Biopharmaceutical Market Size & Trends

Get More Information on Biopharmaceutical market - Request Sample Report

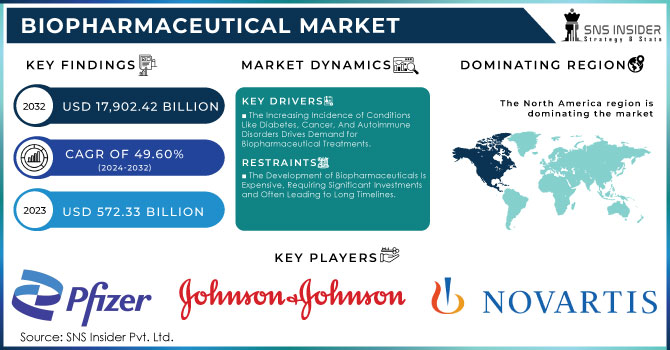

The Biopharmaceutical Market Size was valued at USD 486.15 Billion in 2023, and is expected to reach USD 1039.14 Billion by 2032, and grow at a CAGR of 8.82%.

The market for biopharmaceuticals is experiencing strong growth due to factors such as the rising prevalence of chronic diseases and the increasing demand for biopharmaceuticals, which can treat diseases that were previously considered untreatable. According to a report by the World Health Organization in September 2022, approximately 55 million people were living with dementia worldwide, with nearly 10 million new cases reported each year. The report also highlighted that Alzheimer's disease is the most common form of dementia, accounting for 60–70 percent of cases. The majority of individuals who develop Alzheimer's dementia are 65 years of age and older. The high incidence of disease and the growing demand for improved treatment are expected to drive the expansion of the biopharmaceutical market in the coming years.

The promising potential of biopharmaceutical products in treating previously untreatable diseases has led to the introduction of new drugs by various companies in this field. For instance, in September 2022, the Center for Biologics Evaluation and Research (CBER) granted approval to SKYSONA (elivaldogene autotemcel) from Bluebird Bio, Inc. for slowing the progression of neurologic abnormality in boys aged 4-17 years with early, active cerebral adrenoleukodystrophy (CALD). Conversely, in June 2022, CBER licensed GlaxoSmithKline's PRIORIX, a live attenuated vaccine against measles, mumps, and rubella. These product approvals are meeting the increasing demand for new medications and are expected to drive the biopharmaceutical industry during the forecast period.

Biopharmaceutical Market Dynamics:

Key Drivers:

-

The Increasing Incidence of Conditions Like Diabetes, Cancer, And Autoimmune Disorders Drives Demand for Biopharmaceutical Treatments.

-

Advancements In Genomics and Personalized Therapies Offer Opportunities for Tailored Treatments and Improved Patient Outcomes.

Restraints:

-

The Development of Biopharmaceuticals Is Expensive, Requiring Significant Investments and Often Leading to Long Timelines.

-

Obtaining Regulatory Approvals for New Drugs Can Be Complex and Time-Consuming, Hindering Market Entry.

Opportunity:

-

Expanding Access to Biopharmaceuticals in Developing Regions Presents Significant Growth Potential.

-

Innovations In Drug Discovery, Manufacturing, And Delivery Methods Enhance the Development and Accessibility of New Therapies.

Biopharmaceutical Market Segmentation Overview:

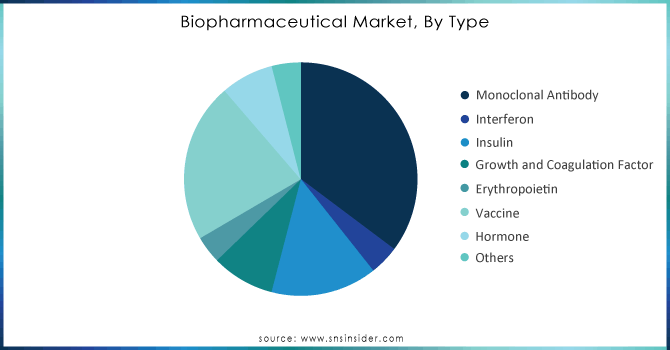

By Type

The monoclonal antibodies held the largest market share in 2023 which is 35.2% and it is expected to continue being so in the future due to the increasing utilization of therapeutics to treat cancer. This growth is driven by the rising number of approvals, clinical trials, and increasing research expenditure. For example, Phanes Therapeutics, Inc. received Phase 1 clearance from the United States Food and Drug Administration (FDA) for PT217, a bispecific anti-Delta-like ligand 3 (DLL3)/anti-Cluster of Differentiation 47 (CD47) antibody, in October 2022. Phanes Therapeutics, Inc. developed innovative approaches to harness the immune system for patients with small cell lung cancer (SCLC) and other neuroendocrine cancers.

Additionally, the increasing number of FDA approvals and the introduction of new products for different indications will further drive the segment. For instance, the FDA approved the use of Kimmtrak in treating HLA-A-positive adult patients with unresectable or metastatic uveal melanoma, a type of cancer that begins in the eye, in January 2022. Similarly, Roche Pharma released a combinatorial kit of monoclonal antibodies and Perjeta (pertuzumab) and Herceptin (trastuzumab) with hyaluronidase in May 2022 for treating patients with breast cancer.

Based on these factors, the monoclonal antibodies segment is expected to experience significant growth during the forecast period.

Need any customization research on Biopharmaceutical Market - Enquiry Now

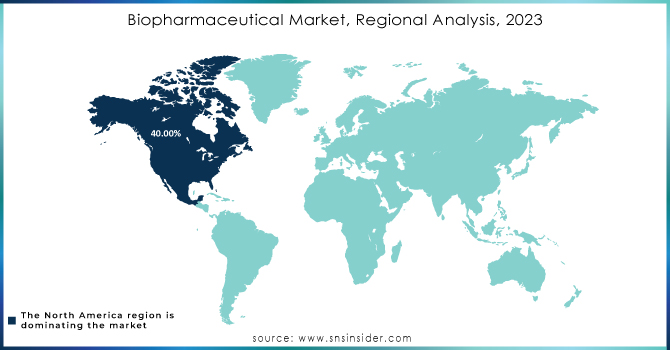

Regional Analysis:

North America held a 40% market share in 2023. The increasing prevalence of chronic diseases unable to be treated by traditional pharmaceuticals, the presence of a large patient base across diverse indications, and the related increase in investments in R&D for this field are expected to fuel growth going forward. Moreover, the presence of established biopharmaceutical companies along with new product launches are expected to propel market growth in the region.

An increase in the number of individuals suffering from chronic diseases in the US is expected to boost market expansion. Roughly 20.1 million adults in the United States aged 20 and over have coronary heart disease, the most common type of heart disease, according to July 2022 updated data from the Centers for Disease Control and Prevention (CDC). According to the same recorded data from the CDC, every 40 seconds someone in the United States has a heart attack, and nearly 805,000 people have a first well as recurrent heart attack. Thereby, the increasing incidence of cardiovascular diseases increases the demand for new drugs for treatment, which in turn is expected to propel the growth of the biopharmaceutical market.

A growing prevalence of chronic diseases in the Canadian population and an onset of conditions associated with these disorders is also anticipated to accelerate revenue growth in the biopharmaceuticals market during the stipulated period. For example, as of July 2022, almost one out of every five Canadians (7,329,910 citizens; 18.8. %) are over the age of 65 years old according to Statistics Canada. The geriatric population is more susceptible to chronic diseases, and the growth of the elderly population is likely to increase demand for efficacious drugs for their treatment, thereby fueling the market growth.

Key Biopharmaceutical Companies:

The Players operating in the biopharmaceutical market are:

1. Pfizer

-

Product Portfolio: COVID-19 vaccine (Comirnaty), Prevnar (pneumococcal vaccine), Eliquis (blood thinner), Xeljanz (rheumatoid arthritis), Ibrance (breast cancer)

2. F. Hoffmann-La Roche Ltd.

-

Product Portfolio: Herceptin (breast cancer), Avastin (cancer), Rituxan (cancer), Ocrevus (multiple sclerosis), Tecentriq (cancer)

3. Johnson & Johnson

-

Product Portfolio: Janssen COVID-19 vaccine, Darzalex (multiple myeloma), Stelara (inflammatory diseases), Invega Sustenna (schizophrenia), Remicade (inflammatory diseases)

4. Novartis

-

Product Portfolio: Cosentyx (psoriasis), Entresto (heart failure), Zolgensma (spinal muscular atrophy), Kymriah (cancer), Tasigna (chronic myeloid leukemia)

5. Merck & Co.

-

Product Portfolio: Keytruda (cancer), Gardasil (HPV vaccine), Januvia (diabetes), Remicade (inflammatory diseases), Brigatinib (non-small cell lung cancer)

6. AbbVie

-

Product Portfolio: Humira (rheumatoid arthritis), Rinvoq (rheumatoid arthritis), Skyrizi (psoriasis), Imbruvica (blood cancer), Venclexta (blood cancer)

7. Amgen

-

Product Portfolio: Otezla (psoriasis), Enbrel (rheumatoid arthritis), Repatha (cholesterol), Aranesp (anemia), Neulasta (neutropenia)

8. Biogen

-

Product Portfolio: Tecfidera (multiple sclerosis), Spinraza (spinal muscular atrophy), Aduhelm (Alzheimer's disease), Ocrevus (multiple sclerosis), Hemera (multiple sclerosis)

9. Eli Lilly and Company

-

Product Portfolio: Trulicity (diabetes), Humalog (insulin), Verzenio (breast cancer), Taltz (psoriasis), Jardiance (diabetes)

10. AstraZeneca

-

Product Portfolio: Tagrisso (lung cancer), Farxiga (diabetes), Lynparza (ovarian cancer), Calquence (chronic lymphocytic leukemia), Imfinzi (lung cancer)

11. Bayer

-

Product Portfolio: Xarelto (blood thinner), Eylea (age-related macular degeneration), Xigduo XR (diabetes), Adempas (pulmonary arterial hypertension), Stivarga (colorectal cancer)

12. Sanofi

-

Product Portfolio: Lantus (insulin), Adlyxin (diabetes), Dupixent (atopic dermatitis), Lixiana (blood thinner), Cabenuva (HIV)

13. Bristol Myers Squibb

-

Product Portfolio: Revlimid (multiple myeloma), Eliquis (blood thinner), Opdivo (cancer), Yervoy (cancer), Pomalyst (multiple myeloma)

14. Takeda Pharmaceutical Company Limited

-

Product Portfolio: Entyvio (inflammatory bowel disease), Velcade (multiple myeloma), Vyvanse (ADHD), Livsty (hepatitis C), Brilinta (platelet inhibitor)

15. Gilead Sciences

-

Product Portfolio: Biktarvy (HIV), Descovy (HIV), Truvada (HIV), Genvoya (HIV), Epclusa (hepatitis C)

16. Vertex Pharmaceuticals

-

Product Portfolio: Kalydeco (cystic fibrosis), Orkambi (cystic fibrosis), Symdeko (cystic fibrosis), Trikafta (cystic fibrosis)

17. GlaxoSmithKline

-

Product Portfolio: Shingrix (shingles vaccine), Trelegy Ellipta (COPD), Nucala (asthma), Advair (asthma), Benlysta (lupus)

18. AbbVie

-

Product Portfolio: Humira (rheumatoid arthritis), Rinvoq (rheumatoid arthritis), Skyrizi (psoriasis), Imbruvica (blood cancer), Venclexta (blood cancer)

19. Moderna

-

Product Portfolio: COVID-19 vaccine, mRNA-based cancer vaccines

20. Regeneron Pharmaceuticals

-

Product Portfolio: Dupixent (atopic dermatitis), Eylea (age-related macular degeneration), Libtayo (cancer), Dupixent (asthma)

21. Novo Nordisk

-

Product Portfolio: NovoRapid (insulin), Levemir (insulin), Ozempic (GLP-1 receptor agonist), Rybelsus (GLP-1 receptor agonist), Victoza (GLP-1 receptor agonist)

Recent Developments

-

In July 2023, Pfizer invested USD 25 million in Caribou Biosciences to advance an immune-evasive, allogeneic CAR-T cell therapy, CB-011. The cell therapy is being assessed in a Phase I CaMMouflage trial for people with relapsed or refractory multiple myeloma.

-

In April 2023, InflaRx N.V. was also granted an Emergency Use Authorization by the United States Food and Drug Administration for its first-in-class monoclonal anti-human complement factor C5a antibody Gohibic (vilobelimab) to be used to treat COVID-19 in hospitalized adults when administered within 48 hours of initiation of mechanical ventilation or extracorporeal membrane oxygenation.

| Report Attributes | Details |

| Market Size in 2023 | US$ 486.15 Billion |

| Market Size by 2032 | US$ 1039.14 Billion |

| CAGR | CAGR of 8.82% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type(Monoclonal antibody, Interferon, Insulin, Growth and coagulation factor, Erythropoietin, Vaccine, Hormone, Others) • By Application(Oncology, Blood disorder, Metabolic disease, Infectious disease, Cardiovascular disease, Neurological disease, Immunology, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Pfizer, F. Hoffmann-La Roche Ltd., Johnson & Johnson, Novartis, Merck & Co., AbbVie, Amgen, Biogen, Eli Lilly and Company, AstraZeneca, Bayer, Sanofi, Bristol Myers quibb, Takeda Pharmaceutical Company Limited, Gilead Sciences, Vertex Pharmaceuticals, GlaxoSmithKline, AbbVie, Moderna, Regeneron Pharmaceuticals, Novo Nordisk, Others |

| Key Drivers | • The Increasing Incidence of Conditions Like Diabetes, Cancer, And Autoimmune Disorders Drives Demand for Biopharmaceutical Treatments. • Advancements In Genomics and Personalized Therapies Offer Opportunities for Tailored Treatments and Improved Patient Outcomes. |

| Market Opportunities | • Expanding Access to Biopharmaceuticals in Developing Regions Presents Significant Growth Potential. • Innovations In Drug Discovery, Manufacturing, And Delivery Methods Enhance the Development and Accessibility of New Therapies. |