Biomarkers Market Overview:

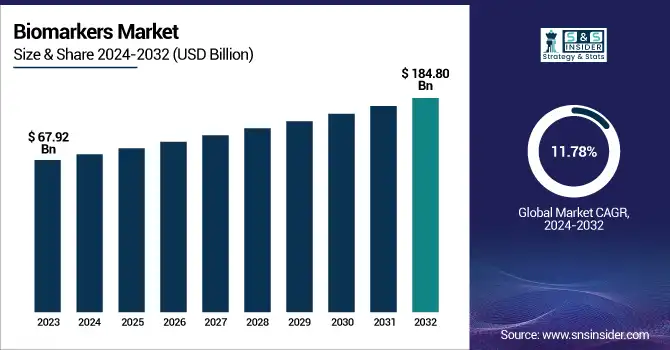

The global biomarkers market is projected to grow from USD 67.92 billion in 2023 to USD 184.80 billion by 2032, at a CAGR of 11.78% during the forecast period 2024-2032.

This report emphasizes the increasing prevalence and incidence of diseases that need biomarker-based diagnosis, leading to greater demand for precision medicine and targeted treatments. The research looks at biomarker testing volume and adoption patterns across geographies, indicating the increased dependence on early disease detection and personalized treatment strategies. It also discusses advances in biomarker-based diagnostics and drug development, highlighting advances in liquid biopsy, companion diagnostics, and AI-assisted analysis. The study also evaluates healthcare expenditure on biomarker-based treatments and diagnostics across regions, highlighting the role of research investments, government programs, and changing reimbursement policies in propelling market growth.

Get More Information on Biomarkers Market - Request Sample Report

Biomarkers Market Dynamics

Drivers

-

Growing Adoption of Precision Medicine and Rising Disease Burden

The biomarkers market is propelled by the growing use of precision medicine, which is dependent on biomarkers for targeted therapy and personalized treatment strategies. The growing incidence of chronic diseases such as cancer, cardiovascular diseases, and neurological disorders is driving demand for biomarker-based diagnostics and treatments. As per the WHO, cancer cases are likely to increase by 47% from 2020 to 2040, and this will raise the demand for sophisticated biomarker-driven solutions. In addition, advances in omics technologies, including genomics, proteomics, and metabolomics, are facilitating biomarker discovery and verification. Also, the incorporation of artificial intelligence (AI) and machine learning in biomarker analysis promotes innovation, enhancing disease diagnosis, and maximizing treatment protocols.

Restraints

-

The high costs associated with biomarker discovery, validation, and clinical trials pose a major restraint to market growth.

The cost of developing a single biomarker-based test is between USD 10 million and USD 100 million, and it is a capital-intensive process. In addition, stringent regulatory conditions and protracted approval processes slow down market access. Regulatory authorities such as the FDA and EMA demand robust clinical validation and compliance with complex guidelines, which leads to commercialization delays. Narrow reimbursement range policies for biomarker-based tests also act as constraints, particularly in low- and middle-income countries.

Opportunities

-

The growing use of biomarkers in early disease detection and companion diagnostics presents significant market opportunities.

Biomarker-based liquid biopsies, for instance, are gaining traction as non-invasive tools for early cancer detection and monitoring. The FDA-approved Guardant360 CDx test is one illustration of how liquid biopsy biomarkers are revolutionizing cancer diagnosis. Additionally, the growing adoption of companion diagnostics, which guide precision treatments based on biomarker data, is driving demand. Pharma firms increasingly collaborate with diagnostic firms to co-develop biomarker-directed therapies, as seen in partnerships between Roche and Foundation Medicine.

Challenges

-

The lack of standardization and reproducibility across different platforms and laboratories.

Variability in biomarker validation procedures, sample collection protocols, and data interpretation causes inconsistency in results, impacting clinical reliability. A study brought to light that almost 60% of biomarker studies do not have reproducible results, which hinders clinical translation. Furthermore, the complexity of integrating multi-omics data and large-scale clinical validation poses major challenges. Global standardization initiatives, enhanced data harmonization, and sound validation frameworks are needed to overcome these challenges to ensure biomarker reliability in the clinic.

Biomarkers Market Segmentation Analysis

By Product

The consumables segment dominated the market in 2023 because of its critical function in biomarker-based diagnostics and research. Consumables such as assay kits, reagents, and lab supplies are critical to biomarker discovery, validation, and clinical use. Their recurring nature guarantees constant demand, particularly in pharmaceutical and biotechnology companies, which depend on them for continuous research and testing. Dominance in the segment is also due to the evolution in biomarker technologies, more R&D spending, and the high incidence of chronic ailments that need constant checking and monitoring. Additionally, with biomarker-based precision medicine becoming more popular, the demand for high-quality consumables keeps rising, further establishing the market dominance of the segment.

The services segment is likely to expand at the fastest rate due to the growing outsourcing trend of biomarker research, validation, and regulatory compliance services. Pharmaceutical and biotech firms utilize expert contract research organizations (CROs) to make biomarker development processes more efficient and cost-effective. Growing complexity in biomarker-based clinical trials has further driven demand for professional consulting, data analysis, and validation services. Also, the increasing convergence of artificial intelligence and bioinformatics in biomarker research has heightened the demand for expert services, and hence this segment is one of the most profitable areas of expansion in the coming years.

By Type

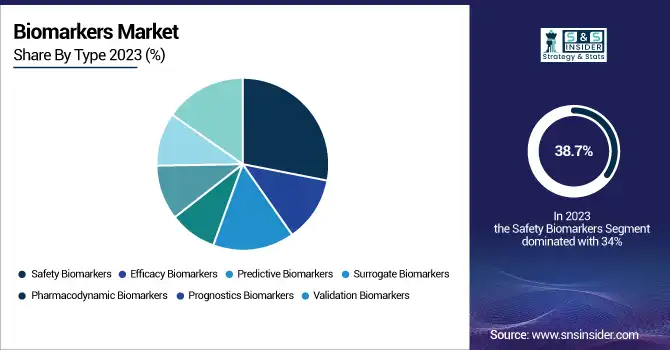

The safety biomarkers segment held the highest revenue share of 38.7% in 2023 because of its pivotal position in drug development and regulatory affairs. Safety biomarkers assist in determining drug toxicity, making sure that pharmaceutical candidates are safe enough to progress through clinical trials. This segment's growth is fueled by strict regulatory demands for drug approval, wherein safety biomarkers are widely utilized to foretell possible adverse effects, thereby decreasing late-stage failures. The rising use of personalized medicine and the requirement for early toxicity screening also increased the demand for safety biomarkers in the pharmaceutical and biotechnology industries. Also, their use in preclinical and clinical research has further reinforced their significance, rendering them a crucial component in drug discovery programs.

The efficacy biomarkers market is anticipated to expand at the fastest rate, driven by the increasing use of targeted therapies and personalized medicine. Efficacy biomarkers have an essential function in assessing response to drugs, streamlining treatment regimens, and enhancing patient outcomes. With the increasing focus on precision medicine, these biomarkers assist in the identification of patients who are likely to respond best to certain treatments, minimizing trial-and-error methods. The use of artificial intelligence and machine learning in drug development based on biomarkers is also speeding up developments in this area. With pharmaceutical companies concentrating on improving the efficacy of treatments, the need for these biomarkers is likely to increase.

By Application

The drug discovery & development segment led the market in 2023, fueled by the growing application of biomarkers in the identification of lead drug candidates and the optimization of clinical trials. Biomarkers are important in streamlining the time and expense of drug development by allowing early detection of efficacy and safety signals. The pharmaceutical sector is putting significant investment into biomarker-based research to maximize drug success rates and accelerate regulatory approval processes. Biomarker-based stratification of clinical trial volunteers also assists in minimizing variability, resulting in more effective and focused drug development. The combination of biomarkers with cutting-edge technologies like genomics, proteomics, and artificial intelligence further adds to this sector's dominance, making biomarker-based drug discovery a prime area of focus for leading industry players.

The diagnostics segment is also expected to report the fastest growth on account of the increasing use of biomarker-based diagnostic tests for early disease diagnosis and personalized treatment planning. Growth in the incidence of chronic and infectious diseases and advancements in liquid biopsy and molecular diagnostics have fuelled the adoption of biomarker-based diagnostic tests. These diagnostic tests allow faster and more accurate detection of disease, enhancing patient outcomes and healthcare cost savings. Furthermore, the movement towards preventive care and the increasing presence of companion diagnostics for precision therapies have further promoted the use of biomarkers in diagnostics. Next-generation sequencing and artificial intelligence's integration into biomarker-guided diagnostics will likely spur substantial growth in this space.

By Disease

The cancer segment dominated the market in 2023, fueled by the extensive use of biomarkers in oncology for early diagnosis, prognosis, and treatment choice. Cancer biomarkers are widely applied in liquid biopsies, companion diagnostics, and targeted therapies, improving accuracy in cancer treatment. The increasing global cancer burden and the increasing emphasis on personalized oncology therapies have also further consolidated this segment's market position. Technological advancements in genomic and proteomic technologies have facilitated the identification of new cancer biomarkers, enhancing early detection and therapeutic decision-making. Further, rising R&D spending in oncology and the growth of biomarker-based clinical trials have also added to the dominance of the segment.

The immunological diseases segment is anticipated to expand at the fastest rate as a result of the growing incidence of autoimmune and inflammatory diseases. Biomarkers are important for the diagnosis and monitoring of diseases like rheumatoid arthritis, multiple sclerosis, and lupus, facilitating early treatment and individualized treatment strategies. Increased interest in immunotherapy and biologics has heightened the need for biomarkers that can anticipate treatment outcomes and disease progression. Furthermore, developments in molecular diagnostics and the increased use of biomarker-guided clinical trials in immunology are driving the fast growth of the segment. As research on immune-related disorders further progresses, demand for immunological biomarkers is likely to accelerate.

Biomarkers Market Regional Analysis

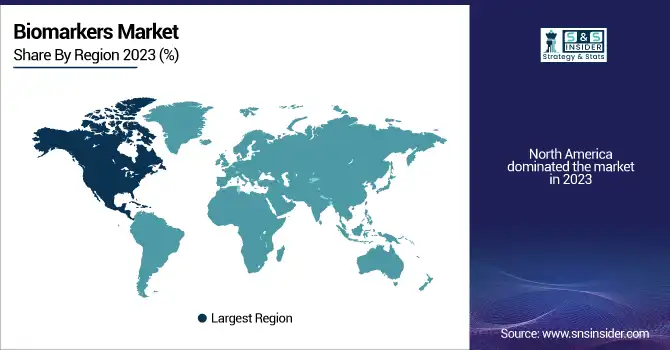

North America dominated the market in 2023 with a well-developed healthcare infrastructure, large R&D investments, and established players in the market. The region is supported by massive government investment in biomarker research, rising adoption of precision medicine, and a high incidence of chronic diseases like cancer and cardiovascular diseases. The United States leads the North American market, fueled by sophisticated diagnostic technologies, robust pharmaceutical industry partnerships, and regulatory encouragement of biomarker-based drug development.

Europe is the next in line as a key market, driven by positive regulatory policies, growing clinical research activities, and expanding application of biomarkers in personalized medicine. Germany, the UK, and France are leading countries due to high healthcare spending and robust biotechnology and pharmaceutical sectors. The region is also experiencing growth in biomarker-based drug discovery and companion diagnostics.

The Asia-Pacific market is anticipated to develop at the fastest growth rate, stimulated by increasing awareness for healthcare, enhanced investment in biotechnology, and increased clinical trial operations. Market growth is driven by China, India, and Japan through improving healthcare facilities and increasing government programs in support of biomarker investigation. A big patient pool along with decreased costs of clinical trials further increases the opportunity in the market.

Get More Information on Biomarkers Market - Enquiry Now

List of Key Companies in the Biomarkers Market

-

F. Hoffmann-La Roche AG – Elecsys Biomarkers, Cobas Diagnostics

-

Epigenomics AG – Epi proColon, Epi proLung

-

Abbott – ARCHITECT Biomarker Assays, Alinity System

-

Thermo Fisher Scientific Inc. – ProQuantum Immunoassays, TaqMan Assays

-

General Electric – Discovery Biomarker Solutions

-

Eurofins Scientific – Biomarker Assay Services, Genomic Biomarkers

-

Johnson & Johnson Services, Inc. – Janssen Biomarker Research

-

QIAGEN – QIAseq Targeted RNA Panels, QIAamp DNA Kits

-

Bio-Rad Laboratories, Inc. – Bio-Plex Multiplex Assays, ddPCR Biomarkers

-

Siemens Healthineers AG – Atellica IM Biomarkers, ADVIA Centaur

-

Merck KGaA – MILLIPLEX Assays, SMC Biomarker Assays

-

PerkinElmer Inc. – AlphaLISA Biomarker Assays, DELFIA Kits

-

Agilent Technologies, Inc. – SurePrint G3 Microarrays, AssayMAP Technology

-

Revvity – LABScreen, Luminex Multiplex Assays

-

Laboratory Corporation of America Holdings – Biomarker Testing Services

-

Charles River Laboratories – Biomarker Discovery & Validation Services

-

BIOMÉRIEUX – VIDAS Biomarkers, VITEK Biomarkers

-

JSR Corporation – Biomarker Antibodies & Reagents

-

Quanterix – Simoa Biomarker Detection Technology

-

MESO SCALE DIAGNOSTICS LLC. – MULTI-ARRAY Technology Biomarkers

Recent Developments

In Feb 2025, BostonGene partnered with BeiGene (soon to be BeOne Medicines Ltd.) to advance biomarker discovery in Mantle Cell Lymphoma (MCL). This collaboration focuses on identifying tumor-based biomarkers linked to treatment response and resistance, leveraging AI-driven molecular and immune profiling solutions.

| Report Attributes | Details |

| Market Size in 2023 | USD 67.92 billion |

| Market Size by 2032 | USD 184.80 billion |

| CAGR | CAGR of 11.78% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product [Consumables, Services, Software] • By Type [Safety Biomarkers, Efficacy Biomarkers, Predictive Biomarkers, Surrogate Biomarkers, Pharmacodynamic Biomarkers, Prognostics Biomarkers, Validation Biomarkers] • By Application [Diagnostics, Drug discovery & development, Personalized Medicine, Disease Risk Assessment, Others] • By Disease [Cancer, Cardiovascular Diseases, Neurological Diseases, Immunological Diseases, Others] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | F. Hoffmann-La Roche AG, Epigenomics AG, Abbott, Thermo Fisher Scientific Inc., General Electric, Eurofins Scientific, Johnson & Johnson Services, Inc., QIAGEN, Bio-Rad Laboratories, Inc., Siemens Healthineers AG, Merck KGaA, PerkinElmer Inc., Agilent Technologies, Inc., Revvity, Laboratory Corporation of America Holdings, Charles River Laboratories, BIOMÉRIEUX, JSR Corporation, Quanterix, MESO SCALE DIAGNOSTICS LLC. |