Assisted Walking Devices Market Size Analysis

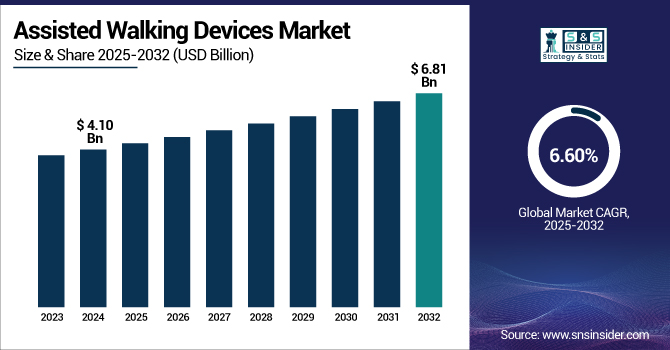

The Assisted Walking Devices Market size was valued at USD 4.10 billion in 2024 and is expected to reach USD 6.81 billion by 2032, growing at a CAGR of 6.60% over the forecast period of 2025-2032.

To Get more information on Assisted Walking Devices Market - Request Free Sample Report

The assisted walking devices market is witnessing steady growth with the increasing geriatric population, increasing prevalence of mobility impairment, and increasing focus on rehabilitation care. Technological advancements in ergonomic design and increasing adoption of home healthcare are also fueling demand. Walkers and canes remain the most widely used aids, with gait trainers gaining traction in rehabilitation centers. In addition, online distribution channels are expanding rapidly, giving consumers greater access to a wide range of mobility products.

For Instance, according to AAFP, an estimated 6.1 million community-dwelling adults use mobility aids such as canes, walkers, and crutches, with almost two-thirds of them aged 65 or older. As the population ages further and more people experience multiple chronic conditions, mobility impairments and associated disabilities are exhibit to become more common. In adults aged 65 and older, approximately 10% use canes and 4.6% use walkers for support.

The U.S. assisted walking devices market size was valued at USD 1.41 billion in 2024 and is expected to reach USD 2.31 billion by 2032, growing at a CAGR of 6.39% over the forecast period of 2025-2032. The U.S. leads the North American assisted walking devices market because of its developed healthcare sector, expanding geriatric population, and high level of awareness regarding mobility assist solutions. The availability of major industry players and the rising use of home healthcare augment the country's position at the top in the region.

Assisted Walking Devices Market Dynamics

Drivers

-

The Growing Aging Population Propel the Market Growth

The rise in the global geriatric population is one of the key drivers of the assisted walking devices market. With age progression, the muscle will weaken, balance will diminish, and the flexibility of the joint will be reduced, leading to mobility impairment. Osteoporosis, arthritis, and old age also cause severe low mobility among old people. It is reported in MDPI that the majority of countries are now experiencing declining births and a precipitous rise in the elderly, leading to decreasing populations overall. World Health Organization statistics indicate that from 2015 to 2050, the global proportion of the who are over 60 years old will nearly double, from 12% to 22%. This is a significant global challenge. Assisting walking aids, including canes, walkers, and gait trainers, is significant in support so that the elderly can stay independent and reduce fall risk, a major concern with older adults. This shift in population significantly increases demand for mobility aids in all care settings.

-

Healthcare and Rehabilitation Equipment Improvement Driving the Market Growth

Improvements in rehabilitation facilities and healthcare infrastructure have been a driving factor in widening the use of assisted walking aids. Hospitals, outpatient rehabilitation facilities, and physiotherapy centers are more adequately equipped with facilities and experts to assess and suggest appropriate mobility devices. For instance, according to the WHO, as of 2024, life expectancy at birth globally has increased to 73.3 years, up by 8.4 years since 1995. The number of individuals 60 years and above globally is estimated to grow from 1.1 billion in 2023 to 1.4 billion in 2030, with this transition occurring most rapidly in the developing regions. Breakthroughs in rehabilitation therapies, including personalized therapy regimens and mobility training, encourage patients to employ walking aids within rehabilitation programs. As healthcare systems increasingly focus on patient mobility and post-operative recovery, the use of walking aids becomes more common, thus driving the assisted walking devices market trends.

Restraints

-

Limited Reimbursement Policies are Restraining the Market Growth

One of the notable limitations in the assisted walking devices market growth is the insufficiency of extensive reimbursement coverage by public as well as private health insurance agencies. In the majority of areas, including developing countries, mobility aides such as walkers, canes, crutches, or gait trainers are not reimbursed or only reimbursed in part under national health schemes or private insurance schemes. As a result, patients have to pay the entire amount out-of-pocket, which is costly, particularly for retired or fixed-income older adults. This financial obstacle deters timely usage or replacement of mobility devices, in the end curtailing market expansion and penetration.

Assisted Walking Devices Market Segmentation Insights

By Product Type

The walker segment dominated the assisted walking devices market with a 64.10% market share in 2024, owing to its prevalent use by older people and patients with mobility impairment. Walkers provide better support and stability than canes and crutches, hence becoming the most popular option for recovering patients from surgery, injury, or suffering from long-term diseases such as arthritis and osteoporosis. Their cost-effectiveness, simplicity, and versatility for indoor and outdoor use have made them widely accepted in hospitals, rehabilitation centers, and home care environments, cementing their market leadership.

The gait trainers segment is expected to grow at the fastest CAGR over the forecast period due to the rising demand for advanced rehabilitation equipment and an increased rate of neurological and musculoskeletal disorders. Gait trainers are particularly beneficial for children and stroke patients because they aid balance, posture, and natural gait patterns in therapy. Improvements in adjustable, fitted designs and heightened awareness of early mobility rehabilitation also boost demand.

By Distribution Channel

The offline segment dominated the assisted walking devices market share in 2024, with a 64.28%, mainly because of the high demand among older consumers and caregivers for in-person assessment and fitting of mobility devices. Brick-and-mortar stores, medical supply stores, and hospital pharmacies enable users to try out devices for comfort, fit, and usability-key factors for users with mobility issues.

The online segment is expected to exhibit the fastest growth rate in the projection years, with 6.93% CAGR due to the growing digital trend among consumers and the ease of home delivery, particularly among consumers with poor mobility. Online channels provide a greater range of walking aids with assisted features, competitive prices, and consumer reviews that enable buyers to make better-informed choices.

By End-User

The hospitals segment dominated the assisted walking devices market share in 2024, with a market share of 83.06% based on the predominant role played by healthcare institutions in delivering rehabilitation treatment and mobility support to patients. Hospitals possess well-trained medical specialists and infrastructure that provide proper fitment, measurement, and post-fit-up maintenance to those patients in need of walking aids, especially those being treated for surgical recovery, injuries, or ongoing diseases. The prevalent use of these products within healthcare facilities, combined with robust healthcare systems allowing patient mobility and rehabilitation, solidified the stronghold of hospitals as the leading end-user segment.

The non-hospitals segment is experiencing the fastest growth over the forecast period, supported by the growing use of assisted walking products within home healthcare, rehabilitation centers, and outpatient facilities. With an ever-increasing aging population and an increasing number of people opting to receive care in the comfort of their homes, the demand for non-hospital mobility aids has increased. Further, with the developments in telemedicine and home healthcare services coupled with the ease of home delivery and self-care packages, the demand for walking aids in non-hospital settings also increases. The growth of the segment is also underpinned by the growing number of rehabilitation facilities and elderly care centers, increasing the scope of mobility aid offerings.

Regional Outlook

North America Assisted Walking Devices Market Trends

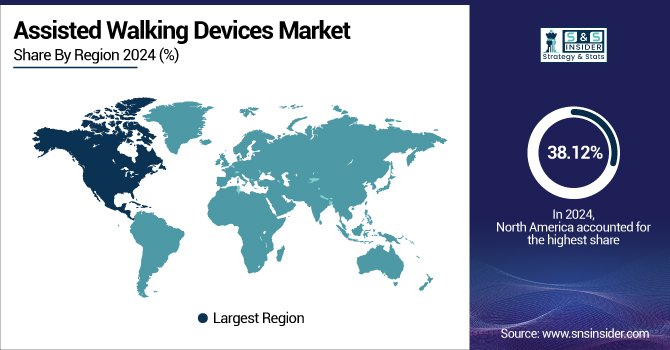

North America dominated the assisted walking devices market with 38.12% market share in 2024 because of its aging population, universal access to sophisticated healthcare, and high mobility solution awareness. The region benefits from established reimbursement policies, particularly in the U.S., which facilitate the acquisition of assistive devices. In addition, the availability of top manufacturers, uninterrupted product innovations, and rising demand for home healthcare services play a major role in making the region a market leader.

Asia Pacific Assisted Walking Devices Market Trends

Asia Pacific is expected to be the fastest-growing region in the assisted walking devices market with a CAGR of 7.25%, driven by the rapidly growing elderly population, increasing prevalence of chronic diseases, and changing healthcare infrastructure. Mobility conditions are becoming more prevalent in China, India, and Japan, and will thus fuel demand for walking aids. Moreover, increased government efforts towards geriatric care and growing awareness of assistive devices are driving growth among both urban and rural populations.

Europe held the significant market share in the assisted walking devices market analysis because of its high population and aging population base, well-developed public health systems, and high priority given to elderly care. Countries such as Germany, the UK, and France have strong healthcare infrastructure and social welfare programs that allow the provision of mobility aids to the elderly.

Germany leads the European walking assistive devices market due to its highly advanced healthcare system, extensive population of the elderly, and high priority for care and rehabilitation of the elderly. It is complemented by high spending on healthcare, universal coverage for insurance, and positive reimbursement policies favoring the use of mobility aids. Furthermore, Germany's advanced manufacturing assisted walking devices companies and availability of best-in-class medical device manufacturers provide a consistent supply of technologically advanced and ergonomically designed walking aids suitable for the needs of elderly people.

The Latin American region is gradually increasing with the increasing number of people aged above 60 years and prevalence of chronic diseases such as osteoporosis, arthritis. Brazil is emerging very rapidly itself through health technology and healthcare expenditure. Mexico is also growing the market through government policies and programs to increase access to assistive devices. Mexico is also growing the market with policies and initiatives by the government to enhance access to assistive devices.

The MEA region is growing steadily due to population trends, including an increasing aging population and increased rates of chronic conditions. Saudi Arabia and South Africa are leading the market with improved healthcare facilities and government initiatives to enhance access to mobility aids. Cultural attitudes and economic considerations, including affordability and income levels, underpin the take-up of walking assist devices in the area. Strategies to reduce cultural stigmas and encourage understanding of the value of these devices are key to long-term market expansion.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players in the Assisted Walking Devices Market

-

Medline Industries LP

-

NOVA Medical Products

-

Briggs Healthcare

-

Sunrise Medical

-

Kaye Products Inc.

-

Carex Health Brands

-

Ossenberg GmbH

-

Topro

-

other players

Recent Developments in the Assisted Walking Devices Industry

-

In July 2024, Drive DeVilbiss Healthcare (DDH) announced the acquisition of Mobility Designed, Inc.'s complete product line. This strategic acquisition enhances DDH's portfolio of innovative medical devices and in-house advanced industrial design capabilities to aid its growth and product innovation.

-

In April 2023, Medline announced a partnership with Martha Stewart to introduce a fashionable new collection of bed, bath, and in-home safety and mobility products. The Martha Stewart Custom Collection blends form and function, providing sophisticated prints, patterns, and finishes that enhance both safety and beauty.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 4.10 Billion |

| Market Size by 2032 | USD 6.81 Billion |

| CAGR | CAGR of 6.60% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Canes, Crutches, Walkers, Gait Trainers) • By Distribution Channel (Online, Offline) • By End-User (Hospitals, Non-Hospitals) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Drive DeVilbiss Healthcare, Invacare Corporation, Medline Industries LP, NOVA Medical Products, Briggs Healthcare, Sunrise Medical, Kaye Products Inc., Carex Health Brands, Ossenberg GmbH, Topro, and other players. |