Cardiovascular Devices Market Size Report Scope & Overview:

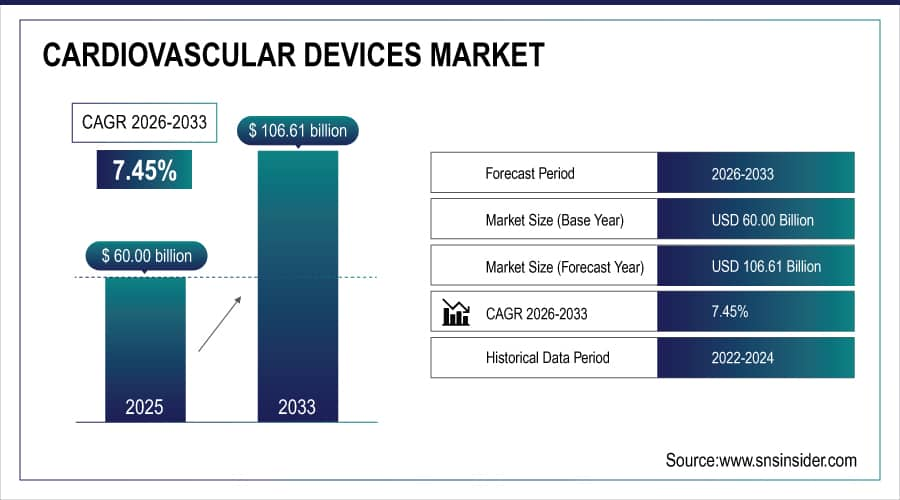

The Cardiovascular Devices Market size was estimated at USD 60.00 billion in 2025E and is expected to reach USD 106.61 billion by 2033 at a CAGR of 7.45% during the forecast period of 2026-2033.

Cardiovascular diseases (CVD) are considered the most common cause of death all around the globe. According to the National Institute of Health (NIH) people suffering from heart disease in rural and urban areas are increasing rapidly. For instance, in the UK approx. 24500 deaths are been recorded because of CVD. There are several factors which are contributing to this scenario. The major factors are an unhealthy lifestyle of the people, consumption of excess alcohol and so forth. The U.S. organizations and hospitals are taking a lot of initiatives to promote awareness regarding how heart disease can be prevented. Mayo Clinic has started promotions related to how physical activities can help people to prevent heart disease.

Cardiovascular Devices Market Size and Forecast:

-

Market Size in 2025E: USD 60.00 Billion

-

Market Size by 2033: USD 106.61 Billion

-

CAGR: 7.45% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get More Information On Cardiovascular Devices Market - Request Free Sample Report

Key trends in the Cardiovascular Devices Market:

-

Rising prevalence of cardiovascular diseases and aging populations driving higher demand for advanced cardiac devices.

-

Increasing adoption of minimally invasive procedures and catheter-based interventions over traditional surgeries.

-

Growing focus on patient-specific and personalized cardiac care through implantable devices and monitoring systems.

-

Technological advancements in stents, pacemakers, and heart valves enhancing procedural success and patient outcomes.

-

Expansion of remote monitoring and telehealth-enabled cardiovascular devices for continuous patient care.

-

Higher investment by medical device manufacturers in R&D for next-generation cardiovascular solutions.

-

Strategic collaborations and acquisitions among key players to expand product portfolios and global reach.

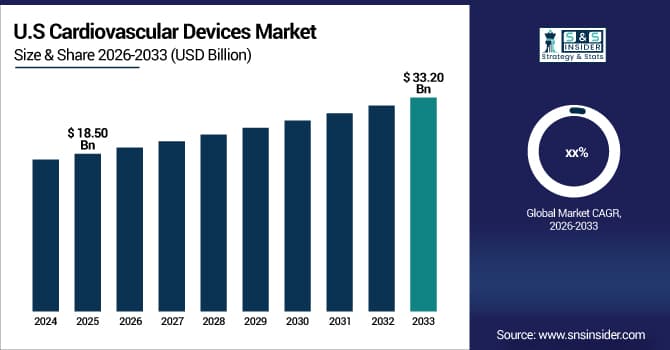

The U.S. Cardiovascular Devices Market size was valued at USD 18.50 Billion in 2025 and is projected to reach USD 33.20 Billion by 2033. Driven by increasing incidence of heart diseases, technological innovations, and rising adoption of minimally invasive procedures. Expanding awareness, improved healthcare infrastructure, and ongoing R&D investments are further fueling market growth, enabling advanced treatment options and improved patient outcomes across the country.

Cardiovascular Devices Market Drivers:

-

Rising Prevalence of Cardiovascular Diseases and Aging Population Fuels Device Adoption

The increasing prevalence of cardiovascular diseases (CVDs) such as heart failure, arrhythmias, and coronary artery disease, combined with the growing aging population, is a major driver of the cardiovascular devices market. The demand for advanced cardiac devices like pacemakers, stents, heart valves, and implantable cardiac monitors is rising as healthcare providers aim to improve patient outcomes and reduce complications. Technological advancements enabling minimally invasive procedures, remote monitoring, and enhanced safety further boost adoption. Additionally, rising awareness about early detection and continuous monitoring is creating sustained demand, accelerating market growth and encouraging manufacturers to innovate.

In March 2025, Medtronic introduced an AI-enabled pacemaker with real-time remote monitoring, allowing physicians to detect complications early and improve patient outcomes.

Cardiovascular Devices Market Restraints:

-

High Device Costs and Complex Reimbursement Policies Hinder Market Growth

The high cost of advanced cardiovascular devices, including transcatheter valves, drug-eluting stents, and implantable defibrillators, limits their adoption, particularly in emerging and low-income regions. Complex and inconsistent reimbursement policies across countries further impede hospital procurement and patient access. Healthcare providers often face lengthy approval processes and regulatory challenges, which delay device deployment. These financial and policy-related barriers restrict market penetration despite the rising incidence of cardiovascular conditions. Consequently, the growth of the cardiovascular devices market is restrained, especially where affordability and insurance coverage limit access to advanced cardiac care.

In February 2025, a U.S. hospital network reported delays in deploying next-generation mitral valve devices due to high costs and stringent insurance reimbursement approvals, restricting patient access.

Cardiovascular Devices Market Opportunities:

-

Integration of AI-Enabled Remote Monitoring Devices Presents Growth Opportunities

The development of AI-driven, wearable, and remote cardiac monitoring solutions provides significant opportunities in the cardiovascular devices market. These devices allow continuous patient monitoring, predictive analytics for personalized therapy, and early detection of arrhythmias and heart failure exacerbations. Integration with telehealth and connected devices reduces hospital visits, improves patient adherence, and enables real-time intervention during critical events. As hospitals increasingly adopt digital health technologies, manufacturers can leverage these innovations to expand market presence, improve treatment efficacy, and address unmet needs, positioning themselves at the forefront of next-generation cardiovascular care.

In January 2025, Abbott Laboratories launched an AI-powered remote cardiac monitoring system, enabling physicians to track heart failure patients in real-time, optimize therapies, and reduce hospitalization rates.

Cardiovascular Devices Market Segmentation Analysis:

By Device Type, Therapeutic and Surgical Devices Segment Dominates Cardiovascular Devices Market with Largest Share in 2025, Diagnostic and Monitoring Devices Segment to Record Fastest Growth with 8.13% CAGR

The Therapeutic and Surgical Devices segment held a dominant share in the Cardiovascular Devices Market in 2025. Rising prevalence of cardiovascular disorders, coupled with increasing adoption of minimally invasive procedures, drives demand for advanced stents, pacemakers, and implantable defibrillators. Continuous product innovations in delivery systems and biocompatible materials improve procedural efficiency and patient outcomes, thereby increasing device adoption and market revenue. Hospitals and cardiac care centers increasingly procure these devices to enhance treatment effectiveness and reduce hospital stays, positioning this segment as the largest contributor to the market.

The Diagnostic and Monitoring Devices segment is expected to experience the fastest growth in the Cardiovascular Devices Market over 2026-2033 with a CAGR of 8.13%. Growing awareness for early detection and real-time cardiac monitoring is driving adoption of wearable ECG monitors, cardiac imaging systems, and remote monitoring solutions. Advancements in AI-enabled analytics and wireless devices allow accurate diagnosis and timely intervention, accelerating market growth. Increasing preventive healthcare initiatives and home-based patient monitoring further fuel the demand for diagnostic and monitoring devices.

By Application, Coronary Artery Disease Segment Dominates Cardiovascular Devices Market with 44% Share in 2025, Heart Failure Segment to Record Fastest Growth with 9.89% CAGR

The Coronary Artery Disease (CAD) segment dominated the Cardiovascular Devices Market in 2025 due to the rising prevalence of atherosclerosis, obesity, and diabetes. Innovations in drug-eluting stents, biodegradable scaffolds, and precision imaging systems improve procedural efficiency, reduce complications, and enhance patient outcomes. Growing interventional cardiology procedures and hospital investments in advanced cardiac care further drive demand, positioning CAD as the leading revenue-generating application.

The Heart Failure segment is expected to experience the fastest growth in the Cardiovascular Devices Market over 2026-2033 with a CAGR of 9.89%. Rising prevalence of chronic heart conditions and aging populations is driving demand for ventricular assist devices, implantable cardioverter-defibrillators, and remote monitoring solutions. Product innovations in miniaturization, energy efficiency, and AI-based predictive monitoring improve adoption and patient outcomes. Increasing government programs and reimbursement initiatives accelerate market expansion in this segment.

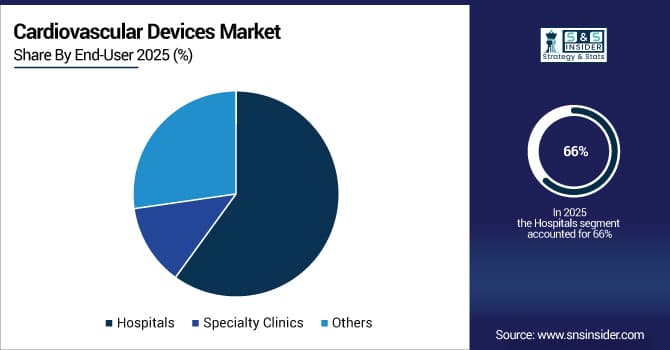

By End-User, Hospitals Segment Dominates Cardiovascular Devices Market with 66% Share in 2025, Specialty Clinics Segment to Record Fastest Growth

The Hospitals segment held a dominant share in 2025 as hospitals provide comprehensive cardiac care, including diagnostics, interventions, and surgeries. High patient throughput, advanced infrastructure, and skilled cardiologists drive procurement of full cardiovascular device portfolios. Investments in smart operating rooms and cardiac catheterization labs enhance device utilization and procedural efficiency, reinforcing hospitals’ central role in market revenue generation.

The Specialty Clinics segment is expected to record the fastest growth in the Cardiovascular Devices Market over 2026-2033. Rising outpatient cardiac care, minimally invasive interventions, and home monitoring solutions drive adoption. Clinics increasingly deploy portable diagnostic and monitoring devices, wearable sensors, and telemedicine solutions to provide efficient, patient-centric care, fueling growth in this segment.

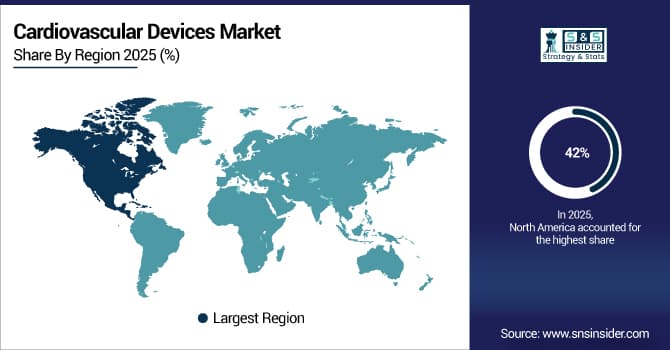

Cardiovascular Devices Market Regional Analysis:

North America Dominates Cardiovascular Devices Market in 2025

North America accounted for an estimated 42% share of the Cardiovascular Devices Market in 2025. The region’s dominance is driven by high prevalence of cardiovascular diseases, advanced healthcare infrastructure, and strong adoption of innovative devices, leading to increased market revenue and investment in cardiac care technologies.

Get Customized Report as Per Your Business Requirement - Enquiry Now

United States Leads North America Due to Advanced Healthcare Infrastructure and High Device Adoption

The United States is the dominating country in North America due to its mature healthcare system, widespread insurance coverage, and high adoption of advanced cardiovascular technologies. U.S. hospitals and specialty clinics invest heavily in minimally invasive procedures, implantable devices, and remote cardiac monitoring solutions. Additionally, strong research and development by leading device manufacturers such as Medtronic, Abbott, and Boston Scientific fosters innovation, contributing significantly to regional market growth and maintaining the U.S. leadership in cardiovascular care.

Asia Pacific is the Fastest-Growing Region in Cardiovascular Devices Market in 2025

Asia Pacific is expected to grow at an estimated CAGR of 7.9% during 2026–2033. Rapid urbanization, rising prevalence of cardiovascular diseases, and increasing healthcare investments drive market expansion and adoption of advanced devices.

China Dominates Asia Pacific Due to Large Patient Population and Growing Healthcare Infrastructure

China is the dominating country in Asia Pacific due to its large patient population, growing healthcare infrastructure, and rising awareness of cardiovascular disease management. Government initiatives to improve healthcare access and reimbursement schemes accelerate adoption of diagnostic, therapeutic, and surgical devices. Expanding private healthcare facilities and increasing cardiology-focused specialty clinics, coupled with rising disposable income, boost market demand. China also attracts global device manufacturers aiming to expand regional operations and capture the growing cardiovascular device market.

Europe Cardiovascular Devices Market Insights, 2025

Europe held a significant portion of the Cardiovascular Devices Market in 2025, driven by advanced healthcare infrastructure and increasing prevalence of heart disease. Strict regulatory frameworks and focus on patient safety further support growth.

Germany Leads Europe Owing to Technologically Advanced Cardiac Care and Strong Hospital Networks

Germany is the leading country in Europe due to its well-established cardiac care network, high adoption of minimally invasive interventions, and investments in research and development. Strong hospital networks, technologically advanced surgical equipment, and favorable reimbursement policies drive cardiovascular device demand. The country’s emphasis on preventive healthcare and digital cardiac monitoring ensures sustained market growth and leadership in Europe.

Middle East & Africa and Latin America Cardiovascular Devices Market Insights, 2025

In 2025, Middle East & Africa demonstrated moderate growth in the Cardiovascular Devices Market, driven by urbanization, rising healthcare investments, and expanding cardiology infrastructure. South Africa leads the region, supported by advanced cardiac centers and growing demand for interventional procedures.

Brazil and Mexico Drive Latin America Growth Through Expanding Cardiology Infrastructure and Rising Disease Prevalence

Latin America also experienced steady growth, with Brazil and Mexico dominating due to increasing cardiovascular disease prevalence and expanding hospital and specialty clinic networks. Government initiatives and foreign investments in cardiovascular technologies are accelerating market adoption, focusing on improving cardiac care access and advanced treatment solutions across both regions.

Competitive Landscape for the Cardiovascular Devices Market:

Medtronic plc

Medtronic plc is a U.S.-based global leader in medical technology, specializing in cardiovascular devices such as pacemakers, stents, heart valves, and cardiac monitoring systems. With decades of experience, the company designs, develops, and manufactures innovative therapeutic and diagnostic solutions that improve patient outcomes in cardiac care. Medtronic’s role in the cardiovascular devices market is critical, providing hospitals and specialty clinics with reliable, high-performance solutions for both minimally invasive and surgical procedures, supporting the treatment of various cardiovascular conditions worldwide.

-

In 2025, Medtronic launched its next-generation implantable pacemaker series, featuring advanced remote monitoring capabilities and enhanced battery life to improve patient management and post-operative care.

Abbott Laboratories

Abbott Laboratories is a U.S.-based leader in cardiovascular medical devices, offering products such as coronary stents, heart valves, diagnostic catheters, and vascular closure systems. The company focuses on innovative therapies that enhance procedural efficiency, safety, and patient outcomes. Abbott plays a vital role in the cardiovascular devices market by providing hospitals and clinics with integrated solutions that support both acute and chronic cardiovascular care, driving adoption of minimally invasive technologies and advanced monitoring systems.

-

In 2025, Abbott introduced its latest coronary stent system with drug-eluting technology, enabling faster recovery and reducing restenosis rates for patients undergoing interventional cardiology procedures.

Boston Scientific Corporation

Boston Scientific Corporation is a U.S.-based global manufacturer of cardiovascular devices, including pacemakers, defibrillators, stents, and electrophysiology products. The company emphasizes innovation, quality, and clinical evidence in developing products that improve patient outcomes and procedural efficiency. Its role in the cardiovascular devices market is substantial, delivering solutions that enable hospitals and specialty clinics to manage a wide spectrum of cardiovascular conditions with precision and reliability.

-

In 2025, Boston Scientific launched a next-generation bioresorbable stent system designed for complex coronary interventions, offering improved vessel healing and reduced long-term complications.

Edwards Lifesciences Corporation

Edwards Lifesciences Corporation is a U.S.-based leader in structural heart and critical care devices, specializing in transcatheter heart valves, surgical heart valves, and hemodynamic monitoring solutions. The company focuses on advancing minimally invasive therapies for heart disease, supporting hospitals and specialty clinics in improving patient outcomes. Edwards Lifesciences plays a pivotal role in the cardiovascular devices market by introducing cutting-edge technologies that reduce procedural risks, enhance recovery times, and expand access to advanced cardiac care globally.

-

In 2025, Edwards Lifesciences launched its latest transcatheter aortic valve system, providing improved deployment accuracy, enhanced durability, and reduced procedure time for high-risk cardiac patients.

Cardiovascular Devices Market Key Players:

-

Medtronic plc

-

Abbott Laboratories

-

Boston Scientific Corporation

-

Edwards Lifesciences Corporation

-

Terumo Corporation

-

BIOTRONIK SE & Co. KG

-

B. Braun SE

-

Johnson & Johnson (Cordis / Biosense Webster)

-

Siemens Healthineers AG

-

GE HealthCare

-

MicroPort Scientific Corporation

-

LivaNova PLC

-

Philips (Koninklijke Philips N.V.)

-

Cook Medical Inc.

-

W. L. Gore & Associates, Inc.

-

Cardinal Health

-

Getinge AB (Maquet)

-

Merit Medical Systems, Inc.

-

Shockwave Medical, Inc.

-

Lepu Medical Technology Co., Ltd.

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | US$ 60.00 Billion |

| Market Size by 2033 | US$ 106.61 Billion |

| CAGR | CAGR of 7.45 % From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Device Type (Diagnostic and Monitoring devices, Therapeutic and Surgical Devices) • By Application (Coronary Artery Disease (CAD), Cardiac Arrhythmia, Heart Failure, Others) • By End-User (Hospitals, Speciality Clinics, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Medtronic plc, Abbott Laboratories, Boston Scientific Corporation, Edwards Lifesciences Corporation, Terumo Corporation, BIOTRONIK SE & Co. KG, B. Braun SE, Johnson & Johnson (Cordis / Biosense Webster), Siemens Healthineers AG, GE HealthCare, MicroPort Scientific Corporation, LivaNova PLC, Philips (Koninklijke Philips N.V.), Cook Medical Inc., W. L. Gore & Associates, Inc., Cardinal Health, Getinge AB (Maquet), Merit Medical Systems, Inc., Shockwave Medical, Inc., Lepu Medical Technology Co., Ltd. |