Capillary Blood Collection Devices Market Size Analysis

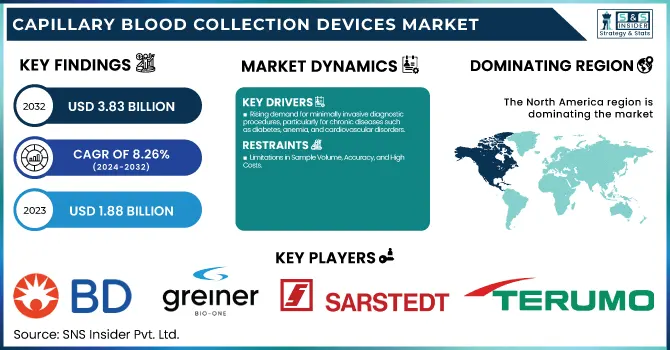

The Capillary Blood Collection Devices Market size was estimated at USD 1.88 Billion in 2023 and is projected to reach USD 3.83 Billion by 2032, growing at a CAGR of 8.26% over the forecast period 2024-2032.

This report underscores the rising incidence and prevalence of diseases necessitating capillary blood collection and changing prescription and utilization patterns across regions. The research analyzes changing regulatory and compliance models pivotal in market access and product approvals.

To Get more information on Capillary Blood Collection Devices Market - Request Free Sample Report

The research also discusses technological innovation and advancements, such as automation and improved device precision, that will revolutionize blood collection practices over the next decade. The study also analyzes spending on capillary blood collection from government, commercial, private, and out-of-pocket sources of funds, varying regionally by impacting market forces and growth opportunities.

Capillary Blood Collection Devices Market Dynamics

Drivers

-

Rising demand for minimally invasive diagnostic procedures, particularly for chronic diseases such as diabetes, anemia, and cardiovascular disorders.

The International Diabetes Federation (IDF) stated that more than 537 million adults worldwide had diabetes in 2023, making it essential to check blood glucose levels regularly. Furthermore, the increasing use of point-of-care (POC) testing and home diagnostics is driving market expansion. The increasing scope of telehealth services and self-monitoring devices, including Abbott's Freestyle Libre and Roche's Accu-Chek, have also driven demand for capillary blood collection devices. Advancements in technology, including automated and pain-free blood collection devices, are enhancing patient compliance, and improving market penetration. Additionally, the growing adoption of capillary blood collection for clinical research and personalized medicine is driving adoption. Regulatory approval for new products, including FDA-cleared Tasso+ blood collection devices, is also aiding market growth. Increasing healthcare consciousness, combined with increased investments in diagnostic technologies, is likely to support long-term growth in the industry.

Restraints

-

Limitations in Sample Volume, Accuracy, and High Costs

Even with robust growth, some factors hold back the capillary blood collection devices market. One of the main challenges is sample volume constraints, as capillary blood collection tends to provide smaller samples compared to venous blood, which may impact test accuracy. This constraint renders it inappropriate for some diagnostic tests that require larger sample volumes. High sample quality variability, resulting from incorrect collection methods or external contamination, can also influence test results. Most healthcare professionals continue to favor conventional venous blood collection for advanced diagnostic testing, limiting the adoption of capillary blood collection. High costs associated with high-end capillary blood collection instruments, especially automated or digital products, restrict access in resource-constrained settings. Regulatory issues present a substantial limitation since strict compliance demands for blood collection devices are slow to allow new products to come to market. Issues related to blood clotting and hemolysis in microsampling also affect the validity of test results. Additionally, healthcare professionals' ignorance and lack of training in developing markets slow down market acceptance. Overcoming these constraints with innovation, training, and enhanced technology integration is essential for greater acceptance.

Opportunities

-

The expansion of decentralized diagnostics, rising demand for self-monitoring health devices, and increasing investments in biomarker research present significant opportunities.

The increasing adoption of self-monitoring health devices, particularly in managing chronic conditions like diabetes and cardiovascular diseases, is creating a strong demand for reliable and user-friendly capillary blood collection methods. Additionally, the rise of personalized medicine and biomarker research is boosting the need for microsampling technologies. Companies are focusing on developing automated and pain-free blood collection devices, such as Tasso’s remote blood collection solutions, to enhance patient compliance. Another key opportunity lies in the integration of digital health technologies with capillary blood collection, enabling real-time monitoring and data sharing with healthcare providers. Growing investments in clinical trials and biobanking further drive demand for efficient blood collection methods, supporting research and innovation in diagnostic sciences. Emerging markets also present untapped potential due to improving healthcare access and rising awareness of early disease detection. Furthermore, government initiatives promoting preventive healthcare and advancements in artificial intelligence (AI)-driven diagnostics are expected to revolutionize the sector. Expanding healthcare partnerships and regulatory approvals for innovative devices will further accelerate market growth.

Challenges

-

Regulatory delays, slow adoption in hospitals, technological limitations in sample preservation, and concerns over data security in digital health integration also restrict market expansion.

One of the main issues is the standardization of microsampling procedures, as differences in collection processes can result in variable outcomes. Maintaining accuracy and reliability between different testing facilities is a top concern. Regulatory barriers are also an issue, as companies have to meet rigorous quality and safety requirements before products can be brought to market. Approval delays can hinder innovation and restrict market penetration. Limited adoption in conventional healthcare facilities is another significant challenge, with venous blood collection remaining the gold standard for the majority of diagnostic procedures in most traditional laboratories and hospitals. Additional evidence and validation are needed before the change to capillary blood collection practices can occur. Technological impediments in the form of enhanced blood stabilizing agents and improved sample preservation are also hindrances to wide usage. Consumer doubt about the validity of at-home testing kits also influences adoption levels. In addition, data security and compatibility issues in digital health integration are challenges that must be overcome to implement real-time diagnosis and remote patient monitoring. Overcoming these, via ongoing research, enhanced regulatory schemes, and industry alliances, will be critical for moving beyond these obstacles and fueling future market expansion.

Capillary Blood Collection Devices Market Segmentation Analysis

By Product

Lancets led the capillary blood collection devices market in 2023, with a 32.1% share of the total revenue. The prevalence of lancets in glucose testing, anemia screening, and point-of-care testing helped them lead the market. Their low cost, simplicity, and common use in home care and clinical settings have cemented their position as market leaders.

Conversely, the micro-container tube segment will witness the maximum growth. It is fueled by growing demand for micro-sampling methods in clinical laboratories and hospitals, allowing for minimally invasive blood collection to conduct specialized testing. The growth of this segment is being triggered by the transformation towards sophisticated methods of collection that minimize sample volume requirements.

By Material

Plastic capillary blood collection devices dominated the market with a 41.2% share in 2023. The widespread use of plastic materials is because they are affordable, lightweight, and highly compatible with sterile healthcare conditions. Furthermore, plastic microtubes and containers offer high durability, hence, a high preference in healthcare environments.

Still, the glass segment is growing at the most rapid pace. With a higher chemical resistance and lower threat of contamination, glass micro-containers, and hematocrit tubes are being increasingly adopted. With the growing demand for high-purity blood-gathering products, glass-based products are finding increased acceptance.

By Application

Amongst applications, whole blood testing dominated the market, holding 25.4% of the overall revenue share in 2023. The popularity of this segment is backed by its widespread application in general blood diagnostics such as glucose testing, complete blood count (CBC), and infectious disease diagnosis. Whole blood collection is a core prerequisite for numerous medical and diagnostic tests, allowing it to retain its solid market position.

The plasma/serum protein tests segment will be the fastest-growing. Growth in demand for protein biomarker testing, monitoring of chronic diseases, and complex diagnostic methods is driving this segment. With the increasing traction of personalized medicine and precision diagnostics, the demand for plasma and serum-based testing is rising.

By End Use

Based on end users, clinics and hospitals stood as the prominent segment that comprised 30.3% of the market in 2023. This dominance can be due to the extensive number of diagnostic tests done within hospitals where capillary blood sampling is regularly applied for emergency diagnosis, regular check-ups, and quick patient examinations. The availability of fully-equipped medical facilities adds weight to the control of this segment.

At the same time, the home diagnosis segment is expected to expand at the highest rate. The growing uptake of home testing solutions, prompted by technological innovation in self-monitoring devices and telemedicine services, is driving demand. Growing consumer desire for convenience, along with the spread of home-based diagnostic kits for glucose, cholesterol, and other health indicators, is driving this segment's growth.

Capillary Blood Collection Devices Market Regional Insights

In 2023, North America led the capillary blood collection devices market with a market share of 32.2%. The leadership of the region is attributed to the high incidence of chronic conditions like diabetes, cardiovascular diseases, and infectious diseases, which demand regular blood analysis. The advanced healthcare infrastructure, robust reimbursement policies, and developed diagnostic industry further support the large-scale use of capillary blood collection devices. The increasing need for home-use and point-of-care testing, especially in the U.S. and Canada, has further fuelled market expansion.

Europe comes next, helped by rising government healthcare expenditure and an aging population that needs constant blood monitoring. The region also experiences increasing investment in minimally invasive diagnostic devices, which aids in the increase in capillary blood collection practices.

Asia-Pacific is anticipated to be the highest growing market, driven by increasing access to healthcare, growing awareness of early disease detection, and rising instances of diabetes and anemia. China, India, and Japan are experiencing a boost in the demand for capillary blood collection devices with better diagnostic facilities and the aggressive growth of homecare testing.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players and Their Capillary Blood Collection Products

-

Becton, Dickinson, and Company (BD) – BD Microtainer, BD Microgard Capillary Blood Collection Tubes, BD Lancets

-

Greiner Bio-One International GmbH – MiniCollect Capillary Blood Collection System

-

SARSTEDT AG & Co. KG – Safety Lancets, Capillary Blood Collection Tubes

-

Terumo Medical Corp. – Capiject Safety Lancets, Microvette Capillary Blood Collection Tubes

-

B. Braun Melsungen AG – Sterican Lancets

-

Improve Medical – Capillary Blood Collection Tubes, Safety Lancets

-

Abbott Laboratories – Freestyle Lancets, i-STAT Capillary Blood Collection Tubes

-

Cardinal Health – Cardinal Health Safety Lancets

-

Retractable Technologies Inc. – EasyPoint Blood Collection Lancets

-

Haemonetics Corporation – Safe-T-Vue Capillary Blood Collection Solutions

-

Medtronic plc – MiniMed Lancets

-

Radiometer Medical ApS – SafeCrit Capillary Blood Sampling Tubes

-

Roche Diagnostics – Accu-Chek Softclix Lancets

-

Siemens Healthineers – Microvette Capillary Blood Collection System

Recent Developments in the Capillary Blood Collection Devices Market

- In Feb 2025, Tasso and Arup partnered to enhance blood testing services for clinical research. As part of the collaboration, Arup conducted validation of multiple assays using capillary blood micro samples, supporting the expansion of minimally invasive diagnostics.

- In Dec 2024, BD (Becton, Dickinson, and Company) and Babson Diagnostics expanded fingertip blood collection and testing technologies for U.S. healthcare systems, enabling use in urgent care centers, physician offices, and ambulatory care settings to enhance diagnostic accessibility.

- In Aug 2024, Vitestro Holding BV received a CE marking for its AI-powered automated blood drawing device, which integrates ultrasound-guided imaging and robotics for precise and secure blood collection. As the first device of its kind to achieve CE certification, it is expected to revolutionize healthcare diagnostics.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.88 billion |

| Market Size by 2032 | USD 3.83 billion |

| CAGR | CAGR of 8.26% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product [Lancets, Micro-container tubes, Micro-hematocrit tubes, Warming devices, Others] • By Material [Plastic, Glass, Stainless steel, Ceramic, Others] • By Application [Whole Blood, Plasma/ serum protein Tests, Comprehensive metabolic panel tests, Liver panel/ liver profile/ liver function tests, Dried blood spot tests] • By End Use [Hospitals and Clinics, Blood Donation Centers, Diagnostic Centers, Home Diagnosis, Pathology Laboratories] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Becton, Dickinson, and Company (BD), Greiner Bio-One International GmbH, SARSTEDT AG & Co. KG, Terumo Medical Corp., B. Braun Melsungen AG, Improve Medical, Abbott Laboratories, Cardinal Health, Retractable Technologies Inc., Haemonetics Corporation, Medtronic plc, Radiometer Medical ApS, Roche Diagnostics, Siemens Healthineers. |