Benzoates Market Report Scope & Overview:

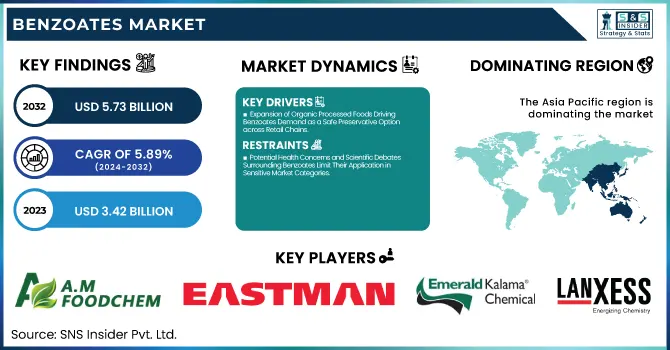

The Benzoates Market Size was valued at USD 3.42 Billion in 2023 and is expected to reach USD 5.73 Billion by 2032, growing at a CAGR of 5.89% over the forecast period of 2024-2032.

To Get more information on Benzoates Market - Request Free Sample Report

The Benzoates Market is evolving with shifting consumer preferences and global regulations reshaping the landscape. Our report offers an in-depth view of the raw material supply chain, uncovering sourcing patterns and production dependencies that impact market dynamics. It explores investment trends highlighting capacity expansions and technology upgrades by key manufacturers. Regulatory frameworks across major countries are analyzed, revealing their role in shaping product formulations and export compliance. With sustainability becoming a priority, the report tracks eco-certification trends and the push toward greener production practices. Adding depth, a detailed consumer awareness and perception analysis reveals how growing health consciousness and demand for clean-label products are influencing buying behavior, making this market increasingly responsive to transparency and innovation.

The US Benzoates Market Size was valued at USD 0.52 Billion in 2023 and is expected to reach USD 0.88 Billion by 2032, growing at a CAGR of 6.01% over the forecast period of 2024-2032.

The US Benzoates market is experiencing steady growth, driven by rising demand from the food and beverage, pharmaceutical, and personal care sectors. Increasing consumption of packaged foods and carbonated drinks, regulated under U.S. FDA guidelines for food preservatives, is a major growth driver. Additionally, the presence of key manufacturers like Eastman Chemical Company, headquartered in Tennessee, ensures robust domestic supply. Regulatory clarity from agencies such as the Environmental Protection Agency (EPA) and the Food and Drug Administration (FDA) further supports market expansion. Moreover, growing consumer preference for extended shelf-life products and the trend toward clean-label formulations are fueling the adoption of safe preservatives like sodium benzoate across various industries.

Market Dynamics

Drivers

-

Expansion of Organic Processed Foods Driving Benzoates Demand as a Safe Preservative Option across Retail Chains

The consumer movement toward organic and minimally processed foods is reshaping preservation strategies within the food industry. Sodium benzoate, recognized for its relatively mild chemical nature and regulatory approvals, is finding favor among organic product developers. Unlike harsh synthetic preservatives, it offers a balance between microbial protection and clean-label compliance. Retail chains such as Whole Foods Market and Kroger are increasingly stocking organic and natural food products where shelf life must be ensured without compromising consumer trust. The Organic Trade Association reports steady growth in organic food sales, indicating heightened demand for safe and effective preservatives. Sodium benzoate is commonly used in beverages, salad dressings, fruit-based snacks, and natural condiments where microbial growth can be problematic. As the organic and health food segment continues expanding, the demand for safe, permissible preservatives like benzoates is also growing. This trend is positioning benzoates as a critical component in the clean-label revolution and increasing their demand across diverse product categories.

Restraints

-

Potential Health Concerns and Scientific Debates Surrounding Benzoates Limit Their Application in Sensitive Market Categories

The consumer movement toward organic and minimally processed foods is reshaping preservation strategies within the food industry. Sodium benzoate, recognized for its relatively mild chemical nature and regulatory approvals, is finding favor among organic product developers. Unlike harsh synthetic preservatives, it offers a balance between microbial protection and clean-label compliance. Retail chains such as Whole Foods Market and Kroger are increasingly stocking organic and natural food products where shelf life must be ensured without compromising consumer trust. The Organic Trade Association reports steady growth in organic food sales, indicating heightened demand for safe and effective preservatives. Sodium benzoate is commonly used in beverages, salad dressings, fruit-based snacks, and natural condiments where microbial growth can be problematic. As the organic and health food segment continues expanding, the demand for safe, permissible preservatives like benzoates is also growing. This trend is positioning benzoates as a critical component in the clean-label revolution and increasing their demand across diverse product categories.

Opportunities

-

Growing Popularity of Plant-Based Foods Opens New Avenues for Benzoates as Safe Shelf-Life Enhancers

The rising adoption of plant-based diets is creating significant opportunities for benzoates in food preservation. Many plant-based foods have high moisture content and lack inherent microbial resistance, necessitating effective preservative systems. Benzoates, especially sodium benzoate, are gaining acceptance as a reliable solution to extend shelf life without compromising product quality. They are increasingly found in plant-based sauces, dairy alternatives, ready-to-eat meals, and cold beverages. Brands like Impossible Foods and Beyond Meat rely on sophisticated preservation techniques to ensure safe distribution over long distances. Benzoates provide microbial stability without adversely impacting flavor or texture—an essential consideration for plant-based consumers. Moreover, benzoates are supported by major food safety regulators, including the U.S. Food and Drug Administration and European Food Safety Authority, when used within regulated limits. As plant-based food adoption grows in mainstream markets and global retail chains, benzoates are emerging as a key ingredient in maintaining product safety, reducing food waste, and facilitating international distribution.

Challenge

-

Inconsistencies in International Regulatory Standards Complicate Global Trade and Product Development Strategies for Benzoates

Navigating regulatory compliance in the global benzoates market presents a significant challenge due to variations in national and regional standards. While key markets like the United States and Europe have clear guidelines for benzoate usage, many developing countries enforce differing limits, usage scopes, and labeling requirements. These discrepancies hinder streamlined production and make global formulation standardization difficult. Companies often need to develop separate formulations for each target market, adding to R&D costs and regulatory burdens. For instance, a preservative level permitted in the U.S. may not be acceptable in parts of Asia or the Middle East, forcing manufacturers to alter supply chains and marketing strategies. These complications slow down time-to-market and limit scalability for international brands. Such regulatory inconsistencies also affect trade negotiations and export planning, particularly for small and mid-sized enterprises looking to enter new regions without established legal support.

Segmental Analysis

By Type

Sodium benzoate dominated the benzoates market in 2023 with a market share of 56.8%, owing to its widespread use as a preservative in the food, beverage, and pharmaceutical industries. Its cost-effectiveness, ease of production, and broad-spectrum antimicrobial properties make it the preferred choice among benzoates. According to the U.S. Food and Drug Administration (FDA), sodium benzoate is approved for use in concentrations up to 0.1% by weight, reinforcing its reputation as a safe food additive. Major food manufacturers like PepsiCo and Coca-Cola use sodium benzoate in carbonated beverages and fruit juices to prevent spoilage from yeast and bacteria. Additionally, the World Health Organization (WHO) and the European Food Safety Authority (EFSA) have validated its use under regulated limits, ensuring global acceptance. In pharmaceuticals, it is used to preserve liquid medications and topical solutions due to its solubility and stability. The compound’s favorable regulatory profile and proven track record across industries cement its dominance in the benzoates segment.

By End-use

The food and beverage segment dominated the benzoates market in 2023, accounting for a dominant 59.6% share, driven by the increasing demand for processed and shelf-stable food products worldwide. Sodium and potassium benzoates are commonly used in products such as fruit juices, soft drinks, pickles, sauces, and salad dressings to inhibit microbial growth and prolong shelf life. In the United States, the Organic Trade Association (OTA) highlighted a steady increase in organic processed food sales, where safe preservatives like sodium benzoate are used under clean-label formulations. Moreover, rapid urbanization and a rise in dual-income households have increased the consumption of convenience foods, particularly in developing economies like India and Indonesia. Large supermarket chains like Walmart and Tesco prioritize products with longer shelf lives and food safety certifications, which further fuels demand for reliable preservatives. The broad regulatory approval and compatibility of benzoates with acidic food products reinforce their dominance in this segment, making food and beverage the largest contributor to the benzoates market in 2023.

Regional Analysis

Asia Pacific emerged as the leading region in the benzoates market in 2023, capturing a 40.8% market share, driven by rapid industrialization, urbanization, and rising consumer demand for processed foods and pharmaceuticals. Countries such as China, India, Japan, and South Korea are at the forefront of this dominance due to their expansive food manufacturing sectors and supportive government policies. In China, the National Health Commission has expanded the use of sodium benzoate in multiple food categories, further boosting its local demand. India’s food processing sector, supported by the Ministry of Food Processing Industries (MoFPI), witnessed a surge in demand for shelf-stable products during and after the COVID-19 pandemic, propelling the use of food-grade preservatives. Japan and South Korea, known for stringent food safety regulations, continue to approve benzoates under strict usage limits, ensuring consumer trust. Additionally, the region’s booming pharmaceutical production—particularly in generics and OTC medicines—has necessitated efficient preservative systems, where benzoates are prominently used. With expanding manufacturing capabilities and a growing middle class demanding safe and convenient food and drug products, Asia Pacific firmly leads the benzoates market.

On the other hand, North America emerged as the fastest-growing region in the benzoates market during the forecast period, with a significant CAGR, spurred by innovations in pharmaceutical preservation and increasing demand for clean-label food products. The United States is the dominant country, backed by the FDA’s regulatory framework that permits sodium benzoate use in foods and pharmaceuticals, which encourages market stability and innovation. The growing popularity of functional beverages, energy drinks, and plant-based alternatives is boosting benzoate consumption, especially as manufacturers aim for extended shelf life without compromising safety. In Canada, Health Canada regulations align with those of the U.S., ensuring consistent market access across North America. The pharmaceutical industry’s shift toward biologics and novel drug delivery systems further elevates benzoate demand, as stability becomes a critical formulation factor. Additionally, companies such as Eastman Chemical Company and Emerald Kalama Chemical are investing in research and local production capacity, capitalizing on domestic and export opportunities. With consumer preferences shifting toward transparency, and regulatory support favoring compliant preservatives, North America is poised to be the fastest expanding region in the global benzoates landscape.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

A.M Food Chemical Co., Limited (Sodium Benzoate, Potassium Benzoate)

-

Akshar Chemical India Private Limited (Sodium Benzoate, Benzoic Acid)

-

Eastman Chemical Company (Benzoic Acid, Sodium Benzoate)

-

Emerald Kalama Chemical LLC (Benzoic Acid, Sodium Benzoate, Benzyl Benzoate)

-

Ganesh Benzoplast Limited (Sodium Benzoate, Benzoic Acid)

-

Hemadri Chemicals (Sodium Benzoate, Benzoic Acid)

-

Jarchem Innovative Ingredients LLC (Vertellus Group) (Benzyl Benzoate, Benzoic Acid)

-

Katyayani Organics (Sodium Benzoate, Potassium Benzoate)

-

Krishna Chemicals (Sodium Benzoate, Benzoic Acid)

-

LANXESS AG (Benzoic Acid, Sodium Benzoate)

-

Linuo Group Holdings Co., Ltd. (Sodium Benzoate, Benzoic Acid)

-

Tengzhou Tenglong Chemical Co., Ltd. (Sodium Benzoate, Benzoic Acid)

-

Vertellus (Benzyl Benzoate, Benzoic Acid)

-

Wuhan Youji Industries Co., Ltd. (Sodium Benzoate, Potassium Benzoate, Benzoic Acid)

-

Nilkanth Organics (Sodium Benzoate, Benzoic Acid)

-

Anmol Chemicals (Sodium Benzoate, Benzyl Benzoate)

-

Otto Chemie Pvt. Ltd. (Sodium Benzoate, Benzoic Acid)

-

Muby Chemicals (Sodium Benzoate, Potassium Benzoate)

-

DPL-US by Dr. Paul Lohmann GmbH & Co. KGaA (Calcium Benzoate, Sodium Benzoate)

-

Xena International Inc. (Sodium Benzoate, Benzoic Acid)

Recent Developments

-

April 2025: LANXESS showcased its sustainable personal care solutions at the in-cosmetics Global trade fair in Paris. The company introduced Purox S Scopeblue, a green-energy-based sodium benzoate, and highlighted its eco-friendly preservatives and fragrances, reinforcing its commitment to innovation and sustainability in the cosmetics industry.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 3.42 Billion |

| Market Size by 2032 | USD 5.73 Billion |

| CAGR | CAGR of 5.89% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (Potassium Benzoate, Sodium Benzoate, Ammonium Benzoate, Others) •By End-use (Food & Beverage, Pharmaceutical, Personal Care, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | LANXESS AG, Eastman Chemical Company, Wuhan Youji Industries Co., Ltd., Tengzhou Tenglong Chemical Co., Ltd., Merck KGaA, Vertellus (including Jarchem Innovative Ingredients LLC), Ganesh Benzoplast Limited, Spectrum Chemical Mfg. Corp., Tokyo Chemical Industry Co., Ltd. (TCI Chemicals), Foodchem International Corporation and other key players |