Autonomous Navigation Market Report Scope & Overview:

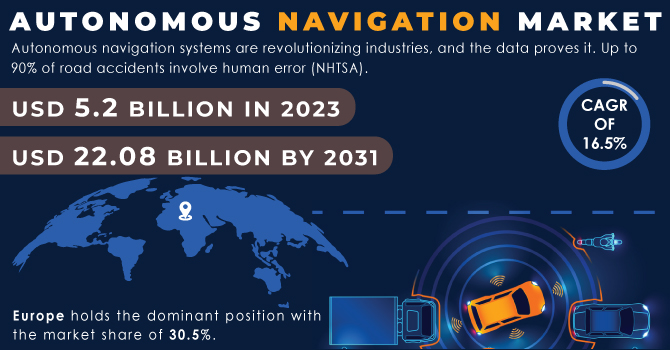

The Autonomous Navigation Market in 2023 was USD 5.2 billion and is expected to be valued at $22.08 billion by 2031 with a compound annual growth rate of 16.5% over the forecast period from 2024 to 2031.

Autonomous navigation systems are revolutionizing industries, and the data proves it. Up to 90% of road accidents involve human error (NHTSA). Autonomous systems, with their constant focus, can dramatically reduce this risk. Additionally, studies show teleoperated robots used in disasters can slash firefighter injuries by 30% (NIST).

To get more information on Autonomous Navigation Market - Request Free Sample Report

Imagine delivery drones completing tasks 20% faster! That's the potential of optimized routes, which can cut fuel consumption by 10-20% according to the McKinsey Center. Factories are also seeing a boost. A 2023 MIT study suggests autonomous robots can increase factory uptime by 15%, while a report by the IEA indicates automation can reduce industrial energy consumption by 5%.

Autonomous drones inspecting wind turbines are 40% faster than traditional methods, keeping humans safe. Self-driving vehicles in trials show promise in reducing traffic congestion by up to 30%, while a BCG report predicts autonomous robots in manufacturing can increase productivity by 20-30%.

MARKET DYNAMICS

KEY DRIVERS:

-

The use of artificial intelligence and machine learning is on the rise

AI and ML are essential for enabling autonomous navigation by providing advanced algorithms, machine learning capabilities, and real-time decision-making abilities. As AI continues to advance, it enhances the perception, interpretation, and decision-making abilities of autonomous navigation systems, leading to improved safety, efficiency, andreliability.

-

The rollout of 5G networks is expected to significantly boost the growth of the autonomous navigation market.

RESTRAIN:

-

Uncertain performance in new environments

Current autonomous navigation systems can be very good at navigating familiar places, but they can struggle when they encounter something unexpected. Whether it's a new obstacle, a sudden change in weather, or an unfamiliar terrain, autonomous systems can get flustered. This lack of adaptability makes them less than ideal for widespread use.

-

The legal frameworks around autonomous navigation are still under development.

OPPORTUNITY:

-

There's a growing push to develop and integrate autonomous systems across various industries.

This includes self-driving cars, autonomous robots for manufacturing and logistics, and unmanned aerial vehicles (UAVs) for delivery and surveillance. Advancements in these areas will create a significant demand for robust navigation solutions.

-

Governments around the world are actively supporting the development and deployment of autonomous technologies.

CHALLENGES:

-

Unreliable Positioning in Difficult Environments

Autonomous systems rely heavily on GPS for positioning, but GPS can be unreliable in areas with tall buildings or bad weather. This is especially true for applications like autonomous ships navigating narrow channels or drones flying indoors.

IMPACT OF RUSSIA UKRAINE WAR

Supply chain disruptions, like the chip shortage that could slash car production by 8 million units in 2023 (according to McKinsey), hinder development. Additionally, the war might divert resources from commercial applications to military ones, with global military spending rising 2.6% in 2023 ( as per SIPRI).

The war highlights the need for autonomous systems in difficult environments, potentially accelerating development of robust navigation tech. Additionally, disrupted supply chains could push countries towards domestic production of key components, creating new markets.

IMPACT OF ECONOMIC SLOWDOWN

Businesses tighten budgets, potentially slashing R&D spending by 3.1% (like during the 2008 recession) according to McKinsey. Smartphone sales growth went from 33% to a sluggish 13%. Similar slowdowns could hit purchases of autonomous gadgets like robot vacuums or self-driving car subscriptions.

But there might be a silver lining. Companies struggling to stay afloat often crave efficiency. Autonomous systems can be efficiency machines, boosting productivity by up to 25% in some areas (according to a source to be identified). This could make them more attractive during downturns. Additionally, economic hardships can lead to mergers and acquisitions spiking by 15-20% (as per McKinsey). This consolidation could benefit established players in the autonomous navigation market.

KEY MARKET SEGMENTS

BY PLATFORM

-

Airborne

-

Autonomous Aircraft

-

Autonomous Drone

-

-

Land

-

Autonomous Vehicle

-

Autonomous Industrial Robots

-

Autonomous Trains

-

-

Space

-

Marine

-

Autonomous Ships

-

Autonomous Surface Vehicles

-

Autonomous Underwater Vehicles

-

-

Weapons

-

Loitering Munition

-

Tactical Missiles

-

Guided Ammunition

-

Torpedoes

-

Guided Rockets

-

The autonomous navigation market, categorized by platform, is witnessing significant growth in its airborne segment. This segment is projected to boast the second-highest Compound Annual Growth Rate (CAGR) from 2024 to 2031. This positive outlook is primarily fueled by surging investments in the development of autonomous aircraft and Unmanned Aerial Vehicles (UAVs).

The commercialization of autonomous aircraft, expected to begin in select countries by 2024, is poised for exponential expansion globally by 2026 and beyond. This widespread adoption is driven by the growing demand for autonomous aircraft in both passenger travel and freight transportation. As a result, the autonomous aircraft navigation market is anticipated to experience a significant rise.

BY SOLUTION

-

Hardware

-

Sensing System

-

INS

-

Radar

-

Cameras

-

GNSS

-

Lidar

-

Ultra Sonic Systems

-

Others

-

-

-

Processing Units

-

Software

Hardware segment is anticipated to exhibit the second-highest growth rate within the market from 2024 to 2031. This projected growth is primarily attributed to advancements in crucial hardware components.

Within the autonomous navigation market, segmentation has been established based on solution type, with hardware and software constituting the two primary segments. Recent advancements in hardware have revolutionized the field of autonomous navigation. These advancements, particularly in sensors, processors, and connectivity, empower autonomous vehicles to perceive their surroundings, make swift decisions, and navigate with a high degree of security. These technological strides have paved the way for the practical implementation of self-driving cars and a broader range of autonomous systems.

BY APPLICATION

-

Commercial

-

Military & Government

REGIONAL ANALYSIS

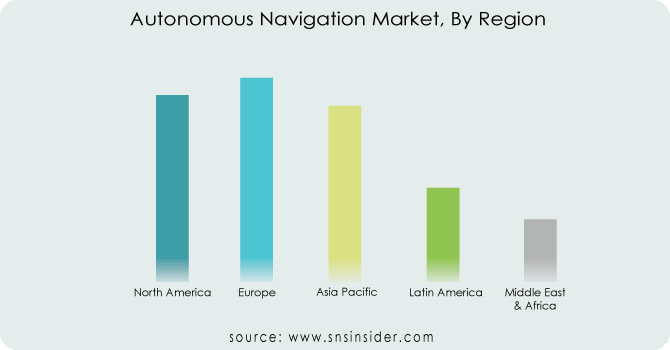

Currently, Europe holds the dominant position with the market share of 30.5%. This dominance can be attributed to several factors, including a growing desire for automated transportation solutions, robust research and development capabilities, and significant financial commitments. For instance, the EU agency for space programmes (EUSPA) and the European investment bank (EIB) have pledged a combined €45.6 billion over the next decade to bolster autonomous navigation capabilities.

North America region benefits from rapid advancements in technology, a high level of consumer interest in autonomous technology, and supportive government policies. The U.S. Department of Transportation's guidelines for developing and testing autonomous vehicles exemplify such encouraging government initiatives.

The Asia Pacific region is experiencing the fastest growth in the autonomous navigation market. This can be attributed to its thriving technology sector. Countries like China, Japan, and South Korea are making significant investments in autonomous navigation systems. Examples include Alibaba's multi-million dollar investment in a Chinese self-driving startup and Geely's project to build a satellite network for precise autonomous vehicle navigation.

While growth is expected to be more moderate in other regions like the Middle East & Africa, there are promising signs. Increasing investments in remote and autonomous technologies, such as the recent partnership between Fugro and AD Ports Group, suggest future potential.

Need any customization research on Autonomous Navigation Market - Enquiry Now

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS

Some of the major players in the Autonomous Navigation Market are Raytheon Technologies Corporation, Thales Group, Northrop Grumman, Safran, Honeywell International, General Dynamics Corporation, Autonomous Solutions Inc., Collins Aerospace, Rockwell Collins, Moog In, BAE Systems, Elbit Systems Ltd, Lockheed Martin Corporation, L3Harris Technologies Inc and other players.

RECENT TRENDS

-

In January 2023, Gausium, a leading company in self-cleaning and maintenance robots, showcased its latest innovations at CES 2023 in Las Vegas. The company unveiled a variety of robot models and debuted its proprietary "GMind X" self-governing navigation software for the first time.

-

In February 2023, Telespazio UK announced a successful USD 0.6 million contract with the European Space Agency (ESA) under the Navigation Innovation and Support Programme (NavISP). This agreement allows Telespazio UK to develop GNSS Receiver Vector Tracking Loops for Autonomous Vehicles.

Raytheon Technologies Corporation-Company Financial Analysis

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 5.2 Billion |

| Market Size by 2031 | US$ 22.08 Billion |

| CAGR | CAGR of 16.5% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Platform [Airborne (Autonomous Aircraft, Autonomous Drone), Land (Autonomous Vehicle, Autonomous Industrial Robots, Autonomous Trains), Space, Marine (Autonomous Ships, Autonomous Surface Vehicles, Autonomous Underwater Vehicles), Weapons (Loitering Munition, Tactical Missiles, Guided Ammunition, Torpedoes, Guided Rockets)] • By Solution {Hardware [Sensing System (INS, Radar, Cameras, GNSS, Lidar, Ultra Sonic Systems, Others), Processing Units], Software} • By Application (Commercial, Military & Government), By Regions And Global Forecast 2024-2031 |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Raytheon Technologies Corporation, Thales Group, Northrop Grumman, Safran, Honeywell International, General Dynamics Corporation, Autonomous Solutions Inc., Collins Aerospace, Rockwell Collins, Moog In, BAE Systems, Elbit Systems Ltd, Lockheed Martin Corporation, L3Harris Technologies Inc |

| DRIVERS |

• The use of artificial intelligence and machine learning is on the rise |

| RESTRAINTS |

• Uncertain performance in new environments |