Geriatric Care Services Market Size Analysis:

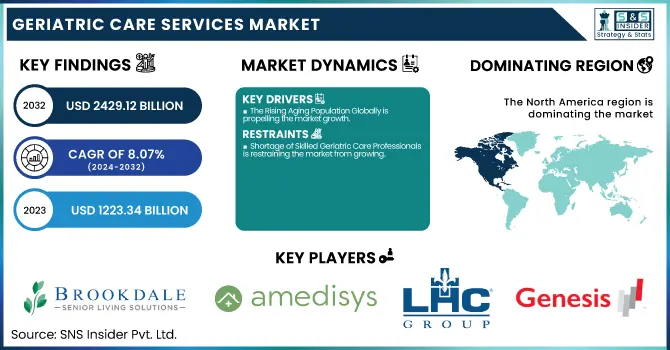

The Geriatric Care Services Market Size was valued at USD 1223.34 billion in 2023 and is expected to reach USD 2429.12 billion by 2032, growing at a CAGR of 8.07% from 2024-2032.

To Get more information on Geriatric Care Services Market - Request Free Sample Report

This report provides an analytical perspective through the integration of in-depth statistical analysis on various dimensions of the Geriatric Care Services Market. It incorporates a detailed analysis of aging population demographics by region, caregiver workforce trends, and caregiver-to-patient ratios, with system strain and regional variations highlighted. Additionally, it examines regional healthcare spending on aged care, divided by government, private, and out-of-pocket sources. The report covers insurance and reimbursement coverage trends through a comparative prism across international markets. Elderly hospitalization and readmission trends are also looked at to understand care efficiency as well as longer-term outcomes through different service environments.

The U.S. Geriatric Care Services Market was valued at USD 344.96 billion in 2023 and is expected to reach USD 667.60 billion by 2032, growing at a CAGR of 7.76% from 2024-2032. The United States possesses a dominant position in the North American geriatric care services market because of its fast-growing older population, established healthcare infrastructure, and prominent presence of both government and private care providers. Moreover, growing government funding and insurance coverage also fuel the growth of geriatric care services nationwide.

Geriatric Care Services Market Dynamics

Drivers

-

The Rising Aging Population Globally is propelling the market growth.

One of the main stimuli of the Geriatric Care Services Market is the worldwide acceleration in the aging population. By 2050, as stated by the United Nations, the number of individuals over 65 will exceed twice that amount, hitting more than 1.5 billion, and rapid growth has already been witnessed in 2023. The aging population trend drives consistent demand for long-term care, home health care, and assisted living. Japan, Germany, Italy, and the U.S. are seeing an upsurge in geriatric-specific healthcare facilities and workforce development initiatives. For example, in February 2025, Brookdale Senior Living expanded its HealthPlus service line, with a focus on high-engagement models of care. The bulging elderly population and their growing healthcare needs, such as chronic disease management and mobility support, directly contribute to the widening scope and innovation in geriatric care services.

-

Shift Toward Home-Based and Community Care Models is driving the market growth.

There is a significant trend towards home-based and community-oriented geriatric care as elderly patients increasingly opt for aging in place over institutional care. This shift is influenced by both patient choice and the increasing cost burden on formal healthcare facilities. Home health agencies and digital monitoring systems have become extremely popular, with providers such as Amedisys and LHC Group increasing home health and hospice care services. In addition, insurance payers and public health systems are encouraging outpatient care to avoid hospital readmissions, bolstered by a 2023 CMS initiative to increase reimbursement for home-based chronic care management. Telehealth options and mobile care units have been implemented in the U.S. and several EU nations to reach rural and aging populations, further supporting the trend. This change is fueling innovation in models of geriatric care delivery, increasing access, and enhancing overall patient outcomes at a cost-effective rate.

Restraint

-

Shortage of Skilled Geriatric Care Professionals is restraining the market from growing.

Among the major constraints on the growth of the Geriatric Care Services Market is the chronic shortage of trained caregivers specializing in the care of the elderly. With the global population aging further, the need for geriatricians, nurses, caregivers, and ancillary support staff has grown more than the availability of a skilled workforce. The World Health Organization estimates that there is an urgent need for millions more health and social care workers around the world to care for the elderly by 2030. In the United States alone, the American Geriatrics Society estimated in 2023 that the nation requires at least 30,000 geriatricians, but fewer than 7,500 are actively practicing. This shortage of workers results in excessive caregiver-to-patient ratios, burnout, and decreased quality of care. In addition, fewer training programs and lower compensation discourage new entrants, curtailing the scalability and efficiency of geriatric care services globally.

Opportunities

-

Expansion of telehealth and remote monitoring for elderly care presents a significant opportunity.

The growing use of telehealth and remote patient monitoring technologies is a major opportunity in the geriatric care services market. With mobility issues and chronic diseases common among the elderly, virtual healthcare solutions offer safer, more convenient access to ongoing medical care. The COVID-19 pandemic hastened digital health adoption, particularly among older adults requiring frequent visits and medication management. As reported by the CDC, telehealth adoption by elderly Americans increased by more than 60% in 2023. Platforms supporting video consultations, virtual vitals monitoring, and AI-powered health alerts decrease readmissions to hospitals and alleviate caregiver burden. With governments and payers broadening reimbursement policies for telemedicine, providers of bundled geriatric care solutions are in an excellent position to take advantage of this tech-driven trend toward aging in place.

Challenges

-

Fragmented Care Delivery and Lack of Standardization are challenging the market's progress.

One of the main problems in the geriatric care services market is that the delivery of care is fragmented, and there are no standardized protocols among service providers. Older patients tend to need a continuum of care, including home healthcare, assisted living, inpatient hospital care, rehabilitation, and hospice that is generally provided by different organizations with little or no coordination. This fragmented strategy can result in communication failures, medication mistakes, duplicative diagnostics, and generally poor patient experiences. Additionally, differing regulatory environments and accreditation requirements across regions add to the complexity of care consistency. For example, in most nations, public and private sector involvement in elderly care is not integrated, resulting in service gaps. Without integrated processes and aligned care pathways, providers experience inefficiencies, and patients and families experience confusion and inconsistent results. These issues are critical to resolve to enhance care quality and operational performance.

Geriatric Care Services Market Segmentation Analysis

By Service

In 2023, the Institutional Care segment dominated the geriatric care services market with a 79.71% market share because of growing demands for round-the-clock medical care and specialized treatment for elderly people suffering from chronic diseases, cognitive decline, or mobility issues. Infirmaries like nursing homes, assisted living facilities, and rehabilitation centers provide overall care services involving medical, therapy, and personal assistance, which cannot be easily offered at home. Also, the increasing population of older adults in developed nations, along with an increasing number of elderly individuals living alone or lacking proper family support, has increased the demand for institutional care. CDC statistics show that more than 1.3 million elderly residents were in nursing homes throughout the U.S. in 2023, emphasizing the dependence on these facilities. Institutional care also enjoys ordered staffing, funding from the government, and unified healthcare services, and hence is the choice for mature geriatric treatment.

By Service Provider

In 2023, the Public segment dominated the geriatric care services market with an 82.23% market share, mainly attributed to widespread government support and grants to provide care for the elderly that is both affordable and accessible. Public care providers, mostly associated with the government or nongovernment organizations, are very important in offering basic healthcare services to the aging population, mainly through publicly funded healthcare systems. This dominance is additionally supported by public insurance programs of broad scope, like Medicare and Medicaid in the United States, which provide far-reaching coverage of a broad range of geriatric care services like medical treatments, preventive care, and long-term care. Such initiatives guarantee that a large percentage of the old people have access to basic healthcare services, thus propelling the expansion and dominance of the public segment in the geriatric care services market.

By Payment Source

In 2023, the Public Insurance segment dominated the geriatric care services market with a 68.25% market share due to its affordability, wide coverage, and high level of government support. Public insurance schemes, e.g., Medicare and Medicaid in the United States, offer very wide coverage of a broad set of geriatric services, from hospitalization and long-term care to treatment for chronic diseases like cancer and cardiovascular diseases. These schemes usually include pre-existing diseases and hospitalization costs, rendering healthcare more affordable for the geriatric population. Public insurance also provides tax relief and cost feasibility, allowing senior citizens to receive required medical care without much out-of-pocket expenditure. The confluence of extensive coverage and financing support has consolidated public insurance's leadership of the geriatric care services market

Geriatric Care Services Market Regional Insights

North America dominated the geriatric care services market with a 40.10% market share in 2023, with its developed healthcare infrastructure, increased healthcare spending, and a large percentage of the elderly population. The region is supported by robust policy backing, such as Medicare and Medicaid, which pay for several geriatric care services like skilled nursing, hospice, and home health care. In addition, the existence of major players like Brookdale Senior Living and Genesis HealthCare brings maturity and structure to the market. The increasing recognition of individualized senior care, along with improvement in remote monitoring of health and electronic health records technology, further solidifies the region's leadership position.

The Asia Pacific region is experiencing the fastest growth of the geriatric care services market with 8.64% CAGR, driven by a rapidly developing population that has aged significantly, especially in South Korea, Japan, and China. Regional governments are more frequently acknowledging the requirements for care for the elderly, as well as increasing investment in the infrastructure and public-private collaborations to cater to demand. Growing disposable incomes, urban lifestyles, and altered family structures are also fueling the need for home and institutional geriatric care. Furthermore, growing insurance penetration and the upsurge of digital health technology adoption are catalyzing market development, thereby rendering Asia Pacific a high-potential growth market for the long term to come.

Get Customized Report as per Your Business Requirement - Enquiry Now

Geriatric Care Services Market Key Players

-

Brookdale Senior Living Inc. (Assisted Living Services, Memory Care Programs)

-

Amedisys Inc. (Home Health Services, Hospice Care)

-

LHC Group, Inc. (Personal Care Services, Skilled Nursing Facilities)

-

Genesis HealthCare (ShortStay Rehabilitation, LongTerm Care)

-

Kindred Healthcare, LLC (Transitional Care Hospitals, Rehabilitation Services)

-

Extendicare Inc. (Home Health Services, Retirement Living Communities)

-

Sunrise Senior Living, LLC (Independent Living, Reminiscence Neighborhoods for Alzheimer’s Care)

-

Encompass Health Corporation (Home-Based Care Services, Rehabilitation Hospitals)

-

Home Instead, Inc. (Companionship Services, Dementia and Alzheimer’s Care)

-

Bayada Home Health Care (Clinical Care at Home, Assistive Care)

-

Senior Care Centers of America (Adult Day Care, Long-Term Residential Care)

-

ResMed Inc. (Home Sleep Apnea Testing, AirCurve BiPAP for Elderly)

-

Comfort Keepers (In-Home Personal Care, End-of-Life Care Support)

-

AccentCare, Inc. (Hospice Services, Care Management Programs)

-

Visiting Angels Living Assistance Services (Senior Companion Services, Fall Prevention Programs)

-

Right at Home, Inc. (24-Hour Care, Specialized Alzheimer’s and Dementia Care)

-

ElderCare Services Inc. (Case Management, In-Home Support Services)

-

Life Care Centers of America (Skilled Nursing Care, Post-Acute Care Services)

-

Interim HealthCare Inc. (Home Nursing, Physical Therapy Services)

-

Trinity Health At Home (Palliative Care, Medication Management)

Suppliers (These suppliers provide essential medical consumables, mobility aids, diagnostic devices, infection control products, and patient monitoring equipment that are critical for delivering quality care in geriatric services across both home-based and facility-based settings) in the Geriatric Care Services Market

-

Medline Industries, LP

-

Cardinal Health, Inc.

-

McKesson Corporation

-

3M Health Care

-

Drive DeVilbiss Healthcare

-

Essity AB

-

Invacare Corporation

-

Coloplast Corp.

-

GE Healthcare

-

Becton, Dickinson and Company (BD)

Recent Development in the Geriatric Care Services Market

-

February 2025 – Brookdale Senior Living announced it will expand its engagement-driven program as part of its strategic effort to strengthen the HealthPlus service line. "We believe this decision will help propel more profitability in the years ahead and better solidify care delivery," CEO Cindy Baier explained.

-

March 2023 – The Optum-LHC Group merger demonstrates the increasing power of vertical integration in the healthcare industry, exemplifying the advantages of bringing service delivery capacity together under one organizational umbrella.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 1223.34 Billion |

| Market Size by 2032 | US$ 2429.12 Billion |

| CAGR | CAGR of 8.07 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Service (Home Care, Adult Day Care, Institutional Care) • By Service Provider (Public, Private) • By Payment Source (Public Insurance, Private Insurance, Out-of-Pocket, Other Payment Sources) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Brookdale Senior Living Inc., Amedisys Inc., LHC Group, Inc., Genesis HealthCare, Kindred Healthcare, LLC, Extendicare Inc., Sunrise Senior Living, LLC, Encompass Health Corporation, Home Instead, Inc., Bayada Home Health Care, Senior Care Centers of America, ResMed Inc., Comfort Keepers, AccentCare, Inc., Visiting Angels Living Assistance Services, Right at Home, Inc., ElderCare Services Inc., Life Care Centers of America, Interim HealthCare Inc., Trinity Health At Home, and other players. |