Antipsychotic Drugs Market Size & Trends Analysis:

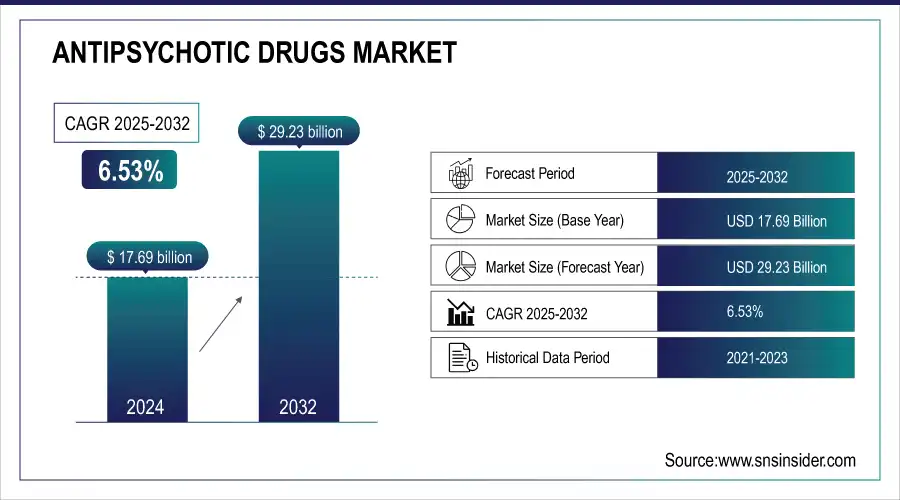

The Antipsychotic Drugs Market was valued at USD 17.69 billion in 2024 and is expected to reach USD 29.23 billion by 2032, growing at a CAGR of 6.53% from 2025-2032.

Get More Information on Antipsychotic Drugs Market - Request Sample Report

An amplified number of persons with mental health ailments across the world support the growth of the antipsychotic drugs market. As many as 21% of adults suffering from mental illness in 2023 (more than 50 million Americans) are living with mental illness. In addition, 4.8% of adults, or more than 12.1 million people in the US, report serious thoughts of suicide, and 16% of youth have at least one major depressive episode. Ample research and development investments are backing this growing demand for novel therapies, including top-spender Merck & Co., in 2023. By contrast, R&D consumed 18.29% of the budget at Pfizer, 10.7 billion dollars’ worth, well known for its devotion to research-based innovation efforts in the industry.

Key Antipsychotic Drugs Market Trends:

-

Growing prevalence of schizophrenia, bipolar disorder, and other psychiatric conditions is driving steady demand for antipsychotic medications worldwide.

-

Rising adoption of long-acting injectable (LAI) formulations is improving patient adherence and reducing relapse rates, making them a preferred option over oral therapies.

-

Introduction of next-generation antipsychotics with novel mechanisms of action, such as muscarinic receptor agonists, marks a shift beyond traditional dopamine-targeted treatments.

-

Increasing focus on personalized psychiatry and pharmacogenomics is enabling more tailored prescribing approaches to improve efficacy and reduce adverse effects.

-

Expansion of digital health integration, including telepsychiatry and mobile adherence tools, is supporting patient monitoring and treatment compliance.

-

Strong pipeline innovation, coupled with M&A activity from major pharmaceutical companies, is reshaping the competitive landscape and fueling product development.

Given the increasing prevalence of psychiatric disorders that are significant public health problems, the demand for effective antipsychotic treatments is urgent. These conditions can devastate day-to-day living and overall happiness which is why timely intervention is so key. Providing access to antipsychotic medications for such systems is becoming a priority as more than 150 million people live in geographic areas with insufficient mental health providers. This urgent need highlights the necessity of continuous research for new strategies to develop novel treatments that can ultimately better target such therapy-resistant cases with fewer side effects.

Market opportunities for antipsychotic drugs are growing, especially after new government efforts. As part of a renewed commitment to combat these issues, the Biden-Harris Administration has just announced over USD 200 million in funding for youth mental health services. The bill also includes funding for Mental Health and Suicide Prevention Programs through the Department of Veterans Affairs receiving USD 13.9 billion in this legislation, a USD 700 million increase over last fiscal year. Conclusion: The antipsychotic drugs market has another promising horizon ahead of it given the pace at which the landscape is evolving, aided by the greater investments flowing toward mental healthcare infrastructure and the provision of novel treatment solutions.

Antipsychotic Drugs Market Drivers:

-

Rising Incidence of Mental Health Disorders Fuels Demand for Antipsychotic Treatments

The rapid rise in mental disorders, including schizophrenia, bipolar disorder, and major depressive disorders are some key drivers that drive the growth of the antipsychotic drugs market. Various mental health organizations have been reporting that mixed anxiety and depression are the most common mental problems in Britain, with a UK prevalence of about 7.8% as reported by the Mental Health Foundation. In England, approximately 4% to 10% of individuals experience depression during their lifetime. A growing number of people are being diagnosed with these conditions as awareness of them grows, which is stimulating demand for effective treatment options. Increased awareness of mental health disorders spurs demand for accessible therapies; subsequently, both healthcare providers and patients alike are incentivized to find novel medications to enhance results.

-

Government Initiatives and Funding Propel Antipsychotic Market Growth

Growing Importance of Mental Health Among Governments Worldwide Drive Minnkey Antipsychotic Drugs Market Growth In a reflection of strong bipartisan commitment to tackling mental health issues, annual funding for the Mental Health Block Grant (MHBG) now exceeds USD 1 billion for the first time. Moreover, Congress upped Section 811 funding for disability housing to USD 360 million, including USD 148.3 million for fresh capital advance grants. This financing can support 1,600 homes, in proximity to amenities. These initiatives not only enhance service delivery but also guarantee that citizens get timely access to services and the chance for niches of innovation and growth for the pharmaceutical market as mental health slowly climbs up national government agendas.

Antipsychotic Drugs Market Restraints:

-

Side Effects and Safety Concerns Hinder Antipsychotic Treatment Adherence

The high side effect burden of many antipsychotic drugs may hinder patient compliance to treatment. Frequent problems involve hypersensitivity to weight pick-up, especially with atypical antipsychotics, and dry mouth from the prescription's effect on acetylcholine. Other effects can be dizziness, drowsiness, sexual dysfunction due to higher prolactin levels that lower libido and make it hard to get an erection, or menstrual irregularities. Other potential side effects include digestive problems, hypotension or low blood pressure, and mental fog which can impair clear thought processes and concentration. These side effects also can dissuade people from continuing the prescribed course of medication, which may reduce the efficacy of treatment before leading patients to search for alternative therapies or discontinue treatment altogether. Solving these safety issues is vital for better compliance and clinical results in mental healthcare.

-

Rising Costs of Antipsychotic Medications Create Barriers to Treatment Access

The cost of newer antipsychotic medications is a significant barrier for most patients, especially in areas with limited healthcare coverage. As a result, treatment with typical antipsychotics for each year costs between USD 16,000 and USD 57,000 in an individual who averages between 55 and 365 symptom days annually. Calculated on the basis of prescribing levels for the year 2021/2022 in England, this translates to an annual cost of approximately USD 410,000 for the NHS, and that adds up to almost USD 42 million in annual antipsychotic medication spending. Furthermore, the aggregate incremental cost for the 55 antipsychotics that saw price increases from July 2017 through June 2022 is USD 41 million. This may ensure patients cannot afford treatment, and particularly low-income patients cannot afford to take treatment, making it essential to ensure access to effective care through affordable medication options.

Antipsychotic Drugs Market Segmentation Overview:

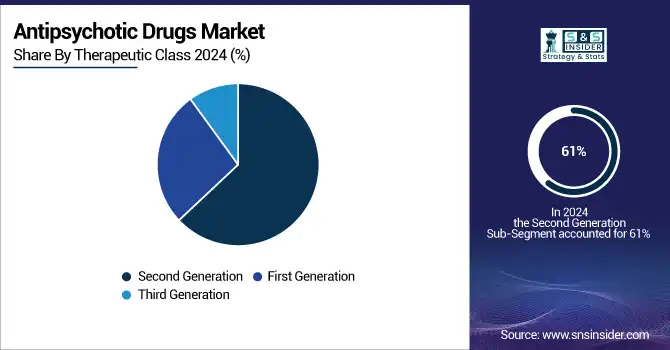

By Therapeutic Class, Second-Generation Antipsychotics Dominate, While Third-Generation Drives Future Growth

Second Generation dominated the Antipsychotic Drugs Market with the highest revenue share of about 61% in 2024 mainly because of their higher efficacy and safety, compared to the first-generation products. Known as atypical antipsychotics, these drugs are widely prescribed because of a lower incidence of extrapyramidal side effects and their ability to treat a whole range of mental illnesses more effectively. Their currently established reputation and many successful patient outcomes have entrenched this second generation of drugs into the dominant market position.

Third-generation antipsychotics are expected to have the highest compound annual growth rate of approximately 7.46% from 2025 to 2032. Driven by the advancement in pharmaceutical development relating to targeted therapy and having fewer side effects or greater tolerability, the increased demand for third-generation antipsychotics would also stem from the interest in innovative solutions of clinicians and patients for complex mental health problems.

By Distribution Channel, Drug Stores and Retail Pharmacies Lead Sales, Hospital Pharmacies Poised for Fastest Growth

In 2024, drug stores and retail pharmacies accounted for an immense share of revenue around 44% in the global antipsychotic drugs market concerned of their worldwide availability which makes it easy for patients or caregivers to buy these medications. They are the choice of consumers as these outlets offer a wide array of antipsychotic medication usually with bundled ancillary health services. The reason behind their market monopoly is due to their competitive pricing and instant access to the medications.

In contrast, hospital pharmacies are estimated to grow at a compound annual growth rate (CAGR) of approximately 7.36% over the period from 2025 to 2032. This growth is supported by the rising number of patients needing inpatient services for severe mental health disorders, requiring antipsychotic agents to be readily available inside hospitals. The incorporation of mental health services into health systems, increasing hospital pharmacies, and their need for specific therapy are further factors to support its rapid market growth.

By Disease, Schizophrenia Remains Market Leader, Bipolar Disorder Emerging as High-Growth Segment

Schizophrenia dominated the Antipsychotic Drugs Market with the highest revenue share of about 42% in 2024, which is expected given demands for treatment of such a prevalent mental health disorder. The long-term management needs of schizophrenia continue to justify the continued prescribing of antipsychotic drugs and their market-leading position. The efficacy of these treatments is continuously improved in research and development, enabling greater acceptance.

Conversely, bipolar disorder is projected to increase at a CAGR of approximately 7.42% between the years 2025 &2032. This rise can be accredited to greater recognition of bipolar disorder alongside derivative treatment customizations that cater to patient complexities. However, with the need for effective management of bipolar disorder to be recognized by healthcare providers, specialists are expected to drive further demand for antipsychotic medications – and thus this market segment is expected to have good growth.

By Drug, Aripiprazole Holds Largest Share, Brexpiprazole Expected to Record Fastest Growth

The antipsychotic drugs market is anticipated to be dominated by aripiprazole with a considerable revenue share at around,24% in 2024, as it has proven effective against a spectrum of psychotic disorders with long-term safety. As a popular atypical antipsychotic with many indications, including schizophrenia and bipolar disorder, it is often highly recommended by providers. Its proven market presence and unique mechanism of action, which balances dopamine levels makes this medication so popular.

Unlike other drugs, Brexpiprazole is expected to show the highest rate of compound annual growth (CAGR), from 2025-2032 about 7.58% The increase is due to the recent launch and continued clinical validation for schizophrenia treatment and as adjunctive therapy in major depressive disorder. Brexpiprazole is expected to have higher adoption rates as physician awareness of the drug's benefits increases and the demand for novel therapies continues to grow.

Antipsychotic Drugs Market Segmentation, Regional Analysis:

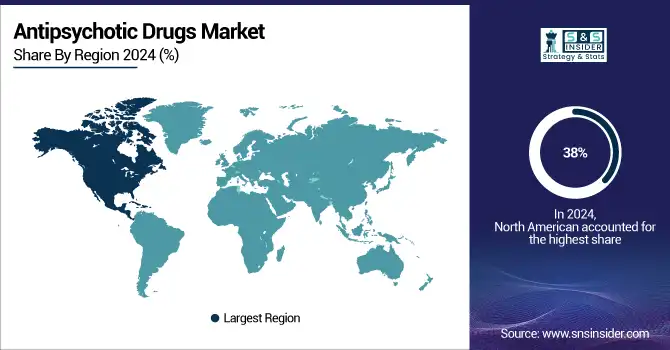

North America Dominates the Antipsychotic Drugs Market in 2024

North America is the dominant region in the Antipsychotic Drugs Market, holding an estimated 38% market share in 2024. This leadership is driven by the high prevalence of schizophrenia and bipolar disorder, widespread healthcare coverage, and the early adoption of innovative therapies such as long-acting injectables. Strong pharmaceutical R&D activity and rapid FDA approvals further strengthen North America’s leading position in the global market.

Get Customized Report as per Your Business Requirement - Request For Customized Report

-

United States Leads North America’s Antipsychotic Drugs Market

The United States dominates the region due to its advanced healthcare infrastructure, strong mental health awareness, and robust insurance coverage that ensures widespread patient access to medications. U.S.-based pharmaceutical companies drive innovation through next-generation therapies, while a high volume of prescriptions for chronic psychiatric disorders sustains demand. Growing recognition of mental health as a public health priority, alongside government-backed initiatives and digital healthcare adoption, positions the U.S. as the central hub for the antipsychotic drugs market in North America.

Asia Pacific is the Fastest-Growing Region in the Antipsychotic Drugs Market in 2024

Asia Pacific is the fastest-growing region in the Antipsychotic Drugs Market, with an estimated CAGR of 7.5% from 2024 to 2032. Growth is fueled by rising mental health awareness, rapid urbanization, expanding access to healthcare, and government-backed mental health programs. Affordable generics and increasing investments from multinational pharmaceutical companies in the region further accelerate adoption.

-

China Leads Antipsychotic Drugs Market Growth in Asia Pacific

China dominates the Asia Pacific market due to its vast patient population, expanding healthcare reforms, and integration of psychiatric care into public health systems. Local manufacturing strength ensures affordable access to generic medications, while collaborations with international pharma companies speed up the availability of innovative therapies. Government-driven mental health campaigns and investments in hospital infrastructure further support adoption. With its large-scale demand and strong healthcare policies, China remains the central hub for antipsychotic drug growth in Asia Pacific.

Europe Antipsychotic Drugs Market Insights, 2024

Europe accounts for a significant share of the Antipsychotic Drugs Market in 2024, supported by universal healthcare systems, strong R&D networks, and government-backed mental health programs. Germany’s high healthcare spending and advanced mental health services accelerate antipsychotic drug adoption, ensuring better patient access and compliance. Germany dominates the European market due to its structured mental healthcare programs, robust pharmaceutical sector, and active participation in clinical research. Favorable reimbursement policies and strong physician adoption of next-generation therapies reinforce Germany’s role as the leading hub for antipsychotic drug innovation and accessibility in Europe.

Middle East & Africa and Latin America Antipsychotic Drugs Market Insights, 2024

The Antipsychotic Drugs Market in the Middle East & Africa and Latin America is emerging, driven by growing awareness of mental health disorders and increasing investments in healthcare infrastructure. Countries such as Brazil, Mexico, Saudi Arabia, and South Africa are expanding psychiatric services through government-backed initiatives and collaborations with international pharmaceutical companies. While adoption lags behind North America, Europe, and the Asia Pacific, these regions show promising growth as stigma reduction, urbanization, and rising access to affordable generics contribute to higher demand for antipsychotic medications.

Competitive Landscape of the Antipsychotic Drugs Market:

H. Lundbeck A/S

H. Lundbeck A/S is a Denmark-based global pharmaceutical company specializing in the development and commercialization of innovative therapies for psychiatric and neurological disorders. With a strong legacy in mental health, the company’s antipsychotic portfolio includes leading drugs such as Escitalopram and Olanzapine, widely prescribed for depression, schizophrenia, and bipolar disorder. Its role in the antipsychotic drugs market is significant, as it provides clinically proven therapies that improve patient outcomes and expand access to modern psychiatric treatment worldwide.

-

In March 2025, Lundbeck expanded its neuroscience-focused pipeline by initiating Phase III trials for a next-generation antipsychotic candidate targeting schizophrenia and major depressive disorder.

Otsuka Pharmaceutical Co., Ltd.

Otsuka Pharmaceutical Co., Ltd. is a Japan-based global leader in healthcare innovation, with a strong presence in psychiatric and neurological treatment. The company is recognized for its groundbreaking work in antipsychotic therapies, notably Aripiprazole and Brexpiprazole, which are widely prescribed for schizophrenia, bipolar disorder, and depression. Its role in the antipsychotic drugs market is central, as it combines research-driven solutions with global outreach to address complex mental health challenges.

-

In April 2025, Otsuka introduced a new long-acting injectable formulation of Aripiprazole, designed to enhance adherence and improve patient management in schizophrenia.

Janssen Global Services, LL

Janssen Global Services, LLC, part of Johnson & Johnson, is a U.S.-based pharmaceutical company recognized for its leadership in psychiatric treatment solutions. Its antipsychotic portfolio includes blockbuster therapies such as Risperidone and Paliperidone, widely used to manage schizophrenia and schizoaffective disorder. Janssen’s role in the antipsychotic drugs market is pivotal, as it develops advanced therapies that improve treatment adherence, reduce relapse rates, and address unmet clinical needs in mental health care.

-

In February 2025, Janssen expanded its long-acting injectable portfolio by launching a novel monthly Paliperidone formulation aimed at improving patient compliance.

Eli Lilly and Company

Eli Lilly and Company is a U.S.-based pharmaceutical giant with a robust presence in neuroscience and psychiatric therapies. Its antipsychotic and related portfolio includes Fluoxetine and Duloxetine, which are widely prescribed for depression, anxiety, and related disorders, supporting millions of patients globally. Lilly’s role in the antipsychotic drugs market is vital, as it combines innovation, large-scale distribution, and deep expertise in psychiatric research to expand treatment access and drive clinical progress.

-

In January 2025, Eli Lilly announced the expansion of its mental health pipeline with a new investigational antipsychotic entering Phase II clinical trials.

Antipsychotic Drugs Market Key players:

Antipsychotic Drugs Market Companies are

-

Janssen Global Services, LLC

-

Eli Lilly and Company

-

AbbVie, Inc.

-

Teva Pharmaceutical Industries Ltd.

-

Dr. Reddy’s Laboratories Ltd.

-

Sumitomo Pharma

-

Alkermes

-

Bristol-Myers Squibb Company

-

AstraZeneca PLC

-

Pfizer Inc.

-

Horizon Therapeutics

-

Sandoz (a Novartis division)

-

Mylan N.V.

-

Novartis AG

-

Boehringer Ingelheim

-

Akorn Pharmaceuticals

-

Generics Pharmaceuticals

-

Sun Pharmaceutical Industries Ltd.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 17.69 Billion |

| Market Size by 2032 | USD 29.23 Billion |

| CAGR | CAGR of 6.53% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Disease (Schizophrenia, Bipolar Disorder, Unipolar Depression, Dementia, Others) • By Drug (Risperidone, Quetiapine, Olanzapine, Aripiprazole, Brexpiprazole, Paliperidone Palmitate, Others) • By Therapeutic Class (First Generation, Second Generation, Third Generation) • By Distribution Channel (Hospital Pharmacies, Drug Stores & Retail Pharmacies, Online Pharmacies) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | H. Lundbeck A/S, Otsuka Pharmaceutical Co., Ltd., Janssen Global Services, LLC, Eli Lilly and Company, AbbVie, Inc., Teva Pharmaceutical Industries Ltd., Dr. Reddy’s Laboratories Ltd., Sumitomo Pharma, Alkermes, Bristol-Myers Squibb Company, AstraZeneca PLC, Pfizer Inc., Horizon Therapeutics, Sandoz (a Novartis division), Mylan N.V., Novartis AG, Boehringer Ingelheim, Akorn Pharmaceuticals, Generics Pharmaceuticals, Sun Pharmaceutical Industries Ltd. |

| Key Drivers | • Rising Incidence of Mental Health Disorders Fuels Demand for Antipsychotic Treatments •Government Initiatives and Funding Propel Antipsychotic Market Growth. |

| RESTRAINTS | • Side Effects and Safety Concerns Hinder Antipsychotic Treatment Adherence • Rising Costs of Antipsychotic Medications Create Barriers to Treatment Access |