Used Serviceable Material (USM) Market Report Scope & Overview:

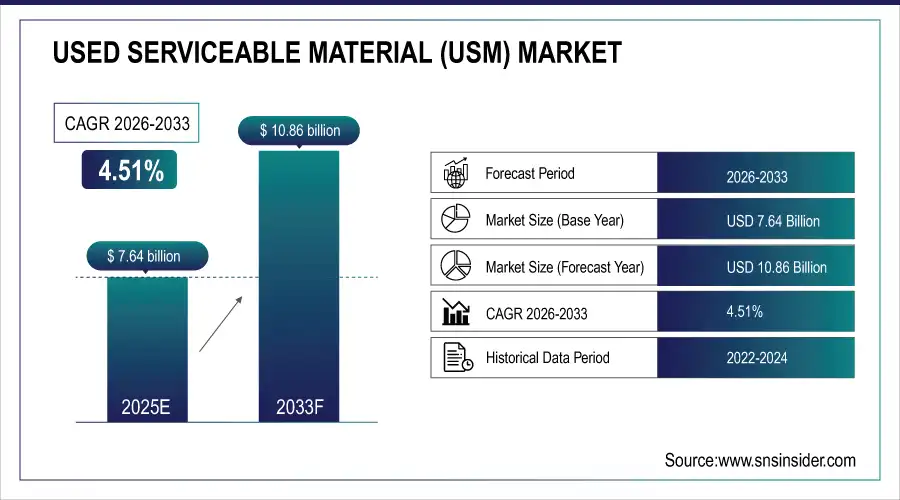

The Used Serviceable Material (USM) Market Size was valued at USD 7.64 Billion in 2025E and is expected to reach USD 10.86 Billion by 2033 and grow at a CAGR of 4.51% over the forecast period 2026-2033.

The Used Serviceable Material (USM) Market analysis growth is driven by the rising demand for cost-effective maintenance, repair, and overhaul (MRO) solutions in the aviation industry. Airlines and aircraft operators increasingly prefer USM over new OEM parts due to the significant cost savings it provides, particularly for expensive components like engines and avionics. The continuous expansion of global commercial and regional aircraft fleets, coupled with the high rate of aircraft retirements, is boosting the availability and adoption of USM, enabling operators to maintain older aircraft efficiently and sustainably. According to study, Airlines save up to 30–40% on MRO expenses by using USM instead of new OEM parts, especially for high-value components like engines and avionics.

Market Size and Forecast:

-

Market Size in 2025: USD 7.64 Billion

-

Market Size by 2033: USD 10.86 Billion

-

CAGR: 4.51% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On Used Serviceable Material (USM) Market - Request Free Sample Report

Used Serviceable Material (USM) Market Trends

-

Airlines increasingly adopt used serviceable materials for cost-effective aircraft maintenance solutions.

-

Expansion of global commercial fleets drives higher demand for refurbished aircraft components.

-

Aging aircraft retirement creates steady supply of high-quality used serviceable materials.

-

Technological advancements improve reliability and safety of refurbished aviation components significantly.

-

Digital tracking and blockchain integration enhance transparency and inventory management in MRO.

-

Predictive maintenance adoption accelerates USM usage, reducing operational downtime and maintenance costs.

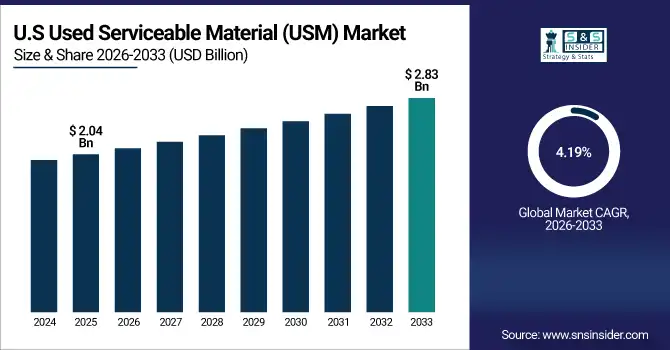

The U.S. Used Serviceable Material (USM) Market size was USD 2.04 Billion in 2025E and is expected to reach USD 2.83 Billion by 2033, growing at a CAGR of 4.19% over the forecast period of 2026-2033, due to aging fleets, high maintenance costs, advanced MRO infrastructure, and widespread adoption of refurbished engines, components, and airframes for cost-effective aviation operations.

Used Serviceable Material (USM) Market Growth Drivers:

-

Cost-Effective Maintenance Drives Strong Growth in Used Serviceable Material Market

The Used Serviceable Material (USM) Market is growing worldwide driven by, growing need for cost-effective Maintenance, Repair, and Overhaul solutions in the aviation industry. Airlines face high operating costs, particularly for engine replacements and avionics systems. The Used Serviceable Material Market provides a financially viable alternative to new original equipment manufacturer parts, allowing operators to maintain aging fleets without significant capital expenditure. Additionally, the global increase in commercial and regional aircraft fleets, coupled with the high rate of aircraft retirements, ensures a steady supply of serviceable parts. The combination of cost savings and reliable availability encourages airlines to adopt used serviceable materials widely, driving market growth.

The increase in global commercial and regional aircraft fleets contributes to 15–20% year-on-year growth in USM availability.

Used Serviceable Material (USM) Market Restraints:

-

Reliability Concerns and Certification Challenges Limit Used Serviceable Material Adoption

Despite its advantages, Used Serviceable Material (USM) Market faces challenges from the reliability and safety of used components. Airlines and maintenance, repair, and overhaul providers are often cautious about integrating used serviceable materials into critical systems due to fears of premature failures or safety compliance issues. Certification processes from regulatory authorities like the Federal Aviation Administration and European Union Aviation Safety Agency can be complex and time-consuming, limiting the rapid adoption of used serviceable materials. These hurdles increase operational risk perception and slow down market penetration, particularly for high-value components such as engines or avionics.

Used Serviceable Material (USM) Market Opportunities:

-

Technological Advancements Unlock New Growth Opportunities in Used Serviceable Material Market

The Used Serviceable Material (USM) Market presents a significant opportunity through technological advancements in refurbishment, predictive maintenance, and digital tracking. Modern refurbishment techniques can restore used components to near-original performance levels, increasing operator confidence in used serviceable materials. Additionally, the adoption of radio-frequency identification, enterprise resource planning, and blockchain-based tracking systems allows for transparent provenance, real-time monitoring, and inventory optimization. This technological evolution enables faster turnaround times, reduces operational downtime, and opens new markets in regions like Asia-Pacific and the Middle East, where fleet expansion is rapid and cost-effective maintenance is in high demand.

Technological integration reduces aircraft maintenance downtime by 20–25% per component.

Used Serviceable Material (USM) Market Segmentation Analysis:

-

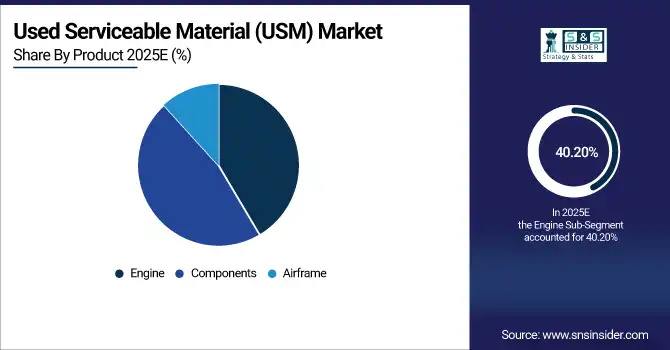

By Product: In 2025, Engine led the market with a share of 40.20%, while Components is the fastest-growing segment with a CAGR of 6.10%.

-

By Provider Type: In 2025, OEM led the market with a share of 55.20%, while non-OEM is the fastest-growing segment with a CAGR of 5.20%.

-

By Aircraft Type: In 2025, Narrow Body led the market with a share of 48.50%, while Turboprop is the fastest-growing segment with a CAGR of 5.50%.

-

By End-Use: In 2025, Commercial Aviation led the market with a share of 60.04%, while General Aviation is the fastest-growing segment with a CAGR of 4.80%.

By Product, Engine Leads Market and Components Fastest Growth

In the Used Serviceable Material (USM) Market, the Engine lead in 2025, due to the high demand for engine replacements and overhauls, which account for a significant portion of airline maintenance expenditure. Engines are critical, high-value components, and airlines increasingly rely on used serviceable engines to reduce operational costs while ensuring reliability. Meanwhile, the Components segment is the fastest-growing, driven by the rising need for cost-effective alternatives for avionics, landing gear, and other critical aircraft systems. Technological advancements in refurbishment, predictive maintenance, and digital tracking have enhanced the safety and performance of components, encouraging broader adoption. This trend reflects airlines’ preference for affordable, reliable solutions for both aging and expanding fleets.

By Provider Type, OEM Leads Market and Non-OEM Fastest Growth

In the Used Serviceable Material (USM) Market, the OEM leads in 2025, as original equipment manufacturer parts are widely trusted for quality, certification, and reliability, making them the preferred choice for airlines and maintenance, repair, and overhaul providers. OEMs ensure compliance with regulatory standards, which enhances operator confidence in critical components such as engines and avionics. Meanwhile, the non-OEM segment is the fastest-growing, driven by cost-effective alternatives and the increasing availability of certified refurbished parts. Advancements in refurbishment technologies, predictive maintenance, and digital tracking have improved the performance and safety of non-OEM components, encouraging airlines to adopt these solutions for fleet maintenance and operational efficiency.

By Aircraft Type, Narrow Body Leads Market and Turboprop Fastest Growth

In the Used Serviceable Material (USM) Market, Narrow Body leads the market in 2025, ue to the high number of narrow-body aircraft operating in commercial fleets worldwide, which require frequent maintenance and replacement of engines, components, and airframes. The widespread use of narrow-body jets in short- and medium-haul routes ensures steady demand for used serviceable materials. Meanwhile, the Turboprop segment is the fastest-growing, driven by increasing regional travel and the cost-efficiency of turboprop aircraft for short-distance operations. Technological advancements in refurbishment, predictive maintenance, and digital tracking have enhanced the reliability and safety of components, encouraging operators to adopt used serviceable materials for both narrow-body and turboprop fleets.

By End-Use, Commercial Aviation Leads Market and General Aviation Fastest Growth

In the Used Serviceable Material (USM) Market, the Commercial Aviation leads in 2025, as airlines operating large fleets require frequent maintenance and replacement of high-value components such as engines, avionics, and airframes. The scale of commercial operations, coupled with the need for cost-effective maintenance, ensures consistent demand for used serviceable materials. Meanwhile, the General Aviation segment is the fastest-growing, driven by the rising number of private jets, small aircraft, and regional operators seeking affordable and reliable solutions. Advances in refurbishment, predictive maintenance, and digital tracking technologies have enhanced the safety and performance of components, encouraging broader adoption across both commercial and general aviation sectors.

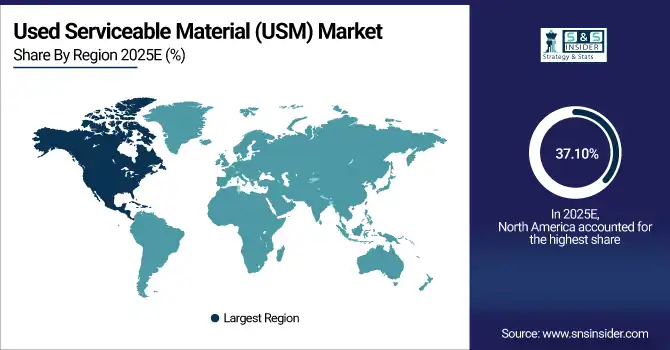

Used Serviceable Material (USM) Market Regional Analysis:

North America Used Serviceable Material (USM) Market Insights:

The North America dominated the Used Serviceable Material (USM) Market in 2025E, with over 37.10% revenue share, due to the presence of major commercial airlines, extensive maintenance, repair, and overhaul infrastructure, and a well-established aviation ecosystem. High operational costs and the aging fleet of commercial and regional aircraft drive airlines to adopt cost-effective used serviceable materials for engines, components, and airframes. The region benefits from strong regulatory frameworks, such as FAA certifications, ensuring the safety and reliability of refurbished parts. Additionally, technological advancements in digital tracking, predictive maintenance, and refurbishment enhance component performance, making North America a key market for both OEM and Non-OEM used serviceable material providers.

Get Customized Report as per Your Business Requirement - Enquiry Now

-

U.S. Used Serviceable Material (USM) Market Insights

The U.S. dominates the North American market, driven by aging fleets, high maintenance costs, advanced MRO infrastructure, and widespread adoption of refurbished engines, components, and airframes.

Asia Pacific Used Serviceable Material (USM) Market Insights:

The Asia-Pacific region is expected to have the fastest-growing CAGR 5.58%, driven by rapid fleet expansion, increasing air travel demand, and the rise of low-cost carriers. Airlines in the region are increasingly adopting cost-effective used serviceable materials for engines, components, and airframes to manage high maintenance and operational expenses. The availability of skilled MRO providers, along with technological advancements in refurbishment, predictive maintenance, and digital tracking, supports efficient maintenance operations. Rapid urbanization and growing commercial and regional aircraft fleets further boost market growth, making Asia Pacific a significant opportunity hub for both OEM and Non-OEM used serviceable material suppliers.

-

China and India Used Serviceable Material (USM) Market Insights

China and India are rapidly growing markets, fueled by Rapid fleet expansion, rising air travel demand, and cost-conscious airlines drive, with increasing adoption of refurbished engines, components, and airframes.

Europe Used Serviceable Material (USM) Market Insights

The Europe Used Serviceable Material (USM) Market is witnessing steady growth, driven by a mature aviation industry, high fleet utilization, and stringent regulatory standards enforced by authorities such as the European Union Aviation Safety Agency. Airlines and maintenance, repair, and overhaul providers increasingly rely on used serviceable materials for engines, avionics, and airframe components to reduce operational costs while maintaining compliance and safety. The presence of well-established MRO networks, advanced refurbishment technologies, and digital tracking systems enhances the reliability and efficiency of used components. Additionally, growing demand for cost-effective solutions in both commercial and regional aviation supports steady market growth across Europe.

-

Germany and U.K. Used Serviceable Material (USM) Market Insights

Germany and the U.K. hold significant market shares, driven by Mature aviation sectors, high fleet utilization, and strict regulatory standards drive demand for cost-effective refurbished engines, components, and airframes, supported by advanced MRO networks and technologies.

Latin America (LATAM) and Middle East & Africa (MEA) Used Serviceable Material (USM) Market Insights

The LATAM and MEA regions are witnessing driven by growing commercial and regional air travel, expanding airline fleets, and increasing operational cost pressures. Airlines in these regions are adopting used serviceable materials for engines, components, and airframes to optimize maintenance expenditure and ensure fleet reliability. The presence of developing MRO infrastructure, coupled with technological advancements in refurbishment, predictive maintenance, and digital tracking, enhances the efficiency and safety of used components. Additionally, rising demand from low-cost carriers and regional operators accelerates market growth, making Latin America and Middle East & Africa attractive regions for both OEM and Non-OEM used serviceable material suppliers seeking to expand their presence.

Used Serviceable Material (USM) Market Competitive Landscape

AJW Group offers comprehensive support for aircraft operators, including the provision of used serviceable materials (USM). They manage aircraft teardowns, ensuring the availability of critical components to meet market demand. AJW's approach addresses challenges related to supply chain constraints and the increasing reliance on USM in the aviation industr0079.

-

In May 2025, AJW Group launched the LARA initiative to balance new and serviceable materials, addressing supply chain challenges and emphasizing the importance of USM.

AFI KLM E&M is establishing a specialized business to source and dismantle aircraft, recovering assets to support its maintenance operations. This initiative aims to enhance the availability of used serviceable materials, aligning with the company's commitment to sustainability and cost-effective solutions in aircraft maintenance.

-

In July 2025, AFI KLM E&M launched the LARA initiative, focusing on the strategic use of USM to manage operational expenses and address supply chain challenges.

Vortex Aviation specializes in quick-turn engine maintenance, repair, and overhaul (MRO) services, emphasizing cost-effective solutions for modern turbine engines. Their capabilities include on-wing engine maintenance, AOG support, and engine disassembly services, aiming to reduce downtime and maintenance costs for airlines and operators.

-

In March 2025, Vortex introduced on-wing engine maintenance solutions, allowing essential repairs and diagnostics to be conducted at the aircraft's location, reducing turnaround time and ensuring quicker return to service.

Used Serviceable Material (USM) Market Key Players:

Some of the Used Serviceable Material (USM) Market Companies are:

-

AAR Corp.

-

GA Telesis, LLC

-

AJW Group

-

Liebherr-Aerospace

-

Delta TechOps

-

AerSale, Inc.

-

AFI KLM E&M

-

STS Aviation Group

-

SR Technics

-

Collins Aerospace

-

AvAir

-

Airinmar

-

Magellan Aviation Group

-

APOC Aviation

-

Avtrade

-

Vortex Aviation

-

Universal Asset Management (UAM)

-

AerFin

-

Wencor Group

-

AviTrader

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 7.64 Billion |

| Market Size by 2033 | USD 10.86 Billion |

| CAGR | CAGR of 4.51 % From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Engine, Components, Airframe) • By Provider Type (OEM, Non-OEM) • By Aircraft Type (Narrow Body, Wide Body, Turboprop) • By End-Use (Commercial Aviation, Military & Defense Aviation, General Aviation) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | AAR Corp., GA Telesis, LLC, AJW Group, Liebherr-Aerospace, Delta TechOps, AerSale, Inc., AFI KLM E&M, STS Aviation Group, SR Technics, Collins Aerospace, AvAir, Airinmar, Magellan Aviation Group, APOC Aviation, Avtrade, Vortex Aviation, Universal Asset Management (UAM), AerFin, Wencor Group, AviTrader, and Others. |