Chromatography Software Market Report Scope & Overview:

Get more information on Chromatography Software Market - Request Sample Report

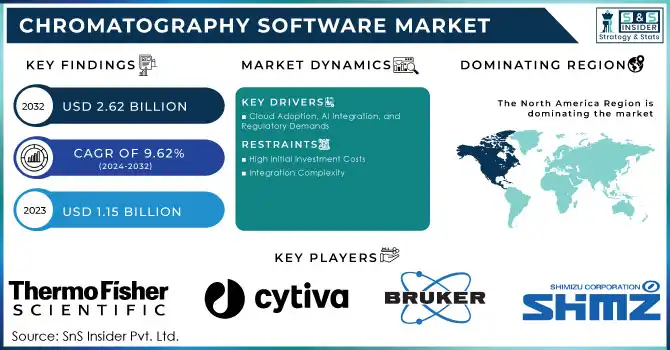

The Chromatography Software Market Size was valued at USD 1.15 billion in 2023 and is expected to reach USD 2.62 billion by 2032 and grow at a CAGR of 9.62% over the forecast period 2024-2032.

The chromatography software market is being driven by several key technological advancements, which are revolutionizing the efficiency, accuracy, and scalability of chromatographic processes. One of the most significant developments in this market is the shift towards cloud-based chromatography platforms. Cloud solutions provide numerous advantages, including enhanced scalability, reduced operational costs, and improved collaboration capabilities across research teams. This move towards the cloud is especially important in the pharmaceutical and biotechnology sectors, where teams often work across multiple locations and require seamless data sharing and storage solutions.

AI and machine learning (ML) are also playing a critical role in transforming chromatography software. These technologies enable faster and more accurate data analysis, improving the efficiency of chromatographic separations and reducing the potential for human error. AI-driven software can analyze complex data sets and predict outcomes, optimizing chromatography processes and providing more reliable results. This automation significantly reduces time and resource costs, allowing researchers to focus on more critical tasks.

Pharmaceutical companies are particularly benefiting from the incorporation of advanced chromatography software into their operations. Chromatography plays a central role in drug development and quality control, and software solutions are increasingly used to ensure compliance with stringent regulatory requirements. The ability to manage large volumes of data, automate processes, and improve the precision of results has made chromatography software an indispensable tool in pharmaceutical research. For example, pharmaceutical companies can now use AI-enhanced chromatography software to predict the best separation methods, which accelerates the drug discovery process. By integrating ML algorithms, chromatography systems can learn from previous experiments to optimize separation techniques, reducing the time needed for trials and improving the efficiency of quality assurance testing.

As industries continue to seek improved data management, faster results, and enhanced precision, the chromatography software market will continue to evolve. These advancements are streamlining workflows, reducing costs, and enabling researchers to achieve more accurate and reliable results, ultimately accelerating scientific discovery and improving product quality.

Chromatography Software Market Dynamics

Drivers

-

Cloud Adoption, AI Integration, and Regulatory Demands

The chromatography software market is being significantly driven by several factors that are shaping its growth trajectory. One of the key drivers is the increasing adoption of cloud-based chromatography platforms. These platforms provide cost-effective and scalable solutions for research and development activities across various industries. They also enable improved data storage, sharing, and real-time collaboration, especially for global research teams in the pharmaceutical and biotechnology sectors. This transition to the cloud is facilitating faster and more efficient data analysis, which is critical in time-sensitive applications such as drug development and environmental testing. Another significant driver is the integration of artificial intelligence (AI) and machine learning (ML) into chromatography software. AI technologies enable the automation of complex chromatographic processes, reduce human error, and improve the accuracy and efficiency of data analysis. These advancements are particularly beneficial in industries that rely on high-precision results, such as pharmaceuticals and environmental monitoring. AI-powered software can predict outcomes and optimize chromatographic separations, leading to reduced trial and error, faster results, and enhanced productivity.

The growing demand for stringent quality control and regulatory compliance, especially in the pharmaceutical industry, is also fueling the demand for advanced chromatography software. The ability to automate and streamline regulatory compliance tasks, such as data recording, validation, and reporting, ensures that pharmaceutical companies meet increasingly stringent standards and reduce operational risks. Additionally, the market is benefiting from continuous advancements in software development, enhancing the functionality and capabilities of chromatography tools, and further accelerating their adoption across diverse sectors.

Restraints

-

High Initial Investment Costs

The adoption of advanced chromatography software often requires significant upfront investment in both software licenses and training. Small to mid-sized enterprises, especially those in developing regions, may find the high costs of sophisticated systems a barrier to entry.

-

Integration Complexity

Many organizations face challenges integrating new chromatography software with existing laboratory systems and workflows. Compatibility issues and the need for specialized expertise to implement and maintain the software can slow adoption and increase operational costs.

Chromatography Software Market - Key Segmentation

By Device Type

Standalone chromatography software devices accounted for the largest share in 2023, driven by their flexibility and lower upfront investment compared to integrated solutions. Standalone devices are typically preferred by small to medium-sized laboratories that require dedicated systems for specific chromatography applications without the need for extensive infrastructure. This segment dominated with over 57.0% of the total market share in 2023. The simplicity of these devices and ease of installation contribute to their continued popularity.

Integrated chromatography devices are the fastest-growing segment, driven by increasing demand for more comprehensive, all-in-one solutions that combine hardware and software seamlessly. These integrated systems are gaining traction, particularly in large-scale operations in industries like pharmaceuticals and environmental testing, where streamlined workflows and higher throughput are critical.

By Deployment Type

On-premise deployment solutions dominated the chromatography software market in 2023, accounting for approximately 60.0% of the market share. This preference stems from the need for greater data security, control, and customization in sensitive industries like pharmaceuticals and forensic testing, where data integrity and confidentiality are crucial. On-premise systems also remain a preferred choice in regions with limited internet connectivity or where regulatory compliance mandates stricter data management protocols.

Web & cloud-based chromatography software is the fastest-growing deployment type, driven by the increasing demand for flexible, scalable, and collaborative platforms. These solutions are particularly attractive to global research teams that require remote access to data, as well as companies looking to reduce IT infrastructure costs.

By Application

The pharmaceutical industry dominated the chromatography software market in 2023, accounting for approximately 43.0% of the market share. Chromatography software is essential in the pharmaceutical sector for drug development, quality control, and compliance with stringent regulatory standards such as Good Manufacturing Practices (GMP). The increasing complexity of drug formulations and the need for accurate analysis has led to a high demand for advanced chromatography software in this industry.

Environmental testing is the fastest-growing application segment over the forecast period. The rising global emphasis on sustainability, climate change, and environmental regulations has driven significant demand for chromatography software in environmental monitoring. Governments and environmental agencies are increasingly relying on chromatography techniques to detect pollutants, toxins, and contaminants in air, water, and soil samples. This growth is fueled by stricter environmental regulations and the need for high-precision testing to ensure compliance with environmental safety standards.

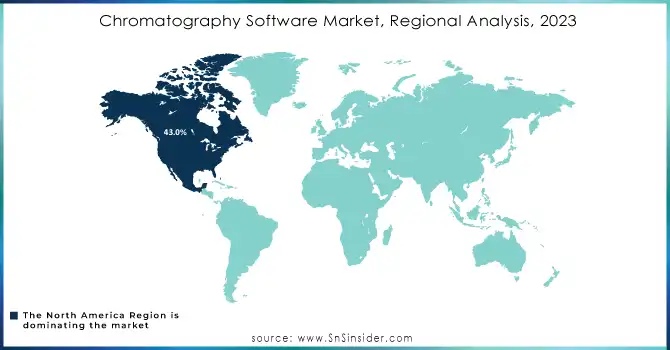

Chromatography Software Market Regional Analysis

North America held the largest market share, accounting for more than 43.0% of the chromatography software market in 2023. The region benefits from the strong presence of pharmaceutical companies, research institutions, and biotechnology firms, which heavily rely on chromatography techniques for drug development, quality control, and environmental monitoring. The U.S. is a significant contributor due to the growing adoption of cloud-based chromatography software solutions in the pharmaceutical and healthcare sectors. Additionally, increasing government investments in healthcare and environmental monitoring further fuel the market growth.

Europe followed as the second-largest market in 2023. The region’s growth is driven by the expanding pharmaceutical industry, environmental testing regulations, and ongoing advancements in laboratory automation. The European market is particularly focused on the implementation of advanced chromatography systems for stringent environmental regulations, where countries like Germany, the U.K., and France are leading the charge in adopting cutting-edge chromatography technologies.

Asia-Pacific is expected to witness the highest growth rate, particularly due to rapid industrialization, expanding healthcare infrastructure, and increased government investments in research and development. Countries such as China and India are witnessing increased adoption of chromatography solutions across the pharmaceutical, food, and environmental industries, spurred by growing industrial and regulatory demands, driven by an emerging need for high-precision analytical tools in drug development, water, and air quality testing.

Need any customization research on Chromatography Software Market - Enquiry Now

Key Players

Bruker Corporation

-

CompassCDS Software

-

TopSpin NMR Software

-

Chromeleon Chromatography Data System (CDS)

Shimizu Corporation

-

Chromatography Data Systems (CDS) (Integrated with Shimizu’s analytical systems)

-

Chromeleon Chromatography Data System (CDS)

-

Thermo Scientific Dionex Chromeleon CDS

-

Thermo Scientific Empower Software

Hitachi High-Technologies

-

Chromaster Chromatography Software

-

Primeview Software for Chromatography

-

Unicorn Software (for chromatography system control and data analysis)

Gilson Inc.

-

Gilson Software (for HPLC, UV-Vis, and chromatography control)

-

Gilson LabSolutions Software

-

EZChrom Elite Chromatography Software

-

Restek Chromatography Data Solutions

Jasco

-

ChromNAV Software (for HPLC, UV-VIS, and other chromatography analysis)

Scion Instruments

-

Scion CDS Software

-

Chromatography Data System Software

Waters Corporation

-

Empower Chromatography Software

-

MassLynx Software

-

UNIFI Software

Axel Semrau GmbH & Co. KG

-

Clarity Chromatography Software

-

Clarity CDS Software

Agilent Technologies Inc.

-

OpenLab CDS Software

-

ChemStation Software

-

EZChrom Software

DataApex

-

Apex Chromatography Software

-

Clarity Chromatography Data System (CDS)

KNAUER

-

ChromGate Software

-

KNAUER Chromatography Data Systems

Shimadzu Corporation

-

LabSolutions Software

-

Shimadzu Chromatography Software

Recent Development

-

In April 2024, Waters Corporation introduced the Alliance iS Bio HPLC System, a state-of-the-art solution aimed at increasing efficiency and minimizing errors in biopharma quality control (QC) labs. This system integrates cutting-edge bio-separation technology with intelligent features, designed to reduce common errors by up to 40%.

-

In February 2024, Thermo Fisher Scientific launched the Dionex Inuvion Ion Chromatography (IC) system, a versatile and user-friendly instrument tailored for ion analysis. This system offers a comprehensive solution for determining small and ionic polar compounds, supporting a wide array of analytical needs.

-

In January 2022, Waters Corporation expanded the deployment of its Empower Chromatography Data Software (CDS) across five field science laboratories within the U.S. FDA’s medical product testing labs. This strategic move enhances the company’s existing product offerings, further integrating its chromatography data systems portfolio and opening up new opportunities to develop efficient solutions for data acquisition, processing, and reporting from a range of measurement instruments.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.15 Billion |

| Market Size by 2032 | USD 2.62 Billion |

| CAGR | CAGR of 9.62% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Device Type (Standalone, Integrated) • By Deployment Type (On-premise, Web & Cloud-based) • By Application (Pharmaceutical Industry, Forensic Testing, Environmental Testing, Food Industry) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Bruker Corporation, Shimizu Corporation, Thermo Fisher Scientific Inc., Hitachi High-Technologies, Cytiva, Gilson Inc., Restek Corporation, Jasco, Scion Instruments, Waters Corporation, Axel Semrau GmbH & Co. KG, Agilent Technologies Inc., DataApex, KNAUER, Shimadzu Corporation. |

| Key Drivers | • Cloud Adoption, AI Integration, and Regulatory Demands |

| Restraints | • High Initial Investment Costs • Integration Complexity |