Biometric Authentication Identification Market Size

To get more information on Biometric Authentication Identification Market - Request Free Sample Report

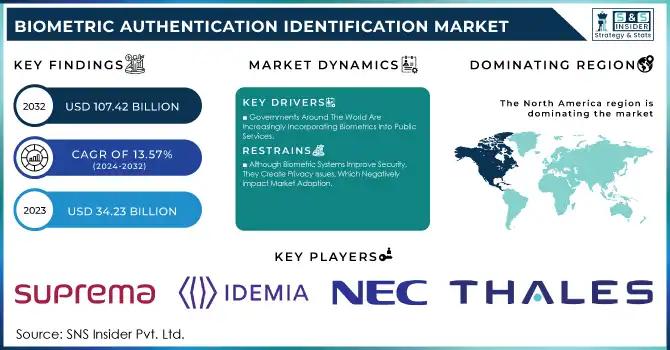

The Biometric Authentication Identification Market Size was valued at USD 34.23 Billion in 2023 and is expected to reach USD 107.42 Billion by 2032 and grow at a CAGR of 13.57% over the forecast period 2024-2032.

The Biometric Authentication Identification Market is seen to have grown considerably in 2023 and is expected to witness much larger expansion over 2024-2032 as it is fuelled by swift technological advancements, government policy initiatives, and widespread growing demand in various fields. Nations like the USA, China, Japan, Germany, France, and India are ahead of the curve in their adaptation of biometrics using the technologies for security identity validation, and operational efficiency improvement.

In the USA, government agencies have deployed facial recognition systems at more than 20 airports, streamlining the processing of some 100 million travellers by 2023. But China has taken the lion's share of biometric system deployment across surveillance, retail, and banking, as more than 1 billion facial recognition cameras go operational by year-end 2023. India continues to be in a league of its own as it signed up over 1.3 billion citizens with their biometric IDs under the AADHAAR initiative. The European Union's Schengen borders will have its Entry/Exit System fully ready by 2024, using both facial and fingerprint biometrics for millions of travellers.

Technological innovation is pushing the boundary of biometric capabilities in many ways. AI-based multimodal systems that integrate facial recognition, fingerprint recognition, and voice recognition have been developed and have gained a good deal of momentum. This reduces error rates by 80% compared to single modality solutions, which becomes an indispensable solution in high-security requirements in finance and healthcare applications. The new launches during 2023 include Fujitsu's AI-powered biometric authentication platform and NEC's upgraded NeoFace suite.

Regulatory frameworks are also driving the market. For instance, the European Union's GDPR has stringent rules about the processing of biometric data that influence such policies worldwide. Japan has instituted measures for the protection of biometric data that align with international standards. In the USA, the National Institute of Standards and Technology has published updated benchmarks for biometric performance in 2023.

Biometric Authentication Identification Market Dynamics

KEY DRIVERS:

-

Governments Around The World Are Increasingly Incorporating Biometrics Into Public Services.

Government-led initiatives for national identification and border control are significant demand drivers in many countries. For example, India's AADHAAR program has digitized welfare delivery to over 99% of the adult population. The U.S. Transportation Security Administration (TSA) has increased biometric security at airports, with 50% of passengers using facial recognition in 2023.

The Entry/Exit System (EES) for the Schengen Area borders has been initiated in Europe, which relies on biometric data for the fast and secure processing. These large-scale projects depict how government adoption is what fuels the biometric authentication identification market, thereby guaranteeing a reliable, scalable framework for citizen identification.

-

Banks around the World Are Using Biometrics for Safe, Customer-Centric Authentication.

With cybercrime being a significant loss to the global economy, amounting to over $8 trillion per year, according to Cybersecurity Ventures, financial institutions make biometrics a priority in fraud prevention. Biometric systems like fingerprint and facial recognition have become the norm in mobile banking applications.

by 2023, more than 75% of U.S. banks had adopted biometric technology. In Asia, Alipay in China and Paytm in India used advanced biometrics for secure digital transactions, making users trust the service. This change decreases fraud risks and increases user experience, making biometric solutions critical in financial services.

RESTRAIN:

-

Although Biometric Systems Improve Security, They Create Privacy Issues, Which Negatively Impact Market Adoption.

Biometric authentication requires the collection and storage of sensitive personal information, creating concerns about misuse and breaches. In 2023, 65% of surveyed users in the EU expressed reservations about biometric systems, citing insufficient transparency in data handling. High-profile data breaches, such as the leak of 27 million facial records in Asia, amplify public skepticism.

Governments and companies face growing pressure to ensure robust data protection frameworks, such as compliance with GDPR in Europe or similar regulations globally. Without strict protections, the possibility of misuse of biometric data for surveillance or identity theft can prevent adoption. So, building public trust through higher security measures and clear policies is the key to sustained growth of the market.

Biometric Authentication Identification Market Segmentation

by Modality

Multimodal Biometric Systems dominated 2023 with 65% market share due to their superior accuracy and adaptability, integrating multiple identifiers for robust authentication. Governments and enterprises favour multimodal systems to reduce fraud and enhance user convenience.

For instance, multimodal systems integrating fingerprint and facial recognition were deployed in major airports worldwide to streamline security. This segment is expected to have the highest growth with the fastest CAGR of 13.63% from 2024 to 2032 due to the rise in AI-powered analytics and adoption in industries with high-security levels, such as in defence and healthcare.

by Technology

Technologies in biometric authentication consist of fingerprint recognition, iris recognition, facial recognition, voice recognition, and palm recognition. The largest share in 2023 is accounted by fingerprint recognition, accounting for 48% market share, mainly due to the increased adoption in smartphones and banking applications.

Iris recognition, with a smaller share, will have the fastest CAGR of 14.21% during 2024-2032, as its high accuracy and contactless nature are highly sought in health care and defence applications. Further advancements in facial recognition algorithms and AI integration are changing the security landscapes in industries.

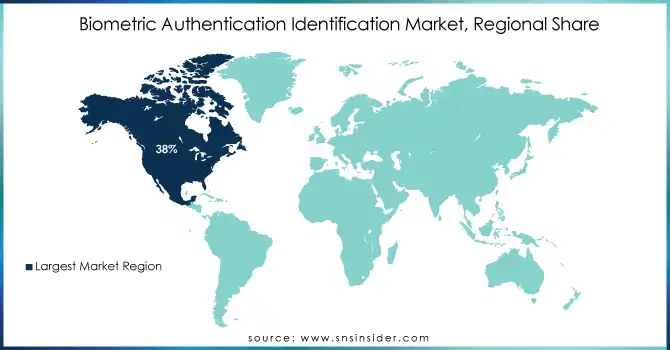

Biometric Authentication Identification Market Regional Analysis

North America dominated the biometric authentication identification market in 2023, holding 38% of the market share, through government projects such as TSA's biometric expansion and rollouts of advanced systems in financial services.

Meanwhile, Europe is likely to grow at the fastest CAGR of 14.50% during 2024-2032, led by the EU's EES and rising adoption across the banking and healthcare industries. The rapid pace of digitalization in emerging markets such as Asia-Pacific also represents future growth potential.

Get Customized Report as per Your Business Requirement - Enquiry Now

KEY PLAYERS

Some of the major players in the Biometric Authentication Identification Market are

-

Thales Group (Gemalto biometric systems, fingerprint scanners)

-

NEC Corporation (NeoFace facial recognition, multimodal biometric solutions)

-

IDEMIA (MorphoWave scanners, digital identity platforms)

-

Suprema (BioStar 2 software, FaceStation biometrics)

-

HID Global (Lumidigm fingerprint sensors, access control solutions)

-

Fujitsu (PalmSecure palm vein scanners, biometric security solutions)

-

Cognitec Systems (FaceVACS software, facial recognition systems)

-

Bio-Key International (WEB-key software, fingerprint readers)

-

Aware Inc. (Knoxville SDK, biometric matching systems)

-

Precise Biometrics (Precise YOUNiQ, fingerprint software solutions)

-

ZKTeco (SpeedFace terminals, biometric access systems)

-

Dermalog Identification Systems (ABIS, biometric identification terminals)

-

Daon (IdentityX platform, biometric authentication solutions)

-

Innovatrics (SmartFace facial recognition, multimodal SDKs)

-

Crossmatch Technologies (Verifier biometric readers, DigitalPersona)

-

FaceTec (ZoOm 3D face authentication, liveness detection)

-

SecuGen (Hamster Pro fingerprint scanners, biometric software)

-

Stanley Security (Access control biometrics, enterprise security solutions)

-

Iris ID (iCAM iris scanners, access management)

-

Smartmatic (biometric voting solutions, identity verification platforms)

MAJOR SUPPLIERS (Components, Technologies)

-

3M (optical sensors, imaging components)

-

Sony Semiconductor Solutions (image sensors)

-

Qualcomm (AI processors, microchips)

-

Infineon Technologies (security microcontrollers)

-

Synaptics (biometric modules)

-

STMicroelectronics (custom ICs for biometrics)

-

Flextronics (hardware components)

-

LG Innotek (camera modules)

-

Lumentum (laser sensors)

-

Amkor Technology (semiconductor packaging services)

RECENT TRENDS

-

March 2024: NEC's flagship facial recognition product, NeoFace Reveal, has been advanced to Version 5 with such features as a new user interface, enhanced image improvement tools, and morphological analysis compliant with the Facial Identification Scientific Working Group standard, among others.

-

November 2024: Technology and blockchain solutions provider Serenity partners with IDEMIA Secure Transactions (IST) to launch sAxess, a biometric security card. The card is an innovation designed to enhance access control over data and scale to manage complex digital assets. Combining the expertise of Serenity in blockchain technology with the long experience of IDEMIA Secure Transactions, which caters to over 1,900 financial institutions and fintech clients globally with payment and connectivity solutions, this merger combines the two worlds.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 34.23 Billion |

| Market Size by 2032 | US$ 107.42 Billion |

| CAGR | CAGR of 13.57 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Modality (Market statistics, Multimodal biometric), • By Motility (Fixed, Mobile), • By Technology (Fingerprint Recognition, Iris Recognition, Facial Recognition, Voice Recognition, Palm Recognition), • By End Use (Government, Banking, Healthcare, Retail, Travel), • By Authentication Type (Single-Factor Authentication, Two-Factor Authentication, Multi-Factor Authentication), |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Thales Group, NEC Corporation, IDEMIA, Suprema, HID Global, Fujitsu, Cognitec Systems, Bio-Key International, Aware Inc., Precise Biometrics, ZKTeco, Dermalog Identification Systems, Daon, Innovatrics, Crossmatch Technologies, FaceTec, SecuGen, Stanley Security, Iris ID, Smartmatic. |

| Key Drivers | • Governments Around The World Are Increasingly Incorporating Biometrics Into Public Services. • Banks around the World Are Using Biometrics for Safe, Customer-Centric Authentication. |

| Restraints | • Although Biometric Systems Improve Security, They Create Privacy Issues, Which Negatively Impact Market Adoption. |