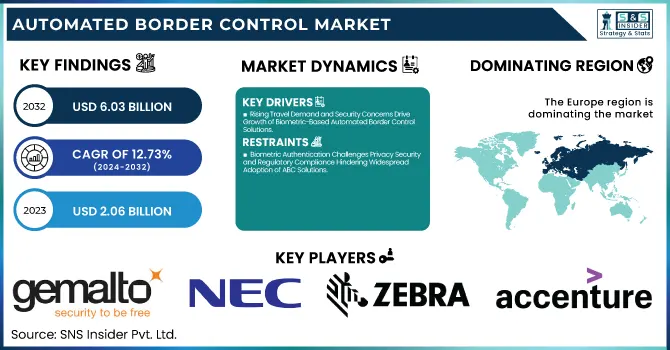

Automated Border Control Market Size:

The Automated Border Control Market Size was valued at USD 2.06 Billion in 2023 and is expected to reach USD 6.03 Billion by 2032 and grow at a CAGR of 12.73% over the forecast period 2024-2032. Integration of Automated Border Control with Smart City Initiatives Seamless, Efficient, and frictionless border processing AI and machine learning are making real-time decision-making, predicting analytics, and fraud detection operationally efficient. The growing focus on energy efficiency and sustainability is leading to energy-efficient and eco-friendly low-power solutions in ABC systems.

To Get more information on Automated Border Control Market - Request Free Sample Report

Moreover, border control points are more convenient and time-efficient, thanks to biometric-linked ticketing and contactless innovations moderately being used for passenger experience enhancement. In the U.S., however, Automated Border Control (ABC) systems have increased substantially in use, with biometric e-gates implemented at major airports located in Atlanta Hartsfield-Jackson, and Los Angeles International amongst others, for speedy processing. More than half of U.S. airports will have biometric-based solutions in place by 2025, improving efficiency and security as per industry standards. The U.S. Automated Border Control Market is estimated to be USD 0.41 Billion in 2023 and is projected to grow at a CAGR of 12.57%. The United States Automated Border Control market is driven by the increased need for faster contactless processing, security enhancement by the utilization of biometric technology, and the initiatives taken by the government such as the Biometric Exit Program.

Automated Border Control Market Dynamics

Key Drivers:

-

Rising Travel Demand and Security Concerns Drive Growth of Biometric-Based Automated Border Control Solutions

Growth in international travel, increasing threat levels, and strict government regulations for border control management are the key factors driving the automated border control (ABC) market. Introduction Airports and border authorities around the globe are increasingly switching to biometric-based automated border control (ABC) solutions that promise to improve security and decrease the time spent processing passengers. Artificial Intelligence (AI) and Machine Learning (ML) are being incorporated into ABC systems that enable real-time identity verification, fraud detection, and operational efficiency. Furthermore, the post-pandemic travel trend for contactless movement has put similar numbers of time into increasing the adoption of automated solution options like ABC e-gates and kiosks, from optional to mandatory. Likewise, smart airport infrastructure investments with accelerated digital transformation initiatives during the forecast period are contributing to the growth of the market.

Restrain:

-

Biometric Authentication Challenges Privacy Security and Regulatory Compliance Hindering Widespread Adoption of ABC Solutions

Biometric authentication poses a serious data privacy and security concern, and this is one of the key challenges faced by the Automated Border Control (ABC) market. Because ABC systems depend on architecture to recognize faces, fingerprints, and other biometric data, it leads to a rise in cyber threats, unlawful data access, and identity fraud. The deployment of ABC solution is made complex due to stringent regulatory compliance such as GDPR in Europe and many other regional data protection laws. Moreover, there is widespread skepticism of biometric surveillance and data collection by the government and private companies, raising concerns that personal data may be used unethically or mistakenly, thus deterring mass adoption.

Opportunity:

-

Early Adoption of ABC Systems in Land and Seaports Unlocks Growth Opportunities in Emerging Markets

The development of ABC systems for land and seaports has started but is still at an early adoption stage, which represents a major growth opportunity for ABC scalability and deployment. As governments around the world turn their attention to increasing border security while also facilitating trade, emerging markets such as in the Asia-Pacific, Middle East, and Latin America are poised to unlock their potential. Cloud-based ABC evolution and blockchain integration for secure identity confirmation present further growth opportunities. In addition, public-private partnerships (PPPs) and growing capital injection in border modernization programs will provide long-term opportunities for the market participants.

Challenges:

-

Interoperability Challenges and Infrastructure Constraints Hinder Seamless Implementation of Automated Border Control Systems

A more relevant challenge is the non-standardization across different regions and border control agencies. Interoperability is a key challenge because biometric technologies, database integration, and security protocols differ around the world, hampering true seamlessness across borders. Likewise, such solutions are difficult to implement because the numerous border crossings lack the data framework needed to provide automated options, and infrastructure constraints at land and seaports. This also delays the complete migration towards automated control as legacy border management systems are a reliance. Moreover, biometric recognition can fail during performance in subpar lighting, with facial obstructions, or from hardware or software malfunctions, which can lead to delays and ineffective operations, ultimately affecting passenger experiences.

Automated Border Control Market Segmentation Insights

By Border Crossing Procedure

The Automated Border Control (ABC) market was dominated by the Integrated Two-step Process in 2023, capturing 52.6% of the market share. It's one of the common methods because of its advanced security benefits, where two separate steps are used for document authentication and biometric validation to provide a reliable process for performing identity verification. Border control governments and authorities prefer this because it lowers any sort of security threat creates ease in following strict immigration rules and provides high fraud detection.

For the period 2024 to 2032, the One-step Process is expected to show the fastest CAGR, owing to its efficiency and less processing time. Several airports and border authorities around the globe are turning to contactless, AI-powered biometric authentication to speed up border clearance, amid growing passenger volume and the requirement for smoother travel journeys. Increasing implementation of self-service e-gates and advanced facial recognition technologies will increasingly drive tailwinds for the growth of One-step Process ABC solutions over the years ahead.

By Solution Type

ABC E-Gates continue to lead the Automated Border Control (ABC) market with a 56.6% share in 2023, supported by a higher rate of deployment at major international airports and border checkpoints. They are highly efficient, have high-level biometric authentication, and seamlessly work with the passport control system to handle even the highest volume of passengers. Their large-scale adoption especially in Europe & North America, where governments are increasingly focusing on smart border solutions is attributed to their capability to in cutting the waits and increasing security.

ABC Kiosks are expected to grow at the highest rate between 2024 and 2032, due to their low cost and versatility. Kiosks, on the other hand, need less infrastructure investment to install and are capable of being deployed at smaller airports, land crossings, and seaports, none of which are suitable for e-gates. This is further fueling their adoption, particularly in emerging markets and regions experiencing an increase in cross-border travel, as the nature of such travel demands a shift toward more contactless self-service solutions and cloud-based identity verification.

By Component

Hardware had led the Automated Border Control (ABC) with 51.2% of the market share. This is a result of the widespread use of biometric scanners, passport readers, face recognition cameras, and/or e-gates that drive automated border control (ABC) systems. Airports and seaports, as well as all types of land border crossings, have invested substantially in new physical infrastructure designed to improve security as well as expedite passenger processing. These hardware parts are highly reliable components that are most necessary with cure equipment and will be in high demand and regional relied in Europe and North America.

The software segment is expected to witness the fastest CAGR from 2024 to 2032 owing to the constant evolution of AI-enabled biometric authentication, cloud security solutions, and real-time analytics. Border agencies will pursue more interoperability, automation, and cybersecurity, enabling increased adoption of software solutions that strengthen their identity verification, fraud detection, and predictive analytics capabilities. Emerging economies are investing in smart border management and will need scalable, AI-driven solutions.

By Application

Airports had the highest share in the automated border control (ABC) market in 2023 at 68.7%. Boasting high passenger numbers in international airports, the demand for high-efficiency security screening allied to seamless border passage has led to extensive installations of ABC e-gates and kiosks. To improve security while reducing wait times, governments and airport authorities are prioritizing biometric-based authentication. Moreover, recently due to the pandemic, contactless travel has gained a lot of importance, therefore investments in automated border control solutions at airports across the globe have increased significantly.

Land Ports are anticipated to witness the highest growth rate (CAGR) between 2024 and 2032, owing to rapid growth in cross-border travel and trade. In regions where there is significant road and rail connectivity, several governments are investing in smart border solutions to improve the efficiency of land crossings. Portable ABC kiosks, biometric checkpoints, and AI-assisted identity verification will also see an increase in use that will strengthen security and mitigate crowding at land borders.

Automated Border Control Market Regional Analysis

Europe accounted for a 36.8% share of the Global Automated Border Control (ABC) Market in 2023, owing to the stringent border security regulations, the developed airport infrastructure, and the rising integration of biometric authentication systems. With the Schengen Zone enabling easier travel across countries, there has been a growing demand for effective automated passport control systems. ABC e-gates have been deployed at many major international airports, including London Heathrow (UK), Frankfurt Airport (Germany), and Charles de Gaulle Airport (France) to facilitate the movement of large numbers of passengers through the border security process, in a way that still maintains compliance with security measures.

Asia Pacific is expected to register the fastest CAGR over the forecasting years 2024-2032 owing to the rising air passenger, growing cross-border travel, and government initiatives towards a secure environment. From China, India, and Japan to Australia, these nations are injecting billions into smart airport infrastructure and biometric-based border immigration checkpoints. Examples are Changi Airport in Singapore, which installed contactless biometric clearance, and India's DigiYatra initiative that will enhance facial recognition based entry at airports. With key hubs such as Beijing Capital International Airport rolling out AI-based border control systems, Asia Pacific is expected to be a key growth region in the global ABC market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Some of the major players in the Automated Border Control Market are:

-

Gemalto (Civic Identity Solutions)

-

NEC Corporation (NeoFace)

-

SITA (SITA Smart Path)

-

Zebra Technologies (Zebra's VisioNize)

-

Accenture (Accenture Passport Control Solution)

-

Indra Sistemas (Sentry ABC Gates)

-

Cognitec Systems (FaceVACS-ABIS)

-

TITUS (TITUS Classification)

-

Thales Group (Thales e-Security)

-

Crossmatch Technologies (Crossmatch DigitalPersona)

-

Veridos (Veridos Automated Border Control)

-

SecuTech (SecuTech Border Control System)

-

Vision-Box (Vision-Box ABC Gates)

-

Suprema (BioEntry Plus)

-

IDEMIA (MorphoWave Tower)

Recent Trends

-

In December 2024, SITA and IDEMIA are collaborating to transform airport operations with advanced computer vision technology, enhancing baggage handling efficiency and passenger experience.

-

In 2024, Thales launched its new Gemalto ABC eGates, combining document verification and biometric authentication with a compact, modular design to enhance border control efficiency.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 2.06 Billion |

| Market Size by 2032 | USD 6.03 Billion |

| CAGR | CAGR of 12.73% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Border Crossing Procedure (One-step Process, Integrated Two-step Process, Segregated Two-step Process) • By Solution Type (ABC E-Gates, ABC Kiosks) • By Component (Hardware, Software, Services), By Application (Airports, Seaports, Land Ports) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Gemalto, NEC Corporation, SITA, Zebra Technologies, Accenture, Indra Sistemas, Cognitec Systems, TITUS, Thales Group, Crossmatch Technologies, Veridos, SecuTech, Vision-Box, Suprema, IDEMIA. |