Anti-Inflammatory Drugs Market Scope & Overview:

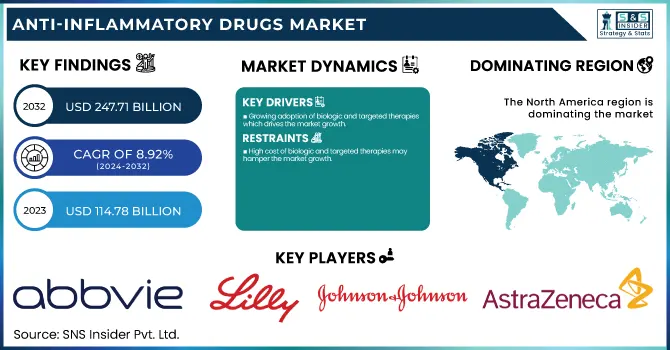

The Anti-Inflammatory Drugs Market size was USD 114.78 Billion in 2023 and is expected to reach USD 247.71 Billion by 2032 and grow at a CAGR of 8.92% over the forecast period of 2024-2032. This report provides statistical insights and trend analysis for the anti-inflammatory drugs market, highlighting key factors shaping the industry. It includes prevalence and incidence rates of inflammatory diseases such as rheumatoid arthritis and IBD, along with prescription and usage trends for biologics and NSAIDs. The report examines drug sales performance, detailing the revenue growth of leading brands and the impact of patent expirations on generic market entry. Additionally, it analyzes healthcare expenditure trends, focusing on treatment costs and reimbursement policies. Regulatory approvals and clinical pipeline developments are covered to track innovation and market expansion. Lastly, the report evaluates regional drug accessibility and pricing variations, offering a comprehensive market outlook.

To Get More Information on Anti-Inflammatory Drugs Market - Request Sample Report

Market Dynamics

Drivers

-

Growing adoption of biologic and targeted therapies which drives the market growth.

Biologic and targeted therapies are driving changing treatment preferences—less dependence on traditional NSAIDs and corticosteroids, more upon biologic drugs and JAK inhibitors in what could transform the anti-inflammatory drugs market. They are more effective because these drugs target pathways of inflammation, as opposed to gross immune suppression, and work better for chronic diseases such as rheumatoid arthritis, psoriasis, and inflammatory bowel disease (IBD). Rinvoq (AbbVie) and Xeljanz (Pfizer) are among several new JAK inhibitors approved in recent years, a class that opens even more oral alternatives to biologics into the therapeutic landscape. Growing targeted therapy solutions and enhancements in insurance coverage and reimbursement policies with the progress of FDA and EMA approvals of novel biologics in 2023 and 2024 illustrate the aspect of quality and equity perspective of the industry. The market is expected to grow steadily due to biotechnology developments in biologic and precision-based therapies for IBD over the coming years.

Restraint

-

High cost of biologic and targeted therapies may hamper the market growth.

High prices of the biologic and targeted therapies are one major challenge in the growth of the Anti-Inflammatory Drugs Market, reducing the number of patients who have access to effective treatment and rapidly increasing the financial burden on healthcare systems. Biologics like Humira (AbbVie), Cosentyx (Novartis), and Dupixent (Sanofi/Regeneron) are unique in being incredibly complex treatments, the production of which incurs higher costs than with traditional NSAIDs and corticosteroids. Although some insurance providers and government programs do cover biologics, much of the uptake remains hampered by stringent criteria and expensive out-of-pocket patient copayments. To make matters worse, chronic inflammatory diseases necessitate long-term treatment, and treatment non-adherence might be highly variable among patients thus further adding to the financial burden on healthcare systems. The cost always serves as a hurdle to expanding the markets, and hence, affordability turns out to be a huge challenge for pharmaceutical companies and healthcare policymakers.

Opportunity

-

Growing adoption of telemedicine and digital health solutions creates an opportunity in the market.

Advancements in telemedicine and digital health solutions that enhance patient access, monitoring, and ultimately disease management bring a tremendous opportunity in the anti-inflammatory drugs market. As chronic inflammatory diseases like rheumatoid arthritis, psoriasis, and inflammatory bowel disease become more common, digital healthcare tools are enabling quicker diagnoses and tailored treatment strategies. Rather, telemedicine platforms serve as a means for patients to meet their specialists remotely, alleviating the need for additional trips back to the hospital, which can be burdensome, particularly in remote and underserved areas. AI-based diagnostic aids and remote monitoring gadgets enable disease management and treatment compliance tracking, which has also resulted in enhanced patient outcomes. Further, pharma companies are partnering with health-tech companies to embed devices such as wearables and mobile apps that offer ongoing reporting of inflammatory markers and patient reactions to treatment.

Challenges

-

Patent expirations and biosimilar competition may create a challenge for the market.

Patent expirations along with growing biosimilar competition are one of the leading aces torturing the anti-inflammatory drugs market, depriving key pharmaceutical companies from huge revenue & leading market positions. Patents on several blockbuster biologics - including Humira (AbbVie), Remicade (Johnson & Johnson) and Enbrel (Amgen) - have recently expired or are approaching the end of their patent exclusivity periods, opening the door for multiple biosimilars to enter the market. As biosimilars improve affordability and access for patients, they also increase competition, decrease pricing power and compress the profit margins for original biologic manufacturers. Similarly, physician skepticism and patient worry about the effectiveness and safety of biologics relative to a reference product impede their usage and add further complexity to the market environment. However, the widening biosimilar landscape is pushing down pricing and profitability despite leading pharma investment into next-generation biologics, combination therapies, and lifecycle management strategies to counter these challenges.

Segmentation Analysis

By Drug Class

Anti-inflammatory biologics held the largest market share, around 48% in 2023. In contrast to traditional treatments with primarily symptomatic benefits, biologics such as Humira (AbbVie), Remicade (Johnson & Johnson), and Cosentyx (Novartis) which target specific inflammatory pathways (e.g., TNF-α, IL-17, and IL-6) can improve chronic disease control with many rheumatologic indications, including rheumatoid arthritis, psoriasis, and inflammatory bowel disease. Due to their better performance with lower side effects compared to steroid and long-term use of NSAIDs, carrying a risk of gastrointestinal and cardiovascular, the high rate of occurrence of autoimmune and chronic inflammatory diseases has increased the need for biologics. Constant changes in the regulatory landscape and expanded reimbursement coverage for biologics in developed markets have also cemented the market position, where physician preference for bringing new biologics to market has remained a powerful driving force.

By Application

Autoimmune Inflammatory Diseases held the largest market share, around 68% in 2023. The number of people suffering from autoimmune disorders continues to grow, as per the World Health Organization (WHO), partly due to genetic risk factors, environmental triggers, and lifestyle modifications. In addition, improved diagnostic technologies have encouraged more timely diagnosis and the management of these diseases, which has resulted in larger patient rates. Humira (AbbVie), Stelara (Johnson & Johnson), and Cosentyx (Novartis), recently became available, these biologic therapies have changed treatment by providing specific action and fewer side effects from the traditional NSAIDs and steroids. Additionally, the rise in government and private insurance reimbursement policies for the treatment of autoimmune disease, mainly in North America & Europe, has increased patient access to high-cost biologics, further bolstering this segment’s market share.

By Route of Administration

Injection held the largest market share around 68% in 2023. Due to the high efficacy, rapid onset of action, and use of biologics and targeted therapies, among the mode of administration segments, the injection segment dominates the Anti-Inflammatory Drugs Market in terms of market share. Biologic agents, such as monoclonal antibodies and cytokine inhibitors, must be delivered via injection because most cannot survive the GI tract and must be delivered parenterally to maintain their molecular integrity and allow for proper absorption. Prominent biologic therapies including Humira (AbbVie), Enbrel (Amgen), and Stelara (Johnson & Johnson) are available in combination with pre-filled syringes and autoinjectors to promote patient convenience and compliance. In addition, hospital and clinical practice prefer injectables for rheumatoid arthritis, psoriasis, and inflammatory bowel disease, due to their accurate dosing, as well as controlled delivery.

By End Use Industry

The Light Vehicle OEM segment held the largest market share around 58% in 2023. This is due to the large production of passenger cars and light commercial vehicles worldwide. It is owing to rising consumer preferences for various types of cars, particularly personal vehicles, SUVs, and compact cars, especially across emerging economies, that the demand for quality Anti-Inflammatory Drugs continues to increase. In light vehicles, coatings are needed at multiple levels from primers to basecoats and clearcoats for aesthetic appearance, protection against corrosion, and durability. Moreover, innovations in waterborne and green coatings have already bolstered this segment, as automakers seek sustainable production methods while complying with stringent environmental regulations. OEMs are investing robustly in advanced coatings to improve performance, durability, and quality making them key players with an edge over others which is further supported by an increase of electric vehicle (EV) adoption and light vehicle production facilities in Asia-Pacific and North America.

By Distribution Channel

Hospital Pharmacy held the largest market share around 69% in 2023. It is owing to the increased requirements for biologics and injectable therapies, and specific treatments, which are primarily dispensed in hospital settings. Biologics are treated under the supervision of medical doctors, hence hospitals become the primary treatment centers for patients with severe autoimmune and inflammatory illnesses, such as rheumatoid arthritis, inflammatory bowel disease, and psoriasis, taking biological drugs such as Humira (AbbVie), Remicade (Johnson & Johnson), and Cosentyx (Novartis). Besides that, hospital pharmacies always keep a wide range of high-cost, prescription-only anti-inflammatory medicines, making breakthrough therapies readily available for patients. Hospital-based treatment is preferred due to the requirement of healthcare professionals, specialists, infusion therapies, and possible adverse reactions monitoring, especially in using monoclonal antibodies and JAK inhibitors.

Regional Analysis

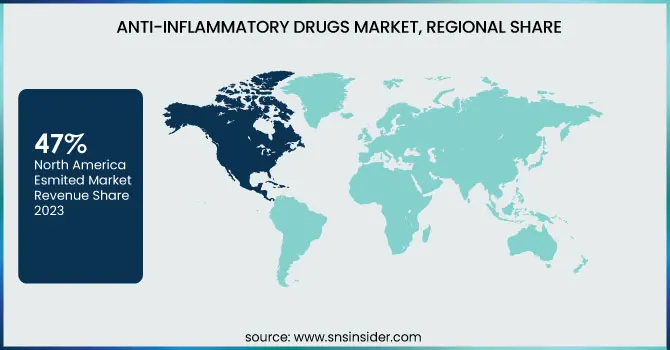

North America held the largest market share, around 47% in 2023. This is owing to the high incidences of autoimmune and inflammatory diseases, developed healthcare infrastructure, and high uptake of biologic therapies in this region. The high prevalence of rheumatoid arthritis, psoriasis, and inflammatory bowel disease in the region, coupled with the high demand for advanced anti-inflammatory therapies and the significant success of biologics and JAK inhibitors, is further boosting the market dynamics over the assessment timeline. Moreover, large pharmaceutical companies like AbbVie, Amgen, Johnson & Johnson, and Pfizer are also present in the growth of the market through continuous innovations and regulatory approvals related to the drugs. Importantly, the relatively favorable reimbursement policies and high healthcare expenditures per capita, driven especially by the U.S. and Canada, have facilitated patient access to high-priced biologic agents (e.g. Humira [AbbVie], Enbrel [Amgen], and Stelara [Johnson & Johnson]). Furthermore, a growing number of hospital admissions, specialty clinics, and retail pharmacies that offer access to anti-inflammatory agents have supported the market in North America.

Asia Pacific held a significant share market share in 2023. attributable to the developing cases of immune system infections, high medical services use, and expanding access to advanced treatments. Furthermore, the growing healthcare infrastructure and government initiatives to provide better accessibility to biological and targeted therapy are also expected to drive market growth. It is aided by the increase in pharmaceutical drug manufacturing networks in the region, with both international players and national companies adding production and distribution networks. In addition, the growing acceptance of biosimilars owing to their cost effectiveness coupled with regulatory approval for usage of biosimilars in countries such as Japan and South Korea also improved market penetration. The demand for both conventional and biological anti-inflammatory drugs in the Asia-Pacific is also likely to keep growing with the expansion of health insurance coverage and increased awareness of inflammatory diseases.

Do You Need any Customization Research on Anti-Inflammatory Drugs Market - Enquire Now

Key Players

-

AbbVie Inc. (Humira, Rinvoq)

-

Eli Lilly and Company (Olumiant, Taltz)

-

Johnson & Johnson Services Inc. (Stelara, Remicade)

-

Hoffmann-La Roche AG (Actemra, MabThera)

-

AstraZeneca Plc (Fasenra, Symbicort)

-

Bristol-Myers Squibb (Orencia, Zeposia)

-

Amgen Inc. (Enbrel, Otezla)

-

Novartis Pharmaceuticals Corporation (Cosentyx, Ilaris)

-

GlaxoSmithKline (Nucala, Benlysta)

-

Pfizer (Xeljanz, Celebrex)

-

Sanofi (Dupixent, Kevzara)

-

Merck & Co., Inc. (Indocin, Singulair)

-

Boehringer Ingelheim (Ofev, Praxbind)

-

Takeda Pharmaceutical Company (Entyvio, Velcade)

-

UCB Pharma (Cimzia, Neupro)

-

Biogen (Tecfidera, Plegridy)

-

Regeneron Pharmaceuticals (Dupixent, Kevzara)

-

Sun Pharmaceutical Industries (Mesacol, Ilumya)

-

Teva Pharmaceuticals (Ajovy, Copaxone)

-

Almirall S.A. (Skilarence, Ilumetri)

Recent Development:

-

In January 2024, Glenmark introduced a biosimilar version of the anti-diabetic drug Liraglutide in India, marking its expansion into the injectable anti-diabetic therapy segment

-

In May 2023, AbbVie secured U.S. FDA approval for RINVOQ for the treatment of adults with moderately to severely active Crohn's disease, further strengthening its anti-inflammatory drug portfolio.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD114.78 Billion |

| Market Size by 2032 | USD 247.71 Billion |

| CAGR | CAGR of8.92 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Drug Class (Corticosteroids, Non-steroidal Anti-inflammatory Drugs (NSAIDs), Anti-inflammatory Biologics,) • By Application (Rheumatoid Arthritis Psoriasis, Autoimmune Inflammatory Diseases) • By Route of Administration (Inhalation, Injection, Oral, Topical) • By Distribution Channel (Retail Pharmacy, Hospital Pharmacy) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | AbbVie Inc., Eli Lilly and Company, Johnson & Johnson Services Inc., Hoffmann-La Roche AG, AstraZeneca Plc, Bristol-Myers Squibb, Amgen Inc., Novartis Pharmaceuticals Corporation, GlaxoSmithKline, Pfizer, Sanofi, Merck & Co., Inc., Boehringer Ingelheim, Takeda Pharmaceutical Company, UCB Pharma, Biogen, Regeneron Pharmaceuticals, Sun Pharmaceutical Industries, Teva Pharmaceuticals, Almirall S.A. |