Blackcurrant Concentrate Market Report Scope & Overview:

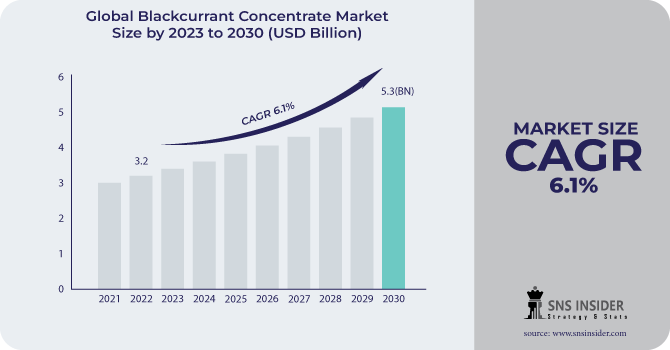

The Blackcurrant Concentrate Market size was USD $ 3.2 billion in 2022 and is expected to Reach USD $5.3 billion by 2030 and grow at a CAGR of 6.1% over the forecast period of 2023-2030.

Blackcurrant concentrate is made by filtering, clarifying, and evaporating blackcurrant juice to get pure blackcurrant. The flavor and aroma of real blackcurrant fruits may be found in blackcurrant concentrate. In 2022, the market for blackcurrant concentrates worldwide had 35% of the market share. The blackcurrant concentrate comes in numerous forms, such as liquid, frozen, etc., and is around three to seven times more concentrated and smaller in amount.

Gamma-linolenic acid (GLA), an omega-6 fatty acid, and the coloring agent anthocyanin are both present in blackcurrant concentrate, giving it a rich, deep purple hue. As one of the highest natural fruit sources of vitamin C, blackcurrant concentrate also provides a variety of other vital nutrients, including fibre and carbs, as well as potassium, phosphorus, magnesium, manganese, and iron. The blackcurrant concentrate market is projected to grow during the estimated period.

MARKET DYNAMICS

KEY DRIVERS:

-

Consumers who are concerned about their health drive demand for wholesome blackcurrant concentrates.

-

The use of blackcurrant concentrate is increased by the growing functional food sector.

The rising use of blackcurrant concentrate has been largely influenced by the growing functional food industry. The distinctive nutritional profile of blackcurrants has found a natural match in functional meals as consumer tastes evolve towards healthier and more meaningful food options. Blackcurrant concentrates excellently meet the needs of health-conscious consumers looking for easy and wholesome solutions thanks to their high antioxidant and vitamin content.

RESTRAIN:

-

Market expansion is hampered by low customer familiarity and awareness.

-

Market share is impacted by competition from different fruit concentrates.

The dynamics of market share are significantly impacted by competition from various fruit concentrates. Alternatives like berry, citrus, and tropical fruit concentrates compete for customers' attention as they look for unique and inventive flavors. Because of the rivalry, producers of blackcurrant concentrate are being forced to distinguish their products through distinctive flavor profiles and health advantages.

OPPORTUNITY:

-

Emerging markets provide opportunities for market growth and higher consumption.

-

Product packaging and formulation innovation boosts market competitiveness.

Innovations in product composition and packaging are crucial for boosting market competitiveness in the blackcurrant concentrates sector. Innovative packaging alternatives, including practical single-serve options or eco-friendly packaging, can draw customers looking for sustainability and convenience. Meanwhile, formulation improvements, including the addition of special mixes or useful additives, respond to a range of consumer tastes and strengthen the product's value proposition.

CHALLENGES:

-

Consumer uptake of items made using blackcurrants is hampered by low awareness.

-

Global supply chain disruptions have an influence on distribution and sourcing.

Disruptions in the global supply chain have a substantial influence on the dynamics of sourcing and distribution in the market for blackcurrant concentrates. These interruptions can delay both the purchase of raw materials and the delivery of products. They range from climate-related disasters to trade prohibitions and logistical difficulties. It may be difficult for producers to maintain a steady supply of blackcurrants, which might delay output and raise expenses.

IMPACT OF RUSSIAN-UKRAINE WAR

The Russian-Ukrainian war has had an impact on and obscured the market for blackcurrant concentrates. Blackcurrants are mostly produced in Russia and Ukraine, therefore any disruption to their agricultural operations might result in a shortage of the fruit, which would affect both the fruit's availability and price globally. Geopolitical tensions may result in trade restrictions, shifting market dynamics, and industry actors re-evaluating sourcing strategies and supply chain resilience to mitigate potential repercussions.

The supply chain was disrupted by the Russia-Ukraine conflict, which led to a spike in the price of goods including Pharmaceuticals, Tablets, Syrups, Food and beverages, Flavoring agents, Lip gloss, Face cream, Bar soap, Eye shadow, Eyeliner, etc. The average price increase for these drugs was 31.6 %. In 2022, certain prescription drugs will cost more than $20,000 or 500% more. The cost of critical pharmaceuticals is predicted to grow by 12%, which would be the largest annual price increase ever. Drug manufacturers often raise list prices by 5%. A 2.1% increase in food prices is anticipated, with a forecast range of -5.1 to 9.9%. Food and non-alcoholic beverages will cost more in the fiscal year that ends in July 2023 by 14.9%. Many F&B businesses raised their pricing by 15% as a consequence.

The Russia-Ukraine war has increased the cost of commodities, which has a negative effect on the market.

IMPACT OF ONGOING RECESSION

The market for blackcurrant concentrates may be affected by the current recession's effects on the economy. Consumer tastes may shift towards more affordable options when their purchasing power declines, which might have an effect on the market for high-end products. Disruptions to the supply chain and fluctuating currency exchange rates may also have an influence on production costs and export/import dynamics, causing industry participants to alter price plans and consider ways to maintain markets in the face of erratic economic conditions.

The price of commodities has grown as a result of the recession, including Ice creams, Juice, Jam, Jellies, Cosmetics, etc. Ice-cream behemoths including Cream Bell, Mother Dairy, Amul, and Vadilal boosted prices by 5% to 8% in 2021, a move that comes after two years, as a result of increasing input costs for sugar and milk powder. After a two-year pause, Amul has raised the price of ice cream by 5% to 8% from February. Despite the price increase, the ice cream business is expanding at a rate of 15–18%. Orange juice costs increased 13.8% in 2021. In line with inflation, lipstick costs increased by 4% in Q4 and 7% in January 2023, whereas face and eye makeup prices increased by 11% and 12%, respectively.

The impact of the ongoing recession has increased the cost of commodities, which has a negative effect on the market.

KEY MARKET SEGMENTS

By Type:

-

Liquid form concentrate

-

Powdered form concentrate

-

Puree form Concentrate

-

Clear form concentrate

-

Frozen form concentrate

By Ingredients:

-

NON-GMO

-

GMO

By Application:

-

Pharmaceuticals

-

Tablets

-

Syrups

-

Food and beverages

-

Flavoring agent

-

Ice creams

-

Juice

-

Jam

-

Jellies

-

Cosmetics

-

Lip gloss

-

Face cream

-

Bar soap

-

Eye shadow

-

Eyeliner

-

Retailers

-

Online portals

-

Local suppliers

.png)

REGIONAL ANALYSIS

North America has the largest market for blackcurrant concentrates in the world in 2022, accounting for 35% of it. The primary drivers influencing the growth of the blackcurrant concentrate market in North America are the rising demand for functional foods and beverages, the rising popularity of natural sweeteners, and the developing knowledge of blackcurrants' health benefits. The largest market for blackcurrant concentrates in North America is found in Canada.

Europe: In 2022, Europe is the second-largest market for blackcurrant concentrates, accounting for 25% of the global market share. In Europe, there are similar factors that support the expansion of the blackcurrant concentrates industry, just as there are in North America. The United Kingdom, Germany, and France are the three countries with the largest markets in Europe for blackcurrant concentrates.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key players:

Some major key players in the Blackcurrant Concentrate Market are Berrifine A/S, Blackcurrants New Zealand Inc., Döhler, Lemon Concentrate, Grünewald Group, Vapable Ltd., SVZ Industrial Fruit & Vegetable Ingredients, Ariza b.v., CURRANTC, Austria Juice and other players.

Berrifine A/S-Company Financial Analysis

RECENT DEVELOPMENT

-

Berrifine A/S made the announcement that it has partnered strategically with The British Blackcurrant Company in February 2023. The arrangement will provide Berrifine A/S access to The British Blackcurrant Company's UK manufacturing facilities for blackcurrant concentrate.

-

Blackcurrants New Zealand Inc. said in April 2023 that it has partnered with A.G. Foods in a strategic alliance. The arrangement will provide Blackcurrants New Zealand Inc. access to A.G. Foods' European production facilities for blackcurrant concentrate.

| Report Attributes | Details |

| Market Size in 2022 | US$ 3.2 Billion |

| Market Size by 2030 | US$ 5.3 Billion |

| CAGR | CAGR of 6.1 % From 2023 to 2030 |

| Base Year | 2022 |

| Forecast Period | 2023-2030 |

| Historical Data | 2019-2021 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Liquid form concentrate, Powdered form concentrate, Puree form Concentrate, Clear form concentrate, Frozen form concentrate) • By Ingredients (NON-GMO, GMO) • By Application (Pharmaceuticals, Tablets, Syrups, Food and beverages, Flavoring agent, Ice creams, Juice, Jam, Jellies, Cosmetics, Lip gloss, Face cream, Bar soap, Eye shadow, Eyeliner, Retailers, Online portals, Local suppliers, Specialty shops) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Berrifine A/S, Blackcurrants New Zealand Inc., Döhler, Lemon Concentrate, Grünewald Group, Vapable Ltd., SVZ Industrial Fruit & Vegetable Ingredients, Ariza b.v., CURRANTC, Austria Juice |

| Key Drivers | • Consumers who are concerned about their health drive demand for wholesome blackcurrant concentrates. • The use of blackcurrant concentrate is increased by the growing functional food sector. |

| Market Opportunity | • Emerging markets provide opportunities for market growth and higher consumption. • Product packaging and formulation innovation boosts market competitiveness. |