Breast Pads Market Size:

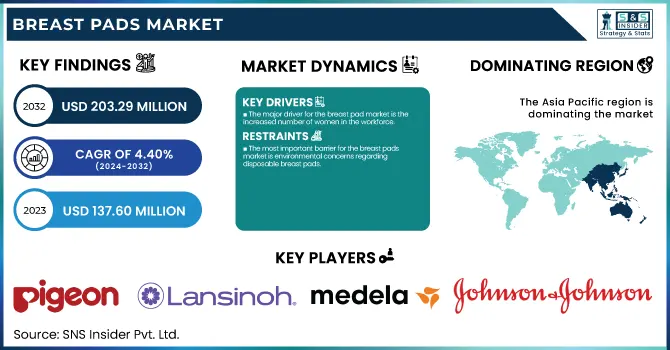

The Breast Pads Market was valued at USD 137.60 million in 2023 and is expected to reach USD 203.29 million by 2032, growing at a CAGR of 4.40% from 2024 to 2032.

To Get more information on Breast Pads Market - Request Free Sample Report

The breast pad market is witnessing significant growth with increasing awareness of the advantages of breastfeeding and the changing consumer preferences. Since 2012, exclusive breastfeeding in the first six months of life has increased by 10% worldwide according to the World Health Organization, with 48% of the global population having the ability to breastfeed as of 2023. The emphasis on breastfeeding is increasing initiation and duration rates, thus increasing demand for breast pads. With many women choosing to breastfeed, companies are developing eco-friendly, sustainable, and organic products, and reusable breast pads made from organic cotton or bamboo are favored by the environmentally conscious shopper.

Moreover, the rise in the employment of women, in particular, of the new mothers returning to work contributes to the growth of the market. The percentage of women participating in the global labor force was only 47.2% in 2022 according to the International Labor Organization, pointing to the growing number of working mothers with the need for discrete and convenient breastfeeding solutions. There will be more working mothers, and therefore a growing market for comfortable and practical products that make life easier, such as breast pads. In addition, supportive governmental actions and awareness programs against breastfeeding are increasing consumer awareness which is driving the potential growth for breast pads. The trend of delayed parenthood is also influencing the growth of the market, with parents willing to spend premium money on baby products, including breast pads.

Breastfeeding products are increasingly being marketed on social media channels such as Facebook, YouTube, and Instagram. Using these channels, companies like Medela and Ameda, Inc., with the help of universities, aim to make women aware of breastfeeding and the benefits of using breast pads. Continuing by introducing innovative products in the market such as Medela's Tender Care Hydrogel Pads has further enhanced the market growth with improved comfort and convenience. Alternatives to emerging economies are contributing to increased birth rates and thus creating new market opportunities and ensuring its growth continues.

Breast Pads Market Dynamics

Drivers

-

Increasing awareness about the benefits of breastfeeding for mothers as well as infants is highly enhancing the demand for products connected with breastfeeding, such as breast pads.

WHO and American Academy of Pediatrics recommend six months of exclusive breastfeeding of a child since early infancy offers essential nutrients and facilitates the enhancement of the immunological system. This heightened awareness has increased the number of mothers who decide to breastfeed, thereby driving the demand for products that make the experience more comfortable and convenient.

Breast pads are very helpful in absorbing milk leakage to prevent stains and are essential in the early stages of breastfeeding for many mothers. According to the Centers for Disease Control and Prevention report in 2022, it was estimated that approximately 84% of mothers in the United States start breastfeeding, but only 58% continue exclusively breastfeeding at 6 months. Challenges like leakage of milk mostly explain the gap between initiation and exclusive breastfeeding; breast pads ensure comfort, protection, and hygiene to help mothers overcome the challenge. Increased encouragement of the mothers to extend their period of breastfeeding increases the market demand for the product, expanding the market.

-

The major driver for the breast pad market is the increased number of women in the workforce.

More women than ever are returning to work after childbirth, and this group often seeks solutions that allow them to continue breastfeeding while balancing professional responsibilities. As of 2023, 74% of mothers with children under 18 were employed, according to the U.S. Bureau of Labor Statistics. This change in motherly roles resulted in a highly demanding market of products meant to facilitate and support day-long comfort throughout breastfeeding.

For many working mothers, expressing milk and controlling leakage at the workplace is difficult. Breast pads ensure that milk leakage does not disturb their daily activities as well as professional appearance. As they are practical, the mother can return to work after knowing that she will face no stains or discomfort after using breast pads, keeping her professional and personal activities together. The increasing number of dual-income households and women who are juggling career and family responsibilities has fueled demand for more convenient and effective solutions such as breast pads. So, as this trend keeps growing, the breast pad market is expected to increase to cater to this section of people, offering varied options such as reusable pads and disposable pads designed with comfort, absorbency, and discretion in mind.

Restraint

-

The most important barrier for the breast pads market is environmental concerns regarding disposable breast pads.

The one-time use of these disposable pads leads to significant waste production. Most of these breast pads are manufactured using non-biodegradable synthetic material, which remains in a landfill for years without getting decomposed. As consumers become increasingly environmentally conscious, the demand for more sustainable products is on the rise. This is forcing the market toward reusable alternatives, such as organic cotton or bamboo pads. The challenge, however, lies in the fact that most people still use disposable breast pads; it will be expensive for manufacturers to switch to these eco-friendly options, which may slow down market growth in the short term.

Breast Pads Market Segment Analysis

By Type

The reusable segment dominated the market with a market share of 45% in 2023. Breast pads made from soft materials and friendly to the environment are quite popular. These are often made from natural fibers that allow for air circulation, ventilation, and breathability, all of which are important to healing sore nipples. These pads are also washable and cost-effective for long-term use. The increasing adoption of organic bamboo fabric to make reusable nursing pads with excellent absorbency and ultra-softness is contributing to rising sales. In addition, cotton and polymer are common materials used for producing reusable nursing pads. Major companies also develop latex-free and gluten-free reusable nursing pads, contributing to the growth of this market.

The disposable segment is expected to grow at the fastest CAGR throughout the forecast period. Disposable nursing pads are similar to sanitary napkins, made out of thin absorbent material, in different levels of absorbency, and possess adhesive backs on them. They are found to be most preferred by working ladies for being discreet and a boon when traveling. Individually packaged they are very handy to move around in handbags, bags, or even pockets with great convenience. Their high moisture retention properties and gentle softness keep the mother from getting nipple soreness, developing breast infections, or irritation issues, making it more preferable.

Distribution channel

In 2023, The retail segment dominated the market with the highest market share. Increasing numbers of retail shops offered a variety of nursing pads. All these advantages are leading to an increased demand for retailing channels providing them all to the customer: ease of cooperation, specific sections for mother-care products, bundled availability, dished-out deals, and uncomplicated shopping under one roof. These retail outlets are typically a "one-stop shop" for all breast care products and are strategically located near residential areas for easy access. With all these advantages, the retail segment is expected to be able to retain its share in the market during the forecast period.

The e-commerce segment is forecasted to register the fastest growth rate over the forecast period. This will be supported by the rising availability of postpartum products in online channels and through e-commerce, which is likely to spur market growth. Consumers want to compare and choose products by type, brand, price, and point of sale that online channels facilitate. The top online retailer in this industry is Amazon. com, Inc. Walmart, Motherhood, FirstCry com. Additionally, e-commerce has many benefits, including discounts, offers, free delivery, and a variety of products. Thus, a few of the leading companies such as Koninklijke Philips N.V., Medela, and Ameda, Inc. are utilizing online mediums to promote their postpartum products and cater to larger audiences. Promotional techniques like buy-one-get-one offers, markdowns, and free merchandise help drive sales through this lead.

Breast Pads Market Regional Insights

In 2023, the Asia Pacific region dominated the market with the largest market share in the breast pads market, at 36%, attributed to the region's large population, as well as high birth rates and increasing breastfeeding rates. Afghanistan recorded around 35 births per 1,000 people which has the highest crude birth rate in the World, according to data from The World Bank Group. In addition, the World Health Organization recommends exclusive breastfeeding for the first six months, auguring well for maternal care products, including breast pads.

Growth in breast pads in India is high because of the rising number of births and increased female labor force participation. Westernization and changing lifestyles have led to a surge in demand for personal care and maternal care categories. The increasing middle class and swift urbanization have also propelled the adoption of breast pads as part of better lifestyle habits. Moreover, increasing disposable income is driving demand for premium and imported maternal care products.

North America is expected to gain significant market share with relatively higher growth in CAGR in the forecast period owing to higher adoption of breast pads, growing female labor force, developed retail structure, new entrants, and higher disposal incomes. The working mothers go back to work, they often prefer breast pads to prevent leakages efficiently. Also, a robust retail presence of supermarkets, specialty stores, convenience outlets, and online channels facilitates the easy availability of breast pads. Consumers in the region possess disposable income, which enables them to spend on value-added and convenience products leading to the growth of the market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Breast Pads Companies int the Market

-

Breast Pads Honeycomb

-

Comfy Feel Disposable Breast Pads

-

Stay Dry Nursing Pads

-

Washable Nursing Pads

Medela AG

-

Disposable Nursing Pads

-

Safe & Dry Ultra-thin Pads

-

Comfort Breast Pads

-

Day & Night Disposable Breast Pads

Nuk

-

Ultra Dry Comfort Breast Pads

-

Ultra Dry Premium Breast Pads

Dr. Brown's

-

Disposable Breast Pads

-

Washable Breast Pads

Johnson & Johnson

-

Nursing Pads (Disposable)

-

Nursing Pads with Comfort Lining

Tommee Tippee

-

Made for Me Disposable Breast Pads

-

Made for Me Washable Breast Pads

Ameda, Inc.

-

ComfortGel Hydrogel Pads

-

NoShow Premium Disposable Nursing Pads

Bamboobies

-

Bamboo Washable Nursing Pads

-

EcoPure Disposable Nursing Pads

Chicco

-

NaturalFeeling Disposable Breast Pads

-

Antibacterial Nursing Pads

Evenflo Feeding

-

Advanced Disposable Nursing Pads

-

Reusable Nursing Pads

MAM Baby

-

Breast Pads (Ultra-Dry)

-

Reusable Nursing Pads

Baby Bliss

-

Organic Bamboo Nursing Pads

-

Reusable Nursing Pads with Wash Bag

NatureBond

-

Washable Nursing Pads with Travel Bag

-

Organic Bamboo Nursing Pads

First Years (The First Years)

-

Breastflow Disposable Nursing Pads

-

Breastflow Reusable Nursing Pads

Kindred Bravely

-

Organic Nursing Pads (Reusable)

-

Overnight Nursing Pads

Natracare

-

Organic Nursing Pads

-

Plastic-free Disposable Breast Pads

BellaBaby

-

Ultra Soft Bamboo Nursing Pads

-

Reusable Nursing Pads for Sensitive Skin

KeaBabies

-

Organic Bamboo Reusable Nursing Pads

-

Disposable Nursing Pads for Mothers

Recent Developments

-

October 2023: Bamboobies Washable Reusable Nursing Pads and Lansinoh Disposable Nursing Pads have been spotlighted for their exceptional features. Bamboobies offer sustainable, comfortable solutions, while Lansinoh excels in absorbency and leak protection. Both products cater to varied preferences with a focus on comfort, durability, and practicality.

-

April 2023: Moong Pattana International PCL, Thailand's exclusive Pigeon distributor, introduced the "Third Generation of New SofTouch" nursing nipple, designed to enhance breastfeeding with innovative comfort and functionality.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 137.60 million |

| Market Size by 2032 | US$ 203.29 million |

| CAGR | CAGR of 4.40% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (Reusable, Disposable, Hydrogel, Silicone) •By Distribution Channel (Retail, Wholesale, E-commerce) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Pigeon Corporation, Lansinoh Laboratories, Inc., Medela AG, Philips Avent, Nuk, Dr. Brown's, Johnson & Johnson, Tommee Tippee, Ameda, Inc., Bamboobies, Chicco, Evenflo Feeding, MAM Baby, Baby Bliss, NatureBond, First Years (The First Years), Kindred Bravely, Natracare, BellaBaby, KeaBabies, and other players. |

| Key Drivers | •Increasing awareness about the benefits of breastfeeding for mothers as well as infants is highly enhancing the demand for products connected with breastfeeding, such as breast pads. •The major driver for the breast pad market is the increased number of women in the workforce. |

| Restraints | •The most important barrier for the breast pads market is environmental concerns regarding disposable breast pads. |