Personal Mobility Device Market Key Insights:

Get More Information on Personal Mobility Device Market - Request Sample Report

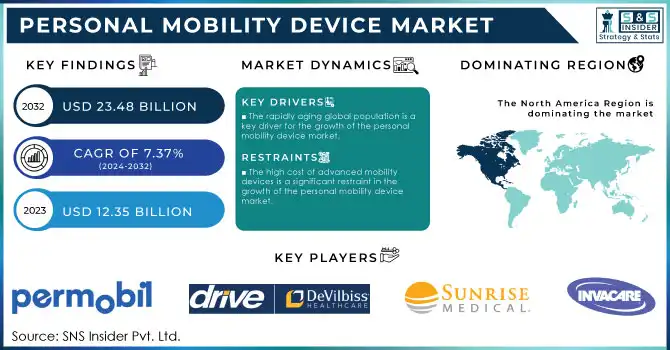

The Personal Mobility Device Market size was valued at USD 12.35 billion in 2023 and is expected to reach USD 23.48 billion by 2032, growing at a CAGR of 7.37% over the forecast period of 2024-2032.

Personal mobility devices are currently one of the fastest-growing industries worldwide because of factors that bring aging and heightened consciousness on disability rights of world populations coupled with improved mobility technologies. The market would comprise a myriad of goods, including wheelchairs, both electric and manual types, mobility scooters, walkers, crutches, canes, as well as other products to aid aged people due to accidents and suffering from the diseases and conditions like arthritis and neurological disorders. The World Health Organization forecasted that the population aged 60 years and over will reach 2 billion in 2050; this would also require a multiplied increase in personal mobility solutions.

These personal mobility devices have, in particular, gained popularity; especially electric wheelchairs and mobility scooters that feature adjustable seats, longer-lasting batteries, and improved steering capabilities. With an ever-increasing population suffering from mobility-related disabilities, new inventions in personal mobility devices continue to advance accessibility and improve quality of life.

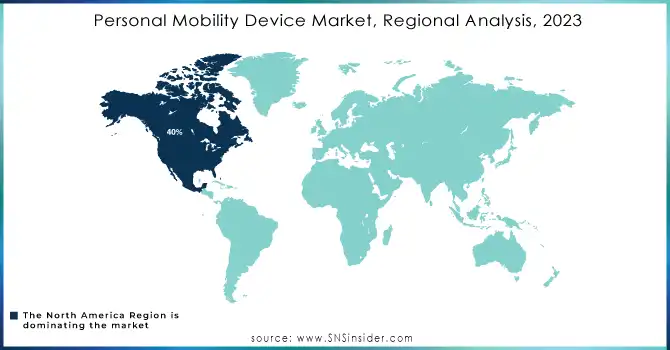

Currently, North America possesses the highest market share, with almost 40% of total revenue in 2023 due to the sophisticated healthcare infrastructure, increasing awareness of healthcare, and a very high rate of acceptance of technology-based mobility solutions. The Asia-Pacific region is simultaneously becoming an emerging market, with increased expenditure on health care and policy initiatives that aim at improving accessibility for disabled persons within such countries as China, Japan, and India.

An added factor that boosts market growth is the rise in disposable incomes in developing countries along with growing concern for inclusive design and technology. The personal mobility device market will grow at a fast pace due to the changes in the health systems that focus on elderly care.

Drivers

-

The rapidly aging global population is a key driver for the growth of the personal mobility device market.

According to the WHO, the population aged 60 and older will be twice that of 2015 by 2050: 900 million people aged 60 and above, or about 2 billion, as estimated. When an individual ages, his or her likelihood of having mobility impairment from conditions such as arthritis, osteoporosis, and neurological disorders increases; hence, more mobility aids are needed. Some estimated of over 20 million people in the U.S. live with mobility-related disabilities, and this rate is expected to increase according to the aging of baby boomers. This created a need for advanced solutions towards higher-quality mobility, such as powered electric wheelchairs and powered mobility scooters, aimed at providing more independence among elderly people.

-

Technological Advancements and Enhanced Features in Mobility Devices

Technological innovation is the other major driver for the personal mobility device market. Advanced mobility aids are becoming very sophisticated, offering smart navigation, customizable seating, longer battery life, and connectivity to mobile apps. These improvements make mobility devices more user-friendly and efficient, which appeals to a wider population. The electric wheelchair segment, which comprised 30-35% of the global market share in 2023, continues to grow rapidly due to such technological enhancements. For instance, some electric wheelchairs now come with artificial intelligence (AI)--powered navigation systems that help the user avoid obstacles and ensure safety. As these devices become more affordable and accessible, their adoption rate is expected to rise, thus contributing significantly to the overall market growth.

Restraint

-

The high cost of advanced mobility devices is a significant restraint in the growth of the personal mobility device market.

Premium products like electric wheelchairs and mobility scooters, equipping themselves with AI navigation and much longer-lasting batteries, cost between USD 2,000 and USD 20,000. Those prices are often very unaffordable, particularly for the people in the low- and middle-income areas.

The World Health Organization (WHO) states that 75% of people with mobility impairments in low-income countries do not have access to assistive devices because of cost. This is particularly true in emerging markets where healthcare systems may not provide adequate reimbursement for mobility aids. Although demand for these devices is increasing, the high cost limits broader adoption, especially among elderly and disabled populations in economically challenged areas. Reducing prices or improving insurance and subsidy options will be critical to overcoming this challenge.

Segment Analysis

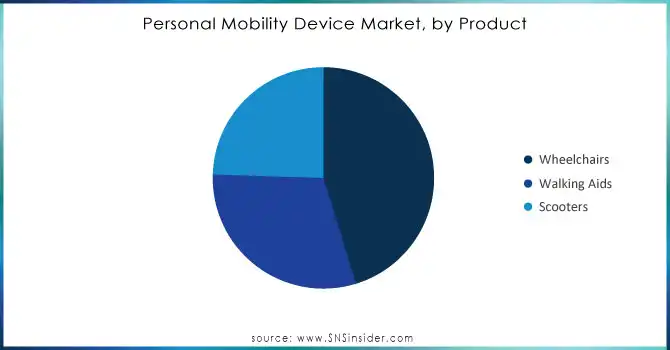

By product

The wheelchair segment dominated the personal mobility device market, accounting for the largest revenue share of over 45% in 2023. This segment is expected to maintain its dominant position throughout the forecast period. Wheelchairs are among the most widely used assistive devices for personal mobility. The United Nations advocates for member states to support the development, production, distribution, and maintenance of these mobility aids. The use of an appropriate wheelchair improves the quality of life because it prevents issues like deformities and pressure sores and enhances digestion and respiration.

With around 2 million new users every year, the demand for wheelchairs is increasing. A major factor driving the growth of the wheelchair market is the aging population worldwide, the increase in chronic diseases, and an increased adoption of powered wheelchairs as a preferred option to enhance mobility.

Need Any Customization Research On Personal Mobility Device Market - Inquiry Now

By End-user

The household segment market is the dominant and by far the lead in the personal mobility devices industry market. The reason is related to the world's increasing trends and disabled people. Such people always need the tools for assistance in daily and routine work at their residences. More seniors prefer staying at home rather than being in an institution. Such mobility aid devices as electric wheelchairs, scooters, and walkers have therefore become important for everyday mobility. In 2023, the share of the household market segment has been over 40%. It will continue growing throughout the forecast period, given that the demand for personal mobility solutions increases with the needs of society. The trend of transitioning to independent living by both the elderly and the physically incapacitated also makes households the largest and most important customer group.

In the personal mobility device market, the long-term care centers segment was the fastest growing in 2023. In the long term, a rise in the elderly population will lead to an increased demand for institutionalized care, thus demanding mobility aids in long-term care centers. Long-term care centers require a broad range of mobility devices because patients of different levels of mobility impairment need to be accommodated, and thus this is the fastest-growing segment. The personal mobility device market in long-term care centers is expected to grow at a faster pace than the overall market, with its share projected to reach 20% by 2032. This growth is driven by the increasing need for better care infrastructure and a focus on improving the quality of life for elderly individuals in care environments.

Regional Analysis

North America dominated the personal mobility devices market with a 40% market share, primarily due to the large patient population in the region. For instance, according to data from the Bureau of Transportation Statistics, US Department of Transportation, about 25.5 million Americans have disabilities that make it difficult for them to travel outside their homes, fueling demand for mobility devices.

The European personal mobility devices market is the fastest-growing from 2023 to 2032, with key growth factors including good healthcare infrastructure, an aging population, a rise in old-age diseases, high expense on healthcare, and preferable reimbursement policies for purchasing and renting devices. Germany is its largest market share holder in Europe; however, the UK accounts for the fastest growth across the region.

The Asia Pacific region holds the second-largest market share in this industry. This growth is being fueled by several factors, an increase in the elderly population, especially in East Asian nations such as China and Japan; a growing awareness about mobility devices; an increased incidence of limb dysfunction and disorders; and better access to healthcare. In this region, the country leading the market in personal mobility devices is China, and the fastest-growing market is India.

Key Market Players

-

Invacare Corporation (TDX SP2 Power Wheelchair, Rollite Rollator Walker)

-

Sunrise Medical (Quickie Q500 M Power Wheelchair, Airgo Comfort-Plus Lightweight Rollator)

-

Drive DeVilbiss Healthcare (Titan AXS Electric Wheelchair, Nitro Euro Style Rollator)

-

Pride Mobility Products Corp. (Go-Go Elite Traveller Mobility Scooter, Jazzy 600 ES Power Chair)

-

Permobil (Permobil F5 Corpus Power Wheelchair, Explorer Mini Pediatric Mobility Device)

-

Ottobock (Juvo B5/B6 Wheelchair, Walker Active Pediatric Walker)

-

Medline Industries (Empower Rollator Walker, Medline Basic Lightweight Wheelchair)

-

Karman Healthcare (S-305 Lightweight Ergonomic Wheelchair, LT-1000 Transport Wheelchair)

-

Hoveround Corporation (MPV5 Power Chair, Teknique XHD Heavy-Duty Power Chair)

-

Graham-Field (Walkabout Lite Rollator, HybridLX Rollator & Transport Chair)

-

GF Health Products, Inc. (Lumex Deluxe Four-Wheel Rollator, Everest & Jennings Traveler Wheelchair)

-

Magic Mobility (Extreme X8 Power Chair, Frontier V6 All-Terrain Wheelchair)

-

Invamed (Invamed Voyager Power Wheelchair, Smart Invamed Lightweight Rollator)

-

Merits Health Products (Pioneer 10 Scooter, Vision Sport Power Wheelchair)

-

Golden Technologies (Buzzaround EX Extreme Mobility Scooter, Compass Sport Power Chair)

-

Handicare Group (Minivator 2000 Stairlift, Gemino 60 Rollator)

-

Shoprider Mobility Products (Streamer Sport Power Wheelchair, Dasher 3 Scooter)

-

Yuwell-Jiangsu Yuyue Medical Equipment & Supply Co. (H-009 Aluminum Wheelchair, Yuwell Foldable Electric Scooter)

-

Nova Medical Products (Vibe 6 Rollator, Transport Chair with Hand Brakes)

-

ErgoActives (Ergobaum 7G Forearm Crutch, iWalk 2.0 Hands-Free Crutch)

Key Suppliers

key suppliers that provide components, raw materials, or manufacturing services for personal mobility devices such as wheelchairs, scooters, and walkers:

-

Invacare Corporation Suppliers

-

Pride Mobility Products Corp. Suppliers

-

Permobil Suppliers

-

Sunrise Medical Suppliers

-

Drive DeVilbiss Healthcare Suppliers

-

Karman Healthcare Suppliers

-

Golden Technologies Suppliers

-

Handicare Group Suppliers

-

Yuwell Medical Equipment Suppliers

-

Nova Medical Products Suppliers

Recent Developments

-

In September 2024, Sunrise Medical introduced the Empulse, a highly anticipated addition to its portfolio. This new product line features state-of-the-art advancements, including enhanced battery performance, ergonomic designs, and customizable options tailored to diverse user needs. The Empulse aims to set new standards for assistive mobility technology.

-

In June 2024, Drive DeVilbiss Healthcare expanded its market presence by acquiring the innovative product portfolio of Mobility Designed. Known for ergonomic and user-focused designs, Mobility Designed’s products align with Drive DeVilbiss's mission to offer high-quality mobility solutions. This acquisition is expected to drive further innovation in the design and functionality of mobility aids.

-

In November 2023, Permobil unveiled updates to its product line, focusing on enhanced accessibility and functionality for users. The updates included improvements to power wheelchairs, seating systems, and assistive technology. Permobil emphasized its commitment to creating solutions that promote independence and ease of use for individuals with mobility challenges.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 12.35 Billion |

| Market Size by 2032 | US$ 23.48 Billion |

| CAGR | CAGR of 7.37% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Product (Walking Aids, Wheelchairs, Scooters) •By End User (Hospitals & Clinics, Long-term Care Centers, Households, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Invacare Corporation, Sunrise Medical, Drive DeVilbiss Healthcare, Pride Mobility Products Corp., Permobil, Ottobock, Medline Industries, Karman Healthcare, Hoveround Corporation, Graham-Field, GF Health Products, Inc., Magic Mobility, Invamed, Merits Health Products, Golden Technologies, Handicare Group, Shoprider Mobility Products, Yuwell-Jiangsu Yuyue Medical Equipment & Supply Co., Nova Medical Products, ErgoActives, and other players. |

| Key Drivers | •The rapidly aging global population is a key driver for the growth of the personal mobility device market. •Technological Advancements and Enhanced Features in Mobility Devices |

| Restraints | •The high cost of advanced mobility devices is a significant restraint in the growth of the personal mobility device market. |