization,” aiming to support research & development of feed optimization.

Haid Group leads China’s animal feed market, manufacturing more than 13 million tons of feed each year across poultry, swine, and aquaculture segments. The company’s dominance comes from its extensive production base, precision nutrition technology, and wide distribution across 30+ subsidiaries. Through continuous innovation in aquafeed, livestock breeding, and feed formulation, Haid drives modernization and sustainability within China’s expanding animal protein and feed production ecosystem.

-

In May 2025, Haid Group entered a strategic collaboration with Evonik Animal Nutrition to advance precision amino acid and enzyme solutions in aquafeed production.

Muyuan Foodstuff holds a dominant position in China’s livestock and feed industry, producing about 10 million tons of feed annually. Its vertically integrated operations ensure quality control and efficiency across pig farming and feed manufacturing. By leveraging automation, biosecurity, and intelligent farming systems, Muyuan reduces costs and enhances productivity, strengthening its position as a key contributor to China’s evolving swine feed and production landscape.

-

In February 2025, Muyuan Foodstuff announced a partnership with Huawei Cloud to implement intelligent farming and digital feed management systems for large-scale pig production.

Animal Feed Market Key Players:

Some of the Animal Feed Market Companies are:

-

New Hope Group

-

Haid Group

-

Muyuan Foodstuff

-

Cargill

-

Charoen Pokphand Foods (CPF)

-

Wen’s Food Group

-

Shuangbaotai Group (Twins Group)

-

Land O'Lakes

-

Tyson Foods (Broiler Division)

-

De Heus

-

Nutreco (SHV Holdings)

-

ADM Animal Nutrition

-

ForFarmers

-

Kent Nutrition Group

-

Alltech

-

Guangdong HAID Group

-

Godrej Agrovet

-

Purina Mills (Land O'Lakes)

-

Kemin Industries

-

Japfa Ltd

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 559.85 Billion |

| Market Size by 2033 | USD 893.92 Billion |

| CAGR | CAGR of 6.05% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Feed Type (Compound Feed, Forage & Silage, Concentrates, Premixes, Others) • By Livestock Type (Poultry, Cattle, Swine, Aquaculture, Sheep & Goat, Others) • By End User (Commercial Farms, Smallholder Farms, Household, Others) • By Form (Pellets, Mash, Crumbles, Others) • By Distribution Channel (Direct Sales, Retail Stores, Online Retail, Feed Dealers, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | New Hope Group, Haid Group, Muyuan Foodstuff, Cargill, Charoen Pokphand Foods (CPF), Wen’s Food Group, Shuangbaotai Group (Twins Group), Land O'Lakes, Tyson Foods (Broiler Division), De Heus, Nutreco (SHV Holdings), ADM Animal Nutrition, ForFarmers, Kent Nutrition Group, Alltech, Guangdong HAID Group, Godrej Agrovet, Purina Mills (Land O'Lakes), Kemin Industries, Japfa Ltd |